Gold's Demographic Problem

We all know there is a lot of discussion about Bitcoin versus Gold. It arises a lot of emotion on each side.

That said, there are some issues with gold that we must consider. After all, commodities tend to be the epitome of supply and demand. Alter one side of the equation and prices can move in a large manner.

Source

Gold has a long track record. The use case for it goes back hundreds of years (even thousands). So it is hard for people to fathom how something that established could be upended. Yet that could be what we are seeing happen.

One of the biggest problems is one of demographics.

Gold Buyers Are Starting To Die Off

It is no secret that Gold is preferred by the Boomers. This is an asset class that they fell into and favor as a fallback. However, this is going to cause a problem as we move forward.

At the other end of the spectrum are the Millennials. They now outnumber the Boomers in the United States by a large number.

We also see those who are at two different ends of the financial spectrum. Boomers are exiting the work force while Millennials are coming into positions of power.

Then we have the situation of death. The Boomers are at that age where the end arise. This is a group that was born between 1946 and 1964. The first of them is turning 75 this year. While that is no longer considered old, a fair portion of people die off before that age.

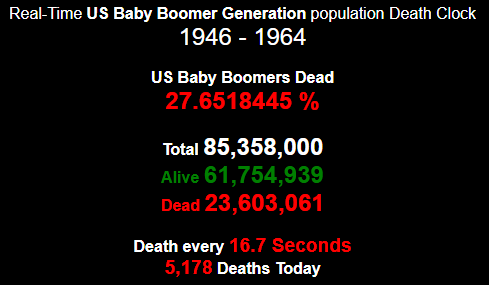

According to Incender.com, more than a quarter of the Boomers in the U.S. already passed away.

As we can see more than 27% of them are no longer alive. What is worse is that more than 5,100 are passing away, on average, each day. This is a number that is going to increase as the entire generation heads toward their 70s and 80s.

What happens when a products customers start to die off? It usually is a sign of trouble. Unless it can somehow tap into the younger generation, the writing is on the wall. We saw it with a number of things that were part of a particular generation. The nightly news is a prime example. Their ratings dropped as the Greatest Generation started dying off. The younger generation simply did not embrace that form of news delivery. Once the Internet showed up, the Boomers (who were a younger generation at the time) embraced that and had newsfeeds everywhere.

Could the same thing be happening to Gold?

Millennials Are Into Bitcoin

Here is where the issue comes from. It appears that Gold is not capturing the attention of the younger generation. While it was probably easier in the past, now there is another alternative.

Bitcoin is now on the radar of the Millennials. They are the ones flocking to it. After all, technology is something they grew up with and know intimately. They are not scared to have to learn something new with an application. This makes them prime candidates to embrace this new form of value, unlike previous generations.

How much of a difference is there?

According to Bloomberg analyst Eric Balchunas from an interview with CCN

“When we talk to our younger clients - we have a core gold allocation in our portfolios, and they’ll ask about that and say, ‘What about crypto?’ And if you talk to, primarily millennials, and ask them which they prefer, bitcoin or gold, it’s a landslide. It’s not even close, it’s like 90% prefer bitcoin.”

That is a huge margin. Granted this is just one survey and other estimates have it ranging from about 65% up to that 90% level. Whatever the accurate number is, we can see how Millennials favor Bitcoin far more than Gold.

Long-term, if the trend continues, this will create big problems. To start, these same Millennials are going to start taking over positions within governments, banks, and wealth funds. It will be they who are making the decisions over large sums of money.

The second is we are moving more into a digital world with a large group of people who are raised in that realm, at least to a degree. That crossover to that arena is going to be far less difficult than it is for the older generations.

Hence, what do you think they will opt for as their store of value? Little yellow pieces of metal or something that is digital in form that can be moved around easily and for little money?

Things could change of course but this is the pattern that is being laid. From the Millennials I came across, most fit into this category. They might opt for both, this could change if Gold does not outperform like Bitcoin has done the last decade.

A lot of long time beliefs are being challenged by technology. This one is tied to the demographic view of things. The technology is being embraced by the Millennials.

In 20 years, most of the Boomers will not be around. The ones that are will be part of the cared for aspect of the economy. It will be the Millennials and Gen Z's show.

There are other issues that could be confronting gold but this is a major one that is fairly obvious and likely to happen since the trend is already forming.

What are your thoughts? Leave them in the comment section.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

I upvoted you, thank you for posting!

https://twitter.com/taskmaster4450/status/1424185979561197578

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I see where you're going with this. Obviously, a lot of customer or customers affect the long term aspect of any product, so if their presence or consistency contribution which in this case has to do with them being readily available and invested, it posses a challenge for the commodity's life span...

The younger generation is much more bitcoin friendly than gold, truth is, few of them actually give attention to gold's existence as an asset class.

That is true and not unheard of. The younger generation has no concept of cash. Hell many of them do not grasp credit cards.

So they are accustomed to having different options than previous generations. The Boomers went years with cash before credit cards became the norm.

So it is a major generational thing.

Posted Using LeoFinance Beta

Do you think it is possible that as the millennial gen grows older and presumably wealthier (say 15-20 years from now) on Bitcoin that they diversify into gold simply because it is tangible and relatively stable?

I could see that happening.

Posted Using LeoFinance Beta

I think that is possible, but I don't know if that's likely to happen. I think all the development that will take place in the crypto ecosystem in 15 or 20 years is going to make it the best move for the majority of the people involved in crypto.

Posted Using LeoFinance Beta

No I dont. We are going to be further into a digital world 15-20 years from now, so why would they want something tangible? It is a foreign concept and really will be then.

This article didn't delve into the technological component either.

So in my view there are a lot of long term headwinds against Gold.

Posted Using LeoFinance Beta

Interesting outlook Task, thanks for the response.

Posted Using LeoFinance Beta

No problem. Always willing to share my views.

Posted Using LeoFinance Beta

In fact, far from the views of the whole world

In my opinion, gold is the most overrated thing in this world. I don't know what's special about it. It's just a metal that everyone chose to be a store of value.

Is it useful in life so that it cannot be dispensed with? I think no. Perhaps iron is more useful than it.

I agree with your general opinion! I also believe that it's a bit on the overrated side but it does have many uses and applications in the industry. Many electronic circuits have gold in them, for example :)

Posted Using LeoFinance Beta

That is exactly what gives it value. I am not sure I would say it is overrated since it is an agreed upon store of value. Since that is the agreement, it holds it value.

However, the younger generations might be changing that view.

Posted Using LeoFinance Beta

Amazing Gold

I agree. I don't see myself ever investing in gold. There are many investments that I favor over gold, and crypto is definitely among them

Posted Using LeoFinance Beta

And I believe you fit the target demographic I am describing.

Posted Using LeoFinance Beta

I still don't mind getting some gold but more into the mining companies since they are more or less focused on selling things as they get it. I have given some thought to the physical stuff but I don't know if prices will drop back to what I want to buy it for since I missed out

Posted Using LeoFinance Beta

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 1400 posts.

Your next target is to reach 200000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz: