The Bond Market Is Telling Us Things Are Very Sick

The economy is going down hard.

This is the forecast of the bond market at least. Something we watched over the last year is only confirming many suspicions people have.

By now it is evident to everyone the Fed is on the wrong path. Yes it is true that the CPI is still raging. However, this can reverse course very quickly.

Powell and company are trying to engineer a soft landing. This is off the table at this point. It looks like we are going to smash into the ground on this one.

Of course, that is the case most of the time with the Central Bank. Rarely are they able to engineer a soft landing.

The Yield Curve Is Screaming

We are seeing some truly scary things in the bond market. Some of the major metrics being watched are flashing signs of peril.

Let us start with the yields. How are we doing with inversion?

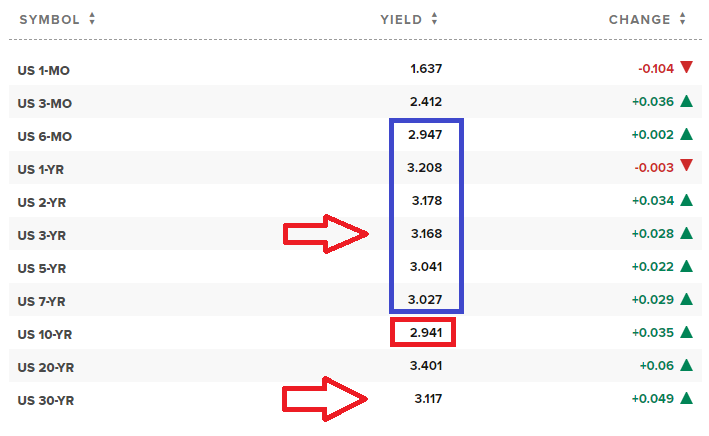

Here are the number from CNBC

To start look at the 10 year rate as denoted by the red box. Now compare that with everything in the blue box. Notice how those numbers are higher?

This means that bonds from 6 months though 7 years have better yields than the 10 year. That is backwards. Money should not cost less to borrow over a shorter period of time. Yet that is exactly what we are seeing.

These are what is plotted on the yield curve.

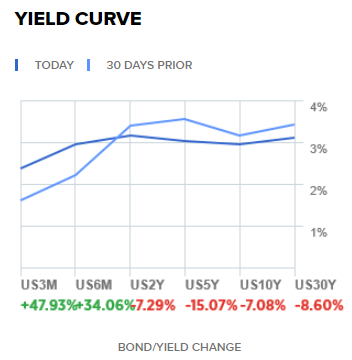

Here is what CNBC also has for us:

We have two issues here:

The middle of the curve, from last month to today flattened out. This reflects the numbers we just looked at.

The front end (left) of the curve went up yet the long end (right) has actually declined over the last month. We see the short end (left) more susceptible to what the Fed is doing, so this makes sense. But the long end (right) actually dropping rates is the exact opposite of what you would think should happen.

This, once again, reaffirms that the Fed is not in control of interest rates. It is the market.

Getting back to the curve, the challenge is things were sick a month ago. Now they are very sick.

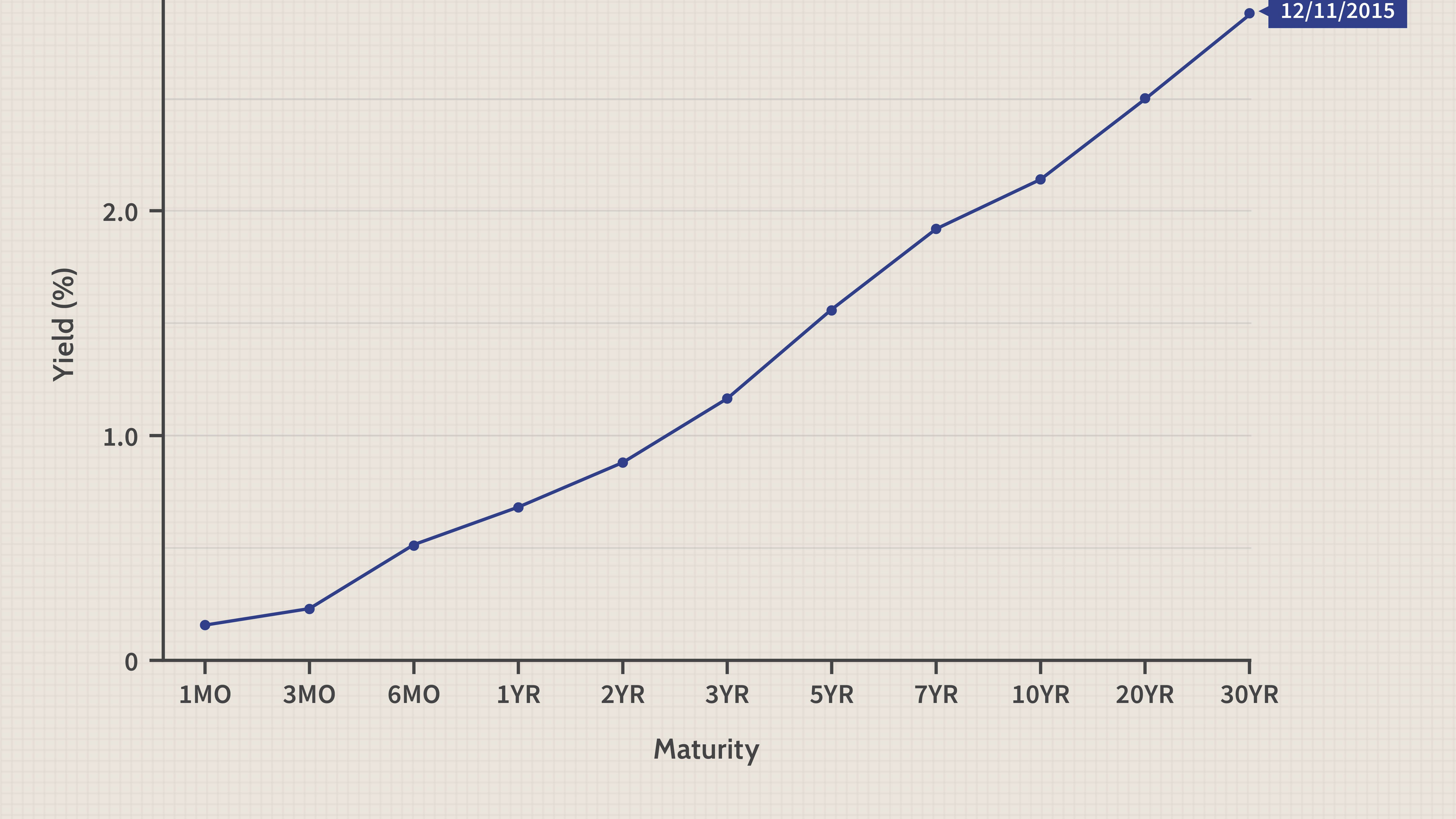

Here is the shape of what a healthy yield curve should look like. Notice a difference?

Alan Greenspan's Favorite Indicator

The former Fed Chair was very open about what his preferred metric was. He believed that this indicator always foretold of recession. It was one of the few that he monitored religiously.

What was that he paid so much attention to?

It was the 3/30. When that inverted, recession was always the result.

Harkening back to the top chart, the both the 3 and 30 years are noted with the red arrows. They are inverted.

The 3 year is at 3.168% versus 3.117% on the 30 year. This is backwards but then, again, so is all of this.

Another point that is very interesting is that present Fed Chair Powell stated the 3/30 spread is very important to him also.

We will see what he does. It is likely the Fed will raise rates at their next Fed meeting later this month. The only question is how much. With such a high print on the CPI, since the Fed is solely focused upon that, we might see 75 basis points.

As stated repeatedly, by now, it is pure foolishness. The bond market is telling us the economy is very sick. We had negative GDP in the US during the first quarter with many expecting the second to be equally as bad. The EU is in the toilet, Japan falling off a cliff, and China locked down in their major cities for part of the quarter.

And yet the Fed keeps listening the inflation narrative while forging ahead with its intent to reduce demand.

For those who don't speak central banker, that means kill the economy.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

I'm in Europe at the moment at it's a bloody mess; as you also mentioned.

I have the feeling these people in charge kind of pretend to know what they're doing but in reality they're confused as well.

Just a feeling though...

Posted Using LeoFinance Beta

I confirm what you wrote at the end of 2021 and the beginning of 2022 it seemed that after Covid everything could start again and instead this war has thrown Europeans back into the abyss

Yes, I had the same exact feeling. I thought everything was about to go back to normal after Covid and the the war happened. Mess after mess after mess. We'll get through this though ... and I hope that the people of Ukraine will get over this as well one day.

Don't you think the last 3 decades of failed and corrupt European "thinking" and "leadership" did this?

Europe is a shithole and has been since the EU was forced upon all of you.

Hard to tell if it is incompetence or something else.

My guess is they were paid off. There is too much love for the WEF and adherence to their policies.

Posted Using LeoFinance Beta

this post is great! I didn't know about this thing! It seems that we are facing a period of which we cannot read the future. We seem to have uncertainty ahead of us

There is also the Eurodollar futures curve which is even larger than the US Bond market.

Posted Using LeoFinance Beta

and those bonuses could generate profits as you explain. But I have a doubt about these bonds to whom I can sell them and if I could sell them at any time and not at the time indicated.

Bonds are a liquid market. There are tens of trillions in bonds traded around the world each day. US Treasuries are very liquid for the most part.

Posted Using LeoFinance Beta

If we had more people involved in making macro-economic decisions in government positions like you @taskmaster4450le , I think we wouldn't be in this death spiral.

Was it just unquenchable greed, a penchant for lying to the American Republic, and a general disregard for goodness that allowed our leaders to drive us to this point?

These people have no remorse, no regrets (other than some inevitably get caught/become fall guys).

Like, this is all just so fucking dismaying if you're American, if you used to watch baseball at the game with your family...if you like memories of what America used to be like.

Things change over time and people need to pull their heads out of their ass.

That is by I am so excited about blockchain and cryptocurrency. Opportunities like Hive can really alter the dynamic of what is taking place and how things are in the future.

It is up to us to make governments, at least the system we have now, irrelevant.

Posted Using LeoFinance Beta