Hive Bonds: Time Vaults Are On The Way

In the decentralized world, it takes a long time to get things done. On Hive, there are discussions, debates, and more discussions. This often includes witnesses, users/stakeholders, and developers.

The topic of Hive Bonds goes back a couple years. It was first proposed as a liquidity mechanism for HBD, only to evolve into something much bigger. One of the main ideas is to generate a high quality form of collateral.

I will cover the details of the collateral and counterparty risk in a future article. For now, the biggest component is infrastructure.

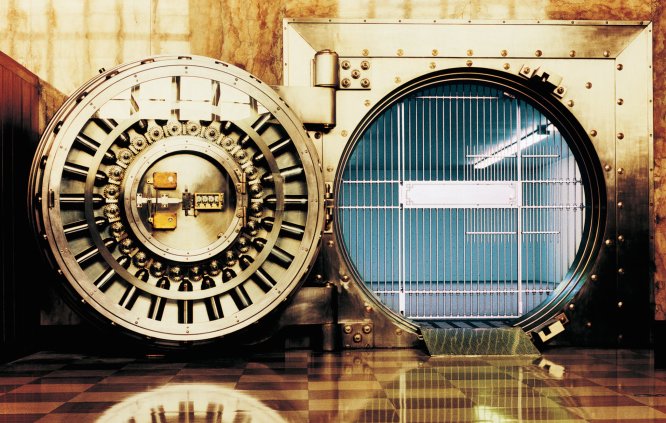

This starts with time vaults.

Time Vaults Being Coded

There was an interesting conversation on the CTT broadcast yesterday. It started out with the focus being on the APR of HBD in savings. This evolved into a larger discussion about the future of HBD along with what could be built.

Blockchains joined later in the show providing valuable insight into the technical process. He also mentioned that he would start the process to get the time vaults built.

Before going any further, we know this is going to happen, we just do not know when. It might make it into the next hard fork or it could be the one after. The point is we might have a bit longer to wait.

Nevertheless, knowing they are on the way means other actions can be taken.

What Are Time Vaults?

Time vaults will reside at the base layer. It is basically a series of savings accounts like we have for HBD now. The difference is that they will be set up in a manner that requires a time commitment in exchange for the interest rate garnered.

Right now there is debate about the interest paid on HBD in savings. Some are for lowering it. What is not debatable is the rate does not require much of a lock up period. Basically, one gets that with a commitment of 3.5 days.

Time vaults will reflect certificates of deposit. As the length expands, the interest rate will increase. This will be determined by the witnesses. Thus, the time periods are hard coded into the chain but the rates can be adjustable.

We also will have the rates locked in. For example, if one deposits HBD into a 1 year vaults today, that rate is good for the entire time. If the interest rate is changed tomorrow, the money that went in today is under the old rate.

As we will see, this is the essence of a financial network.

There is another advantage to time vaults. They do provide a security feature for the ecosystem. Since HBD is a debt instrument, it could be a point of vulnerability. We already saw some security features put in place to prevent a TerraLuna situation. Time vaults would be another.

Under this scenario, any HBD put in is locked up for a period of time. That means anyone can see what is coming due and when. My view is the risk diminishes the more that is built on top of HBD. With more options, the idea of converting back to $HIVE is reduced.

Hive Bonds

This is the first idea of what can be an entire financial network. The time vaults are base layer. Hive bonds will be a second layer (or a series of) solution.

Basically, one would deposit the HBD through an application. This would place it into a multi-sig wallet. The individual would garner the interest for that particular transaction, just like at the base layer. There is also a token issued for the HBD, forming the "bond".

This token can be tied to an exchange. Here we see liquidity provided to individuals who lock the HBD up. Just like when one buys a bond, the money is not returned until maturity from the borrower. However, one can always go to the market and sell the asset.

Collateralized Lending

Another facet of the financial network is lending.

Many are familiar with the Maker DAI lending application. People are able to post bitcoin as collateral on a loan. This allows individuals to borrow against a certain percentage of their asset.

For example, if someone has $5,000 in $BTC, perhaps they borrow $2,500 (or 50%). This is a common scenario.

The drawback is volatility. Bitcoin can move from $30K to $25K in no time. This means that people have to put up more money if their collateral value drops below a certain level.

What is being proposed with Hive Bonds reduces this. A Hive Bond is based upon a certain amount of a stablecoin placed in a vault, garnering a specific return over a certain period of time. All components are fixed.

The market can change the value as we see with bonds. They do, however, usually pale in volatility when compared to stocks, let alone bitcoin. The one time they did tank was when the Federal Reserve rapidly raised interest rates. This provides the Witnesses with incentive to be slow with their moves regarding rates.

We are looking at the result where bond is less volatile than bitcoin, making it a much better unit of collateral.

Value To The Ecosystem

Over the last couple years I discussed what gives a currency value. It is not the usual things pointed to including the asset backed notion. This is going to really hinder the majority of the stablecoins out there.

What gives a currency value is the economic productivity tied to it. This can come in the form of both commerce and finance. Generating a circular economy helps a great deal with the first. The latter, however, is where the steroids are.

The entire foundation of this financial network is HBD. Over time, the goal is to get it tied to:

- payments

- derivatives

- funding and investing

- collateralization

As the options expand, more HBD is required. While there is debate over the present interest rate, in the end, that is still small numbers. We could potentially be dealing with the need for billions of HBD. This can only happen through conversion of $HIVE.

Unlike most other stablecoin projects that are trying to provide value through the reserves, this creates it through utility. If we are dealing with a DeFi network of financial services that people are using, HBD will be in demand. Since this is directly tied to Hive, the market will, at some point, reflect that in the value capture token.

Counterparty Risk

The other piece that has to be mentioned here is the counterparty risk.

When dealing with the financial system, there are two issue: friction and counterparty risk. They tend to stem from the same area, financial intermediaries.

As more financial institutions are involved, that expands the risk. One needs to trust each. Solvency at every level is important and, if one fails, it can have a fallout effect.

We are looking at reducing this as much as possible. HBD in savings eliminates any centralized entity. The counterparty in this transaction is the blockchain. Even the wallet is decentralized in the sense one can access through many different websites.

This is being expanded with the development of an open source, desktop wallet by the core development team.

Hive bonds does add in another level of risk. This can be mitigates by having many options for creating the bond. By this I mean 3Speak, Ecency, PeakD, Leofinance, and whomever else could set up something on their platforms to allow it.

We also can utilize decentralized, layer 2 node systems to host the transactions, tied to multi-sig wallets.

Thus, even though we are dealing with second layer applications, they are tied to infrastructure that is decentralized.

The same is true for many of the ideas of this network. There will obviously be some areas of centralization but we can reduce some components in ways the existing financial system cannot.

In Conclusion

Stepping back and seeing the bigger picture is important.

We are discussing a longer term road map here. This is going to develop over the next year or two. HBD in savings was the blockchain's first real step into decentralized finance.

Now we are looking at taking it even further.

Time vaults will be the next leg in this evolution.

logo by @st8z

Posted Using LeoFinance Alpha

Ah this is actually happening eh?

Nice.

Although I feel like it will be woefully incomplete infrastructure without the bond NFTs to create liquidity and prevent the timelocks from sucking money out of the system and ushering in a deflationary environment.

I hate splitting hairs but I think it's 3 days.

Just kidding I love splitting hairs did I trick you?

Yeah. It is incomplete with just the base layer. Need to get that infrastructure at some point.

It might be worth writing a post on the process of how the bond market takes "NFTs" (the bonds that cash out at random times based on when purchased), and funnels them through an exchange to make them fungible and tradable with massive liquidity. I still don't quite understand that bit.

Good idea.

Yes. As @edicted mentioned, I think Layer 1 NFTs would be required for the bonds to be transferable. Relying on Layer 2 for that would add unnecessary counterparty risk.

Unless I'm misunderstanding the process.

Yes they would be required and are not possible on Hive.

The layer 2 is going to have to use multi-sig wallets and decentralized node systems. Of course, there could be apps that choose not to do that but that is what people will want to shy away from.

In exchange for the liquidity, one does assume more risk. The time vaults provide the same benefits (minus liquidity) with the blockchain only as the counterparty.

About fracking time this got off the ground. Your persistent pays off.

The future is bright.

!BBH

@taskmaster4450! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @bradleyarrow. (9/50)

What if the witnesses raise the HBD interest to 10000% for one minute, issue a bunch of one year bonds before lowering the interest rate back?

To start, that would have to be consensus.

Secondly, the bond itself goes through a second layer application so it would take time to do that.

Of course, any other created at the same time would fall under the same situation.

But you bring up a valid point. There could be a cap of increase coded into the time vault to prevent manipulation in such a way.

If u need HBD liquidity, and if there is demand for it, Hive holders will simply convert Hive to HBD. Then it’s 100% backed by hive. No need for crazy interest rates in this case. I.e. when there is a demand for HBD, hiveans will simple create the HBD themselves using the hive they have.

This is a very timely post. I was trying to follow the conversation started recently about lowering the HBD APR, and adjusting my witness votes to support those in favor of keeping it at 20%, and completely forgot about Hive Bonds.

Now, while I won't support a reduction in HBD APR at this time, I may be more inclined to consider it down the road when we can adjust that rate with an extended lock in period. I know so little about this particular topic, it's hard to have a valid opinion on it, but I've come to believe HBD, if it can continue to hold the peg as well as it has been for the last year or 2*, is how this ecosystem grows and thrives.

*From what I've seen HBD hasn't moved outside of 3% in either direction for the entirety of this year, and I don't recall seeing it outside of 5% for months leading up to that. I think most of us can do business with a 3% margin of error, particularly in the places HBD is gaining traction, where 3% may literally be $0.03 +/-.

I feel like Hive bonds are going to be very

usefulnecessary going forward, specifically because of the option to get a higher return on something stable. I've been in the crypto space to some degree since 2013, and my primary complaint about the space is how volatile EVERYTHING is. I think that volatility is pretty much the only real reason crypto adoption is taking so much time (term used loosely). I'm very excited to see what unfolds after we get bonds, especially if we can adjust the rate of return based on time locked.Agree.

Time vaults will essentially provide Hive with CDs on the base layer. After that we can get the bonds going on the second layer.

All of it will come together. There is likely going to be a very low APR on the savings with no lock up (1% or 2% is my guess).

I have this one doubt, if HBD bonds happens then that means HBD Savings disappear or we will have Savings with a lower APR and Bonds with a Higher one?

The base layer has time vaults of different durations and interest rates, simply to how CDs operate. If you opt for a 1 year lock up, we then you will get a higher interest rate.

Bonds will provide liquidity at the second layer.

Thank you for bringing this to our attention. After giving things a bit of thought regarding the APR debate, I think the core of the issue comes down to the disproportionate time commitment between withdrawing HBD savings (3.5 days) and powering down Hive (3 months!).

With time vaults, this is going to give pause to anyone thinking of depositing HBD into their savings looking to reap the %20 rate. Your preaching paid off, congrats!

While that is perhaps a consideration, I think simply looking at the time to access the capital is a mistake. HP and HBD are completely different asset classes, with different benefits.

Fixed income versus speculation.

Nothing gets the ball rolling faster than a good kick in the ass.

Thanks for freaking out, Hive.

Task.

Is that supposed to say "Blocktrades"? And where can I find that talk? I knew it was coming but didn't know from where.

Yup it should say blocktrades but it says blockchain

I thought so. Thank you.

Yes, it was @blocktrades.

The discussion should be accessible via @cttpodcast account sometime soon:

https://peakd.com/@cttpodcast/posts

Very good. I've followed the account. Thank you very much.

Is there any timeline for Time Vaults implementation at base layer?

No idea. It might make it into the next hard fork (which we dont know when that is). Blocktrades has to talk with his team and see how long it will take to construct.

Not sure but would this not constitute as hive giving out securities?

Who is Hive? Who is providing the securities?

Do you want Hive to get into compliance? Who fills out the application and what company is used?

Who is hive? - Node and witness runners, if there are focused work done on Hive it is not hard to look at who are running the nodes, the network is not that high a number.

Who is providing the securities? - Again node providers.

Get into compliance? - It be argued again the nodes are not that high a number it will be identified who are providing the nodes, now if we think of Hive as a company we can argue we are all part of the network the hive token holders with HP and the witness/node runners. This network is not as big as the Bitcoin network, now if miners can be stopped how hard can it be to stop hive the network when there are not a lot of these servers running our blockchain.

Who fills out the application - I vote you do it since you are very knowledgeable.

You obviously do not understand decentralization and open source software. Anyone can run a node and many are anonymous. There is nobody tied to them and the names are not public. It is easy to set up nodes anonymously (if you know how to set up nodes).

What is your address...I will put your addy on the paperwork to get into compliance.

I know the concept of decentralising, you sure obviously think, just because there are nodes made by aliases there is no way for governments to track them if there is ever a desire to get the details of who are running the nodes.

Complicity occurs when there is a consensus being made by node operators to run a new version with these said securities like arrangement.

And if need be I'm not scared of ever giving my details, I got nothing to hide. I have never been hesitant towards KYC.

Congratulations @taskmaster4450! Your post has been a top performer on the Hive blockchain and you have been rewarded with this rare badge

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

This is a great project. There could be varying aprs depending on the amount of time the bonds are locked.

Lending on the other hand seems to be quite risky. Take a look at celsius who were very strong and confident in the beginning but ultimately crashed.

So because Celsius was a bad deal, that means lending should be done away with?

FTX was a scam, should all exchanges be taken down.

Failed entities happen for a lot of reasons. We have to remember that (as well as learning).

Great to hear about the new features being developed. With the upcoming marketing campaign funded by DHF, we will have more users joining in. What I would like to see more is the ability to easily buy $HIVE and $LEO

Very interesting article. 😃

I look forward to seeing how Hive develops in the future.

!ALIVE

!PGM

!DHEDGE

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

@taskmaster4450! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @ tuisada. (4/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power (2x 50 HP) and Alive Power (2x 500 AP) delegations (4 weeks), and Ecency Points (4x 50 EP), in our chat every day.

This post has been selected for upvote from our token accounts by @tuisada! Based on your tags you received upvotes from the following account(s):

- @dhedge.bonus

- @dhedge.leo

- @dhedge.ctp

- @dhedge.pob

- @dhedge.neoxag

- @dhedge.waiv

@tuisada has 1 vote calls left today.

Hold 10 or more DHEDGE to unlock daily dividends and gain access to upvote rounds on your posts from @dhedge. Hold 100 or more DHEDGE to unlock thread votes. Calling in our curation accounts currently has a minimum holding requirement of 100 DHEDGE. The more DHEDGE you hold, the higher upvote you can call in. Buy DHEDGE on Tribaldex or earn some daily by joining one of our many delegation pools at app.dhedge.cc.

That's good news!

I now exceeded my 100 HBD savings for the year. I think I can do 400. 1,000 is the goal for next year. So far, I am able to follow the logic from HBD savings, to time vaults, Hive Bonds, and collateralized lending. A very informative reference that I need to review.