Adding To Hive's Fixed Income Platform: HIVE Into Savings

We will start off by stating I have no idea about the technical capabilities and how this could be done at the blockchain level. However, if some with development skills could chime in about the feasibility, that would be great.

It seems that CZ is at it again. The CEO of Binance admitted the company mistakenly staked customer's cryptocurrency. This is something that those of us on Hive know all to well. One time could be a mistake, multiple ends up being a trend.

We have to be leery of centralized exchanges. With all that is taking place within the cryptocurrency industry, it is hard to know who is friend or foe. For this reason, it is best to get as much on-chain as possible.

This is something we will explore in this article and offer up a solution to the problem. It ties into the Hive Backed Dollar (HBD) and how to leverage both coins for exponential impact within the ecosystem.

BUSD Crosses 20 Billion

The "stablecoin wars" are heating up. We have 3 major players, at the moment, who are vying for the prize.

At the top of the list is still Tether, with USDC in second place. Coming up the rear but gaining is Binance with the BUSD token. This just crossed 20 billion in market capitalization.

Binance has an advantage over the others in that it is the largest cryptocurrency exchange. Recent moves basically made BUSD the default stablecoin on that platform. This actually is an intelligent move on their part since it provides an expansive use case. Now, when traders want to "park" their money, BUSD will be the choice.

Even with all the focus from politicians and regulators, we see how the path forward for this sector is very optimistic. Stablecoins offer a powerful use case that the industry is just starting to uncover.

We discussed some of this regarding HBD. Please skim through this article as a precursor to some of the ideas we are going to present there.

Hive Creating A Similar Situation

When it comes to the Hive Backed Dollar, Hive has an interesting situation. There is the Internal Exchange which allows users to swap HBD for $HIVE (and vice versa). At the same time, we also have the ability to generate profits off the activity of users through the HBD Stabilizer. However, instead of feeding the pocket of someone like CZ, we see the proceeds being fed into the Decentralized hive Fund (DHF).

Here is what I wrote in the other article:

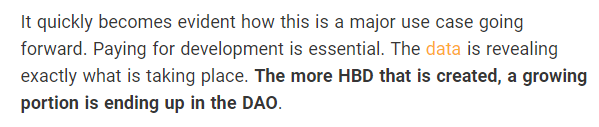

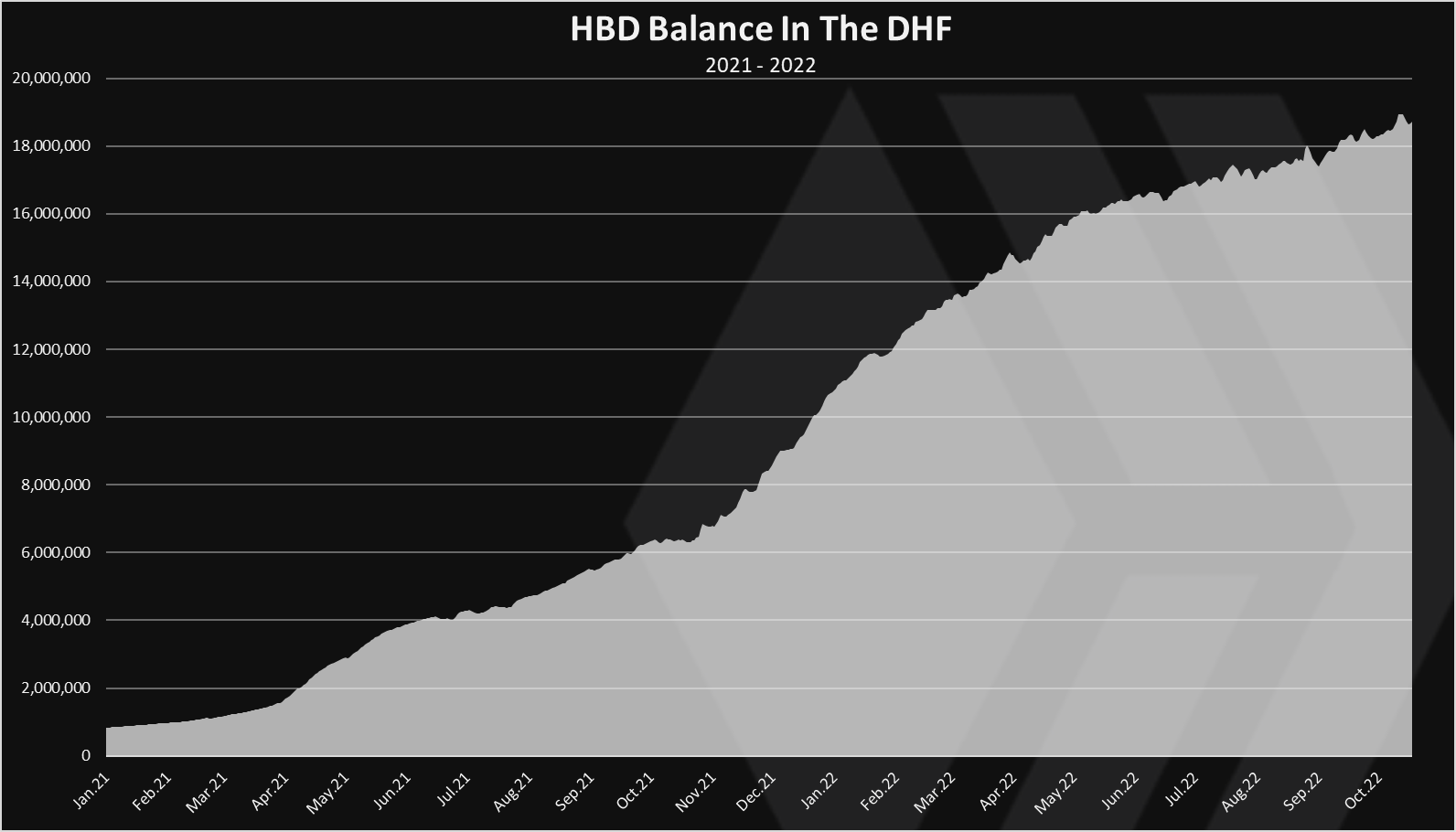

Basically, the more HBD that gets creates, the more that finds it way into the DHF. This makes sense when we think about it. By following how the flow works, we can see clearly what takes place.

- HBD is created and placed in users wallets

- Users trade some of the HBD for $HIVE, often trading with the HBD Stabilizer

- More HBD is fed into the DHF, which allows for larger HBD allocation to the HBD Stabilizer

- This allows for more trading, which increases as more HBD is in users wallets

Rinse and repeat.

One of the keys is to achieve depth and liquidity with HBD. This is vital for markets to operate efficiently. We know the present level of HBD is not sufficient. BUSD recently went over 20 billion; HBD bare has 10 million available.

As was opined, HBD has a major use case that is setting it apart from much of the stablecoin world. Because of the actions of the HBD Stabilizer, HBD is actually serving the role of funding and investing. The HBD that enters the DHF ends up, in part, funding further development tied to the Hive blockchain.

This is a very powerful use case.

Therefore, the decision to offer a base layer, fixed income market on Hive has been a giant step forward. Over the next few years, the HBD Stabilizer will just keep feeding the DAO with more coins, expanding the ability fund development.

So this brings up the question of how can we add to this?

$HIVE In Savings

At present, anyone who puts HBD into savings receives 20% APR paid out in HBD. This is serving as a low-risk, strong return option for users of Hive. Now that we have data showing the threat to the ecosystem due to more HBD being created is minimal, we can take a look at adding another layer.

Keep in mind, the more HBD that is created, a significant portion ends up on the DAO. We have data over the last year showing this.

Going back to the idea of CZ staking users coins, here is where we offer some incentive to bring some back on-chain. Fortunately, due to the establishment of the DAO, the governance of Hive is more secure than it was a few years ago. Nevertheless, helping to reduce the attack vector is never a bad thing.

A possible path to take is for Hive to offer a 10% APR on $HIVE placed into savings. The key is the payouts do not come from inflation but, rather, are done using HBD.

Thus, if one puts $100 worth of $HIVE into savings, he or she will earn $10 worth of HBD.

We already have the Internal Exchange which has some of the best liquidity for both coins. This means we have ongoing price feeds that can allow for us to use a 3 day moving average.

The goal is to provide people with a reason to hold $HIVE. It is often pointed out that most investors do not want to curate content nor do they like the 13 week lock up period. For this reason, we can offer another alternative.

A 10% return might not be the best thing in cryptocurrency, but it is a strong return on a coin that could see massive appreciation. It also is lower than what many can get by powering up. Of course, using savings has no impact upon governance since that is only tied to staked $HIVE.

Time Locked Vault

Here is where we get into the long discussed idea of a time locked vault at the base layer of Hive.

For those who are not aware of this idea, basically it is expanding savings so there is an option for a higher return in exchange for locking up the HBD for a longer period of time. We will use a 1 year 25% return for the example.

The time locked vault adds another layer to the ecosystem that provides even greater security. One of the reasons HBD in the DAO is a positive is that it is not a threat to the blockchain. Since it is locked up, it cannot be converted to HP and used for governance. It also cannot alter the coin distribution through the conversion mechanism.

We can see the same thing with the time vault.

Let us look at the proposed idea and how it could play out:

An individual puts $HIVE into savings, earning 10%. That is paid out in HBD. What are the options?

- swap HBD for $HIVE

- put HBD in savings

- bridge HBD across to a derivative

- keep it liquid

- put it in the time vault

Here is where we see the flow of HBD. While we cannot know the percentages, we can conclude is that a certain amount of the HBD generated will be put in the 1 year vault for a higher return. Therefore, just like the DAO due to HBD Stabilizer, a portion of new HBD created ends up locked away.

Ragnarok Savings

There is another powerful idea emerging that is actually similar to what companies like Circle are doing.

Ragnarok is going to sell all assets tied to the game for HBD. This not only provides a use case but also effectively serves as a "lock up" option. The goal is to take whatever HBD is acquired and put it into savings. Here the interest will be earned, HBD that is used to fund the reward pool for the game.

The idea is that, over time, the amount of HBD in savings (or a time vault) grows as in-game assets are sold, thus increasing the reward pool. There is no reason to touch the principal since that is the proverbial "golden goose".

Circle

Circle is the company behind USDC. This is a stablecoin that is backed 1:1, with each USDC having a USD or a cash equivalent tied to it. The last part is very important.

Without looking up the percentages, we can presume that the overwhelming majority (probably 80%) is backed by cash equivalents, i.e. US TBills. This is important to note since cash generates no return yet the TBills (or bonds if they use them) do have a payout.

Thus, each time someone creates a new USDC by submitting dollars, more Treasuries are purchased. It is a move that ends up generating a larger payout in interest.

And guess who benefits from that? Obviously, this is kept by Circle.

The point of the Ragnarok example is that here we see a similar concept applied. A key difference is the interest is being used to benefit the players and investors in the game.

Under this scenario, it is likely that Ragnarok would want to get the best return and would lock up all of its HBD in a time vault. We also see how HBD is now funding the reward pool and aspects of the game itself.

How many other projects will do the same thing?

Rinse and repeat.

Feeding Value To $HIVE

Over the last year, we covered the idea of HBD in detail. The relationship between HBD and $HIVE is very powerful. It is something that can be leveraged for greater gain to the ecosystem.

A main premise is that we have to drive value (not price) to each coin separately. Then, due to the correlation, we are able to see that compound upon itself in terms of the impact.

The idea of paying HBD as interest earned on $HIVE placed into savings is a way to add more value to the latter coin. It adds another reason for people to hold $HIVE.

Of course, as more is placed into savings, it is not on the open market to be readily traded. While 3 days is not a long lock up period, someone who is playing the markets will not utilize this option. Under that scenario, liquidity is key.

Feeding value to $HIVE is crucial since it is the backing mechanism for HBD. By removing some liquidity from the exchanges, we could tighten supply, potentially pushing prices higher. The coins are not destroyed so they are in the market cap yet are not actively on the market.

Here is where the leveraging of both coins against each other can have an impact.

The Hive Financial Network

The foundation of the Hive Financial Network was to drive value to the both the base layer coins.

One aspect is Hive Bonds. This utilizes the time vault to provide liquidity to whatever money is tied up. However, this is only a piece of the puzzle. By having an asset that can be collateralized, we now open up the possibility for lending. This pushes the case further out since HBD in the time vault that is bonded and used for lending is likely to be redeposited once reaches maturity.

We also proposed the idea of having layer 2 markets and operations that utilize a derivative of HBD. This is done via a 1:1 bridge. That means the HBD is in a wallet on Hive, backing a derivative stablecoin at the second layer. If this is being used for transactions, just like Ragnarok, a certain percentage of the HBD is not going to be accessed.

Hopefully it is becoming clear how this can all tie together.

Remember, the key areas of focus for a currency need to be:

- payments

- derivatives

- funding and investing

- collateralization

This means we have to provide:

- depth (the creation of more HBD)

- liquidity (HBD Stabilizer, liquidity pools)

- sophistication (Hive Financial Network)

- infrastructure (Layer 2 solutions)

Base layer, fixed income on Hive provides a solid financial foundation for the ecosystem. When we add in the social media aspect, we see how the integration of DeFi is forming Web 3.0.

What are your thoughts on adding another piece to Hive's Fixed Income menu?

Let us know in the comment section below.

Other Articles Related To This Subject:

- What Gives HBD Value: Payment System

- What Gives HBD Value: Derivatives

- What Gives HBD Value: Investing And Funding

- What Gives HBD Value: Collateralization

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

https://twitter.com/1331330355513745413/status/1584546761787396101

https://twitter.com/1442509135161946116/status/1584601310653210624

https://twitter.com/1415155663131402240/status/1584731826030903296

https://twitter.com/27706436/status/1584806204353961984

The rewards earned on this comment will go directly to the people( @taskmaster4450le, @zpek, @rzc24-nftbbg, @seckorama ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I don't understand well the idea. From what I understand, you can offer investors better APY for being locked for a longer time. the stablecoin HBD.

mistakenly... Do you realize how much income they make from pooling all of those cryptos and earning staking fees it's nutz! It's going to be interesting to see what happens to hive and HBD when some more larger projects start to come on board outside of just Splinterlands ones that actully produce massive amounts of sales and value. My hopes are it spurs even more to be built on hive and really shake things up.

It is a hope that many of us share. We can see how the potential exists and the more development, expansion has to occur.

A few large projects will radically affect every layer of Hive. So when we start getting more people using the internal exchange, as an example, it only feeds in more to the HBD stabilizer and DAO.

This is just one piece of the ecosystem.

Posted Using LeoFinance Beta

Any thoughts on @blocktrades requiring a passport or Government ID now?

I get why they did it but I think we need a easy decentralized way without Giving up personal info.

Blocktrades have a license to operate in the US hence I beleive comes under FINRA.

They have no choice but to KYC.

The bottom line is that anything to do with fiat especially, is going to be KYC. It is doubtful that we will see the on and off ramp to fiat being without government ID.

The best we can hope for is to get the crypto-to-crypto going without that (DEX and LPs) could be vaulable and get people to accept it as payment.

But we will have to see how it evolves.

Posted Using LeoFinance Beta

I never used fiat on it/. Just litecoin to Hive. But it they had fiat out option obviously I see it’s what they gotta do to stick around. I had nice words with Dan when I mentioned I wasn’t going to use anymore but of course it makes sense for them Agreed. But I do hope a simple option crypto only comes outta it. Brian’s lighting thing working? I really enjoy the podcasts btw! Been boosting and I gotta say you might be winning me over on some of our past different views discussed in comments. I really enjoy the guests but also the solo episodes wity u and Jon a lot.

Cheers 🍻

Well I can speak to what regulation they come under. This is not something I brushed up on but it might be they are considered a money transmitter, whether they deal in fiat or not.

The future, in my opinion, is liquidity pools and DEX. That is where we will see crypto-to-crypto.

Glad you enjoy the show. We aim to help people find out what is going on with crypto, hive and some different projects.

Posted Using LeoFinance Beta

Yes, it’s potential amazingly large in scope, but surprisingly requires something bigger then something which is already huge. My mind is blown here.

Posted Using LeoFinance Beta

@pixresteemer(5/10) gave you LUV. tools | wallet | discord | community | <>< daily

tools | wallet | discord | community | <>< daily

HiveBuzz.me NFT for Peace

Interesting for investors - thanks for the information

I see some users putting Hive in savings but I didn't know what the APR was, I only saw the HBD's APR on the wallet page.

Paying out Hive savings in HBD is a great idea on providing more liquidity for HBD. It will work on multiple levels, both for everyday users and investors.

There is no payout on Hive in savings. It is simply a defense machanism right now. If one's account gets accessed, the 3 day wait will give one time to recover the account.

Posted Using LeoFinance Beta

Very interesting! I think there are definitely some really good ideas floating around out there about how we can increase the value of the tokens. It will be interesting to see which ones actually get implemented. Even if only a fraction comes about I think we are going to be in a good place as Hive holders. I am trying to temper my excitement though.

Posted Using LeoFinance Beta

Yeah that is all true. It is interesting to see the integration of these different ideas. I know as I delve into the framework I develop, different things overlap.

It is why the time vaults, HBD, Hive bonds, collateralization, and lending all flow together.

Posted Using LeoFinance Beta

Binance mistakenly staked customers' cryptocurrency is like the banks investing customers' funds, this action should be telling the enemy worth avoiding cryptocurrency.

It will be of more benefit to the ecosystem if we could see more projects do this like Ragnarok when it finally launches.

The idea of staking Hive to earn HBD is appealing to me and could be appealing to those uninterested in powering up due to the longer duration of power downs. Get more HBD for staking HBD and HIVE while also reducing the amount of Hive in circulation.

I think the possibilities are worth exploring for expanding the use case of both Hive and HBD.

Posted Using LeoFinance Beta

Ragnarok certainly appears to be a text model for some of these ideas. The fact that it is moving closer to entering beta (or is it alpha) release means that players will be interacting with the game. I would think that the idea of getting some assets sold will appeal to all involved. This will allow for a better experience with the game as well as the opportunity to start filling the account with HBD and building the reward pool.

Posted Using LeoFinance Beta

Dear @taskmaster4450,

Your support for the current Hive Authentication Services proposal (#194) is much appreciated but it will expire in a few days!

May I ask you to review and support the new proposal (https://peakd.com/me/proposals/240) so I can continue to improve and maintain this service?

You can support the new proposal (#240) on Peakd, Ecency, Hive.blog or using HiveSigner.

Thank you!

If we would push to get APR% also for Hive we would have some strong Savings financial instruments at our fingertips. Full control, ownership, small withdraw period...I am sure we would see a lot of locking into it.

Posted Using LeoFinance Beta

It would be an interesting situation. I would think it will pull $HIVE onchain. However, will people pull out of Hive Power? That is an interesting scenario. The point being people will have more options which is never a bad thing.

Posted Using LeoFinance Beta

The thought of people pulling out of HP is fascinating. It is passive like delegating to curation pools, but potentially less controversial if pools behave badly, and of course, secure.

Posted Using LeoFinance Beta

Amazing they doing that. I can't even withdraw my hive right now.

That sounds like a good idea for hive to pay 10% interest.

The HF, I believe, went through today. So it is understandable the wallets will be locked.

Posted Using LeoFinance Beta

I like the idea of the "Time Vault," without it, I would be a little concerned about the "greed factor." If Hive is going to be offered at "above market" return rates, I'd think it should be structured somewhat like old-fashioned certificats of deposit. You get varying rates for 6 months, a year, two years, five years... but your high APY is a reward for your Hive being locked up jelly tight for the contract period. Eearly withdrawal results in a stout penalty... perhps you lose all your interest + 10% of your principal.

=^..^=

Posted using Proof of Brain

It does makes sense and I honestly would like to see more use cases for HBD used as a currency. Right now, most of the HBD being kept is more for the savings and that makes me wonder whether or not we could fall into a pitfall like UST if it's only there for the interest.

Posted Using LeoFinance Beta

I'm not sure it's wise to incentivize weakening governance for profit. HP holders would see easy money and power down. I don't see how that contributes to furthering decentralization efforts either. You'll end up with people thinking, "Why should I give a fuck about witness selection, proposals, etc. if I can just make some easy coin."

This is an interesting possible outcome.

Although I wonder how much HP is tied up in curation pools for passive earnings through curation, and never used in governance, because the owners are as passive about governance, as they are about earnings?

I think the more questions we ask, the more answers we find, and then more questions like yours are asked, which generates more answers and then more questions.

In a way, it’s like one peak down a rabbit hole seems to reveal more rabbit holes, with each successive peak down each new rabbit hole revealing even more rabbit holes.

:)

Posted Using LeoFinance Beta

People do often shoot themselves in the foot, for profit.

It can be both funny and depressing at the same time. One example is how several members that share common interests delegate their stake to something like leo voter. Now they can't support one another, so their posts receive fewer rewards, or they've concentrated all those potential views into one view, and now their posts aren't getting views, because a service is literally paying people to not look.

It's a fact here. People WILL put profits before connecting all the dots and seeing where it could lead down the road. So yes I don't mind pointing it out. Folks talk about the importance of retention and in the same breath offer them ways to get paid to not be around. Six years of this shit...

Whatever..

I didn’t see this before: “.. because a service is literally paying people to not look.”

But now I do.

I think your right to say that because delegation relieves you of the need to curate, so why look at posts anymore, and if your stake is delegated, why vote.

Interesting.

We always learn something new, when we allow ourselves to see through the eyes of another.

This one is funny, but true, it explains the absentee landlord phenomenon. ”.. Folks talk about the importance of retention and in the same breath offer them ways to get paid to not be around.

Yep, they are not here minding their delegated stake, and seeing what people do with it.

The same could be said for stake parked on exchanges, and used to vote by exchanges.

The more you look, the more you see, and wonder why.

Oh well.

Posted Using LeoFinance Beta

Many of these situations where someone is dangling easy money over ones head in my view seem like cutting one end of the rope off, tying it to the other end, then convincing people the rope is longer; but really the rope has only become weaker. Nobody notices because money good.

Blah. Back to sitting back and watching.

Thank you. I have been reading your articles on HBD for a while, and quite honestly I don’t always understand them. But today “a light bulb went on in my mind” .. and I feel like I understand. I suddenly see huge value in a relationship between HBD and $Hive held in a 3 day lock up, HBD interest earning investment vehicle, and the huge potential for investors to move their Hive and potentiallly HBD off exchanges back to Hive.

Posted Using LeoFinance Beta