The Buy And Hold Philosophy

I'm not an investing buff. But I like to poke around and discover the ways individuals have come with in regards to navigating their investing journey.

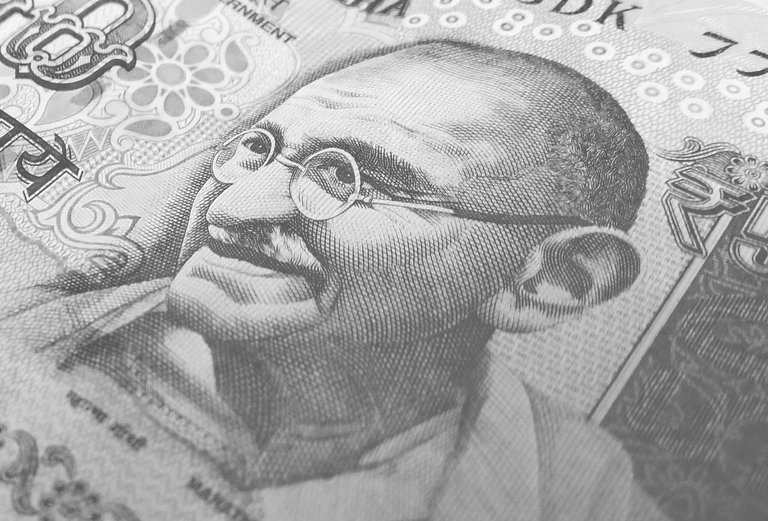

For people like me, investing is sort of new. Our parents or grandparents weren't investors in the modern sense of the term. Neither were accessible investment vehicles nor enough money to invest available.

In investing, it is said that much of the game is passive. There's little to no activity going most of the time. So that's what gave interest to this philosophy for me.

With buy and sell, there are two points of activity. When you buy and when you sell. With buy and hold, it's only one. When you buy. 50% less activity.

An Investing Philosophy

According to the internet, there isn't one single person to pinpoint as the founder. It could be the outcome of pure rational thinking based on past investing experiences.

However, there's a group of people that it is oftenly associated with. Benjamin Graham, Warren Buffett and company.

Buy and hold is an investment strategy where investors purchase assets with the sole intention of holding for a long period of time, typically years or even decades.

The idea behind it is taking a long term perspective towards one's investment(s), potentially benefiting in a huge way from the compounded growth and returns over time.

Given the great track record of investing Warren Buffett has, we can see how effective of a strategy it is. But it is also a bit old school now. It may not be fully compatible with the current rapidly changing economic environment.

Benefits And Drawbacks

First of all, provided we can control our emotions, taking a long term approach to investing will save us from making numerous and sometimes costly investing mistakes in the short term based on FUD or FOMO .

Reduced emotional decision making can lead to more disciplined and rational investment choices. Patience is also cultivated. In a way, patience is a prerequisite to successful investing. So that's a big benefit.

Other benefits are reduced transactions cost. Since the frequency of buying and selling is minimal. This can play out into a simple portfolio management, eliminating the need for constant managing and adjusting of holdings.

Another big benefit is the potential for compounding returns. This is where astronomical results are achieved. We recently celebrated Bitcoin pizza day on May 22. 13 years ago on May 22, a crypto enthusiast purchased two Papa John's pizzas from another individual in exchange for 10,000 Bitcoins. You know what's that worth today?

At the time of writing, the price of Bitcoin is around $26,679. If we multiplied it by 10,000 then it equals $266,790,000. The price value of Bitcoin wasn't determine by then but the agreed upon price was 10,000 Bitcoin for $25. So it is roughly 10,000X.

Drawbacks

The drawbacks are also both short term and long term. In the short term, there will be many missed opportunities. Some of them could be opportunities for huge profit taking.

Flexibility will be limited in a buy and hold approach. Given how projects can exists today and be gone tomorrow, having the ability to quickly adapt to changing market conditions will be important to thrive in the investing landscape. Some dips are permanent for some projects, they don't recover from them.

Then there's the long term drawback, the risk of holding an underperforming asset(s) for years on end hoping that it will outperform one day. By the time we decide to cut losses and reallocate capital, aeons have elapsed.

In Closing

At an overview level, it seems the benefits outweighs the drawbacks on this investing philosophy. Just one successful investment with a huge return on investment can pay for all the losses incurred both short term and long term.

But it wouldn't be a bad idea to make a cocktail by blending the buy and hold and buy and sell approches together. Having an investing exit plan is useful in certain investments. Isn't it?

Thanks for reading!! Share your thoughts below on the comments.