Beware Of Deflation

All the talk these days is of inflation. This is in high gear with Fed Chair Powell testifying in front of Congress. Of course, he claims that is the #1 focus of the Fed now that the CPI is out of control.

Never fear, the Fed is here. After all, it has our backs.

The reality is that the inflation story was over long ago. It is a trailing indicator even though people are emotional about it. We has a supply shock coupled with lock downs that saw service spending plummet. People decided to spend a lot on goods including remodeling projects that put even more strain on tight supply lines.

All of this coincided with a bull run in commodities.

Nevertheless, where everyone is going wrong is the fact that this was not caused by Fed "money printing". To believe in that nonsense is on par with waiting for Santa Claus to come down the chimney.

The reality is we are still in a collateral and USD crisis. There is no liquidity, something that is going to keep affecting markets.

In the meantime, the Fed will ensure that the economy is zapped.

We are already seeing the signs of deflation being just around the corner.

King Copper

Have you ever heard the saying "Copper is King"?

The reason that many believe this is because it is such a versatile metal. Basically, it is in products from electronics to construction. Many use this as a bellweather on how the economy is going.

“Copper contributes to every aspect of our daily lives, well-being, and safety and security,” says Trussell. “For example, cell phones, laptops, cars – especially electric cars – appliances, life-saving medical devices, microbial disinfectants, and national defense systems. The adage, ‘If it’s not grown, it’s mined,’ underscores how essential mining is to our standard of living and quality of life.”

In fact, copper is omnipresent both in the workplace and in the home. An average 2,100 square-foot house contains surprising amounts of copper, including 195 pounds (88 kg) of building wire, 51 pounds (23 kg) of plumbing tube, fillings, and valves, 47 pounds (21 kg) in built-in appliances, 24 pounds (11 kg) of plumbers’ brass goods, 12 pounds (5.4 kg) in builders’ hardware and 10 pounds (4.5 kg) of other wire and tubing.

For this reason, it is probably worth taking stock of what is happening. Here is a 5 years chart.

While the price is elevated, this is the lowest point it was at in the past 16 months. Notice how, historically, when copper spikes, it does not operate at the elevated levels for too long.

We spent a year at record highs only to see things pulling back. Since copper is a major part of housing, the sell off could be an indicator of what the market is seeing there.

Shipping

Remember the shortage for shipping containers and the outrageous prices manufacturers were having to pay ship stuff around the world?

Well that is starting to ease up a great deal also.

Let us start with the Global Freight Container Index. This peaked in September of 2021, at over $11,000.

The latest reading has it just over $7,000. Notice how the pace of the drop is accelerating, really driving down since March. This is still elevated yet that is a serious pullback.

Notice how a lot of the moves started long before the Fed did its tightening.

We get a similar read with the Baltic Dry Index.

After a powerful run up after the COVID lockdowns, it also peaked last Fall, heading down significantly. We are now in at the upper end of the long term range for this index.

It appears the shipping of goods throughout the world is coming down. What kind of impact will that have?

Purchasing Managers

By now, the inventory problem is garnering a lot of attention. With Walmart and Target both reporting massive increases in inventory, the people are suddenly aware there might be a demand issue.

This is something we discussed since last fall. The signs were there if people know how to look for them.

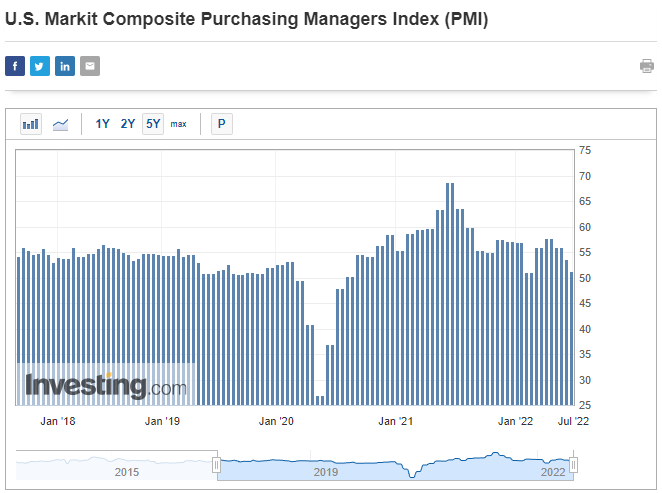

Now, we compound the problem with the latest Purchasing Manager's Sentiment Survey.

Source

Notice the steady decline. What is concerning is this month's print is just above 50 (51.2). The way to read this index is that anything above 50 is considered expanding while below is contracting. When purchasing manager's are not optimistic, this is a problem considering they are the ones doing the ordering for companies.

The last time we saw these numbers was earlier in the year when there was the Omnicron variant.

If we couple this with many companies talking about layoffs, we could see things turn very quickly.

As I stated on a number of occasions, the path from inflation to disinflation to deflation can be a quick one.

When this happens, things can start sliding. Remembers, moves down are very powerful. Prices collapsing might seem like a good thing but the fallout is horrific.

We started to watch the inventory numbers back in the 4th quarter. Now we add in these other metrics.

The case for deflationary money has not changed. Since the Great Financial Crisis, the shortage of collateral has starved the global economy. Now with prices so elevated, this is going to have a horrific outcome.

Right now this is not a popular sentiment but beware of deflation.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

You and edicted are ahead of the curve on deflation.

Posted Using LeoFinance Beta

!LUV

@taskmaster4450le, @tin.aung.soe(1/4) sent you LUV. wallet | market | tools | discord | community | <>< daily

wallet | market | tools | discord | community | <>< daily

Good analysis. Reads like Wall Street.

But Bill Ackman said inflation is super out of control.

I've been thinking for a while now that the real problem is going to end up being the deflationary shock. I hadn't looked at any of these prices. It just makes sense that it will happen.

Impressive perspective and good analysis. Thank you.

Posted Using LeoFinance Beta

But the question is how do we take advantage of it❓

yes these days inflation is a trending topic to discuss as I can see many blogs about it, thanks for spreading awareness among us.

That's another angle to another different situation,yes everyone is talking about inflation and left aside deflation ,very informative note thanks for sharing with us

Posted Using LeoFinance Beta

The point you made about copper being in everything is interesting. Anecdotally, in my part of California, new home construction is still chugging along... I was just this morning working in a new phase of a tract that hasn't had any activity in years!

I enjoy reading your articles much more than I do the videos, it's easier to read for non-English natives than it is to listen, some of the details can be lost...

In Italy, inflation is rising, but in some cases it is incalculable. There are some electrical components that don't have a price, they are sold at auctions. For me, the situation is out of control. There is inflation more people who raise prices dishonestly. The prices of construction works are rising every month. A disastrous situation, in my opinion. I find it hard to recognize that it is inflation, this for me is an uncontrolled price increase.

I wonder if the reduced trade will cause inflation or deflation. I do think deflation is more likely because people will refuse to pay the higher prices at some point.

I also noted the rise in copper when it was pumping a lot but I haven't seen many people focus on it as much.

Posted Using LeoFinance Beta

july 4 - there will be a reckoning the likes of which the american people have not experienced.

inshallah.

The supply of some cryptocurrencies deflates over time, meaning that so long as demand remains consistent the price of each individual coin will rise.