Pumps: The Reason HIVE and HBD Need Derivatives

We all have witnessed what is taking place. Over the last week or so, due to the activity on Upbit, the price of both $HIVE and $HBD pumped. The latter went to an incredible 3x over its peg, something that is counterintuitive for a stablecoin.

How can these be prevented? Is there a way to ensure this does not happen?

This is what we are going to approach in this article. There are a number of challenges when it comes to situation of this nature. One is to maintain a balance between "scarcity" and liquidity.

So let us dive right in.

Scarcity

There is a lot of $HIVE out there right now. This is something we cannot deny.

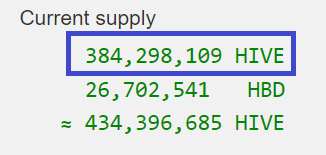

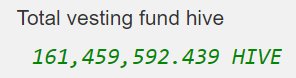

According to Hiveblocks, this is what we are looking at.

As we can see there is a total supply, just under 385 million. At the same time, the amount locked is just over 160 million.

This leaves us with around 223 million $HIVE floating on the open markets. Many think the solution is for more people to lock up the coin. As explained in the need for Hive Power is going to grow, this will likely be the case. However, does that solve the issue?

The answer is no. When the floating supply of an asset is reduced, volatility will increase. If we get to the point, say, there is only 100 million $HIVE on the open market, we can expect much larger swings. It will also likely be easier to generate pumps even if the price is higher. With less coins available for trade, this lack of liquidity translates into bigger moves.

Of course, the same holds true for $HBD. We know the situation is stark there since we have around 27 million, yet 17 million of that is locked in the Decentralized Hive Fund. So this gives us a float of about 10 million $HBD.

The challenge is we are looking at more than 3 million of that locked up in savings. While this can be liquidated in a few days, it is of little use in a pump. Things simply move too quickly in markets.

Naturally, having more $HBD in savings is a good thing for the Hive economy. This will help to generate more of the stablecoin over time while also enhancing the balance sheet of individuals on Hive.

Once again, the scarcity will lead to volatility, especially since Upbit is the only exchange with any volume of both coins. For a stablecoin, this is fatal.

Liquidity Comes From Derivatives

This is an ideal situation to show how important derivatives are to Hive and how they provide the solution to the paradox of scarcity versus liquidity.

In the world of decentralized finance, we see that liquidity pools are a central part of the equation. Having coins or tokens with many pools is the goal. At the same time, we want depth to those pools so the liquidity is available when needed.

With the Hive coins, this has, so far, fallen to Leofinance. They built out a few liquidity pools using the coins on both BSC and Polygon. The tokens created are derivatives of what is on Hive.

Let us look at the mechanics of $HBD to see how it works.

When one wants to get involved with a LP using either bHBD or pHBD, the coin is first bridged over. This basically created the associated token while putting $HBD in the wallet of the Leofinance team. A portion of this is placed into savings to take advantage of the APR being offered.

An equal amount of pHBD, for illustration purposes, is generated. We now have twice the amount we started with. If there were 100 $HBD moved, that is now in a Hive wallet while 100 pHBD are in a Metamask wallet.

The individual would then swap 50 pHBD for another token, say USDC, and then put both in the LP. Effectively, we just added 100 pHBD to the pool since the "purchase" of USDC likely ended up in one of the LPs.

This is how both scarcity and liquidity can be maintained at the same time. At the moment, since Upbit has such a large percentage of the floating Hive coins, there is little that can combat the pumps. Over time, the course of a day or two, things can return to normal. However, it likely takes some of the bigger holders stepping in. This is fine if they will do it each time. That said, it would be much better if market dynamics were able to take care of it.

Always A Paradox

When it comes to currency, there is always a paradox. For example, with the reserve currency, there is something called Triffin's Dilemma. This basically says the country behind the reserve currency, at some point, is going to have to decide between its own economy or the global one. Where are the resources allocated for growth?

We can see the same thing here. For the US Government and, more specifically the Fed, this paradox was solved by the Eurodollar system. That eventually because a derivative center for the USD. An entire system was built based upon the dollar with, ultimately, no dollars in the it.

The solution for the stablecoin is more $HBD. Of course, to generate this, for the most part, $HIVE needs to be converted. This will eat into the amount of that coin which is out there, something that could be problematic if the need based upon utility increases. This will only create more volatility in end.

Therefore, we can use derivatives to produce the stability desired, especially on the stablecoin while also ensuring the scarcity via use cases. The above example showed how we can have both at the same time. The $HBD that is bridged sees a portion in the savings, generating more of the coin. At the same time, the liquidity pool deepens, ensuring trading can occur as needed. There is a limit to how this progresses since it is all dependent upon $HBD. Here is where the derivative can add value to the underlying asset, in this instance the stablecoin.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

So what will happen when more and more people join Hive? The price will be seriously affected because eventually more $Hive will be produced.

The amount of $HIVE produced is at a disinflationary rate. It keeps decreasing each year. Certainly, more could be created by converting $HBD to $HIVE. However, if there are use cases for the stablecoin, the incentive to do that isnt there. The price of $HIVE would then go up, if there is a need based upon utility.

Resource Credits are the primary use case for the coin. That means people need it to engage with the blockchain. This is going to be an interesting dilemma in the future.

Posted Using LeoFinance Beta

That's true... more deriatives will find more use cases for Hive DEFI users...

I think liquidity is important ...so just taking out the supply as you said leads to volatity as pumps and dumps will happen and again little Hive holders will be most affected!!

I did not know HBD price went 3x to its peg... I have seen earlier too... they happen especially on bull markets... but as you say HBD has to be a stable coin meaning can't have upwards large deviations of its peg, that will promote more trading of it, when its a stablecoin. Anyway

Yeah last week it was pumped in the overnight hours (for me). I woke up to a price of like $1.60 or $1.80. But it touched much higher levels.

Of course, the ability to combat it was limited due to the amount if pHBD and bHBD available. Here is where the liquidity in those pools could help.

Posted Using LeoFinance Beta

https://twitter.com/taskmaster4450/status/1554473346531827716

The rewards earned on this comment will go directly to the people( @taskmaster4450le ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

the only reason is that HIVE is one of tha favourite coins for PUMPS AND DUMPS for binance and so on. Tomorrow the volume will be nearly 1m-3m$ for a day

The pump comes mostly from Upbit.

Posted Using LeoFinance Beta

it doesn't matter. Now value is on the same place as previous

I was out of town and totally missed out on the bulk of the movement this past weekend. It seems like that is always the case for me. I actually had some liquid Hive I could have taken advantage too. Oh well. Next time I guess since there likely will be a "next time".

Posted Using LeoFinance Beta

Yeah. It was a quick hit. Didn't last too long. Like $HBD, maybe a day.

Posted Using LeoFinance Beta

That's usually how it goes. I guess I need to stop taking vacations! :)

Posted Using LeoFinance Beta

just put in a sell order for the price you would sell at and you won't miss out.

Posted Using LeoFinance Beta

Good point!

I'm loving more each day learning something new about Hive tokenomics - how everything connects is undoubtedly Amazing.

Total hive locked is still Good and supply in circulation is also fine - the fact you said lower the supply more volatility will increase and for now in these 2 months i saw hive standing strong even in bear market.

Liquidity pools with insane APR are Good reason for people to provide liquidity and also savings APR for HBD and APR or benefits of HP is yet a thing people in cryptoverse are unaware of.

This whole thing is interesting to me and glad I'm learning new stuff each day. This is so informative tbh!

The good thing about them is they bring another token into the equation. The payouts to those in the LPs are done in $POLYCUB and $CUB. This means the $HBD that is in savings by the Leo team is earning the 20%, building more in circulation but the Defi platforms are providing the incentive.

Posted Using LeoFinance Beta

With Leofinance doing the part of creating liquidity pools for HBD, attention needs to be given to the use of HBD for transactions, gaming is a quicker way to accomplish that I think, with that we get to see things expanded and replicated giving us desired result. Other than building use cases around HBD we might have to get use to pump and dump of HBD for the time being.

Posted Using LeoFinance Beta

Transactions can come in time. And nothing says $HBD has to be used for transactions either. You can use pHBD orbHBD for that alos. Hivelists is now accepting both as payment I believe.

Posted Using LeoFinance Beta

I guess i now got a bit clue why we got a pump on hive, there is need to have a good derivative means of keep hive supply balanced.

I fear what might happen if mass sell occur, how do we prevent such dump since more hive are created on daily basis to reward authors, the supply will always increase with time.

It does increase with time but as a slowing rate. And people can convert Hive to HBD so that could also lessen the amount.

The big issue is going to be when $HIVE is needed to operate. HP equates to RCs. This means that people, if the user base grows, will need it.

More that is powered up means less on the open market. That could create liquidity issues.

Posted Using LeoFinance Beta

Thanks for the clarification.

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 1440000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Liquidity for Hive for sure is a big one in particular still HBD which has been a bit hard to get your hands on. However with the increase in price of Hive payouts would start to increase again for HBD. Thus allowing for more liquidity in those markets. Polycub and CUBDeFi both saw this hit hard for liquidity issues during the last crazy swing we just had. I have to say though its night and day better compared to what it once was and it's only going to get better.

Yes well there is not a lot of liquidity out there for the derivatives either. That is a problem at the moment.

Sure there are ways to work on it and we just have to keep forging ahead. The fact there are options is a great first step.

Over time we can keep filling up the LPs which will help to provide a depending of both coins.

Posted Using LeoFinance Beta

and what price will be for Hive at the end of a year and will we see a new pump before an event?

The market is so fucking crazy sometimes

Hive is actually a better place because people are holding and still earning to invest more.

Posted Using LeoFinance Beta

And there is building still taking place. We are seeing people and teams roll out new stuff. A lot happening in a relatively short period of time.

Posted Using LeoFinance Beta

Yeah you are right. Alot of things happening which we really don't know how to figure them out

I think the Hive supply looks fine but I am always skeptical if we can really push prices down without more pools for Hive. As for HBD, I agree that we need more supply and more liquidity in the pools. It's relatively easy for it to get pushed back down compared to Hive.

Posted Using LeoFinance Beta

Liquidity is an issue and that will always be the case. That is why derivatives can solve the problem. The base coins, with multiple use cases, are actually providing people with incentive to hold them. That is a good thing but does create issues with liquidity and the markets.

Posted Using LeoFinance Beta

Great Post!

!1UP

Click the banner to join "The Cartel" Discord server to know more!

You have received a 1UP from @luizeba!

@leo-curator, @ctp-curator, @vyb-curator, @pob-curator, @neoxag-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.

PIZZA Holders sent $PIZZA tips in this post's comments:

@curation-cartel(14/20) tipped @taskmaster4450 (x1)

Please vote for pizza.witness!

I was fortunate enough to be on the computer at the right time to be able to take advantage of the spike, but I would prefer it to be more stable.

I don't like that one group of people can cause that much chaos.

Very interesting post, @taskmaster4450