50% Reduction In Global GDP Possible

Things could be getting very bad over the next couple years.

This year, 2020 was certainly difficult for the global economy. With the shutdown due to the Coronavirus, the economic impact is immense. While things improved a bit in the 3rd quarter, the second was so bad that it will certainly throw things into the negative for the year.

My guess is we see at least a 5% drop in the U.S. GDP for the year. The EU is going to be even worse.

This is all before the second wave of shutdowns take place, which are already starting. The UK is on lockdown with other EU countries following suit.

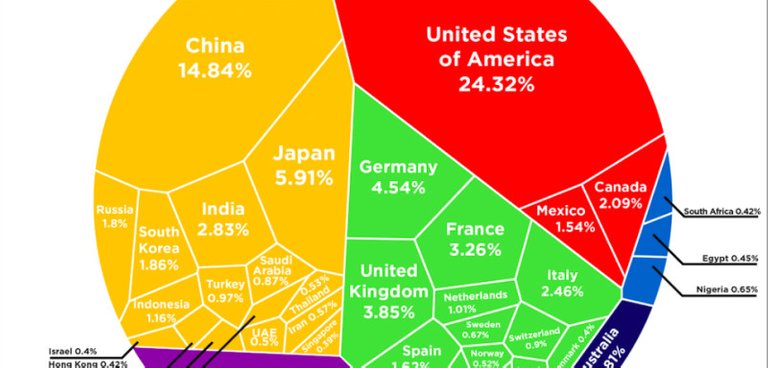

Source

So far, we saw the greatest drop in GDP in any recession, or the 1930s depression. This is unprecidented, to the point that President Xi China called it the worst recession since the 1930s.

While the lockdowns is being done in an effort to save lives, it will end up doing the exact opposite. Humanity does better with economic prosperity. When the situation reverses, people die.

For example, we are still early in this process yet we are already seeing food shortages. In the United States, mage grocer, Giant, is already limiting purchases in an effort to offset these shortages.

The problem is that with the interruption in farming and meat processing, food shortages are going to be the norm. In other countries, shortages tend to become famine.

None of this is positive for GDP or global growth.

Unfortunately, 2021 is looking like it will be worse than 2020. Heading into 2022, we could see near a 50% drop in global GDP.

The hospitality industry and anything related to it is already in tatters. Airlines, rental cars, cruise lines, and restaurants have seen an enormous loss of business. Hundreds of thousands of small businesses already went under, with more on the horizon.

Automobile manufacturing is on a multi-year decline, something that hit another low in 2020. With shutdowns looming on a wide scale, this industry is going to get hit harder.

Of course, all of this impacts employment. Even with a safety net, people end up making less money than under normal conditions. In economies like the United States, where 70% of GDP is consumption, this is a major draw down.

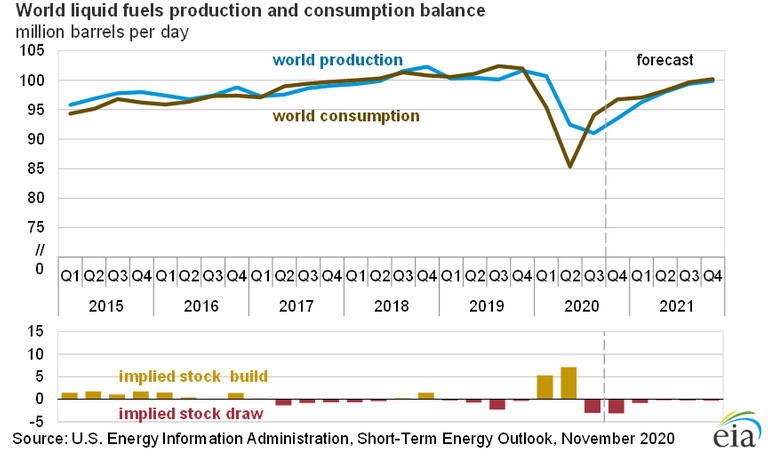

Here is the daily consumption of oil:

Source

Even with the rebound in Q3, we will likely see a drop of more than 8 million barrels per day. The fact that lockdowns are starting again means that the benefits from Q3 will quickly be given back.

Oil consumption is still a big barometer of the health of the global economy. Even though renewable energy production (consumption) has increased, it is still a minor part of the global energy picture.

Unfortunately, 2020 might have just been a preview of worse things to come. Many industries are struggling and another shutdown will absolutely obliterate them.

This is a story that will keep getting worse as we progress through next year. Look for a major low to hit as we enter 2022.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance Beta

I agree with you, the worst is still to come economically. There is going to be issues in the credit markets. Foreclosures are coming. That tends to have a multiplying effect.

Posted Using LeoFinance Beta

Right it's like chain reaction it's gonna effect all because if us is doing that bad what about other places

No place is safe. We are going to see all countries affected.

For example, as the US falls, there goes the outsourced manufacturing in countries like China and Vietnam. That ends up spilling over into the African nations which came to depend upon Chinese money for their growth.

Posted Using LeoFinance Beta

Yeah the commercial real estate market is already a mess and, at least in the US, residential is holding up simply because of the forebearance that is taking place. However, once that ends, the market will get a crushing blow as millions of homes are taken back and, eventually, hit go up for sale.

Posted Using LeoFinance Beta

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

US AN EU are still doing ok compare to other countries in here it completely lock down or you can say second lock down and live is hard with nothing but internet in hand

I would disagree about the EU at the moment. It looks decent on the outside but the entire Eurozone is a mess and only getting worse. Of all the developed areas, that is the worst of them all.

They had issues even before COVID which was putting them on the path to collapse. This situation is only accelerating it.

Posted Using LeoFinance Beta

Our Myanmar cetizins suffer the recessions too including me.

We should try to pass this Obstacles in new normal age by learning and doing Blockchain Business.

Posted Using LeoFinance Beta

At the moment over half of the market cap is made up of Bitcoin with a still high dominance of 66.3%

Bitcoin is currently the queen of the markets and we are confident that the liquidity entered through BTC will be equally distributed on the altcoins

Posted Using LeoFinance Beta

Bitcoin is the known entity and is viewed as safe from those on the outside. It is easier to pick that gem out as opposed to messing around in the alt-coin world where there is a lot of trash.

Posted Using LeoFinance Beta

Lockdowns will show their true effects in the coming years. It's real productivity that feed the people of the wold. GDP, stocks etc are numbers that can easily send us in a wrong direction.

All the jobs lost, food production closed, stress and fear caused, fines put on innocent people and many more sins are have created a huge opportunity cost.

Posted Using LeoFinance Beta

No doubt about that.

There will likely be more deaths as a result of this actions taken as compared to what COVID actually affects.

We are already seeing issues such as suicide, domestic violence, and depression on the rise.

Sadly, we are just getting started with this process.

Posted Using LeoFinance Beta

your analysis about this 100% correct

you should write a Book about digital marketing

Posted Using LeoFinance Beta

I tend to be the very bearish when it comes to COVID-19 and anything COVID-19 related, mainly because I tend to think of the pandemic as something akin to 21st Century version of Gavrilo Princip - an event that served as an excuse and catalyst for something bad that was brewing for years, if not decades. Further problem with such events is that their impact is becoming obvious only after some time. For example, most Europeans became aware what real consequences of 1929 Wall Street Crash were only in 1931.

Small glimpse of long term COVID-19 economic consequences could be seen if we compare election results held this Summer in Croatia and Montenegro. Croatia held elections in early July and governing party HDZ comfortably held to power, mostly due to elections being held before the peak of tourism seasons. Voters apparently accepted official media narrative of pandemic being defeated with strict March/April lockdown and foreign tourists - upon which most Croatian economy depend - returning just like they did in 2019.

In neighbouring Montenegro elections were held in late August and DPS, party of Milo Đukanović, president who was at power continously since 1989, was defeated and had to relinquish power for the first time in history. The reason is simple - elections were held after the peak of tourism season, and Montenegrins, whose economy is even more dependent on tourism, saw that they won't see any money that had previously could expect from government.

Posted Using LeoFinance Beta