Tesla In 2024: Revenues Off The Charts

It is amazing how short sighted people can be.

Anyone who follows my videos knows I am a big fan (as well as an investor) in Tesla. The bears are having a field day. They like to repeat the statement the stock was down 70% in 2022.

Yabba-Dabba-Doo.

Here we get a clear indication the markets are completely insane. In fact, as a metric of value there is no worse indicator that stock price. You are better off going to a gypsy at the traveling carnaval. This holds for cryptocurrency as well as stocks.

Getting back to Tesla, it is best to look past the noise (this is true for any investment you are going to make). This is one company that has repeatedly made the Wall Street analyists along with the financial media look like the horse's asses they are.

For this reason, we will move past the bullcrap and do some simply mathematics to project where things will stand at the end of 2024. While it is true the market can do anything it wants, we will focus upon the company.

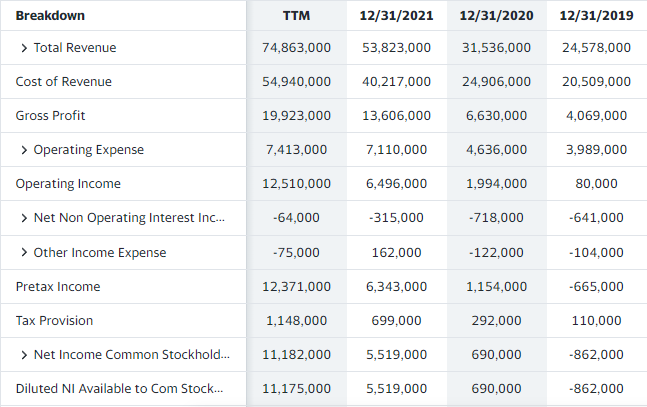

Of course, before going there, let us look at a comparision to a year ago.

We don't have the Q4 2022 numbers so we will work off the TTM. But notice how the revenues jumped $21 billion while the operating income about doubled. Does this sound like a company that is collapsing?

Nevertheless, what will the revenues look like in 2024.

As a side note, the reason I chose that year is because it will allow for the ramping throughout 2023. Here is where we see production exploding.

2024 Revenues

Let us start with the energy division. Why? Because that is overlooked in all the talking points.

Megapacks

The new Lathrop facility has a capacity of 10K Megapacks per year when ramped up. These go for $2M-$2.4M apiece.

That is a total revenue stream of $20 billion in a year. The plant is now running so we will give them a year to scale it. We can figure the company will reach capacity in 2024.

By the way, I would expect an announcement of another plant to be built at some point in 2023.

2024 Revenues: $20 Billion

Cybertruck

This is going to be introduced in 2023. Estimates vary when the line will start production. It is one of the main reasons to jump ahead to the next year in our projections.

The Cybertruck ramp should be quicker than others since the vehicle is square and has no paint. This makes for easier manufacturing.

According to reports, the company has 1.5 million orders for the Cybertruck. While these are only $100 deposits, many should be filled. Thus the company can likely sell the first 1 million no problem.

How many can they build and deliver in 2024 is the question we are concerned with here. For our purposes we will give them 250K for the first full year. This is likely a conservative number.

At $80K apiece, this is another $20 billion in revenue.

The price is for the earlier deliveries. These first ones produced will be the higher end models.

2024 Revenue: $20 billion

Semi

Elon Musk set a target of 50,000 for 2024. We all know how Elon's numbers are. For that reason, let us scale that back a little.

The Tesla Semi is going to carry a price, one they get it into production, of $200K at a minimum. Some are claiming the price will jump to $250K but we will stick with this lower number.

Again, we have production estimates to figure out.

We will go with 25K at $200K per Semi, taking Elon's projection and cutting it in half.

2024 Revenues: $5 billion

Other Vehicles

The Model Y, 3, S, and X are all in the lineup. In 2022, they totalled 1.31 million delivered. This is a number that Tesla is intent on growing.

It has a goal of an average of 50% vehicle growth. This is a target it hit over the last 5 years, growing at an average of 60+% in that time.

So what can we expect in 2024? We will throw out 2.25 million for this knowing that is a very consevative number. Some expect Tesla to hit that in 2023. Nevertheless, we will go with 2.25 million of these vehicles sold in 2024.

The average selling price if now over $50K. This is a bit high, even embarassing according to Elon. For our purposes, we will go with a $40,000 average selling price.

That gives us $90 billion in revenue here.

Keep in mind this isn't much higher than what the 2022 revenue will likely come in at (I estimate around $80 billion). Either way, we can feel confortable in this.

2024 Revenues: $90 billion

The Conservative Numbers

If we add this up, we get revenues of $135 billion for 2024.

We have to keep in mind, this does not include the Powerwalls, services, software, or solar. This is simply focusing upon the vehicles and Megapacks.

Using the $80 billion in revenues for 2022, we see this is a 68% jump, or about 34% annually. This is, of course, below Tesla's target of 50% yet does show how much the company is growing even if it disappoints.

What is ironic about these numbers is this is a very low bar. It is actually a curtailing of things, call it a recessionary forecast. Suddenly, Tesla will have revenues that rival General Motors.

Of course, profit is the bigger criteria. How much money is a company making? That is hard to tell so far in advanced.

That said, one thing we can point to: with the Megapacks, the US Government will be paying $100K per unit. That drops right to the bottom line.

Either way, just going based upon this simple napkin analysis, we can see how the FUD around Tesla is a lot of noise.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

I think there must be a lot of concern if he can really run 5 companies at the same and deliver on all of them. (Either real or targeted as retaliation for buying twitter) Increasing revenue is fine, but if you don't get the margin and leverage then it is not at attractive of buyers.

Posted Using LeoFinance Beta

Now we just have to manage to get there. lol Maybe by then I can put my name on the list for a Tesla of my own.

Posted Using LeoFinance Beta

Tesla has a lot going for it but I think it's just all the drama with Twitter getting to the stock right now. The numbers are still good even if they do miss their estimates a few times because Tesla is still growing.

Posted Using LeoFinance Beta

And don’t forget the co2 emissions rights

I think Tesla is going to be around for a longtime, and continue to successful.

You may enjoy my polite rant about the Media and Elon Musk.

https://leofinance.io/@shortsegments/the-media-should-be-more-fair-and-balanced-in-stories-on-elon-musk

Posted Using LeoFinance Beta