The Crypto Bear Market Through The Rest Of 2022

The bear market has been fierce. Our sleeping beauty came out of hibernation in a powerful way.

Over the last 6 months, we saw a grinding down of the cryptocurrency markets. This is coupled, recently, with the reversal in the equities. Bonds are also getting hammered providing people with little safe haven.

All the talk is on inflation. Now, the Fed is going to do all it can to stamp that out. Since they didn't cause it, they will now go after the economy. If the stock market is wiped out, that is of little concern to them.

The same holds true for cryptocurrency.

For those involved, the major question is when will the bear market end? This is tough to predict but it looks like this will last through 2022. With the Fed's actions, we are going to see a bad situation made worse.

In this article we are going to analyze what is taking place and forecast what the Fed might do.

Liquidity Crisis

As mentioned in a number of other articles, the global banking system was suffering from a liquidity crisis. There are not enough US Dollars in the economy due to the fact commercial banks have not been lending. At the same time, since the Great Financial Crisis, collateral was in short supply, tightening the entire banking system.

Of course, the Fed's Quantitative Easing program only made the collateral situation worse by pulling Treasury securities off the market. By swapping them for Reserves, they were no longer available. Plus, from an international banking perspective, Reserves are useless since they cannot be collateralized.

Reserves do provide some liquidity to the Repo market. This helps keep the overnight lending between the banks going. Now the Fed is starting Quantitative Tightening which is going to pull some of the Reserve liquidity out of the market.

Or are they?

While they are now talking about this, it appears the Fed started a while back.

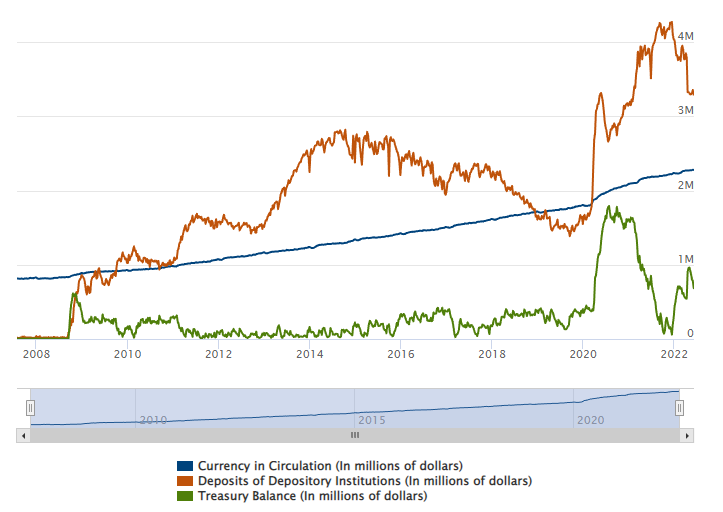

Notice the brown line, the bank deposits.

As we can see, there is a drop of almost $1 trillion since December. When we look at the Reserves, we see this accounts for a fair portion of it.

.png)

This saw a drop of $600 million in that time and Quantitative Tightening hasn't started yet.

Risk Off

Traders talk about Risk On/Risk Off. This is a risk off environment.

Over the last few months, we saw tech stocks like Tesla, Facebook, and Amazon get hit hard. These are high multiple growth stocks that do well when money is flowing. Naturally, if the opposite happens, they get killed.

When investors are moving to safety, assets like these get crushed. Contrary to the rhetoric, cryptocurrency is not a safe haven. It is a risk on/risk off asset category. That means when money gets tight, the markets will pullback.

Of late, we now have a lot more talk of a recession. This is only going to feed into the negative sentiment. The fear that people have is only going to grow as this is felt through the economy. Layoffs are likely to follow meaning households are going to be further affected.

None of this bodes well for cryptocurrency.

Inflation

All eyes are on inflation.

This is a problem because we are dealing with a situation that has multiple factors, few which have to do with the Fed. Nevertheless, the political pressure is now on the Fed to do something about this. As stated, they will hammer the economy in an effort to reduce demand.

Wars. Lockdowns. Supply chain shortages.

All of these are the reason for 40 year prints in the CPI. We also have a massive bull run in commodities which is not helping matters.

This is why we see persistence with prices. Since this is the Fed's focus, we are not going to see a change in policy until this is under control.

Unfortunately, that means removing whatever liquidity is out there. We are going to have to wait for another recession to take place so that we can see the stimulus start rolling out.

Gear Up For 2023

Cryptocurrency is going to take off and moon. This is for certain.

We are going to see the Fed reverse their policy. The multi-trillion dollar question is when?

It is safe to say they will hold this path until it is too late. There is little chance of a "soft" landing. We know a rate increase is coming in this Fed Meeting. It is likely we get one in the next. Looking out towards September, it could get questionable.

The Fed tends to foreshadow things. Thus, we have to build in 3-4 months before any change in policy actually takes effect.

For example, the Fed talked about raising rates back in December, yet did not move until March. We can expect the same thing on the reverse.

If the Fed stops raising sometime in the Fall, we could see them switch as we enter 2023. When the easing starts again, we will see the risk on trade go into overdrive.

This will set cryptocurrency on fire. At that time, we could see some of the six-figure price claims for Bitcoin coming true. In the meantime, we might be in for more pain.

The Fed's preference is to have the equity market grind down. That said, all of this could be accelerated if we see a major crash in a short period of time. It is easy to see how 3200 on the S&P is on tap. However, we could also see 2500 on the table at some point.

A market crash will get the Fed's attention. Consistently moving lower only reaffirms their actions (at least to them).

Therefore, it is vital to monitor the pace as well as the direction of things. Since all eyes are on the Fed, that gives them a lot of power.

It is time to dance very lightly.

Fixed Income Market

One final point that might help in terms of what to watch.

Typically, the fixed income market recovers before equities. The move to risk is first realized by entering there. So keep an eye on that.

Once that market starts to recover, then we can expect investors/traders to have a larger appetite for risk. That means equities and cryptocurrency will follow.

Remember, this is a game of expectations and the Fed is the major mouthpiece in this area. Following its playbook can offer insight into what is going to happen.

After all, they do not keep it a secret.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

@taskmaster4450, @pixresteemer(4/10) sent you LUV. wallet | market | tools | discord | community | daily

wallet | market | tools | discord | community | daily

Thank you for a very clear and simple text.

it's ironic that bitcoin which was supposed to free us from the legacy system is at the mercy of the FED. I hope that it will actually decouple from the markets once the system crashes. There is an argument to be made that whatever the FED will do it will crash the system: raising rates will lead to the crash, QE will put us into hyperinflation... But all of this is actually bullish for cryptos as it leaves a door open for an alternate path

Actually QE doesnt cause this since the money doesnt get out into the general economy. It is actually backwards. QE locks money into the banking and financial system which can send some assets up but general prices will not respond since the average person cannot hold Reserves printed by the Fed.

Of course, stopping food and energy production like the politicians did will always lead to higher prices.

Posted Using LeoFinance Beta

good point

Well, the fed does not control bitcoin, but if government bonds offer a safer yield, then people with a lot of money, who do control the price of bitcoin as supply and demand, will move into bonds.

Posted Using LeoFinance Beta

When risk off is on the table, you are right, the whales move away from the risky stuff like BTC to something more conservative.

Posted Using LeoFinance Beta

Or they wait for prices to bottom out and buy very cheaply.

Posted Using LeoFinance Beta

We could face a leveraged domino effect. Because of the inflation, FED increases interest rates which reduces overall liquidity that is already limited at the moment. At a global level, it seems that nobody wants to start increasing interests first because this will lead to an appreciation of their currency, which will provoque a slow down of their export economy. All together, there are plenty of ingredients in place for a big crash. Unfortunately crypto, as one of many investment vehicules, can't escape from it, at least in the mid term.

The Fed will increase rates aggressively but the yield curve is screaming STOP!!!.

We saw the long end of the curve call bullshit starting in December. It continues today. So the overall reading of the bond market is not for growth and inflation expectations. Instead, it is the exact opposite.

The LIBOR curve says the same thing.

A lack of liquidity is going to mean less economic growth which we saw since the end of the GFC.

Posted Using LeoFinance Beta

https://twitter.com/taskmaster4450/status/1536716837018292229

The rewards earned on this comment will go directly to the people(@taskmaster4450le) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This goes to show how much we'll need to grow in the crypto space... pulling free from the control of the Feds is a dream that wouldn't be easy to see actualized but it doesn't mean it isn't possible.

These are hard times, certainly not for the faint at heart. We can only watch and pray while we try to make very careful smart moves, hopefully we'll get through 2022 and probably celebrate again in 2023.

This was very informative..thank you ❤️

It isnt so much being tied to the Fed's actions as it is providing the banking/monetary/economic system with what it needs.

Crypto has to solve the liquidity problem. This is where it cam make a difference. Until then, we are going to be dependent upon the Fed sucking up the pristine collateral (Treasuries) or releasing them as they see fit.

Posted Using LeoFinance Beta

very beautiful jobs

The crypto bear market has left a lot of people very poor. Especially those that bought high like myself. It just keeps dipping as no one know where the bottom is.

I believe we just have to be hopeful at this juncture as the crypto bear market has made the non-cryptonians mock us. As more money keeps going for the dip.

For now am off the trading avenue

Cheers in tears 😢 to me as am heartbroken 💔.

Thank God for Hive

It is all about timing. Markets go up and down. Long term, depending upon what you are holding, there is a good chance we see newer highs in 2023, and by a large margin. However, we probably have not seen the lows yet.

Posted Using LeoFinance Beta

Interesting stuff. It is a little depressing to hear that we are likely going to have to go through this for a while longer. Nice to know that there should be a light at the end of the tunnel. Meanwhile development continues. Banking system won't know what hit it when we come out on the other side of this.

Posted Using LeoFinance Beta

The industry has to mature. We are still in the embryotic stage. The role of crypto is to fill the liquidity need. That is where it can have major impact.

However, with the volatility, it makes for lousy collateral, especially for short term lending. And we cannot help the USD shortage until we get some legitimate stablecoins operating and developing value on their own.

Posted Using LeoFinance Beta

That is a good point. I never really thought of the fact that right now we are still just trying to proliferate crypto out there.

There is a hole in the global financial world that cryptocurrency can fill it. It is a solution that we can bring to the table.

Posted Using LeoFinance Beta

How did you notice the global financial system suffering from a liquidity crisis?

You talk about the dollar then, but this is not global.

If you consider the dollar as an indicator of the global economy, it's not like that. In the EU, China, Russia, and basically in most of the rest of the world, the dollar doesn't indicate a liquidity crisis, I'm not sure it ever created a global liquidity crisis.

Moreover, I don't think the US witnessed a liquidity crisis any time since 2007, which was the last time I've heard of this term, but then again, perhaps living in the US gives you better information on this one.

Still, everything I was observing so far was the opposite of a liquidity crisis. Money was flowing like crazy, corporations were presenting huge growth and profits, and lending was once again at the roof.

But, as I said, I'm in the EU, so perhaps my sources concerning the US economy are flawed.

The USD makes up the majority of global transactions. It is the number one holding of Central Bank reserves. The major of FX OTC transactions (like 90%) are in USD. US Treasuries are the only form of pristine collateral right now. About half of all global debt is denominated in USD, which means that entities need USD to pay back their loans (which is why central banks have USD as their primary reserve).

US commercial banks, which are the ones that create USD via loans, saw lending flat since the Great Financial Crisis. That means few new dollars.

We also have low interest rates which means a lack of money. When interest rates are high, that is a sign of abundance. Hence we are in a liquidity crisis of both USD and collateral, the latter which is vital to the international banking system.

The EURO and and YEN are regional currencies with little use case outside those regions. Plus, the US banks will not touch the debt of either of them, forcing another issue that feeds back into those regional banking system.

To say the USD is not global is a mistake. It is throughout the entire global and financial system.

Posted Using LeoFinance Beta

Sure it is significant and a mistake in the way I presented the case.

Of course it is used universally and the top used reserve for foreign exchange by Central banks.

Thanks for the explanation. I still haven't heard anything about a global dollar liquidity crisis, and felt there was abundance of dollars (and euro in the European region.)

Maybe this is too recent so I haven't found any news about it.

Last time I checked there was abundance of liquidity, thus I considered logical the FED's step to increase interest rates.

https://www.bloomberg.com/news/articles/2021-09-02/the-world-is-awash-in-dollar-liquidity-that-no-one-wants#xj4y7vzkg

If there was a world full of dollars, we wouldnt see:

All of that is indicative of a USD (along with collateral) shortage.

Most of the media doesnt focus upon how the monetary truly works globally.

After all, have you read up on the Repo market? When was the last time you saw a trader from the realm on CNBC?

Posted Using LeoFinance Beta

Dollar goes up against worse fiat currencies. Strong in this case means it losses less purchasing power than the rest. The rest central banks are doing less to sustain the value of the currencies they control.

I feel like this time when the bears is over, we may see a big rally.

Posted using LeoFinance Mobile

I think by the time this year ends we would have more crypto adoption. More companies putting in the instruments with which crypto can be purchased or crypto are part of. So we are going to see the market up sooner or later. We just dont know how high it would go and also what things would trigger the normal recovery.

I find it hard to imagine what the El Salvadoran government is experiencing right now, after investing huge amounts of money in bitcoins before the crash.

Posted Using LeoFinance Beta

They are getting crushed. Same with Microstrategy.

Posted Using LeoFinance Beta

I think it's hard for us to understand the extent of this concept, crush)

!LUV

@taskmaster4450le, @barski(4/10) sent you LUV. wallet | market | tools | discord | community | daily

wallet | market | tools | discord | community | daily

I am happy if we have this for the next year or two to be honest as this is perfect for growing. A year or two serious fortunes can be made and stacking and staking is the way to succeed.

Posted Using LeoFinance Beta

Well I see a very black outlook for the crypto market and the traditional market, both are suffering staggering losses that have not been seen in years. I have read that this bear market is the worst that has been seen since the beginning of the crash. And as you say it is the big tech companies that are the hardest hit.

Posted Using LeoFinance Beta

Oh, I hope you're right on this one. Half a year is not the end of the world...

Posted Using LeoFinance Beta

Greetings @capataz4450

no doubt that what remains of the half year 2022 , will be marked by a market of much nervousness and expectation for next year, this is a cycle that we have to wait for it to pass.

the winter will pass and better times will come.

I think Btc may go down to 15k

Posted Using LeoFinance Beta

That's what the chart appears to me too. Two more waves. One more bounce and another sell on rally. Just don't know how long will it take.

Posted Using LeoFinance Beta

This entire crisis is caused by governments and central banks. Ever since 2007 the financial system has been on life support and central bankers are attaching band aids to keep things going.

Making the global banking system "safer" has caused reserves to go up and lending to stay stagnant as a result. Banks are no safer as a result. All that has happened is that the fees depositors pay to banks have gone up.

What the world needs is more savings. Not more loans. But who in their right mind will lend, i.e. deposit, more money to banks and receive a pittance in interest when government caused supply-line inflation is in excess of 8% pa?

Yes, crypto has a role to play. This relies on improved use cases. Using crypto in "real-life" transactions rather than purely online ones.

Posted Using LeoFinance Beta

That is expected but as you said it's not easy to identify when the Fed will do that.

This level of FUD somehow gets me excited witnessing an opportunity like this.

Posted Using LeoFinance Beta

The cryptocurrency bitcoin for classic example has been a great gauge of investors’ risk threshold for equities and the recent plunge in prices can only mean more bad news for the broader stock market.

I see difficulties for a full year, at least until the end of 2022 and Bitcoin could seriously return to $ 10,000 in my opinion. For now, I am not mistaken about the descent to $ 20,000. I said it at the beginning of the year with uncertainty and I said clearly on May 9, 2022.

Posted Using LeoFinance Beta