Is this an echo bubble ? BTC pumps and a FT article.

I have found an article like many other an investors guide for 2023 and it focuses in 10 things. The reason that peaked my interest so much was todays PUMP of BTC.

- Peak dollar

- Rise of the ROW “rest of the world”

- Not-so Big Tech

- Less money, better TV

- Echo bubbles

- Japan is back

- ‘Anywhere but China’

- Return of orthodoxy

- Political relief

10.Blue birds

Now I will focus on 3 things that i find it the one that is more relevant for me.

# Echo bubbles

Bubbles don’t necessarily burst all at once; the declines are often punctuated by big rebounds — “echo bubbles”. These bounces cushioned the fall of many famous bubbles, from commodities in the 1970s to dotcoms in the late 1990s.

By early 2001, the Nasdaq had fallen nearly 70 per cent, but it would stage two false rallies before the year was out. The echo bubbles looked big — with tech stocks up as much as 45 per cent. But it was a mathematical illusion. Bouncing off such a low bottom, tech would have had to rise 250 per cent to regain its previous peak, and never came close in 2001. Tech finally hit bottom the next year, and remained sluggish for the rest of the decade.

During the pandemic, bubblets emerged within the broad markets, appearing in small cap stocks, clean energy stocks including Tesla, cryptocurrencies including Bitcoin, Spacs or “special purpose acquisition companies,” and tech stocks that have no earnings but include famous names (Spotify, Lyft). These bubblets have already suffered falls of 50 to 75 per cent, but the story is not over. The fortunes of crypto kings and Elon Musk are still whirling wildly.

The psychology behind bubbles is powerful. People refuse to easily abandon the idea that inspired the bubble. They buy the dips and give up only after their faith has been deflated repeatedly. 2023 is likely to see more echo bubbles, including in the most hyped themes of the last decade: big cap tech in the US and China. But don’t be fooled again. The next big winners will be emerging elsewhere.

In this link you can find more about the Echo bubble theory

https://www.investopedia.com/terms/e/echobubble.asp#:~:text=An%20echo%20bubble%20is%20a,leave%20relatively%20less%20damage%20behind.

# Rising japan

The image of “rising Japan”, unstoppable superpower, was so ingrained in the global imagination that as late as 1992 US presidential candidate Paul Tsongas could proclaim that “the cold war is over, and Japan has won”.

Today, to the extent Japan has an image, it is old people and bad debts, not superpowerdom. Global investors barely give a thought to Japan, which is just what its leaders should hope for. If hype surrounds countries at a peak, and hate piles on in a crisis, those poised for success are shrouded in indifference.

Quietly, Japan is turning for the better. Growth in the working age population, which turned negative in Japan three decades ago, is about to turn negative across the developed world. Measured as a share of the economy, private debt is on average higher in other developed economies than in Japan.

Japanese households and corporations reduced their debt load for much of the last decade, and will be less hard pressed in a tight money era than many outsiders may assume. Profit margins have been rising steadily. The cost of labour, adjusted for worker productivity, is now lower in Japan than in China.

Japan may not be back in the sense of a rising superpower, but it is poised for a relatively good 2023.

Anywhere but China

Couple rising labour costs with Beijing’s turn away from openness toward state control, and many foreign companies looking to outsource production now look, so it is said, “anywhere but China”. In the US, there is talk of manufacturing coming “back home”, or moving next door to Mexico, but the big winners so far are next door to China: Vietnam, Taiwan, India and South Korea.

More than half of US businesses in China say that their first choice for relocation would be other countries in Asia; less than a quarter say back home; less than a fifth say Mexico or Canada. These decisions are guided by all manner of risks and costs, but a central advantage of Asia outside China is wages.

The average monthly factory wage in Vietnam and India is less than $300 — about half the level of China, a quarter lower than Mexico, a small fraction of the $4,200 monthly wage in the US. No wonder American companies are still looking to offshore, just not in China.

In this link you can read more about the article

https://www.ft.com/content/3e040c2c-f7e4-4121-9dfe-7ba5732707f7

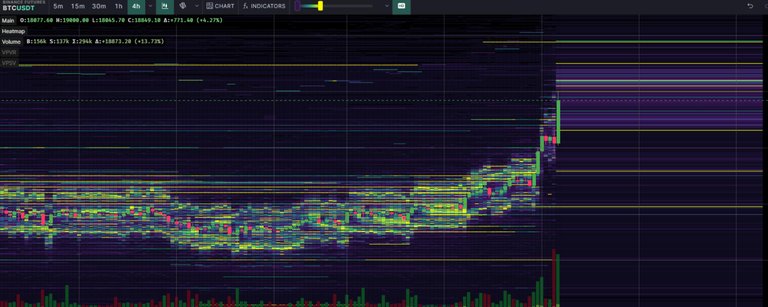

# Is this an Echo bubble??

Guys finally the market is fun again , after 2 months of boredom we have some action and we are at a frenzy again. I almost forgot how it was to feel FOMO kicking in. but is this an Echo ????

But as i said in previews post i am not convinced that this rally is sustainable. Yes we might hit the bottom but i find it more plausible to crab walk inside that range.

By looking at the heatmap we can see that with less capital the market is pumping that is happening because the market is very illiquid

Posted Using LeoFinance Beta

https://twitter.com/2762386109/status/1613649194434142223

The rewards earned on this comment will go directly to the people( @steemychicken1 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.