Polycub Builting Out Value For pHBD

This is an overlooked topic in the stablecoin world and I am glad that the Polycub team is approaching it.

During the week, we saw this Tweet sent out:

There is now a pHBD-POLYCUB liquidity pool on Polycub.

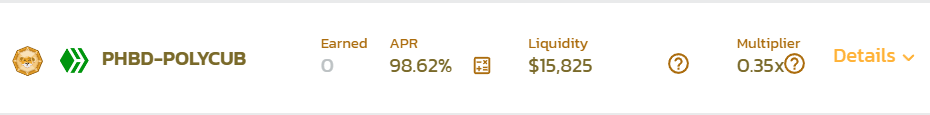

Here is what the farm looks like:

A nice APR although not a lot of activity in it as of yet.

This is a very important development in the expansion of pHBD.

Building Value On The Stablecoin

When it comes to a currency, it is vital to build value. This is something that appears overlooked in the world of cryptocurrency.

We noted what we can learn from the strength of the USD. While many focus upon the payment aspects of a currency, there are actually many other layers.

With pHBD, we are seeing expansion that can, in time, help to build value on it.

At present, there are two liquidity pools for the token. This means that people can acquire it by swapping either USDC or $POLYCUB. Both will net the individual pHBD.

Obviously the pools are lacking in their depth. We can see the numbers are not enormous. Of course, this is not surprising considering where HBD stands. This has a very low circulating supply, something that will have to change over time.

For now, we are without use cases so it is not the end of the world.

The next challenge is going to be to provide some use cases for pHBD. This can include it as a payment system for other investments. As explained in the past, getting into the derivative along with synthetic asset markets is vital. At the same time, we could develop something similar to Treasuries by building a bond tree.

One of the keys with bonding of this nature is that it will lock up pHBD for a period of time. Whatever time vault the user enters, the tokens are locked away. This means the liquidity has to come from a secondary market which is a huge opportunity for Polycub and the protocol.

Pushing Value To Hive Backed Dollar (HBD)

It is important to mention that pHBD is really a derivative. This is "backed" by HBD. Essentially, it is simply switching form.

Think of it this way:

HBD is water. If we freeze it, we get ice. What is ice? Water in a different form. Melt the ice and you once again have water.

Under this scenario, all pHBD has a 1:1 backing of HBD. The way pHBD is created is by using the LeoBridge to swap HBD for pHBD. If one reverses the process, once again he or she has HBD.

Since pHBD is a derivative, it helps to push value back to the original coin. This means that, as pHBD enjoys more success, this will translate into the same for HBD. More importantly, pHBD is a way to provide resiliency to HBD.

Of course, once the features of Polycub are rolled over to Cubfinance, we will see the emergence of bHBD. This is another opportunity to duplicate the same scenario. With each new iteration, along with the different use cases tied to each, more resiliency (and value) is driven to HBD.

Rinse and repeat.

The real excitement of pHBD, HBD, and bHBD is going to be the other aspects that are built out. If we see Polycub bonds, we could have a major use case within the fixed income market. Naturally, if this is created and duplicated, we can see how each EVM chain will incorporate this.

According to what was discussed, the intention is to have at least 4 or 5 Ethereum forks with a platform like this on it. Therefore, if each has 4 or 5 use cases for the wrapped version of HBD, then we can see how this will impact HBD.

Suddenly, we could go from something depending upon arbitrage and trading bots to a coin with a number of derivatives used for many different purposes.

This is the first tier which would then begin to separate HBD from the rest of the stablecoin market.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Interesting thoughts @taskmaster4450

Originally the use case for Leo was similar to that you now propose or perhaps put more accurately, report as a new use case for HBD. I can see value in this use case, as a stablecoin holds its value better then a volatile asset like a cryptocurrency, and this type of stablecoin distribution already exists as USDT and USDC show us this has utility, as USDC is present on Ethereum, Binance Smart Chain and Polygon.

Posted Using LeoFinance Beta

$LEO is the mechanism to capture the value of the entire entity. For this reason, it is more akin to a stock in the sense of it represents the overall market valuation of the entity.

With pHBD, there is the utility aspect of things that is going to be further enhanced by focusing upon solid currency value building activities. When we focus upon:

then you have a currency that is resilient and have inherent value.

Posted Using LeoFinance Beta

Ahhhhh

I am beginning to understand.

Thanks

Posted Using LeoFinance Beta

generating value to our stablecoin is very important since we have seen how projects without sufficient foundations disappear

Good stuff! We will have our NFT marketplace use case for pHBD coming soon as well!

That is strong. Payments are one way to add resiliency to a token. With HBD, we can couple many different derivatives (pHBD, bHBD, etc..) all to add value to it.

However, the case is for Polycub to even go further and add more layers of resiliency to pHBD.

Posted Using LeoFinance Beta

While HBD still swings wildly pHBD is holding stable and it's what we need a real stable coin. I could see pHBD taking off bigger than HBD itself in wallets there's massive opportunity for people here to invest in it on Polycub DeFi

Posted Using LeoFinance Beta

Well you embark into an interesting area.

Now we are discussing the idea of elasticity. You could be right. The derivatives of HBD could be more widely used as compared to the coin itself. So yes, there could be a lot of variations on HBD that get used more often than that does.

For example, I proposed the idea of Polycub bonds which would then add an exchange and eventually could feed into synthetic assets. If that was all conducted in pHBD, that would really add layers to it that isnt applied, directly, to HBD.

Posted Using LeoFinance Beta

It's nice to see the pairing but there is already a PolyCUB/USDC pool I think. So I wonder how many people will actually join that pool. We do need to have more use cases so HBD can take off.

Posted Using LeoFinance Beta

Well you need liquidity and depth too.

As stated repeatedly, people tend to focus on currency as a payment when that is not what adds the resiliency.

There are many other layers as stated in a comment above.

Posted Using LeoFinance Beta

I think there may be an APR incentive for the pHBD-PolyCub pool, and XPolyCub holders can vote more yield in PolyCub via the multiplier for our native HBD versus USDC. So we can have the safety of a token-stablecoin pair and feed our ecosystem.

Posted Using LeoFinance Beta

Very happy to see the newest farming addition. I personally do not like USDC, so having a pHBD-POLYCUB farm solves that problem immediately!

Posted using LeoFinance Mobile

That does take care of the problem while also allowing for some upside move in addition to the APY.

Posted Using LeoFinance Beta

Why do you dislike USDC?

Posted Using LeoFinance Beta

USDC was created by Coinbase in collaboration with Circle. It is now backed by BlackRock. BlackRock is fucking disgusting, and truly evil. They control the vast majority of the world's financial markets and are worse than a monopoly, because they ultimately dictate who becomes the rulers of whichever country they want to screw with. They've been heavily involved with keeping Latin America and Eastern Europe poor for decades, extracting all the equity from major institutions while padding their pockets. Some people need to be removed from the levers of power. They're the big fish needing to be fried.

Posted Using LeoFinance Beta

Wow!

I had no idea they were do bad.

Not to mention, USDC is completely 100% centralized, Circle/Coinbase/BlackRock can freeze any wallet address they want at any time, steal funds from them, and essentially control the inflows and outflows of fiat to USDC and vice-versa however they'd like. Gatekeepers are not welcome.

Posted Using LeoFinance Beta