Could Hive Follow The Ethereum Model?

A lot is made about Bitcoin. There is a no doubt that it is still the reigning king of cryptocurrency and, when it comes to value, might always be at the head of the class. It has captured the attention of those on Wall Street and institutions are starting to acquire it.

There is another cryptocurrency that made a great deal of noise in 2020. Ethereum was placed front and center in media coverage due to the explosion of DeFi. With now over $4 billion locked up, this alternative financing system is gaining steam. Maker just crossed $1 billion in locked up ETH, making it the single largest DeFi application.

What is interesting is that the ETH token just started to run. While Bitcoin had a solid year thus far in terms of the return, ETH was lagging behind. For a network that is making news everyday, this is a bit odd. The lag is something that could be very important in this story.

When we look at things categorized, Bitcoin is termed an "asset based cryptocurrency". This means that it is financial in nature and most development is aligned with that. Essentially, Bitcoin's main purpose is to transfer value from Wallet A to Wallet B.

Ethereum, on the other hand, is a "technology based cryptocurrency". While it does provide the ability to transfer value, this is not how it is primarily being operated. In other words, development and user experience are required to make the value of the network grow. Initially, Ethereum gained a lot of attention for the ICO craze through its smart contracts. Since that was popped, Ethereum languished without much of an identity. That was, of course, until DeFi came about.

Now we see something interesting with Ethereum's activity. When we look at the number of transactions, we are not impressed. In fact, both Ethereum and Bitcoin rank poorly in this category.

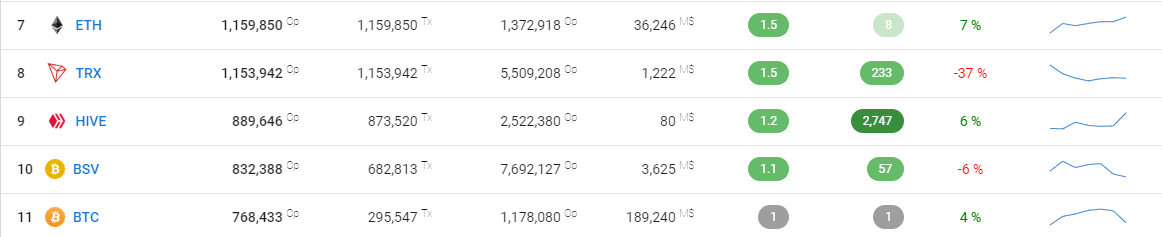

Here is a portion of the Blocktivity.info rankings.

Ethereum comes in at #7 while Bitcoin ranks at #11. They trail the leader, EOS, by a wide margin. In fact, we see Hive planted right in the middle of the two.

The important factor with these two blockchains is they are the leaders, by far, when it comes to the amount of money transferred. Ethereum just passed Bitcoin to take over the lead yet those two do not have a near competitor. While they might do fewer transactions than other blockchains, the amount of each transaction, on average, is off the charts. Those who want to move large sums turn to these two currencies.

Here we saw two approaches. Bitcoin is basically the same system as it was 11 years ago upon introduction. Then, it used DLT to transfer value from one wallet to another without the need of a third party. Today, it basically does the same thing.

Ethereum entered the picture with its smart contract capability and desire to be the world's first virtual computer. It might still achieve this goal in the end. However, at this point, that is still down the road. The platform is looking to alter its validation system by moving to proof of stake from proof of work.

Nevertheless, the we witnessed the Ethereum network transform in many ways. The ICO mania was just one phase of the development. We would be remiss if we omitted the CryptoKitties phase which introduced the world to NFTs (non-fungible tokens). Now we see Decentralized Finance (DeFi) becoming very popular on that platform.

A couple issues that Ethereum has is the fact that the cost of gas, due to network usage, is through the roof. In other words, it is costly to conduct business at the moment. We also see a limitation to the amount of transaction that can take place. The proof of work mechanism is simply not designed for large numbers of transactions.

Will the shift to POS solve this for Ethereum? It is likely to address the limit on the number of transactions since all POS systems appear to beat their POW counterparts. However, as we learned with EOS, being a POS system does not eliminate the potential for massive increases in transaction fees. We will have to see how Ethereum handles this.

Now we get to something very interesting. Both of these problems mentioned are non-existent on Hive. The number of transactions presently conducted, while rivaling Ethereum and Bitcoin, have little impact on the network. In fact, a 10x in the number of transactions would not cause any problems.

At the same time, we see that Hive has no direct fees on transactions. As long as someone has a minimal amount of Hive powered up, all transactions are free.

This provides a major opportunity for Hive to grow. The big question is how to do that?

Looking at Ethereum as a model, we can see the solution is in development. Technology based cryptocurrencies rely on this to attract users. Providing a better user experience in some form is vital. Thus far, across the industry, a poor job was done. Few applications have garnered much attention outside the most ardent crypto fans. A large part of this is the difficulty in use and the lack of perceived benefit in switching from what is known.

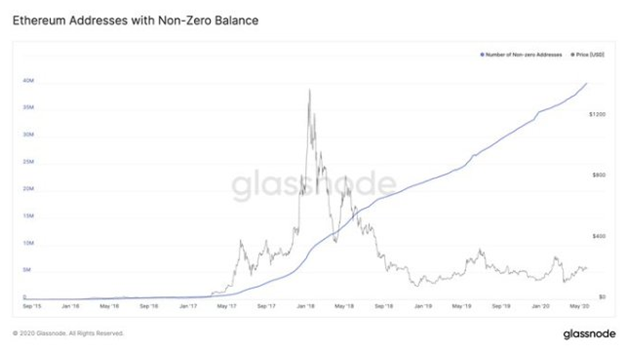

That said, Ethereum is paving the way forward. According to research done at the end of May, Ethereum wallets holding more than zero jumped 350%. It reached an all time high of 40 million. Obviously, the DeFi explosion has a lot to do with this yet it does show it is possible.

Here is where I can see a similarity between Ethereum and Hive. Over the years, Ethereum evolved as more development took place. Few in 2017 foresaw that this blockchain would be the DeFi leader in a couple years. Yet that is exactly what happened. In fact, during the ICO days, nobody was really talking about DeFi other than in the theoretical, futuristic sense. Today, that is no longer the case.

Thus, we case see how radically things can change in 3 years.

Which brings us back to Hive: What will this blockchain look like 3 years from now? If the model that Ethereum presented is an indication, it is likely to be a lot different.

Actually, if we compare things today to a few years ago, we can see a marked difference. Last year, Hive-Engine (Steem-Engine) was introduced which provided the ability for communities to tokenize themselves. This was a major breakthrough, providing this ecosystem with token creation. This has since evolved to include NFTs, another major factor going forward within the cryptocurrency industry.

We are now seeing games and other applications appearing which leverage NFTs for a better user experience (however users define that). In gaming, we see the ability to own in-game assets in a way that previously was not possible. A few games on Hive are starting to implement this. Yesterday I wrote a post mentioning how NFTShowroom is now catering to the art community, allowing buyers and creators of digital art to come together. This is an arena that got some recent attention, not surprisingly, on Ethereum, and is now on Hive.

Ultimately, we see some valuable piece in place. It all comes back to the development and attracting entrepreneurs to this blockchain. This will stimulate innovation, bringing greater value to Hive. At some point, this will end up reflected in the token price.

If Ethereum is a model, one thing we can expect is a delay. Hive is obviously not known to many investors and will not likely benefit from massive pumps. It does, however, have great utility, especially as more applications come online. This will only drive the need for the token which could them propel it to much great levels.

Does this mean that I think that HIVE will rival ETH in price? No, let us be realistic. One is a $36 billion market cap while the other comes in at under $80 million. The point is that if Hive does follow a similar path, the ability to grow is there. In other words, the upside potential is great.

In the end, the applications are going to tell the story. It would be great to have a major breakthrough like Ethereum did on a number of occasions that are "Hive only". That is rather unlikely. Nevertheless, it is not a competition. Hive only needs to offer solid applications that cater to the different market segments. Look at it this way, while Ethereum might drive 1 million digital artists to its applications, if Hive can drive 10,000, it will have a massive impact on the ecosystem.

After all Monaco is not the largest country in Europe but it is one of the wealthiest.

Hive has the potential to tap into very profitable niches that could provide a tremendous experience for all who choose to be involved.

Ethereum provided a path to follow. The question is will Hive follow?

As always, time will tell.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance

Your current Rank (42) in the battle Arena of Holybread has granted you an Upvote of 17%

I think one thing that should be considered is creating a stablecoin based on Collataralized Debt Positions like MakerDAO. That would allow passive investors to buy into HIVE and earn a return without messing with the Proof-of-Brain mechanism.

That is very true. It is one of the reasons why I am interested to see what LeoFi will look like.

Leofinance announced that is coming the other day but was sketchy with the details.

It could have a profound impact on Hive if done properly.

Posted Using LeoFinance

Very interesting! I definitely agree. LeoFinance is on fire!

Yep, over collateralized loans are the way to go but I don't think we need another stablecoin - we already have HBD. Also someone would need to buy those stablecoins (take the loans) and pay the fees and I can't see the reason to do it.

Instead we could have a system where you deposit BTC/ETH and take the loan in HIVE. You could power-up this Hive and make a nice APR while still having your crypto. The Hive for loans could be provided by liquidity pools fueled by hive users that want to get passive income without need to power-up. It could also work the other way around - deposit Hive/HBD and take loan in BTC/ETH.

I wonder if anyone would actually use it :)

HBD sucks as a stablecoin.

Anyone who wants to buy HIVE with a leverage. Suppose HIVE were used as collateral. You could use your HIVE as collateral and have the new stablecoins created. Then you could buy more HIVE with those stablecoins. When you're expecting a pump in the value of HIVE, it would make sense to do so. You could also trade those stablecoins for any crypto asset on the market.

That's another possibility. A good one, too, if you were going to do something useful with that HIVE. On the other hand, I'm not sure if any more passive auto-curation is needed.

That system couldn't work on the Hive blockchain alone. It would have to be a multi-chain app. MakerDAO takes any ERC-20 tokens as collateral but only those so it works on Ethereum and fully trustlessly.

DeFi seems all the rage now. $4 billion is locked in DeFi smart contracts on Ethereum. Hive would have lower fees.

Just to be clear - you're writing about new products that would probably take 1 year+ to code on hive blockchain, I'm referring to apps/services that can be created today but sadly in a mostly centralized way.

So someone would need to sell his hive in exchange for this stablecoin. I imagine that holding those coins would yield you passive income, right? And the fees could be paid in Hive?

Well, first this token would need to be listed on exchanges which is pretty optimistic :) I guess we would use hive engine for a start.

Well, we can have an automated script that monitors BTC/ETH deposits on provided wallets and issues hive engine pegged tokens. Something like what we already have on h-e but without the crazy 1% deposit/withdraw fee.

Of course, but Hive doesn't have smart contracts that would allow trustless loans. So back to the basic question, do we want to wait months for hive devs to even start working on it or do we try to build more centralized product and hope that someone will use it :D

can't hive also somehow use smart-contracts?

we already have escrow built in (even though noone uses it)

both :)

start centralized, if people use it and like, they automatically wanna go forward and decentralized -> ask/ demand for hive devs programming :)

I know.

Yes.

No. A stablecoin is a stablecoin. You hold a stablecoin because you want stability.

I don't think a new stablecoin on Hive would have to be listed on any external exchanges to be useful. Hive already has an internal exchange. But yes, it would be very convenient to have it listed on external exchanges. Also, its market cap would be boosted by having it listed on exchanges.

I don't think getting it listed would be outlandishly optimistic. Many exchanges that list HIVE list HBD already. Ditto for STEEM and SBD.

The problem with that is that such an app would have to be centralized and not trustless. But sure, why not.

I know.

I have nothing against that. :) Please go ahead if you find the idea worth implementing! A centralized product can be valuable as a proof of concept. The other way it would be valuable would be that the code could be made at least partly portable despite not being written in C++ like Hive blockchain code. At the very least, parts of the architecture could be reused.

With the popularity of DeFi, I have a feeling it would be used.

It would all depend upon how well it was marketed. This idea might actually enable the ability to reach outside the ecosystem.

Posted Using LeoFinance

@leofinance is already have plans for DeFi. Read their roadmap: https://peakd.com/hive-167922/@steem.leo/leofinance-2020-roadmap

Ethereum has a massive community, and like 100 theycallmedan's. That's their secret. Hive needs that magic. Hive has a better potential at getting there better than ethereum because of its distribution system through its tokenization of web 3.0 technology. Hive is being spread out, Ethereum wasn't spread out easily like Hive is. One bitcoin bull run will send this place into chaos. Time will tell as you say

Ethereum created a ton of millionaires with their ICO. A ton of people got in early and were able to ride the price a lot higher.

However, even still, their distribution of the token isnt that great. Hive might actually have passed them in that area. Not sure that means much when we consider all the tokens on top of both blockchains since there are whales all over the place although the ERC20 tokens have more value than the HE.

Hopefully in time that starts to shift.

Posted Using LeoFinance

Exactly....(1st paragraph)

Yeah true as well....with all the defi applications all over the place

Posted using Dapplr

I don’t see how this is still even a debate.. CryptoKitties vs Splinterlands

I was hoping SMT’s would cause an “ICO style” craze... But I am hopeful greater minds are building great things for us.

It will be indeed interesting to watch the progress of Hive