We Are Going To Need A Lot More HBD

Over the past few weeks we discussed the Hive Backed Dollar (HBD). This was instigated by the article proposing the idea of Hive Bonds. Here we have a concept whereby we can develop, at the base layer, a fixed income system that starts with a basic bond tree.

Since this is tied to blockchain, the transparency could set this up to be pristine collateral. Reducing the risk associated with collateralization always elevates that asset for this purpose. The world is in desperate need of high quality collateral. It is a problem that cryptocurrency can fill.

Another benefit of the Hive Bond idea is to strengthen the HBD. As a stablecoin, the token is still lacking. That is understandable since it was overlooked for so long. Now we are seeing focus placed upon it and Hive Bonds can help in a big way.

The benefits are:

- Locking up HBD for long periods of time

- Creating an astronomical amount of HBD

Many scoff at this notion believing that there is a major risk.

Let us look at what is taking place in the cryptocurrency world.

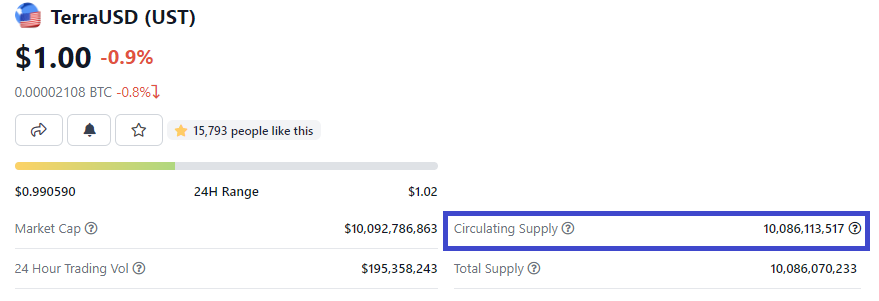

UST Reaches $10 Billion

UST is the stablecoin that is built on LUNA. This is a very interesting project since it uses a similar concept to what Hive does. The relationship between HIVE-HBD is something that should be focused upon. We now see this concept in action.

What is important to note is that UST is an algorithmic stablecoin that is not backed by USD. Like HBD, the tied to USD is only as a unit of measure. There are no Dollars involved in the process. Instead, it is tied to the base token.

Here is what the situation with UST looks like right now according to Coingecko:

Notice how it just reached 10 billion UST in circulation. Read that again: 10 billion. Where have we heard that before?

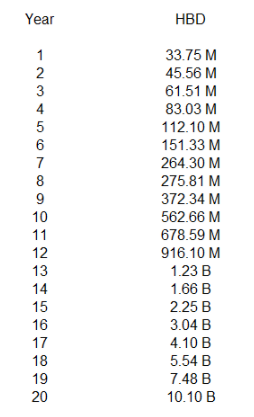

In the article How Much HBD Will Be Produced, we charted the path to 10 billion HBD. As the chart shows, it will take up to 20 years using the Hive Bond idea presuming all present tokens are put into the 30 year category.

To be a serious stablecoin, there needs to be billions of tokens available. This is something that many seem to overlook. One of the worst fates is a liquidity crisis. When there is not enough money to engage in the level of commercial activity an economy requires, it contracts harshly.

Here is a short video about how Terra works

In short, each UST is created by swapping LUNA. Sound familiar? As the need for UST grows, LUNA is swapped to create more of it. This is exactly how HBD can work.

While this sounds great for the value of the base token, with Hive there is an issue. We could well be creating a liquidity crisis in that token. As have to keep in mind that HIVE also applies to account creation and Resource Credits. Splinterlands already showed how much HIVE can get eaten up if there are a lot of accounts created. All of this is based upon HIVE, not the value in USD.

Thus, Hive Bonds is a way to solve this problem. We can generate a lot of HBD, which will help grow the Hive economy while protecting the circulation of HIVE. The latter can then be used for other purposes such as the two functions just mention, something that is likely to take place in 2022.

The First Pillar Going Into Place

Did everyone see the article about Ragnarok? It appears from the reactions many are very excited about this game.

There are a few major points that need to be considered. From the overview, it looks like this could rival Splinterlands in terms of the growth and popularity. There is a uniqueness to the game, especially in blockchain gaming. With some targeted marketing, it could end up bringing a large number of new users to Hive.

The other piece that is vital is this game will utilize HBD as the purchasing token. Here we see the first major use case potentially developing. Like the concept of Hive Bonds, the idea is to lock up the HBD for long-term income generation.

From the article we see this:

HBD Sink, all HBD for in-game items is put into a SIP v1 where interest is paid out to players perpetually

The different components of the game are going to require players to utilize HBD. This is going to be locked away in a SIP. Since we are unsure what that means at this time, we will presume that it is tied to the base layer savings project that is currently paying out at 12%.

Of course, if the game does become very popular with an expanding economy, where is all that HBD going to come from? Many will feel that HIVE conversion would be a good thing but that harkens the question of how are we going to create millions of accounts when necessary? Naturally, we also need to be mindful of Resource Credits since those are essentially created by HIVE moved into Hive Power.

A lot of this seems far-fetched at the moment. However, it is always best to plan for something before it is needed. This is akin to scaling. Many blockchains focused on areas other than scaling, an issue that is becoming serious as the traffic gets clogged up. On Hive, the core development team spend time scaling the blockchain, long before it was needed.

HBD is no different. We need to ensure there is enough available to allow for the pace of organic growth that occurs. At this moment, things seem slow yet Splinterlands did show how quickly things could change. Does Ragnarok doing something similar? If it does, we best be prepared.

The Chicken Or The Egg?

Here we see the dilemma we are facing. It is hard for most to envision a rapid expansion of HBD while things are slow. For this to be achieved, we obviously need use cases. That comes from having a sufficient amount of the token available so that projects will utilize it. Once again, for that to happen, there need to be use cases.

Unfortunately, while this block continues, advancement will be slow. As the Terra project shows, those who aggressively go after things can quickly position themselves. Stablecoins are coming under attack from regulators so algorithmic driven tokens are likely to become popular. HBD is an excellent opportunity for this.

To achieve this end, we need to address some of the shortcomings of the token. At the present moment, the failure to hold the peg is an issue. Part of this stems from the lack of liquidity since so few tokens are available. Also, the fact that it is not spread widely on exchanges creates an issue.

Once again, the chicken or the egg?

The bottom line is that we are going to need a great deal more HBD going forward. Failure to provide it will stifle the economic growth of projects.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Little by little I understand the economy of Hive thanks to you!

It takes time. Just keep chipping away at it.

Posted Using LeoFinance Beta

Little by little I understand the economy of Hive thanks to you!

This is fascinating for me. Till now, I always looked into project tokens or utility tokens as the potential drivers. UST has shown us how stablecoins can bring value to the whole project. I need to learn more about stablecoins and your articles are amazing resources. As you said, the looming regulations around existing stablecoins can dump the existing crypto market but may also provide an opportunity to these algo stablecoins, including HBD. Staking whatever amount of HBD I may have in the future :)

Posted Using LeoFinance Beta

It's only a matter of time before they will try to figure out a way to harass algo stablecoins.

It's hard to balance all of this, buying up awesome project stuff and trying to save LOL

It depends upon the centralization. If there is no single entity behind it, then there is nothing that can be done.

That is why HBD is so powerful. It is base-layer which means that nobody is in control of it. All is based upon the blockchain code which is run on more than 100 computers around the world.

We see this is the problem with the non-algo stablecoins. Circle and companies like that are targets. It will still work, they are just going to he regulated like banks. Is that what we really want though?

Posted Using LeoFinance Beta

Yeah, they will definitely still try and I think they will just revert to other tactics like shutting down servers that people are using to run the chain that are hosted on AWS or Azure since they know they can't attack the coin itself. Will be lots of fireworks related to this!

On another note though, I'm kind of glad that we don't have the same attention that UST does. We can keep an eye on what happens to them and see where things go from there.

You are right. There is a lot of advantage to flying under the radar. We have time to build and grow into things while discussing different approaches and topics.

However, there will be a time when we have to hit the "go" button and we need to be prepared.

They could be a model to watch yet we still need to forge ahead on our own.

Posted Using LeoFinance Beta

All valid points. The only thing that I want to add is to be innovative and pioneer rather than being the close second. The early attention is not always bad. Hive seems to fly under the radar till now. I have never seen in crypto twitter mentioned Hive as a web 3 platform/application/project. Not sure that's a goo thing. I want attention to Hive. I know it is happening as shown by the recent price action.

Posted Using LeoFinance Beta

It is a vastly overlooked dynamic. Commerce requires money and the money in this regard, used for transactions, are stablecoins. For all the fluff about crypto replacing the USD, it is not. People treat crypto like stock, looking for it to moon. That will not work as a medium of exchange (sorry Bitcoin).

Hive would be well served to understand the need for a strong base layer algorithmic stablecoin along with the establishment of pristine collateral. This could really set Hive apart form all else that is out there.

Posted Using LeoFinance Beta

True. Things are happening at the base layer on hive and that's always good. I am not sure who is driving the conversations about HBD use, including bond, within Hive but it is absolutely necessary to develop Hive as a complete ecosystem.

Posted Using LeoFinance Beta

I think one of the good things I've seen occur over time is the devs have spent a good amount of time in the early days on the tasks related to scaling. I think what is direly needed if we are to scale more with popular games like Ragnarok, are resource credit pools/delegations. I want to assist lots of people with my spare resource credits but what I don't want to do is decrease my Hive Power to do so! It's hard to address all of these competing priorities since we are trying to also compete for attention of others in the blockchain space. Thankfully we have some good things in place currently but hopefully we could address both HBD supply proposals and resource credit pools/delegations in the same swoop. Difficult? Absolutely! But like anything crypto, it's best to minimize the hard forks so it would be sweet to get them both knocked out in the same one. I doubt these could be addressed with a soft fork.

I see there's a lot of discussion related to HBD of late and that's great. Getting it more attention as not just that weird token on Hive that many newcomers have no clue about or what to do with it, is going to increase adoption of it's utility. Personally the past month or so, I've been spending all of my HBD I had saved up on Splinterlands instead of trying to convert it to Hive. I think it's an awesome way to save on Hive but also get the use out of HBD more as time goes on. Hell even Splinterlands could incorporate HBD into more parts of the game.

It then does certainly come down to supply! I didn't know that we had 33.7M HBD, according to the chart above, so thanks! That seems like a lot for sure but scaling needs more resources for sure. The fun balancing act of supply versus demand and price.

Absolutely. The core team led by Blocktrades deserves a lot of credit on that. He was the one who obsessed about it over the past year and pushed to improve things.

They have their own in game tokens that work for those purposes, especially DEC. So they have that covered.

We actually have about 25 million. The 33 is the forecast if the 25 million was placed in the 30 year Hive bond account (35% interest).

There is also a major portion of the HBD in circulation locked in the DAO. So it really is not on the open market yet.

Either way, we need to keep having this conversations about HBD and working to improve it. I think we can make the case after a few use cases pop up.

Hive can fill a couple major economic needs: a base layer stablecoin and pristine collateral at the same level. This would really alter things.

Posted Using LeoFinance Beta

Yeah, I forgot about the DAO. I haven't done a good job at keeping an eye on the raw numbers of things! Hard to do sometimes lol

A lot of stuff to keep up with.

It is all fascinating. The bottom line is we are going to need a lot more of everything on Hive: more accounts, more HP, more RC, more HBD.

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.And a lot HBD staked.

That is what generates more. It becomes a self-feeding situation.

The simultaneous development of more HBD along with more uses cases could really see things exploding.

Posted Using LeoFinance Beta

I am wondering though how long and what it takes for HBD to finally become stable. I am also thinking to start moving some HBD into savings the next year, but hopefully it will manage to hold the peg till then.

Hard question to answer.

I think two key elements that are required is to get more HBD on the open market along with eliminating the conversion time. The 3.5 days makes arbitrage unattractive.

That is a game that is looking to scalp a percent or two very quickly. Waiting 3.5 days is not in the game.

Posted Using LeoFinance Beta

There will definitely be a better improvement that is yet to come to make it progress to another level.

I'm very happy to read this article. I like I see tremendous optimism. Keep giving your best, don't get discouraged.

Why would I get discouraged?

Posted Using LeoFinance Beta

I’m sorry I got carried away in realizing that HBD uses the same method as the Terra UST, Hive is absolutely the Jack of all trades. Having almost all the qualities in one.

I am not exactly sure of the layers that Terra is operating upon. It looks to me to be a second layer solution. I could be mistaken about that though.

Will have to do some research to see how it is structured. Either way, HBD was already utilizing that premise.

Posted Using LeoFinance Beta

This is a very interesting article. Thank you for your thoughtfulness. I have been trying to shift resources toward Hive and HPdue to the upcoming airdrops. I wonder if the system would be better served if the airdrops were also targeted toward hodlers of HBD? I haven’t seen that this is the case but could have missed something.

Well Hive is the governance token and that is where the distribution of the influence comes from. Hence those airdrops that are looking to mirror the level of decentralization that HIVE attained will target that.

Posted Using LeoFinance Beta

First Time to Know that UST is using the same system as HBD, This is fantastic

I think that when Hive grow more and being in top 100 or top 50 and have higher Marketcap like Luna this will help HBD.

The upside potential is enormous.

We are going to see things happen very quickly I believe once a few things hit the market.

Splinterlands showed us what is possible. I expect #ProjectBlank to bring in more users than Splinterlands and the potential of Ragnarok is just coming into being.

Add in some of the other things being developed and we could really see something amazing taking place.

Posted Using LeoFinance Beta

How is HBD created now? I was under the impression that it was continually created to ensure a peg with HIVE... which is why I don't really understand the need for Ragnorak to create a HBD sink... won't the system just create more and more HBD as it goes into the sink?

HBD is created:

The peg to $1 worth of HIVE is based upon the market dynamics. Arbitrage is vital to keep it in line. HBDstabilizer is helping to tighten the range but it is not enough. We need more adjustments, in my opinion, to make arbitrage more feasible.

As for Ragnarok, if the "sink" is putting more into savings, then yes it will create more HBD. Of course, if the sink is a second layer and pays out of transaction fees, then it will be like a HBD kingdom on Cubfinance.

Posted Using LeoFinance Beta

Thank you TaskMaster! I didn't realise it was arbitrage that kept the HBD/HIVE peg, I thought that more was created when it was over $1 and less was created when it was under $1... but what you've laid out actually makes more sense from a programmatic point of view.

Yes and the HBD stabilizer is always at work.

So it is doing its best to keep the peg tight. To tighten it further is the goal.

Posted Using LeoFinance Beta

Is the most simple and safest solution not just to focus on growing the market cap of Hive?

Certainly we want the market cap of Hive to increase. That is a piece of the puzzle while also creating more resiliency. The larger the system, the harder it becomes to attack.

That said, HBD is a different entity. We can get there if the market cap explodes yet that is only one piece. Having enough HBD available to conduct commerce if vital.

It is why I put forth the idea of Hive Bonds. This is a great way to generate a steady production of HBD while also locking it up. The collateralization process will, in my opinion, generate a great deal of interest if it is structured properly. This alone could be a major boon for Hive.

Posted Using LeoFinance Beta

I have been holding quite a little hbd in my savings too @taskmaster4450 , seeing how much you hold I feel I should save more of it. I guess this is the second time I would read your content about promoting HBD. I love the insight you see in this. All these things can't be attended to all at a time since hive is still developing but I believe things would change in due time

It is basic money management. People do not put every penny they own into high flying, high risk stocks. Instead, they have some in assets of different risk levels.

People need to get in the habit of taking some money off the table and putting it in HBD. When you spec play turns out in your favor, take some risk off the table.

HBD will be a great parking spot if we can tighten the peg.

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

LOL as I was writing the title that thought came to mind. I was going to search YouTube for the clip but this works equally as well.

Posted Using LeoFinance Beta

I think you've done well to explain the benefits of developing the bond. What were some of the concerns for major risks against its creation?

The major concern that was expressed is the fact that creating so much HBD could make the ecosystem vulnerable. There are many who focus upon inflation and not growth.

My view is the risk is mitigated by the fact that a lot of HBD will be locked up in a time vault. If one chooses the 30 year bond, then that HBD is off the market for 3 decades. Yes it generates more HBD, at a rate of .35 HBD per year. However, some of that will likely be reinvested.

Another concern is liquidity. That is where the HBD deposited needs to spit out another token which can be traded with the time stamped information tied to it. Hence we can create a secondary market which gives liquidity. Nobody is going to lock up HBD for years if there is no way to operate in a liquid manner. Having a "bond token" is what can allow someone to sell it if need be.

Posted Using LeoFinance Beta

Thank you very much. There's a lot of learning for me to get done here.

I think the peg has been holding up fairly well right now and I don't really know if having more volume of HBD out there will help. After all, this won't increase the funds in the stablizer project and it would increase volatility. However I do think we need billions in order for people to take it seriously.

Posted Using LeoFinance Beta

The holding of the peg is improving but still not tight enough.

More HBD increases the total amount in circulation. Bigger markets tend to be less volatile. Volatility is the arch-enemy for a stablecoin.

We also need the HBD to spread out. Getting it utilized by more people will also bring stability. Right now, the main trading location is Upbit. If more people were swapping HBD on the internal exchange, that might also help to stabilize things.

It is all a process. This is not going to happen overnight.

Posted Using LeoFinance Beta

Got me to look closer at Terra token and UST in the making.

Hive and HBD are truly in a smaller scale but not far where we need to be.

Reading about it consistently is the key for a great adoption.

Use case is the main driver to have at least one billion worth of HBD.

!BEER

Posted Using LeoFinance Beta

To go from 25 million to 1 billion is going to take us a while. We need a lot of increase in, well, everything to get to that point.

Not saying it cannot happen. In fact, I will be putting it in my next article but we could see a liquidity squeeze in HIVE over the next year.

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Exactamundo. I've been saying this for years!

Theres barely enough liquidty at a given time I'm the internal hbd hive market for someone to swap 5k to 10k usd worth without drastically impacting price or losing 2 to 5 percent

People do not realize how detrimental a lack of liquidity is. We need a great deal more produced. HIVE is need to give us more accounts and RCs. HBD is needed to enable commerce and grow the Hive economy.

A lack of liquidity of either is fatal. We need to keep focusing upon that and keep it growing.

Posted Using LeoFinance Beta

I can't agree less boss

I'm more and more interested into Ragnarok. I will for sure give more attention to this ! !PIZZA

Ragnarok looks very interesting from what I can see. It will be interesting how many jump on board, especially those who were not into Splinterlands.

A lot taking place. I am also curious how soon until this comes out.

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@ykretz(5/5) tipped @taskmaster4450 (x1)

You can now send $PIZZA tips in Discord via tip.cc!

Hive at $5 or $10 also makes HBD staking more desirable as this is where we are heading and this is just the beginning.

Posted Using LeoFinance Beta

That makes the market cap a lot bigger which will allow for a lot more HBD generated.

Posted Using LeoFinance Beta

Yeah, if HBD wants to compete with the other stablecoins, there needs to be a lot more HBD on the market. Right now only HIVE users will use HBD as a store of value because it's not USDT or USDC and not available to use most places.

One chain it makes for a great holding mechanism. So we have that going for us.

However, a lot more needs to be accomplished with it. But we have to remember that things just started less than a year ago with it. Thus we are still just getting warmed up.

Posted Using LeoFinance Beta

I would say that UST and Terra blockchain in general have achieved a very great feat this year. I think we should not directly compare UST to HBD because our HBD is really not a stablecoin yet and it has little or no use cases both within Hive and outside Hive.

I agree with you that we need more HBD but sadly, I can't tell how that can be achieved. But what I do know is that more use cases should be attached to our HBD. Equally, the conversion of HBD to Hive period should be looked into. 3.5 days is really really unattractive

Posted Using LeoFinance Beta

I agree about the conversion time. My presumption is that is a security feature. Perhaps that is not required or can be diminished as we see more HBD created.

The use cases are minimal, that is true. But we have to keep in mind that, until the HBD Stabilizer came along, few were even paying any attention to HBD.

Now it is getting the attention so we are moving closer. Not there yet but gaining on it.

Posted Using LeoFinance Beta

Love how deep down the Hive Backed Dollars economics rabbit hole you've gone lately.

There's no doubt that HBD has the potential to not only catapult the price of HIVE itself, but also offer the truly decentralised stablecoin option the market craves.

Onward and upward!

Posted Using LeoFinance Beta

There is a lot of work being done to help it along. We are seeing the potential that is forming.

The economics are unfolding. I see more people putting it into savings to help things along. We are now helping to increase the amount out there. We just need to get some use cases going.

I am sure a few applications will start to implement it during the first half of the year.

Posted Using LeoFinance Beta

Ragnarok is an interesting game. Popular we shall see, because playing a complex game while paying for it will not attract the masses. But Dan himself said it's more of a spectator game, the elites will play while the masses will cheer from the sidelines.

We will have to see what rolls out over the next 6 months. It is evident a lot went into the game.

This could be one of those major attractions. Always a lot of optimism but the success comes from the details. What was released so far looks top notch though.

Posted Using LeoFinance Beta

I agree. I look forward to the game myself.

Resource credits have their own pool, and the RC "price" needed to perform operations on the adjusts dynamically. If the supply of HIVE/HP were to contract a lot, it is entirely possible that 1 HP could be enough RC for a lot of activity.

Likewise witnesses can adjust the fee for new accounts. It was 100 STEEM at one point. We could adjust it to 0.01 HIVE if that made sense.

I don't think converting HIVE to HBD is problematic in any way. Finally, as the price of HIVE goes up, less needs to be converted to create a given amount of HBD.

Thanks for the clarification on some of these points. Helps to further understand how things are "under the hood".

Posted Using LeoFinance Beta

The biggest block I see here is the incentive for people to buy and hold large amounts of HBD. HBD as a currency is a great way to transact. I purchase items on HE regularly with HBD.

Most people do not realize they can earn 12% APR for locking HBD in savings. I like the HBD bond idea a lot better than a big liquidity pool.