Hive Potential: Billions Of HBD Locked As Collateral

The banking industry is certainly capturing the attention of people within cryptocurrency. This naturally sparks calls for change. Unfortunately, many do not realize the crux of the problem and what led to the decline of Silicon Valley Bank.

That said, this is a topic we discussed repeatedly over the last few years. One of the reasons to be most excited about the Hive Backed Dollar (HBD) is because of the potential it carries. We can add to the sophistication of it, positioning this currency as an important variable in the global financial system.

Understanding the world of money and finance today requires the focus on collateral. This is the epicenter for what is taking place. When we start to trace the issues we are seeing, most of it tied, in some form, to this premise.

It is also something that really came to a head 15 years ago with the Great Financial Crisis.

Therefore, let us consider a day when billions of HBD is locked as collateral. What does that do for Hive.

https://www.sifma.org/resources/research/us-repo-statistics/

Trillions In Lending

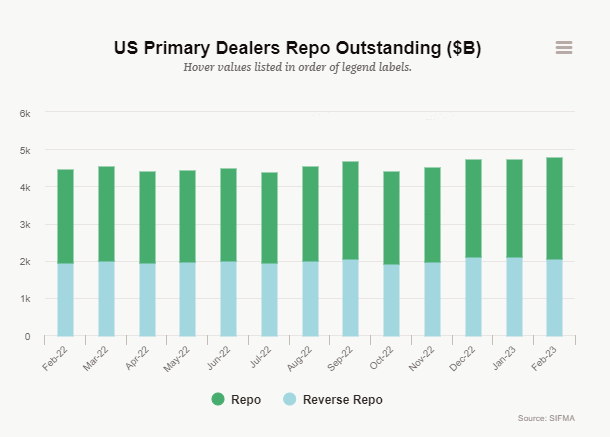

The above chart shows us how big HBD can become. It shows the daily repo and reverse repo operations. This is an average of the daily volume. As we can see, it is just shy of $5 trillion per day. All of this is collateralized, meaning it is secured lending. Financial institutions along with governments enter with U.S. Treasuries, backed securities, and certain commercial debt to secure the funding.

Here we see one aspect of the lending market, mostly tri-party short-term. It is this market that funds an estimated 90% of global trade.

A quick example is a stock account at a brokerage firm. When one sells, say $5,000 of IBM, the UI will show a negative throughout the day. However, when logging in the next day, that is gone and the account is updated.

The problem is stock transactions take at least 2 days to settle and clear. Hence, the firm is providing a "loan" to the account holder. How is that done?

If there is a deficit for the firm, it enters this market and will secure the cash it needs. This allows for operations to continue without interruption.

We also have to account for the bilateral agreements that are drawn. This is sketchy since little data is available. These are agreements between two institutions that are not primary dealers nor do they use the custodian (Bank of NY Mellon). A bank in the UAE and a brokerage firm in Australia may put together a deal that does not show up on the Fed's numbers.

Some believe this adds trillions more in daily activity.

The point here is the market is huge, bigger than most people envision.

A Lack of Collateral

One of the reasons behind the concept of Hive Bonds was for this purpose. Since the Great Financial Crisis, the private sector's share of high quality collateral diminished. It was thought that MBS filled this role, equating them to US Treasuries. After that blew up, the world was left with sovereign debt. Unfortunately, when central banks implemented their negative interest rate policy, that nuked their bond markets.

This left the world with only Treasuries. To get the best rate along with lowest overcollateralization, bring on-the-run Treasuries to the table.

Sadly, we run into another problem. Due to the moves by the Fed, and the inversion of the yield curve, we have a situation where the demand for securities at the long end of the curve is not there. It makes sense since locking up money for 10 years when you can get 100 bps higher with a 3 month commitment is not appealing.

The result is a large portion of the US Treasuries on the balance sheets of banks and other financial institutions is off-the-run. That means liquidity is not present. It is exactly what Silicon Valley National Bank ran into.

Over a year ago, I wrote this article:

Here we sit 15 months later and the collateral situation is only getting worse. Balance sheets all over the world are being constrained creating a monetary crisis.

Hive's Opportunity

People have a tough time believing that Hive can be anything but a niche blockchain. The reality is we have the potential to create an asset that could have a major impact upon the financial system.

What do you think would happen if there were hundreds of billions in HBD locked up as collateral? The only reason it existed was to be bonding and used for short term lending? How would that affect the value of the Hive ecosystem?

Keep in mind the correlation between HBD and $HIVE. As it stands now, the haircut rule is 30%. That means the market capitalization of HBD cannot exceed 30% of the total of the virtual cap.

Does this mean that Hive is going to take over the Fed's open market operations and insert itself at the center of the short-term lending market? Not likely.

It does, however, show the enormous potential that exists and how much funding is required to power a $100 trillion global economy. We also have to consider how other forms of lending exist.

Here is a quick tidbit:

On average, Americans take out $61.8 billion in new auto loans each month. By age, Americans younger than 50 take out $38.5 billion in auto debt monthly, according to the New York Fed, compared with $22.4 billion by those 50 and older.

That is close to 3/4 of a trillions dollars in loans on a yearly basis.

How about Hiveautoloans.io?

What Separates Hive

Many might question what makes Hive different? After all, there is all kinds of lending already in place with decentralized finance (DeFi).

The difference is the design if HBD. To start, the volatility will be reduced, since we are using a stablecoin as the basis of the collateral. We see Bitcoin lending where people put up their BTC. What happens when the price drops 25%? More collateral is required.

A secondary aspect to this is the true decentralization of the asset. This is totally market driven. It decides how much HBD is available and how many bonds would be required. If lending drops, the market simply adjust by people "letting the bonds roll off". Of course, the return is attractive as a means of keeping the HBD in place, even if not bonded.

We also have the stability in the pricing. The idea of time vaults is to establish a fixed rate of interest and avoid the situation where the value of the bonds is destroyed by the maneuvering of rates.

Finally, these assets can be created by the market instantly, as needed with full transparency. Since it is on the blockchain, it is clear how much is in there along with the return and date of maturity.

In Conclusion

We are presently watching the fallout from the collateral situation. This is all tied to the deflationary money cycle that we are operating under. The latest round of long dated securities going off-the-run only shows the catastrophe that can result.

The key for cryptocurrency is to find a need and fill it.

Here we have a glaring hole that needs fixing.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

https://twitter.com/1331330355513745413/status/1637099543845122049

https://twitter.com/1472693700933345286/status/1637139332698914817

https://twitter.com/1415155663131402240/status/1637349895186305025

The rewards earned on this comment will go directly to the people( @taskmaster4450le, @kalibudz23, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

As always thanks for the education.

All roads lead to Hive and Hive is the future.

I am not sure all but we are going to try and get as many as possible.

Posted Using LeoFinance Beta

Absolutely 😀

!BBH

@taskmaster4450le! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @bradleyarrow. (15/50)

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 1690000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

!PGM

!LOLZ

!MEME

Credit: cmmemes

Earn Crypto for your Memes @ HiveMe.me!

It takes one to look deeply at Hive to appreciate its possibilities for one to start realizing it is just more than a niche platform. The potentials are vast but require time for full-blown results from developments.

Posted Using LeoFinance Beta

As a financial system, there are a ton of possibilities.

This is going to get very interesting if we build the proper stuff.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

I think Hive Bonds, collateralized by $HBD could be huge. Just look at what $HBD is doing in Venezuela and Cuba right now. Both countries are under economic sanctions (and embargo for Cuba) by the United States. Neither country is allowed to freely purchase USD on the global market, and Venezuela's government has severely restricted access to Dollars, which has helped destroy the purchasing power of the Bolivar. $HBD auto loans in developing economies could be HUGE.

And that's before considering the possibility of $HBD-backed home loans, personal loans, construction loans, even college/education loans.

Posted Using LeoFinance Beta

https://leofinance.io/threads/@mercadomaestro/re-leothreads-2kkeoinn3

The rewards earned on this comment will go directly to the people ( mercadomaestro ) sharing the post on LeoThreads,LikeTu,dBuzz.

I agree that there is a void that cryptocurrency can fill right now and the banking situation looks fragile right now. I think I saw a video by Steven Van Metre about 180+ banks at risk and if they start to fall, I think it could potentially get worst. The only issue with HBD is the liquidity.

Posted Using LeoFinance Beta

This would be the equivalant of a secured credit card, where you place money against your ability to lend up to that value in money. A plausible use, with a full value collateral, in case of ever a default, by returning the HBD to other users by authorized sale to recover the loss.