Commercial Real Estate Crash: Building In St Louis Sold For $3.5M

It has sold in 2006 for $205 million.

There is a major deflationary force coming upon us. This is the commercial real estate sector, specifically office space in urban areas.

We are seeing a total collapse in many major cities within the United States. The latest to make headlines is St. Louis.

For a century, the Railway exchange building served as the bustling heart of downtown St. Louis. Locals filled its sprawling, ornate 21-story structure daily, whether for work, shopping at the department store on the lower floors, or dining on the famous French onion soup at its restaurant.

Today, the building stands vacant, its windows boarded up. A fire last year, believed to be caused by copper thieves, left its mark. police and firefighters conduct occasional raids to search for missing individuals or evict squatters. Tragically, a search dog died during one raid last year after falling through an open window.

This is the result of decay in many of there areas.

Naturally, there are a variety of factors feeding into this. For this structure, it is evident the problem started long ago. In fact, it is probably the case for this downtown area.

That said, there is something else at work here that has to be considered.

Remote work

Things changes are great deal post-COVID. The lockdowns really turned the tables on employers.

At that time, there was a "unity" among both sides of the equation. Both employers and employees worked together. Remote work situations were set up. The mantra was "we are all in this together".

That didn't last.

Employees found out they liked working from home. The idea of having to sit in traffic and commute was unappealing. Suddenly, family time was possible with a better work-life balance showing up.

What did employers do, especially those headed by Baby Boomers? The old mantra went out the window and suddenly the back to the office push was on.

Unexpectedly, this was met with resistance.

Over the past year or two I wrote about the battle that was taking place. However, in my mind, it is game over. This is not a battle that is going to last long. companies simply will not win this one. Remote work is the future.

COVID did not create the work-from-home model. This was caused by the Internet. What the lockdowns did was show everyone what was possible.

Hence, 4 years after that struck, rates of return are still low.

The crash in commercial real estate is part of the fall out.

Occupancy Rates

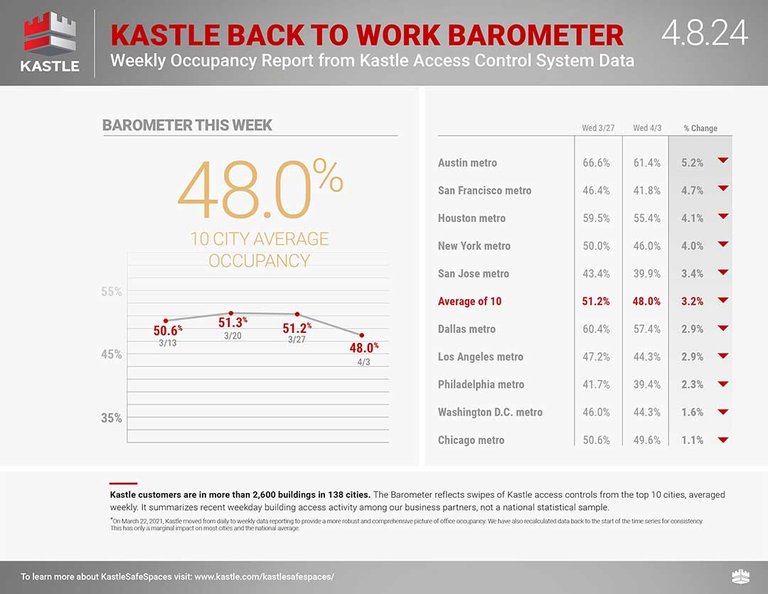

When we take a look at the occupancy rates, we can see how dire the situation is.

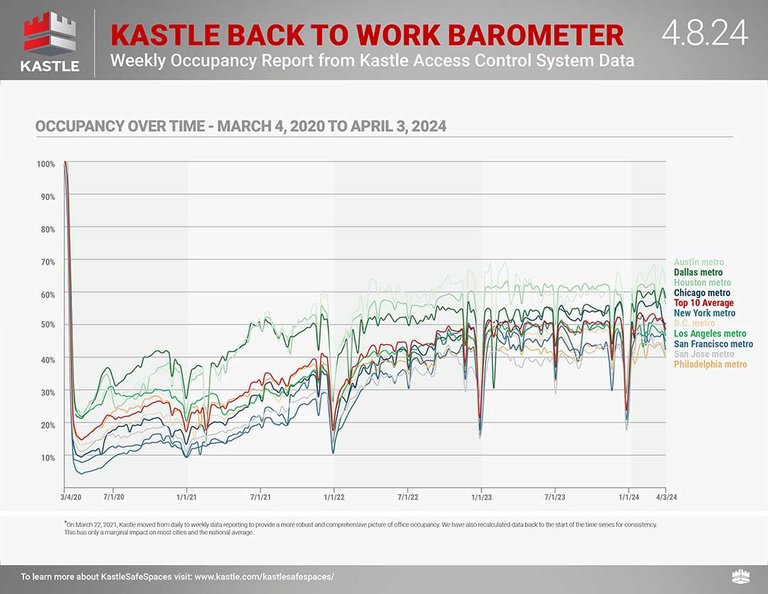

Over the last few weeks, we saw a drop in the rate in the 10 markets that this company, Kastle follows. If we step out, we get a better grasp on the picture.

Notice how we saw a major collapse in the Spring of 2020. From the nadir, we saw a steady increase as companies returned to the office. That lasted a couple years. Something interesting has cropped up since that time.

Since the Fall of 2022, basically 18 months, the rate has flatlined. The average has hovered around that 50% line.

This means that half the offices in these cities, as monitored by this company, are vacant.

We are starting to amass enough data that states we are not going to return to the old "normal".

Technological Age

What we are witnessing is in alignment with the technological era.

Remote work due to technology is a progression that should be expected. As telecommunications, computer networks, and AI systems get more powerful, the need to physically be in an area is reduced. Many jobs will either be handled by computers or done remotely. This is the logical step for knowledge work.

This is going to have impacts in many ways.

As I laid out in The Layout For The Globalization Of Real Estate, this is going to end up creating a global shift.

Real estate is never going to be the same.

We also discussed how https://inleo.io/@taskmaster4450le/starlink-is-going-to-change-real-estate due to providing communication services to remote areas.

All of this is converging to make the old office experience completely different. We still have generational tendencies to consider. Nevertheless, as the Baby Boomers (and GenX) head for the door, the younger generations, who grew up on the Internet, start to emerge.

The idea of commuting for an hour or two each way is not going to be on the agenda of these people.

This is going to have a major impact upon real estate. We can see a seismic shift forming. Commercial real estate is the first to show what is happening.

People want deflation, here it comes.

Posted Using InLeo Alpha

The thing is, for the companies that embrace WFH, the cost savings are incredible. Building rental, heating, cooling, cleaning are all expensive... and you're usually restricted in hiring only the people who live nearby or are willing to move (usually subsidized by the company). People (but not everyone) are generally more productive and there are far less interruptions and pointless time-wasting meetings.

The commute is a big deal, my commute could be anywhere from 20 minutes to 2 hours depending on traffic and that is soul-sucking. I'd leave early from work to try and avoid the worst of the traffic, and now WFH allows people to work longer if they want to... or just have happier lives.

I don't know what the future of all these commercial buildings is... it'd be great if they could be converted to apartments but I understand the physical complexities with that... I don't think it's unsolvable though.

Very true.

In the US, a lot of the leases are long term. Some go out as long as 20 years. So the companies are stuck on that end. Why they dont save on the other stuff you mentioned by keeping them empty is beyond me (in the cases where they dont leave them empty).

I agree with the soul sucking aspects of commutes. People easily spend 10 hours per week commuting, on top of their work hours.

It is a massive drain. There is no way the future is one where offices in down town areas are full of employees. I have a feeling we will see a steady decline.

As companies that embrace WFH find themselves more productive and profitable, the market will decide that office spaces are a waste of resources.

wow that's a huge loss. Someone bought for that much but then sold for that cheap O.O wonder if that was the right play for them

I know a lot of people that resigned and changed companies because their employer was asking them to return to the office. People, especially those in IT, saw that they can do their job remotely. In a lot of cases, the government is the one mandating the companies to get their employees to come back to the office. Apart from commercial real estate, there are a lot of sectors also affected by WFH. Public transportation is hurt with less commuters, small and big businesses [restaurants, suppliers, malls, etc.] have less clients, gas companies are getting less profit, and the government is receiving less taxes overall because of this. There are more, but the WFH effect could be felt by all, and could result in a domino effect.

COVID started this and even after the COVID, the effect is still felt. Quite pathetic to see the drop and currently now I am still wondering what can be done or implemented to return the rate back to the top instead of it been dropping