What Is HBD And Building An Economy (Part 2)

This is a follow up to our previous article about HBD and building an economy.

In that we covered some important points:

- an economy is fueled by the money that is available

- increasing the money supply will increase economic productivity as long as the country has the resources available to do so

- currencies other than USD and EUR are basically national currencies, with these making up the majority of reserves and transactions

- The Hive Backed Dollar(HBD) is global in nature

There is roughly 81 billion Tether on the market and around $2.3 trillion US dollars in banknotes. Both of these points will be important.

HBD Transactions

Every HBD transaction requires some $HIVE staked. This is a vital point to consider.

Unlike other blockchains, where transaction fees are charged on an individual basis, Hive operates off its resource credit system. This is a non-tradeable token that is assigned when $HIVE is powered up. Each written activity to the chain has a "cost" to it, which is charged against the holdings in the wallet. This does recharge on a daily basis, making interacting with Hive an investment as opposed to a cost. The Hive Power is still held by the individual.

This system means that when utilizing HBD, the sender will need a small amount of $HIVE staked. It means demand is being driven to the backing agent as transactions grow. Basically, the more HBD that is circulating and being utilized, the more $HIVE that has to be staked.

In other words, transactions are "paid" for on Hive with staked coins as opposed to blockchains like Bitcoin which utilizes liquid ones.

Tether

What is Tether used for? This is a legitimate question considering that it has the largest market capitalization in the stablecoin market, by a wide margin.

How many websites can you use it on? What real world stores accept it? Can someone buy lunch with Tether?

Obviously there might be a few places where this was integrated. The same could be true for USDC. However, the reality is most activity tied to these coins is financial. In fact, it is a very specific purpose: to store money so as to remove volatility.

The overwhelming majority of stablecoin use case is as a parking spot. When the cryptocurrency markets get to volatile, people sell whatever coin or token and move it into Tether.

Bear in mind, this provided enormous utility. It is a crucial that a "safe haven" exist when speculators (or anyone really) take risk off.

The distribution of Tether and USDC amounts to 111 billion, most as a store of value offered from the price stability of the coins.

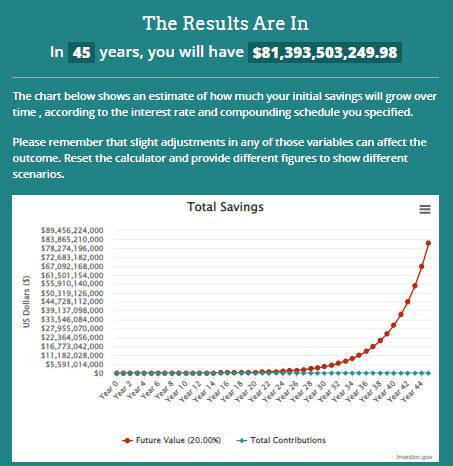

At Tether's current total, this is how long it would take HBD to reach simply based upon the 20% APR paid out of savings.

Economic Building Blocks

Here is where we see a massive opportunity.

Hive has the potential to implement the economic building blocks tied to its currency. HBD can be the foundation of the ecosystem that is all tied together. The fact the coin is base layer means there is no third party involvement. Everyone involved with Hive has a vested interest in the utilization and expansion of HBD.

So what are the economic building blocks that apply to the currency.

They are:

- payment system (commerce)

- collateralization

- funding and investing

- derivatives

We covered each of these in the past so no need to dive deep in this article.

The important point here is we see, as these are built out, value shifted to the currency itself. No longer is it the backing agent that is where the value comes from. The utility that results in economic productivity is what provides value to currency.

Consider the idea of a project tied to real estate.

Imagine being able to bond HBD (derivative) that is used as collateral on a loan to purchase real estate. The bond is put up against the loan to secure funding for the property. It is all tied to a stablecoin meaning the volatility will be reduced as compared to using the value capture tokens.

Do you think 80 billion HBD could be needed in that instance?

Considering the global real estate market was estimated to be worth $326.5 trillion in 2020, we can see how big the numbers are.

This, of course, is just one use case. What about the funding of businesses? Venture capital firms reportedly dumped $30 billion in funding in cryptocurrency companies in 2021. There is a natural market for us to fund ourselves and cut the VCs out.

The point is we see the opportunities for hundreds of billions in economic activity that can be tied to stablecoins.

There is no reason why HBD, which has no counterparty risk and resides at the base layer, cannot be a large part of that.

Central Bank Digital Currencies

Central Bank Digital Currencies (CBDC) are getting a lot of attention in the cryptocurrency world. However, few are talking about the main focus of them.

The concentration of these projects is based upon two areas, at least to start. They are:

- interbank payments/funding

- cash

We will leave the first aside since it isn't relevant. The second, however, is where we already see progress with HBD.

CBDCs are designed to digitalize cash. They want to remove it from the system, mostly for tax purposes in my opinion, and get people utilizing digital wallets. The issue they have is HBD already offers this.

The US dollar has $2.3 trillion in banknotes circulating. More than 70% of them reside outside the U.S. Why is that? This is the currency that people in many countries use as a defense against their own governments and the destruction of the native currency. There are many places in the world where there is a black market for US dollar banknotes.

It is also interesting that the majority of the world's population lives in countries who have this need. Move passed the USD, EUR, GBP, CNY, AUD and JPY to enter the real rat race. The remaining currencies can be a nightmare.

Unfortunately, these people do not have access to the dollar. If they go to the bank, it will not provide them with USD. Any physical notes that come into the country are likely picked up by the power brokers. The general public has to fight for the scraps.

HBD provides the equivalent to FedCoin without the Fed. It is a USD denominated asset, fully digital and can be acquired by anyone with a wallet. Notice what is happening in Sucre, Venezuela. Those people much prefer HBD over the Bolivar. It is only a matter of time before more activity occurs using this currency. It is to the benefit of the customer along with the merchant.

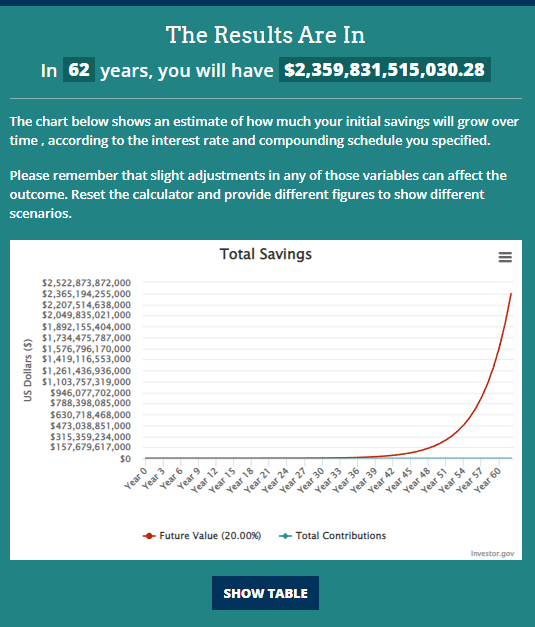

Again, if we focus upon the US Dollars (cash), in circulation, this is how long it would take for HBD to achieve that level?

This, of course, does not include the physical notes for other currencies. There are more than a trillion in EUR outstanding.

Does this mean trillions of HBD are required? We are not asserting that. However, it is clear that a couple hundred billion HBD will be required to facilitate global economic activity based upon the construction of some basic financial services.

We will have a 3 section in this series since there was an announcement regarding infrastructure. Also, we will also show how the other components of HBD are incorporated into this.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

https://twitter.com/1331330355513745413/status/1648334499732766720

https://twitter.com/1415155663131402240/status/1648476648013176832

The rewards earned on this comment will go directly to the people( @taskmaster4450le, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

HBD would be improving the use case side of the economy. I am pretty sure that if we have bonds kind of things apart from the HBD savings that would be a good thing if it is against any game based NFT or metaverse item. I kind of feel that building HBD around metaverse would be one of the hardest work but can make Hive in a mainstream.

As usual I find this absolutely amazing. Extremely educational and informative.

It shows what Hive should be, will be.

So excited to be part of it from the start.

I really liked this article in particular. It makes me happy to have a little HBD and a nice chunk with a high apr as my savings.

Posted Using LeoFinance Beta

I would like to know if anyone else thinks hive takes the concepts of energy and applies it to money and currency. I would also say the hive platform has seen good reception because of its common sense and representation of the natural order of human transaction (in all forms)