Time Vaults: It Is Time For Community Feedback

This is a post to solicit feedback regarding adding a time vault to the next hard fork. It is always good to have on-chain discussions about these topics.

We have a subject that was talked about in great detail over the last year. It is projected to be on the list to incorporate into the blockchain. This will add another base layer option for people on Hive to utilize.

Let us start with the basics.

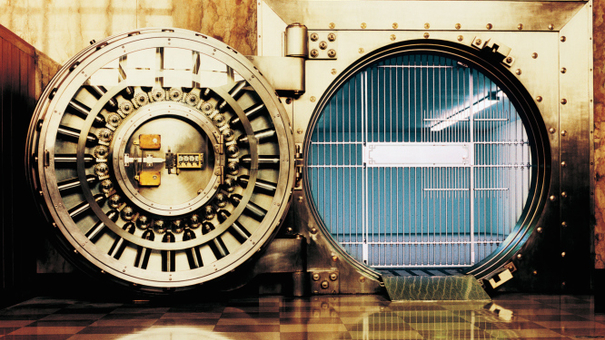

Source

What Are Time Vaults

A time vault will be an extra layer to the Hive savings account. It will allow users to deposit Hive Backed Dollars to earn interest. At present we have a system where people can place HBD in savings and earn 20% APR. There is no lock up period although there is a 3 day withdrawal time on savings.

By adding a time vault, we are incorporating the idea of locking HBD up. This is similar to staking where one is making a commitment for an extended period of time. In return, a higher APR is paid out.

For the sake of this article, we will use a 1 year lock up for a 25% return. The exact rate will be set by the Witnesses similar to the interest rate on the savings account.

Essentially, individuals and applications will have the choice of either keeping HBD liquid, putting it in savings to earn 20%, or locking it up for a year and earning 25% (based upon this example).

Expanding Hive's Fixed Income Offering

The fixed income market is enormous. Over the past year, we saw the problems associated with cryptocurrency staking and DeFi. Basically, counterparty risk was introduced, something cryptocurrency was meant to replace.

Hive can solve this. By adding time vaults, we expand the options to provide another fixed income instrument. Since this is at the base layer, the only counterparty risk is the blockchain. As long as it is running and the haircut rule is not exceeded, the risk is removed from HBD. People can stake without fear of a company going under, rug pull, or the second coming of SBF.

Fixed income is appealing to those seeking yield. While many love to speculate, most investors, especially corporate, prefer to use their treasury to gain yield. Having a time vault could be a beneficial option.

1 Year Time Vault

This is something that, if the community agrees, can expand over time. To start, it makes sense to add one vault and see how it goes.

At this point, it appears that a 1 year lock up is the best option. This is a long enough period of time to be able to monitor the status of the circulating supply of HBD while also enticing to users. A 30 year lockup, for example, would not get a lot of use.

Shorter periods could be useful in the future. A big part of a time vault is what is going to be built on top of it. Hive Bonds is an example of an idea that can be developed as a layer 2 solution using the time vault idea. As we will see in a moment, there is an idea to create longer term assets on the second layer based upon another feature built into the time vault.

Locked In Rate

Interest paid on Hive is actually a free floating rate. The "market" is the consensus of the Witnesses. This can change at any time.

The savings account is set at 20%. That could shift to 22% tomorrow, or drop to 18%. Nobody is in control of this. If a number of Witnesses change their settings, the rate is altered.

A time vault is a way to get a fixed rate locked in. Whatever the individual receives when the transaction is made, that is good for the duration of the lock up period. For example, if we put in 100 HBD today at a rate of 25%, that is what is paid over the next 365 days. A change in the rate the following day, in either direction, will have no impact upon that 100 HBD.

Benefits To Hive

A time vault brings a number of benefits to Hive.

- as mentioned, it expands the fixed income offering that can attract more users

- it is the foundation for more layer 2 solutions/application that can incorporate this into their business models (plans for some of these are already in discussion)

- debt management: since HBD is debt, it allows the Witnesses to monitor the circulating supply and see how the free float is expanding or contracting

- enhanced security since HBD locked up for an extended period is no threat to the blockchain and cannot be used as an attack

We also have the benefit of innovation. In the past we mentioned Ragnarok. The plan here is to accept HBD as payment for in-game assets and entry fees. All money raised will be put into savings, with the prize pools being paid out of the interest. The goal is basically to have HBD enter and never leave. A time vault is ideal for this since it can lock it up for a longer period. If the game grows in users, the amount of HBD being locked up each year only increases.

Having a time vault is an advantage for both the game and the entire ecosystem.

In the past we covered the idea of derivatives on HBD. Moving a lot of the HBD activity to side chains in the form of a HBD derivative moves the defense further out. Under this scenario, we could lock up a portion of the HBD that is backing the layer 2 token (let's call it sHBD) in the time vault. Hence, if there are 10 million sHBD, perhaps 50% is locked up knowing that not all will be bridged back to Hive.

This effectively adds another layer as more is locked up yet liquidity is still present albeit through the derivative.

Once this feature goes live, it is likely that development teams figure out other ways to incorporate this into their business models.

Longer Lock Up Periods

The ultimate idea behind time vaults is to develop something similar to a bond tree. This is the idea where the HBD is locked up and liquidity is provided by having an asset that can be traded on an open market. Hence, if someone needs money, the asset can be sold.

Here is where Hive Bonds enters. This is the concept of building a layer 2 application where creates a token based upon HBD deposited. Since there is a time period, payout schedule, and a rate of return, we effectively are dealing with a bond. This is part of the idea of trying to create high quality collateral.

For this concept to truly take hold, longer lock up periods are needed. As we know, bonds extend out many years.

We can keep adding more time vaults in the future. If it works, we can add 3, 5, and 10 year. This is one approach.

There is another way to develop this which could be coded in immediately.

The 1 year time vault has a "renew" button. This means that one can opt to automatically keep renewing the lock up. Using the Ragnarok example, as the HBD is put into the time vault, the option can be selected to keep redepositing the HBD as it unlocks.

This serves a few purposes. To start, when it comes to managing HBD, it is good for everyone to know what is slated for a longer lock up period. Let us say Ragnarok has 500K HBD locked up for another 6 months, but it is clear an automatic redeposit is taking place, then everyone knows that is effectively off the market for 18 months.

Another benefit is the bond tree could effectively be built at the second layer. An application could use this feature to offer long term bonds, perhaps 3 years, since it is simply a matter of auto-renewing.

Finally, the owner of the account doesn't have to worry about HBD unlocking and just sitting there. If Ragnarok has HBD entering everyday, a year later the reverse will take place. This feature could remove that obstacle for the team.

Of course, there is the possibility that things change and someone does want to reverse the decision. Here we can program the feature to be reversed as long as it is outside a window. My suggestion would be 30 days. The auto-renew can be disabled until one is within 30 days of the unlock. Get in that window and it is too late.

Again, this allows for people to monitor the flow of HBD and how people are operating.

Let Us Know Your Thoughts

What are your thoughts about time vaults?

Do you think the auto-renew (redeposit) idea is an effective way to enhance the features on Hive with regards to this? Will this enhance the potential of applications that integrate this into their processes?

Is there something that we are overlooking? Are there other things that you can see added that could be of benefit to the ecosystem?

Drop your thoughts in the comments.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

https://twitter.com/1331330355513745413/status/1626586508600942593

https://twitter.com/1493176574086156289/status/1626595601432612867

https://twitter.com/3380382322/status/1626956186821050368

The rewards earned on this comment will go directly to the people( @taskmaster4450le, @nill2021, @rubencress ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Totally agree with this idea and its very well explain here, one question, can an account have many Vaults, lets say my 1 year Vault is still running but in 3 months I want to add more to it can i create a new one and have multiple vaults? they are just contracts, thx for sharing ✌️

I also had similar thoughts too , but I am asking myself, won't that defeat the purpose of the time vault itself ??

I dont think so , the idea is to lock down, but then what if months latter i want to lock down more hbd on another vault, now if you unlock the first vault before time then i think that defeat the purose

Hmm I see

Yes all activity on Hive is time stamped.

Hence you can add 10 HBD to the vault on day, another 10 a week later.

They would unlock a week apart.

Posted Using LeoFinance Beta

I am 100 percent for this

Sounds like a good idea to me. One thing that would help it gain traction is a market for buying and selling locked assets and trading future rewards essentially.

A lot of Ve tokenomics projects that are experimenting with time locks are finding new use cases through trading. People love to speculate and having liquidity on demand is useful for emergencies.

Not sure if that would work on Hive though because it's a lot easier to implement when your lock is an NFT.

BTW are there any numbers to work with regarding the last APY increase to 20%? Did HBD gain more users after that change was implemented?

Posted Using LeoFinance Beta

The idea is that a layer 2 app will be able to create a token (NFT) to trade on a DEX. Honeycomb is already working on a DEX where this would work. So yes the idea is to be able to trade the "bonds".

I dont know about the wallet numbers but the amount of HBD in savings has skyrocketed compared to where we were before.

Posted Using LeoFinance Beta

For trading purposes, NFT does not feel right. How do you lock 100,000 HBD? Lock it in one NFT? How do you sell that later? Mint 100,000 NFTs? Thats a lot transactions to make.

If these are supposed to be traded, you probably need to settle for a fungible coin such as HBD01JAN2025 that releases the same amount of HBD on 01/Jan/2025. No coupons, please. Just compute the price on a given timestamp.

I know, there might be a bit of a naming problem (are numbers even allowed in the name?).

If you get the amount of FT classes (=payout dates) right, there will be enough to trade without too much liquid HBD thrown out at the market in a single moment.

This or too many payout moments with a damn good condenser that looks up alternatives close to your preferred maturity.

The idea is that a layer 2 app will be able to create a token (NFT) to trade on a DEX. Honeycomb is already working on a DEX where this would work. So yes the idea is to be able to trade the "bonds".

I dont know about the wallet numbers but the amount of HBD in savings has skyrocketed compared to where we were before.

Posted Using LeoFinance Beta

Now we are talking. All for the idea in that case!

To be honest I am scared of staking and lock periods now after Luna crashed. I am staking 50% Hive and keeping other earnings liquid.

I lost it all on a 21 day unstake, imagine a 1 yr stake. Will there be an option to break out of the stake for a fee given if something happens you want cash out fast.

Posted Using LeoFinance Beta

This would definitely be a added advantage.

You will be able to sell yours to a bigger fool.

I think comparing the two is no applicable. That is like saying something about a stock because another stock imploded.

The only similarities between UST and HBD are the fact they are algorithmic stablecoins.

Posted Using LeoFinance Beta

Correct and Hive has a system in place the continues to ensure stability and it is decentralised with multiple people and programs ensuring it.

Luna was a fraud from the gitgo.

@dollarvigilante called their death spiral months before it happened.

3rd party risk is at 99% against you getting your money back today, hive solves this.

It’s a good idea. I wouldn’t use it personally, 3.5 day lockup is enough for me along with the 13 week powerdown for Hive.

I personally still have PTSD from watching my UST and paired assets that was locked up melt away before my eyes and I couldn’t do anything about it because it was locked up. Because of that, and the hole it created for me, I am starting at Subway on Monday, lol.

Posted Using LeoFinance Beta

Always an option for people to use.

Of course, there is the Lindy effect. The further we go forward in a working manner, the longer we will likely continue.

Posted Using LeoFinance Beta

Oh for sure. It is certainly a good option to build in. I would probably use it one day when I don't need quick access to my funds lol. But now I have 2 offline jobs so I'll be able to stack the stacks again!

I like this type of post that invites on-chain discussion and feedback for potential features.

I am not at all sure if there will be much interest in such time vaults. It seems to me that crypto as a whole still has quite a lot of insecurity, volatility, large constant change in it, so the idea of offering something "secure" where one can park money seems dubious. There is no "set it and forget it" due to the constantly changing landscape. And anyways, people who are familiar with the HBD mechanics will know that the time vault interest is not guaranteed if the HIVE debt becomes too large and new HBD printing has stopped.

Apart from "security", the time vault also seems to offer a bigger return. This sounds great on the surface of it. But since this is crypto, people know that there are far greater returns to be gained by riding a bull run than a meager 25% (or similar) return. If someone locks up their capital for a year, this can prevent them from catching the bull run. So why would they lock it up? What is the target audience that would lock up their capital for this long?

Spot on. The target audience is everyone incapable of following your reasoning.

It is a product that is so ready for success in this world.

Most of the investing world is after yield, not speculation. The fixed income market dwarfs other market.

So while there are going to be those who look for the 10x runs, many will opt for fixed returns.

Posted Using LeoFinance Beta

The idea is good, but it is not time to apply it, first HIVE must earn a better market capitalization position in the top 50 and grow in usage power. We live in very uncertain times and for proposals like this trust must prevail. Greeting.

Posted Using LeoFinance Beta

You forget that something has to trigger that growth to the top 50 market caps, which any initiative could be a potential catalyst for it.

To me, the catalyst will be more evolutionary. It will be a series of steps moving in that direction.

Posted Using LeoFinance Beta

Why would ranking based upon market cap make the viability of something like this better?

And what do you mean usage power? The use cases for $HIVE are pretty evident.

Posted Using LeoFinance Beta

I have a question, are the interests from these time locks paid as liquid HBD or they are added to the account vault creating a compounding effect?

That is a good question, one that I didnt things about. It would be best to pay that out as liquid HBD. The compounding could take place by simply adding it to the HBD time vault.

Posted Using LeoFinance Beta

As for this 25% on 1-year lock, I assume this would be set as parameter being 125% of 3.5 lockup at moment of locking. The same with other periods? Yeah, I get it, through the locking period it stays the same.

What I'm afraid of it blurres the picture for average person getting into Hive. Let's keep minimal needed complexity of layer 1. I wouldn't go as far as bonds and derivatives, and even if I would introduce these tools, I'd never speak these names.

Current financial world is of such complexity is unavailable for avarage Joe, it doesn't bring trust and creates this environment of exclusion. Let's have this in mind while creating alternative. It must be done in a very careful way.

And that is by design. Most of the financial system is cut off from the average person since they are not accredited investors. So the idea that we cannot create tools that can be available to all people isnt what cryptocurrency is about.

There is no complexity. On base layer, there is just another savings account, longer term and different APR.

They are potentials that will be layer 2. They are not base layer but time vaults is vital if we are going to build out a robust financial network.

That is true although most of that comes from ideololgy, ignorance, and laziness. The information is out there.

I get what you are saying but we have to build out a system that rivals the existing one, not one that appears the masses. The reality is 90% or so of the population is going to be sheep and simply follow along.

As must as people talk about everyone being involved, the reality is most will not put forth the effort to achieve that end.

Posted Using LeoFinance Beta

Speaking of derivates - what do you have in mind? Commodities, precious metals, currencies, bonds, stocks, stocks indices....?

I think it's a great idea to implement it but I'm not entirely sure if I want my HBD locked up for a year. I held HBD for 7 months recently but I want to convert it back to HIVE when the time is right, as it was two months ago when the price was really low. As of now, I have more within 2 months than I would with 20% apr, in terms of USD value.

if there was a time vault I would miss the low time. As long as the cyclical nature of crypto happens, I want to try and earn maximum profit out of this. In the next year or 2 I am going to sell Hive to HBD piece by piece again and then ultimately back to Hive again. This is just me but I would be afraid to lock up HBD for a year.

Maybe I would do it with a part of my HBD but it's going to be quite a small percentage of the holding.

You have the option NOT to stake there. I don't have the option if I want to. It would be a feature, not mandatory

Yeah, that one is clear enough. I said that I like the idea and have nothing against it being implemented. I just don't think I would use the option in the near future.

Exactly.

Posted Using LeoFinance Beta

This feature will definitely enhanced the capabilities and use cases for Hive. My question would be can one progressive add to the vault once it is locked away? Or will it required entering a new vault. Also can one choose to withdraw before the time period for example by paying a penalty fee?

You can keep adding. It would be one year from the date of entry.

I havent suggested any early withdrawal for a penalty. It is something to consider.

Posted Using LeoFinance Beta

Right. I got it now.

Oh okay, it's a possibility then.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

I would like this feature for sure. What if we want to add more to already locked HBD? Can we have multiple separate locked vaults? I think that is the way. Lets say I have liquid 1000HBD and I want these:

And of course the option for my unlocked HBD to lock at a later time.

If there were different vaults, that would be possible. From what I understand, we are looking at one to start.

So you would be given the choice of one. But if this is successful, we could discuss adding more layers in the future.

Of course, with the time vault, what describe could be constructed on the second layer, especially with the autorenew.

Posted Using LeoFinance Beta

What I want is multiple deposits. They could start their own periods. Is that possible with this concept?

I'm on board with this. If it actually goes to a vote or there is a proposal put out about it I will certainly vote for it. It seems like a really sound idea to me. Plenty of other platforms do it. I feel like there is less risk here on Hive too.

Posted Using LeoFinance Beta

I feel the risk on Hive is less because of the precautions being taken.

Posted Using LeoFinance Beta

For sure. You have done a good job of pointing those precautions out over the year.

Like I said in other comments, where this topic was already touched, time vaults are interesting concept, but part of much bigger new functionality of lite accounts ("free floating funds" tied to address, not an account). There are many reasons to introduce such accounts, there was already some back and forth exchange of ideas on CoreDev chat, but I won't go into the details here.

Time vaults are basically NFTs. Some people will need many, with different time locks, others (most) won't use them at all. That's why they can't be implemented in a way similar to current savings where every account has a corresponding balance (in fact I think we should go the other way and make current saving balances into "free floating funds"). I'm guessing here, but they could probably be implemented as some form of Pay-to-Script-Hash with built-in script that would only "free" the balance for transfer after check on head block time is passed (plus proper signature of course). But I'm not familiar with the details on various address/signature schemes - that's part of the initial research that needs to be made and one of the reasons I don't think the topic has a short time-to-market, definitely not HF28.

Some issues: I don't see the auto-redeposit, neither from technical standpoint nor as a user. If they are to be like bonds, then they should not pay anything after maturity, no? The window of opportunity that user could have to "turn off" auto-redeposit complicates things a lot. Without it we can pay all the interest upfront (since it is locked anyway) and the vault could be stored as just address and asset.

Another issue: how do we calculate funds in vaults towards HBD debt limit? It seems natural to have some time-to-maturity weight attached to each one, but we'd need a way to compute such sum without running over all existing vaults. Besides we might open ourselves to a debt problem in case a lot of vaults unlocking near the same time. So maybe there should be no way for users to create those vaults but rather witnesses/system should hold "bond auctions"?

Well I certainly cannot speak to the technicalways of creating this so that will have to be directed to people a lot more capable than myself.

Yes bonds pay at maturity yet the bond idea is, at this point, a layer 2 solution. At the base layer, it is more akin to a CD or savings bond. The liquidity is not at the base layer, under this scenario, unless there is a penalty for early withdrawal like other people brought up.

Of course, if that path wants to be pursued at the base layer, it could but then we would add a lot more complexity to the equation. Certainly, that might extend the time to plan/develop.

I would say a weighted average somehow makes sense. We know something that is 5 weeks from expiration is a greater threat than HBD that was locked up a week ago. How that will calculated is a topic for discussion.

Of course, there is another factor in this: a lot of the vulnerability of the debt comes from the value tied to HBD. If we have no use cases and it is only used to create more HBD, than we have a tremendous flaw there. However, if we starts to become build out with derivatives, payments, used for funding, and being collateralized, then we are dealing with something completely different.

As always we are dealing with things from a holistic poerspective as opposed to being in a vacuum.

Posted Using LeoFinance Beta

Could it work better if person would "burn" hbd then gain small amounts of it everyday for a year totalling 125% of the original?

Such solutions have two problems: they add automated work to the core code. Nodes have to observe timers (extra index needed) and do some transfers on their own. Second, while each single step of such work takes very little time, there is risk of it accumulating inside single block. Then we have to have a mechanism that prevents that. We already have those, f.e. for recurrent transfers, but such situations should be avoided rather than worked around.

There will be less people locking HBD for sure. Why? Because - if any major market trading season is here, you can unlock HBD and in 3 days you can use them to trade or make an exchange. Just think of hive, making 20% rise for few days (that's happening many times a year, btw). Or major moves while FED talks about disinflation... I will not be doing this for sure. Maybe...if you give me 40%+ 😀

Most of the world is not speculators. If your view was the majority, the stock market would be larger than the bond market. That simply is not the case.

There are more people who seek yield verses speculation.

HBD is not an option for everyone long term just like holding all in $HIVE waiting for a run doesnt.

The fixed income market is huge.

Posted Using LeoFinance Beta

Bond market is around 3x bigger as stock market. But you have to ask yourself why. If there would be no central banks,which work in tandem (around the world) to keep whole market afloat, while buying each other's bonds daily... How big would bond market actually be? You think someone would buy 30year bonds for same or even lower rate as 6 month bond? Banks do. Because they have to. Because money market, stock market, realestate market depends on bond market. What I want to say is... hive has not same structure as eurodollar market. Not even close. But if you want you can make survey for all hive users to see what people really think

What if we have time locked vaults with the option of setting the beneficiary account for that lock. You lock your money for 1 year and set it up so the interest goes to my account.

We could use this feature for collateral or other contracts

Bonds... time vaults... whatever we end up calling them, I do like this idea of "fixed deposits."

I'm thinking (ultimately) that we should have 30-day, 90-day, 1-year, 3-year, 5-year and 10-year offerings.

The issue becomes incentives. I'd be inclined to suggest reducing the rate for "liquid" savings to 12%, and offering the higher rates to locked deposits; maybe 15% on 30-day, 18% on 90-day, 20% on 1-year with up to maybe 30% on a 10-year "note."

sounds like a good idea.. haven't looked at the problems of it yet

If we will keep the Savings which basically can be seen as a 1 Month deposit, Time Vaults are a good idea. If this is to implement I believe we should have from the get-go the periods configurable, allowing periods like 3 Months, 6 Months, 9 Months, 1 Year, and even 1+ year. While it doesn't mean we will use all of them, is better to have the support in the infrastructure rather than needing to change the code later on.

Posted Using LeoFinance Beta

My thoughts are:

My questions are:

I think options like this are a great idea and can certainly set us apart.

My concern remains in the area of security though and I hope to see a discussion on making account balances private. It seems like a real problem for real world use.

You've been talking about this for a while, and I'd love to see it come to fruition, but there's something I've noticed that keeps distracting me. Why would I lock up Hive for 1 year for a mere 5% increase in return (25%) when I can get 20% and keep my holdings virtually liquid.

It just seems like even though I'd love to get a 25% return, I'd likely settle for the 20% if I didn't have to lock funds for extended time. I understand you've just been throwing that number out there as a place holder, but it's been happening long enough I need to ask if you think that's a valid increment. I ask because I think this would be a very valuable tool for Hive, but I'd hate for the devs to go to all the trouble to build it and no one use it because it seems less valuable on the surface than it really is. Is this all still more or less hypothetical, or will it be added to the next hard fork for certain?

Maybe something that incentivizes keeping your money in the "vault" for extended or indefinite periods and\or having a larger amount deposited in it... Could also be tiered by amount invested

I think it's a good idea but does it compound while being locked? The saving is compounded monthly if people are active and I wonder if the rates would consider that or not.

Posted Using LeoFinance Beta

It is interesting, it is the same scheme that we used before in banks with savings in fixed terms of one year, only that the option of saving in a fixed term of one year should be placed without being able to withdraw but if it can be deposited several times, there must be one way to do it.

Honestly, Time Vault would be a no-brainer for Hive to introduce. Not just HBD, but HIVE itself could also be time-locked if projects that are built on Hive were to do airdrops. But as you said, it could be expanded as we proceed.

A Time Vault would be a smart step for Hive to expose its DeFi properties.

Payout time?

The current savings mechanics allow us to compound every 30 days, which if say a 20% rate has been calculated throughout the year, would result in almost 22%.

Would the time vault also be paying out HBD every 30 days for X locked-up period? i.e. I lock up 1000 HBD for 1 year with a 25% rate, would I get ~20,548 HBD paid out after 30 days? Or will the pay-out occur after 1 year? (as in, we wouldn't lose the compound opportunity)

I feel that a fixed amount for the rate isn't a game-changer if rewards are paid out after a year, as it would remove the compound property on our already existing savings mechanic, with no time lock. If it does payout every 30 days, it is a no-brainer to place the initial HBD in a time lock for years.

I have written an in-depth article about introducing an HBD Savings delegation mechanic, this could work so well with a time vault (rewards can be claimed by the delegated account), as it would open up Hive to trustless contracts with other users and accounts on the network.

Emergency Withdrawal

Like pancakeswap, or other similar staking protocols, that were introduced as a time vault, they also introduced an "emergency withdrawal", where users would void their rewards back to the pool if they pulled out funds earlier than the agreed time. I have used an emergency withdrawal. Have you thought about the functionality of incorporating that into a Time Vault? Burning rewards/Sending rewards to the DHF fund for example?

Posted Using LeoFinance Beta

Like the idea, just a couple of questions:

How are the payments going to be made, are we going to have to wait 30 days as in savings or will it be at the end of the year?

Have you thought about making something like the PancakeSwap auto compounding pool that adds rewards to the staking balance?

https://leofinance.io/threads/@andyblack/re-leothreads-njszq

The rewards earned on this comment will go directly to the people ( @andyblack ) sharing the post on LeoThreads.

Second time to see this. That's the good thing with https://alpha.leofinance.io/threads and also with PeakD's "Listen to Post" option. I was able to listen to the article until the end. Time Vault now made sense to me. It is somehow an answer to people's fear of crypto projects following the footstep of SBF. The good thing is everything will be on the chain and so anyone can monitor what's going on with HBD.

Hive Bonds too is making sense now. That is great to see Hive developing high-quality collateral. Moreover, I am glad to be reminded about Ragnarok using HBD and also the assurance that locking up HBD will not affect its rate during the market's volatility.

Making time vault savings transferable is essentially creating another liquid coin backed by the Hive currency which is guaranteed to go up with the dollar. This is a dangerous debt instrument.

I have weighed in on this concept before, but I will do so now with a bit more detail.

I would say a decision needs to be made whether the initial long-term HBD instrument should be treated as a 'bond' or as a 'certificate of deposit'. A 'bond' would pay all the interest plus return the principal at the END of the lock period; a 'CD' format would enable withdrawal of the principal at any time, but with a penalty (typically all or a portion of the accrued interest).

Personally, I think the 'CD' format would be better, as it is much more flexible for the depositor and doesn't require secondary markets if the depositor has a change of heart and needs immediate access to the principal.

Shortly after my wife and I got married (25+ years ago), we had some cash we wanted to get a yield on, but we wanted to have access to it if need be. In other words, we had no immediate needs, but we were expecting our first child, we were renting but considering purchasing a home, etc. So flexibility was important to us.

I ended up getting multiple CDs with various durations (e.g. 3 mo, 6 mo, 12 mo) at various interest rates, and I spread out their initiation dates over the first few months. And, when the shorter-period CDs expired, I could roll them into their own longer-period CDs, so that I always had at least one CD renewing within 30 days. This is a process known as a 'CD Ladder' (sometimes done over years; I did it over months, to maximize our liquidity).

The net result was, if we needed access to cash, we could either [1] wait a few weeks until the next-to-renew CD was redeemable without penalty or [2] redeem whichever CD had enough cash in it to meet our immediate needs and had the least penalty.

The nice thing about that setup was, although it took a little bit of up-front calculations and legwork, once I set it all in motion, I had the benefits of longer-term yields with immediate access to 1/12 of my money at any time, penalty free, 1/6 for a modest penalty, etc.

My suggestion would be to follow the CD model and make it so that the 'CD Ladder' strategy is built in (i.e. don't force savvy investors to jump through a bunch of hoops to accomplish this -- make it easy for them).

@taskmaster4450, I would be happy to draft a procedure and parameters to implement an automated 'CD Ladder' strategy if you think that might be worth further exploration.

I like this idea. !BBH

@taskmaster4450! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @fiberfrau. (2/5)

this looks like a great idea to us for the time vault the one-year contract and even the 3 4 or 5-year contract, the rates are amazing and if nothing dodgy happens as we know it happens everywhere, particularly in centralized banks and institutions, it could be a way for the future of our kids and grandkids, without being threatened of being stolen of our savings for such or such government or state reason.