What if you're broke?

There may be times in your life when you are unsure of how you will pay your bills. The quantity of money required to pay the bills can occasionally be greater than the amount of money available.

It doesn't take a very huge unforeseen bill or a very large loss in income for "broke" to become more than just a catchphrase, as the majority of Americans have little or no savings. A sudden expense or a loss of income might quickly leave you in a situation where you are simply out of money when there is no buffer.

Most people are aware that they should have an emergency fund, and those who don't usually have plans to do so in the future. The majority of those who struggle to make ends meet would prefer to have some extra money, but they don't appear to be able to. These aren't your top priorities if you're broke. These are little more than nebulous ideas when you're poor. Nobody who has spent the last few years surviving paycheck to paycheck and handling numerous emergencies without money believes that this is the ideal way to live.

If you're in it, there don't appear to be any alternatives. All too frequently, the next step is a downturn for the worse.

So what can you do if you're broke?

MALERAPASO/ISTOCK

Evaluate your circumstances

The first step in making any decision is to evaluate your circumstances. To be sure that the solution you're creating is practical, you need a solid basis.

You'll need to know just how much money, if any, you do have on hand.

You'll need a list of all your bills, along with the amounts owing on each one, including any past-due balances.

You'll need to make a list of your recurring costs, such as food and other things you might pay for on the fly. You must prioritize after going over your lists. Determine what is most important and what follows after that if you can't pay everything at once.

You may need to make some or significant cuts, depending on how much room there is between income and expenses. Cuts can always be made. Sacrifices must be made, even if just a small amount, when there are more outflows than inflows. It might have to leave if it isn't necessary for your continued health and survival.

Make that call

You must get in touch with the person or company you owe money to if you are unable to pay a bill. Some issues, like federal student loans, will be simple. There are guidelines; either you qualify for assistance or you don't. If you don't have any money and make very little or no money, you probably can find some assistance.

Someone having a history of on-time payments will find that many lenders are extremely ready to work with them. When it comes to someone with a poor payment history, they could be less accommodating.

You can't go wrong by giving them a call and explaining your situation, your struggles, and your strategy.

Ask for help

Truly decent individuals do experience bad things. Numerous initiatives exist to assist those in need- state and municipal initiatives, and there are federal programs. There are other charitable organizations whose sole aim is to assist individuals in need.

It will depend on your circumstances and to some extent on where you reside whether you qualify for any state, local, or nonprofit assistance with food, housing, or other sorts of aid.

Asking might not guarantee that you get all the assistance you need, but not asking ensures that you won't.

Sell stuff

Selling items is an easy way to make a little money. That is its main draw. The fact that you no longer possess the item you sold is a drawback. Starting with items you don't use or need is a terrific idea, of course. But the potential of this plan is limited. There are only so much of your possessions you can sell and how much money you can make doing so. It is a temporary fix, but it does assist in a hurry.

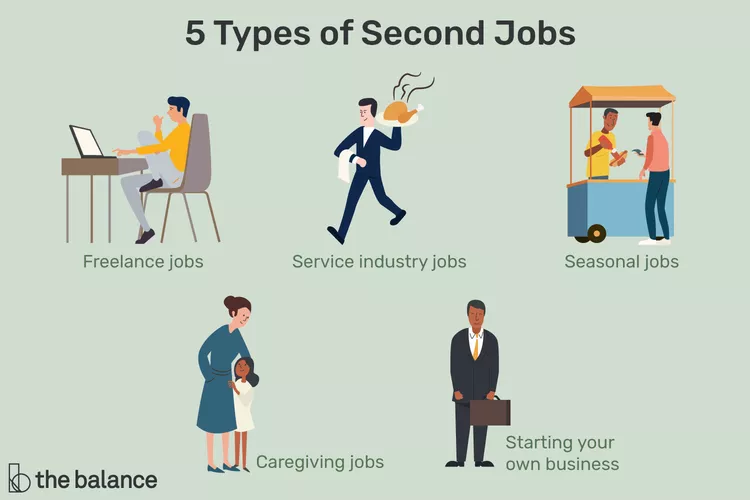

Get a second job

The longer-term and better solution to being broke is to get a job or a second job.

Having a second job is unpopular for certain people. It isn't need to last forever. If your financial condition is dire, you should take immediate action.

After the adversity...

The inability to pay debts frequently results from a series of events.

To look backward is not to criticize yourself. It is to provide an honest evaluation of what took place and how you arrived here. If you wish to never return to this place, doing this is crucial and required.

After the worst of our adversity has passed, we can more clearly see what needs to change. Perhaps we need to come up with a long-term plan for raising our income. We might need to come up with a long-term plan to cut back on significant costs like rent or transportation. maybe a little of each.

Last note...

It does occur for someone to be broke. This incident is by no means exceptional. It serves as a wake-up call for some people to start making preparations to take back control of their financial situations and prevent similar situations from occurring in the future. Or at least to lessen the likelihood that it will occur again.

Debt is a reality.

You don't have to stay poor.

Gold and Silver Stacking is not for everyone. Do your own research!

If you want to learn more, we are here at the Silver Gold Stackers Community. Come join us!

Best Regards,

I am not a financial adviser. This article is not meant to be financial advice. My articles on cryptos and precious metals share my personal opinion, experiences, and general information on cryptos and precious metals.Thank you for stopping by to view this article.

I hope to see you again soon!

I post an article daily. I feature precious metals every other day, and on other days I post article of general interest. Follow me in my journey to save in silver and gold.

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

Thanks @ssg-community!

Posted Using LeoFinance Beta

How are you dear friend @silversaver888 good day

In much of the world the economy is unstable. What you say is very true, there are many people who are very indebted, the tips and advice that you have touched are excellent

I take this opportunity to wish you a happy weekend

Hello @jlufer, my friend!

I hope we will all be okay, but that is not the case.

These advices are standard, in fact people can do these even when they are not broke (except calling the people you owe).

Have a great weekend!

!LOL

Posted Using LeoFinance Beta

lolztoken.com

..and then a chair and then a table.

Credit: reddit

@jlufer, I sent you an $LOLZ on behalf of @silversaver888

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(4/6)

Circumstances can sometimes put us in unfavorable situations. It's part of life and it happens sometimes. I think it's a wake up call to assume responsibility and take control of one's financial life. These strategies will indeed get the ball rolling and help pull you out of the 'broke zone'.

And... you don't have to be broke to do some of the things I listed, as a way of controlling your financial life!

!invest_vote

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

Circumstances make us meet ourselves where we don't except sometimes

Yes! When unexpected circumstances arise, such as when you lose a job... it is catastrophic if you are not prepared. So, while you can, save!

!invest_vote

Posted Using LeoFinance Beta

Yes, you're right

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

It is important to keep some extra funds. I still have a Gold coin I was going to sell. But I decided to hold on to it !

Good for your @olympicdragon! If you don't need it yet, keep it for that rainy day!

Have a wonderful Saturday, my friend!

!PIZZA

Posted Using LeoFinance Beta

I was homeless too multiple times in my life. Even as a child.

Try our best to make our situation good again. We did it multiple times. Of course we often received help from kind and generous people.

There was a time when I had two four hours per day part time jobs, but finding even a single part time job is very hard with multiple disabilities. It is good that we (both my brother and me) receive a pension-like income, even if it is deeply under the local minimum wage.

Just keep doing what you do, my friend, @xplosive! We all have to work. But good things happen to well-intentioned people.

There is a saying that you can always save. Pay yourself first, no matter how small.

!invest_vote

!PIZZA

Posted Using LeoFinance Beta

Nowadays I am building my Hive Dollar (HBD) savings often literally cents by cents. Approximately two hours ago I transferred $0.01 HBD to savings. But the real life income is often different. I know what starving is. Not having money to buy food. Especially around the end of the months. You simply cannot save money in those circumstances, because you cannot even buy food.

Thank God for Hive! It has been a source of income for many!

I will pray that we will all be okay!

!LUV

!invest_vote

Posted Using LeoFinance Beta

@xplosive, @silversaver888(5/10) sent you LUV. wallet | market | tools | discord | community | <>< daily

wallet | market | tools | discord | community | <>< daily

HiveWiki

HiveBuzz.me NFT for Peace

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

Saving some funds is much important, but it most difficult to do so especially if your expenses is much greater than your income.

So when we're in debt we find all means to get balance and make use of every strategy to pull us out of the broke. Selling properties, call for help, get extra work is one those way that reduced it, but not always.

Thanks for sharing this

It's easier said than done, but if your expenses exceed your income, you're living above your means. You cannot spend more than what you have. Try not buying anything other than necessities (that is if you are serious) until you have your finances under control. If this article is worth reading- read it again! There is a way out of it!

!PIZZA

!LUV

Posted Using LeoFinance Beta

@adedayoolumide, @silversaver888(3/10) sent you LUV. wallet | market | tools | discord | community | <>< daily

wallet | market | tools | discord | community | <>< daily

HiveWiki

HiveBuzz.me NFT for Peace

Thank you my friend

Posted Using LeoFinance Beta

Have a nice evening!😊

!LADY 😍🌺🤙

Posted Using LeoFinance Beta

View or trade

LOHtokens.@silversaver888, you successfully shared 0.1000 LOH with @adedayoolumide and you earned 0.1000 LOH as tips. (1/30 calls)

Use !LADY command to share LOH! More details available in this post.

Whenever my family had serious struggles like that we would dramatically cut costs. Lowering electricity usage was typically the first step for us, and cooking more often at home, instead of eating at restaurants or ordering fast food.

Yes- Hurray! It happens to the best of people, @esecholo. If it takes cooking at home, so be it!

!PIZZA

Posted Using LeoFinance Beta

Hey there, great post! You just got a decentralized curation vote from the Leo Finance team, keep creating great content!

We invite you to check out latest initiative, talk about CUB's new variable staking and earn some curation from Leo Finance!

Posted Using LeoFinance Beta

I'll seriously consider this, @leogrowth!

!LUV

Posted Using LeoFinance Beta

@leogrowth, @silversaver888(4/10) sent you LUV. wallet | market | tools | discord | community | <>< daily

wallet | market | tools | discord | community | <>< daily

HiveWiki

HiveBuzz.me NFT for Peace

My advice would be learn to live with less.. less stuff.. less money.. less stress

Yes, @davedickeyyall. Learn to live within your means. Less is more!

!WINE

Posted Using LeoFinance Beta

Congratulations, @silversaver888 You Successfully Shared 0.100 WINEX With @davedickeyyall.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.203

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

Getting out of a situation like this is really difficult but if you have discipline it is possible. The most important thing is to learn the lessons of life and when circumstances improve, in the end they will always improve, so you have to save even a little. Because the bad times will return, but this time we will be prepared.

Yes, @yeckingo1. It is difficult, but there is always light at the end of the tunnel.

We must be prudent in both good and bad times.

!invest_vote

!LOL

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

Thanks again, SILVER SAVER - @silversaver888. Yes, I'm afraid it is going to get worse. More & more, Needy, on the street corners.

@cve3...let us hope that people will not lose their jobs. .. that they will be okay.

!invest_vote

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

You have shared an interesting topic. As you indicated, it is always good to evaluate your finances very well in this way, you will not be faced with unexpected expenses. I have learned some new tips from your post thanks for sharing buddy.

I'm glad you learned some new tips from this post, @salamdeen. I am pleased that you find it interesting!

Thanks you.

!invest_vote

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

I gifted $PIZZA slices here:

silversaver888 tipped adedayoolumide (x1)

silversaver888 tipped olympicdragon (x1)

silversaver888 tipped xplosive (x1)

@silversaver888(5/5) tipped @esecholo (x1)

Send $PIZZA tips in Discord via tip.cc!

Ms. Saver @silversaver888

!LOL

lolztoken.com

He's working in the crust station.

Credit: reddit

@silversaver888, I sent you an $LOLZ on behalf of @stokjockey

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(1/4)

!LOL

Ms. Saver @silversaver888

!LUV

@silversaver888, @stokjockey(1/4) sent you LUV. wallet | market | tools | discord | community | <>< daily

wallet | market | tools | discord | community | <>< daily

HiveWiki

HiveBuzz.me NFT for Peace

!LUV

@stokjockey, @silversaver888(1/10) sent you LUV. wallet | market | tools | discord | community | <>< daily

wallet | market | tools | discord | community | <>< daily

HiveWiki

HiveBuzz.me NFT for Peace

Yes, I moonlighted when and where I can for some extra cash, even collected beverage cans and bottles to get their deposits back, you can't believe how many people don't bother to get their deposits back.

Always, with love 🤗🌺❤️

Posted Using LeoFinance Beta

Every little thing helps, sis. I sometimes think those who don't do everything they can to better their circumstances deserve what is coming to them.

Hugs and kisses, sis 😊

!LADY 😍🌺🤙

Posted Using LeoFinance Beta

View or trade

LOHtokens.@silversaver888, you successfully shared 0.1000 LOH with @kerrislravenhill and you earned 0.1000 LOH as tips. (2/30 calls)

Use !LADY command to share LOH! More details available in this post.

If you are living paycheck to paycheck, one adversity can you turn your world upside down @silversaver888 !🙄

Many people also live beyond their means...... Shopping at Costco warehouse, looking for bargains, selling things you don't use anymore, and in extreme cases a second job can help a dire situation....

It's not an easy road, and ultimately saving an emergency fund when possible, it is one of the best plans you can have......

These are common-sense actions that must be taken whether you are in a dire situation or not, until you have saved up enough for your emergency fund. After which, you can ease up a bit!

!PIMP

Posted Using LeoFinance Beta

You must be killin' it out here!

@silversaver888 just slapped you with 1.000 PIMP, @silvertop.

You earned 1.000 PIMP for the strong hand.

They're getting a workout and slapped 1/1 possible people today.

Read about some PIMP Shit or Look for the PIMP District

Very true @silversaver...... So many people once they get in a bad situation financially they give up trying! I wish more people would ask for help, many lending agencies are more than happy to help them till they get out of a bad situation...

I think they are ashamed, or their pride wouldn't let them. It happens to the best of people!

That's very true @silversaver888 , I am sure many struggle not wanting to let people know.......

All good points and great advice sis! Thanks for sharing; much love!😘🤗🌸💞

Thanks sis! Love ya 😊

!LADY 😍🌺🤙

View or trade

LOHtokens.@silversaver888, you successfully shared 0.1000 LOH with @elizabethbit and you earned 0.1000 LOH as tips. (4/30 calls)

Use !LADY command to share LOH! More details available in this post.

🤗😘💞🌸 Love ya back!

During the pandemic I kind of experienced the cash issue, I got the job back but things are damaged. I guess getting back is hard as we age, I am nearing 40s now. Hive has been slow help and I am at mercy of god most of the time. A lot of things are not working out for me. Thanks for your guide.

Hang in there, @devpress! It is tough.

You're young!!! Treat it as if you are just starting out. And do it right.

Truly decent individuals do experience bad things. But there is a light of the end of the tunnel.

!invest_vote

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

Unfortunately lots of people are going to need this advice now a days, Ideally folks should be prepared and have an emergency fund but that's not the case for many

It's unfortunate. If I didn't come across the Silver Stacking community of YouTube, who knows where I would be today. I was clueless! I abandoned Youtube for two years to focus on Hive. I am slowly getting back into it to give back. Hey, why nt subscribe to my channel: Silver Saver

https://www.youtube.com/c/SilverSaver888

Posted Using LeoFinance Beta

I'll be sure to check out your channel and similar to your story the SGS community on steemit/hive helped get me Into precious metals.

Words of wisdom.

Posted Using LeoFinance Beta

Thank you @shortsegments!

Please follow me in my journey to save.

!invest_vote

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

To me there is no excuse been broke but if it happens unexpected then it's always advisable to have a second job because you can trust on people to help you when broke but it only ends in disappointment. I have stopped since my university days depending on people because they will deliberately get you annoyed when you asked for help. All I do is trust God for providing my needs. And I appreciate him. Thanks for sharing, I wish you a new week of joy and gladness

It happens to the best of people. A second job is possible and a great help. In fact, if income is not sufficient, that should be a recourse before everything goes south.

Have a good week, and I wish you the best!

!LOL

!LADY

Posted Using LeoFinance Beta

Great article saver 👍 and you just reminded me —> holy crap! This site actually is a source of INCOME 🤯

Will be re evaluating my situ, and may just have to start writing sea shanties again — 😜 y’arrr!