Are We Being Misled About Demand?

We hear a lot about the supply chain issues. There is no doubt that the economy was nuked in early 2020 due to the lockdowns from COVID. At the same time, the supply chains were completely disrupted as companies, globally, shut down operations. In short, nothing was moving very fast.

With people locked up at home, they decided to do a bit of shopping. This could be done online and people had money. Since services were closed off, people were able to concentrate their purchases to IT and durable goods. These sectors did very well and the products that were available were quickly scoffed up.

This created a problem. When retailers when to refill the orders, they were told to just wait. Delivery times exploded as items were very slow to be replaced. Even after economies started to open up, the process was very slow.

Here we sit 18 months later and the global supply chains are still disrupted. Or are they?

Perhaps what the financial media and the talking heads on television are telling us is not quite accurate.

Shipping

It is best to find out about the movement of products by looking at shipping. After all, most of what is produced and delivered globally happens on the open seas. Thus, monitoring what is going on there is vital.

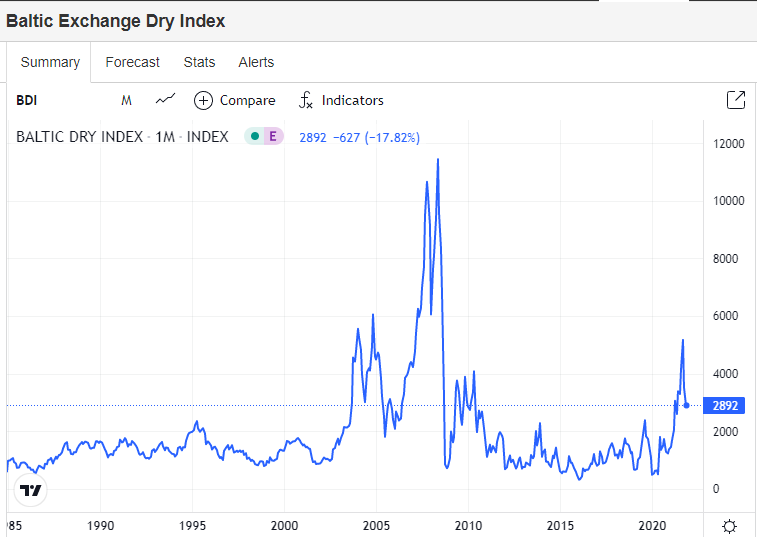

For this, we turn to the Baltic Dry Index. This is consider the benchmark as to what is taking place within the shipping realm. We are getting some rather interesting data coming from there.

Before going into the chart, here is what Wikipedia said about the BDI:

The Baltic Dry Index (BDI) is issued daily by the London-based Baltic Exchange. The BDI is a composite of the Capesize, Panamax and Supramax Timecharter Averages. It is reported around the world as a proxy for dry bulk shipping stocks as well as a general shipping market bellwether.

Now let us take a look at what things look like:

Going back to the start, we see how the chart lays out. Not surprisingly, last year, prices shot up. This was often discussed as the cost of shipping skyrocketed. Companies were paying a lot more per container due to the increased demand. After all, since things were locked down, after they reopened, customers wanted products. Whatever came off the factory lines was immediately shipped out. There was a shortage of everything.

This continues to this day. We are told how there is still demand out there and the consumer is strong. However, the BDI is issuing a warning on this idea.

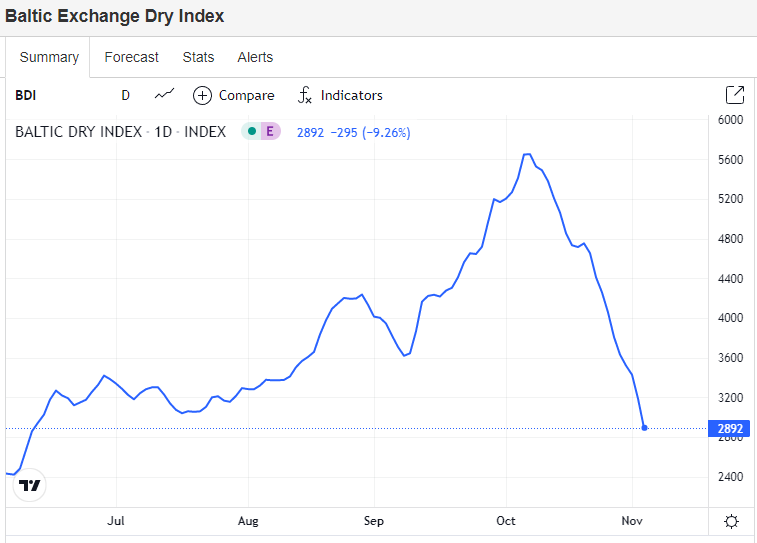

Here is a close up of the last year. Notice how things turned of late.

We saw a 48% drop in the index over the last month. It has registered 11 straight down days.

Does this make any sense? If there is a major supply chain shortage of containers along with consumers screaming for product, why are the shipping rates suddenly plummeting?

Supply and demand says that if the later is strong, prices will be increasing, not decreasing.

Yet they are falling off a cliff.

How can that be?

Demand Not As Strong As Made Out

The answer to this is that demand is not what people are claiming. In fact, one of the main indicators of consumer expectations is coming in rather poor.

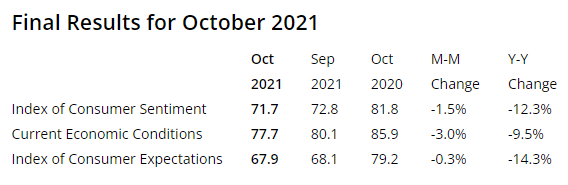

We are seeing the numbers drifting down each month in the University of Michigan Consumer Sentiment Survey. This is not a heathy sign for the economy.

Here is the summary of the latest results:

As we can see, both the Month-over-Month (MoM) and Year-over-Year (YoY) are both reading negative. What we are seeing is the consumers are not buying into this idea that things are so great. For an economy like the United States, which is made up of 70% consumption, that is going to have a massive impact.

This could be leading to the sudden drop in the cost of shipping. If people are starting to turn away from purchasing, then the entire system pulls a reversal from last year. Instead of the suppliers cutting off the shipping, it is the demand side that freezes it.

Of course, considering the decline in China's GDP from the second to third quarter, this also lines up. When the world's largest exporter has a major decline, it is time to start asking questions.

There is no way with data like this that we can conclude anything is going well. There are major issues forming, something that the media is omitting from their narrative.

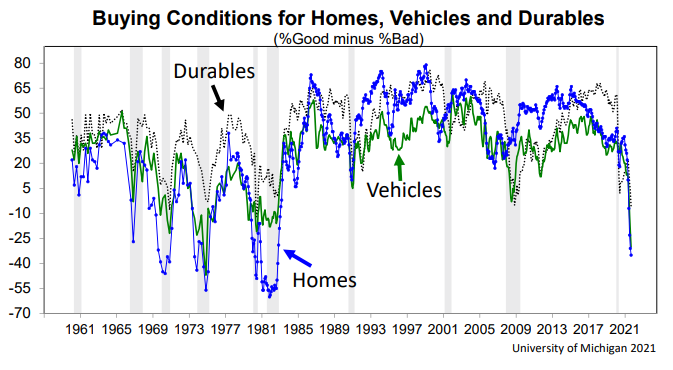

In fact, in some categories it is to a level we have not seen in 40 years.

This is the sentiment results for durable goods, vehicles, and real estate. Notice how it is much worse than either the Great Recession or the aftermath of the DotCom bubble.

Sorry but there is no way to conclude that people are going to be rushing out and spending a lot of money in this areas. This is something that is hard to overcome.

It looks like there is a major demand issue starting to line up. We can expect this to hit the numbers for companies going forward. This does not bode well for the economy.

Expect more contractions ahead.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Late December should get pretty interesting.

It will be. The end of the year and into the first couple quarters of 2022 should tell a large part of the story.

We will see what comes out.

Posted Using LeoFinance Beta

https://twitter.com/taskmaster4450/status/1456428228760018954

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This article is amazing. I often thought that the general media often distorted the story to fit a narrative. Misinformation is the order of the day. Thankfully you had the good sense to do a bit of research and school the rest of use :-)

The media certainly does that. It is all agenda driven, in part by ads. The financial media is no different.

Posted Using LeoFinance Beta

The indicators are weird. In a way, we all know discretionary spending will drop because prices are going up while wages aren't.

However I have heard a few stories about how some companies stopped taking orders and orders will only be fulfilled in the future. So I wonder which side is the real trend.

Posted Using LeoFinance Beta

I would saw there is nothing 100% when look at things from a macro perspective. We can always find that which goes counter to the trend. After all, even in the worst bear markets, there are a few stocks that go up.

In this instance, a few stores do not tell the entire story in my opinion. You can find some counter to what is taking place but when shipping costs are dropping like a rock, something is going on.

Posted Using LeoFinance Beta

with the crazy politics around the world makes every macroanalysis useless :D

"Market can bust? Oh no lets help with more money"

Seriously am confised @taskmaster4450le

Government statistics lie about a lot of things, mostly in service of not sharing just how bad things are when they are bad.

I believe we've been misled for several decades about a number of things, including true unemployment, true demand, true number of new jobs and so on.

The fallacy in the current narrative is this idea that "people went shopping" because they were locked up. We know a LOT of people and I can tell you that very few of them went shopping... and even more found themselves trapped at home and realized how much stuff they already had and actually started simplifying their lives by getting rid of stuff.

I think this is not a Covid-related blip; rather we are on the front wave of moving towards becoming more of a post consumer society... when I used to call the "Europeanization" of the economy several decades ago.

We have more money than a year ago... because we have sold second hand stuff. And guess what we'll be using it for? Getting caught up on our property tax arrears! That won't be showing up as "consumption" anywhere.

And we're not alone...

=^..^=

Posted Using LeoFinance Beta

Government stats have value when one views them in totality of the trends they create as opposed to the tangible number being handed out. That is why just reading the headlines tells nothing. In isolation, they make it look at whatever they want.

As for the lockdown, non-spending, I would disagree and so did most of the earnings reports. We know people spent a great deal on durable goods during that time. However, the pulling of demand forward never creates more, just adjusts when the purchases take place. It is a net zero gain overall.

Post consumerism is not likely, only changing form. I believe we are seeing the switch from physical to digital. Many have music playlists that would have cost thousands of dollars for pieces of plastic to own. Now it is all digital.

Posted Using LeoFinance Beta

I agree as we are getting reports that are contradicting themselves. I saw one the other day that the global shipping basically had lost a third of all it's ships due to the queueing waiting at ports. The report stated that there were no slots available for companies to book containers as those slots were all full with no available capacity. Maybe there was a surge and back log for existing orders for Christmas but after that honestly cannot see a demand or spike. Where is all the consumer money coming from to make a sudden boom? I see a recession coming very quickly as that makes far more sense and think some countries are already in one as I know here in SA there is a lack of money in general.

Posted Using LeoFinance Beta

Watch the overall credit reports. That usually tells the entire story.

Posted Using LeoFinance Beta

Education was one of the biggest sectors that was rocked by this. With schools closing down and going remote it was important for every student to have a useable device. Many districts didn't have the quantity of devices they needed to make the accommodation. They government "gifted" us the money to buy the devices but then districts were facing shipping lead times of months to almost a year. It was and still continues to be a hot mess. My district was lucky. Others, not so much.

Posted Using LeoFinance Beta

This example shows how truly inept government is these days. It is a point I keep making. Government is ill-equipped to deal in the digital age.

Thus, when people fear government enforcement and control, I laugh. They are completely impotent in this matter.

Posted Using LeoFinance Beta

I would imagine its a bit of a seesaw and right now things are starting to improve as shopping slows a bit while more containers come online. As someone who is trying to stock a store at my gym, I know goods are stuck in ports, and we've had to beg for any leftover gear available within the united states, because the gear coming from Thailand is jammed up, and will not be here before Christmas. Perhaps the bottleneck is now clearing out which is great.

Posted Using LeoFinance Beta

Baltic Dry will be used the most time to look for a recession in the world economy. IMO since covid and a lot of randomnesses, it doesn't work that well or maybe not "just in time".

Maybe + X amount of time. Money printing like hell makes it even more difficult to look at it and get some useful data out of it.

IMO Market is in a tulipomania rush and everything is a bubble.