What is Autonomous Finance and are we ready for it?

Autonomous Finance is a next-generation finance platform that learns from your constantly changing finance and accounting transaction data. It forecasts business outcomes by proactive decision-making to increase working capital impact, customer experience, and cash forecasting accuracy.

What is autonomous finance and how it differs from traditional finance?

Autonomous finance can be defined as the ability to run day-to-day finance functions with minimal human intervention. Powered by AI and machine learning, it automates financial processes for improved efficiency and accuracy. It includes tasks like budgeting, investing, and risk management. Source

Corporate finance has typically relied on mostly manual efforts and antiquated tools, making it one of the most time-consuming, labor-intensive, and costly jobs.

Despite the development of automated software to manage repeated, basic activities, many processes remain fundamentally unaltered from how they were decades ago, with physical labor at the heart of the endeavor.

However, when the same finance teams are supported by autonomous technology that provides vital spend insights, they are finally free to think wider about how to develop their businesses and have a stronger impact on overall transformation and growth.

Human-Centered Difficulties

Spend management can be complicated because it lies at the heart of all businesses. Although careful examination, risk management, and sign-offs are essential, there are often issues of nuanced decision making and interpretation that must be addressed in order to process spend. Financial teams have justifiably opposed end-to-end automation due to a lack of dependable and sophisticated financial software that can manage gray areas such as qualitative assessments or the complexities of diverse cross-checking.

Every firm would benefit from autonomous finance operations, with several industries having specific requirements.

For financial services. The challenges of adopting technology-enabled business models and increasing regulations require finance teams to operate with more efficiency and lower risk.

Finance teams in professional services must fight to keep knowledge workers—lawyers, consultants, bankers, and agency directors—focused on serving customers and earning business while also controlling cost and lowering risk.

In the life sciences, the rapid pace of innovation, corporate partnerships and startups, and external research and development is accompanied by increased risk and a complex regulatory environment that requires complete financial transparency.

High-technology organizations. Because of the fast-paced cultures and appetites for risk-taking innovation in high-tech businesses, finance teams must be extra diligent when it comes to spending, thoroughly evaluating and approving all expenses.

For manufacturing. Global competition, unstable supply chains, and complex compliance mean that finance teams in manufacturing must control expenses, create good sourcing and labor ties, and hunt out any fraudulent spending.

Regardless of industry, if your financial experts are constantly making decisions regarding manual and repetitious processes, they will be unable to devote their entire focus, skill, and experience to other business-critical activities. The option is now more accessible because of advances in technology.

How Artificial Intelligence (AI) is Changing Finance

The pandemic era provided organizations with a once-in-a-lifetime opportunity to reset systems and adjust strategy. Redefining finance as an AI-driven, self-sufficient operation has the potential to transform your workforce and give your staff the time and space they need to produce ideas, insights, and strategies that will help your company grow and compete.

The AI-powered capabilities of autonomous finance operations have the potential to be game changers.

- Extraction and reading of invoice and expenditure report information, including not just numbers and text, but also logos and images.

- Contextual understanding that makes data sense—who is buying what and how to account for it

- Autonomous expenditure and invoice processing that acts—detecting and assigning any required reviews or next steps.

- Human-like adaptability in seeking and incorporating human intervention and decision-making only where policy exceptions exist.

Companies that go from basic, to automated finance, to autonomous, then AI-powered finance, see considerable performance gains.

- End-to-end AI processing with confidence on non-electronic invoices results in decreased error rates, fewer manual interventions, and more cost efficiency.

- By reducing invoice processing time from weeks to as little as one day, one may generate discounts for early payment and savings on all third-party spend.

- Overpayments are reduced through a more thorough pre-payment audit that extends from spot checks to 100% of spend.

- Finance teams can learn new technology, explore flexible work methods and processes, and shift their focus to more strategic thinking.

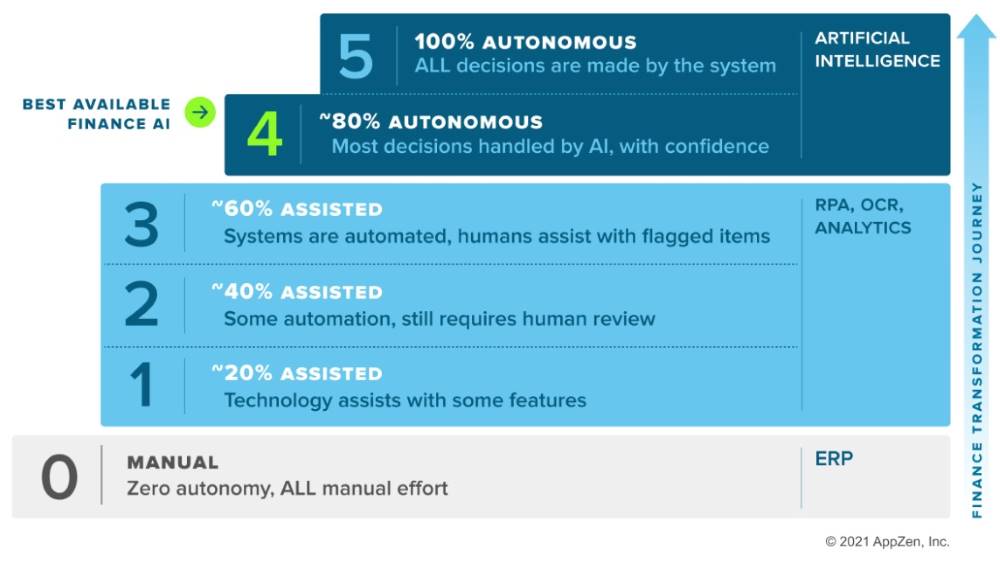

These firms are mapping their transformation by first determining where they are on the Autonomous Index for Finance (below) and where they want to be, and then determining the technology, people, and new operational procedures required to get there.

Source

The effects of this transition through AI-powered autonomous finance can be enormous. A billion-dollar corporation may save millions per year and see a return on investment within three months of implementation. Furthermore, shorter invoice-cycle times and lower barriers to supplier onboarding and invoicing make everyone happy, from the firm's partners to their staff.

However, it is based on self-learning software agents, and CFOs will require a solid technical roadmap as well as a new attitude to execute this shift. Three CFO mentality modifications to attain financial autonomy

- Experiment with technology to gain value.

- Give autonomous finance the same amount of credit as individuals.

- Advocate for self-driving finance technologies.

Finance teams frequently struggle to produce relevant reports and analysis due to a misalignment between finance's methodology and the needs of the company. Fragmentation has resulted from piecemeal investments in finance data and analytics, where data, tools, and talent sit in silos across the firm.

The following are common fragmentation indicators:

- Data professionals and financial analysts conversing in "different languages"

- New data is being obtained without the knowledge of finance workers.

- Best practices for leveraging analytics tools are failing to spread throughout the firm.

Autonomous finance provides useful insights to decision makers, discovers new methods to leverage analytic resources, and connects business problems to data to assist inform better decisions.

The path to 100% autonomous finance is now more attainable than ever. As we evaluate how to effectively navigate the road ahead, with the twists and turns of the shifting economic and workforce landscape, the correct technology will prepare finance teams to propel forward.

References:

https://pitchbook.com/webinars/exploring-the-opportunities-and-challenges-of-autonomous-finance

https://www.gartner.com/en/finance/topics/autonomous-finance

https://www.highradius.com/autonomous-finance/

https://sievo.com/blog/what-is-spend-management

https://hbr.org/sponsored/2021/08/how-ready-are-you-for-autonomous-finance-operations

😍#ilikeitalot!😍

Gold and Silver Stacking is not for everyone. Do your own research!

If you want to learn more, we are here at the Silver Gold Stackers Community. Come join us!

Best Regards,

I am not a financial adviser. This article is not meant to be financial advice. My articles on cryptos, precious metals, and money share my personal opinion, experiences, and general information on cryptos, precious metals, and money.Thank you for stopping by to view this article.

I hope to see you again soon!

I post an article daily. I feature precious metals every other day, and on other days I post articles of general interest. Follow me on my journey to save in silver and gold.

@silversaver888

Posted Using LeoFinance Alpha* item1

- item2

- item3

https://leofinance.io/threads/silversaver888/re-leothreads-2v3p61dmu

https://leofinance.io/threads/seckorama/re-leothreads-agrelzut

The rewards earned on this comment will go directly to the people ( silversaver888, seckorama ) sharing the post on LeoThreads,LikeTu,dBuzz.

Thanks @poshthreads

You received an upvote of 100% from Precious the Silver Mermaid!

Please remember to contribute great content to the #SilverGoldStackers tag to create another Precious Gem.

Thanks @ssg-community

Thanks for the revive.

AI is going to be worse for jobs then computers were. Glad I work with my hands.

Everything is changing, @silverd510. I want to just hive under the bed!

Hahaha!

!WINE

Congratulations, @silversaver888 You Successfully Shared 0.100 WINEX With @silverd510.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.091

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

Finances changing quickly day by day @silversaver888!😀

It will be interesting to follow this and see where this takes the financial markets both traditional and crypto!🤗

What we can imagine, will happen, @silvertop !

!PIMP

You must be killin' it out here!

@silversaver888 just slapped you with 1.000 PIMP, @silvertop.

You earned 1.000 PIMP for the strong hand.

They're getting a workout and slapped 1/1 possible people today.

Read about some PIMP Shit or Look for the PIMP District

Very true my friend, so many people are not even concerned or trying to invest @silversaver888 ...🤔

That I really don't understand........

I think AI will play a big roll (maybe bigger than some may want) in all aspects of work duties. It will definitely impact those that do not want any part of it.

Thanks for sharing sis and have a lovely day! hugs and kisses!🤗😘💕🌸 !LADY

I think so too. It is big now, wait until next year!

xoxo🤗😘

!LADY😍🌺🤙

🤗💕🌸😘

Ms. Saver @silversaver888

!LUV

@silversaver888, @stokjockey(2/5) sent you LUV. | tools | discord | community | HiveWiki |

HiveWiki |  NFT | <>< daily

NFT | <>< daily

Ms. Saver @silversaver888

Been There - Done That!!

!LOL

!PIZZA

lolztoken.com

An udder failure.

Credit: reddit

@silversaver888, I sent you an $LOLZ on behalf of @stokjockey

(1/6)

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

!LOL

!PIZZA

lolztoken.com

He said nothing.

Credit: reddit

@stokjockey, I sent you an $LOLZ on behalf of @silversaver888

(2/8)

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP

Stepping on a LEGO that cracked me Up Ms. Saver !

$PIZZA slices delivered:

@silversaver888(3/5) tipped @stokjockey

stokjockey tipped kerrislravenhill

stokjockey tipped silversaver888

Its so useful. The apps you can get from playstore has many features, automates it to your requirements !

AI is changing finance for the better, @olympicdragon !

!LUV

@olympicdragon, @silversaver888(2/10) sent you LUV. | tools | discord | community | HiveWiki |

HiveWiki |  NFT | <>< daily

NFT | <>< daily

It is good to bring this technology to the table for companies to save costs for checking every spending and income. AI might cut jobs for people who are doing that in their field.

AI is changing finance for the better.

!invest_vote

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

Are we gonna see a lot of unemplyed Bank Tellers, Financial Advisors and Planners? I think this may be an opportunity to On Board some to Hive!

Always, with love 🤗🌺❤️

I Know YOU @kerrislravenhill and Ms. Saver @silversaver888

May find this Video Very Interesting and Educational.................

The guy speaking in the Video Steve Austin is a great Resource for Silver Art Bars..........

Kerris keep your Eyes Open when you are out in the Wild searching for your SILVER !

https://silversteveaustin.com/

!LUV

!PIZZA

@kerrislravenhill, @stokjockey(3/5) sent you LUV. | tools | discord | community | HiveWiki |

HiveWiki |  NFT | <>< daily

NFT | <>< daily

Hahaha, yeah! AI is changing finance for the better.

xoxo🤗

!LADY😍🌺🤙

View or trade

LOHtokens.@silversaver888, you successfully shared 0.1000 LOH with @kerrislravenhill and you earned 0.1000 LOH as tips. (2/30 calls)

Use !LADY command to share LOH! More details available in this post.

Great post! I agree AI is changing finance for the better. I'm sure traders have already set up their systems to catch indicators and trade faster with AI and increasing their gains. It's becoming a whole new world....

!luv

!pgm

@silversaver888, @thebighigg(5/10) sent you LUV. | tools | discord | community | HiveWiki |

HiveWiki |  NFT | <>< daily

NFT | <>< daily

It sure is, @thebighigg ! I sometimes want to hide in my kitchen cabinet.

Hahaha!

!LOL

lolztoken.com

I said oh god not that as well!

Credit: reddit

@thebighigg, I sent you an $LOLZ on behalf of @silversaver888

(3/8)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

!HBIT

Success! You mined 1.0 HBIT on Wusang: Isle of Blaq. Sorry, but you didn't find a bonus treasure token today. Try again tomorrow...they're out there! | tools | wallet | discord | community | daily <><

Check for bonus treasure tokens by entering your username at an H-E explorer or take a look at your wallet.

Read about Hivebits (HBIT) or read the story of Wusang: Isle of Blaq.

The global economy is opening its eyes to the advantages of IA as a tool. This is one of the many areas where we can leverage utilities to not only improve finances, but to expand our businesses, making them more efficient.