Why is gold surging while bitcoin is moving sideways?

I think the answer is the bond markets. US bond yields are rising which means bond prices are falling. In other words, investors are dumping bonds. But why?

Because US inflation ticked up last month, and the jobs report came in strong - this means that not only will there be no interest rate cuts this year, the Fed might have to raise interest rates. Only the Fed can't raise interest rates because that will break the US govt. The Biden administration is running budget deficits of 7% of GDP, and it's interest bill is now bigger than it's social security bill.

So the Fed will have to tolerate inflation. No wonder the markets are panicking and dumping bonds.

In uncertain situations like this, investors go "risk-off". They dump anything deemed risky and hold anything deemed safe. Unfortunately, Wall Street still deems bitcoin and all crypto as risky.

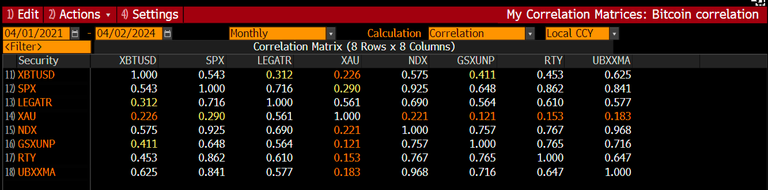

So while gold, the ultimate safe asset, has been surging, bitcoin has been moving sideways. You can see from the following table how uncorrelated bitcoin and gold are:

Perfect correlation = 1.00. Gold in the table is XAU, bitcoin is XBTUSD. UBXXMA = Magnificent 7 tech stocks, SPX = Standard & Poor 500, NDX is Nasdaq 100.

You can see that Bitcoin's highest correlation is with the Magnificent 7 tech stocks at 0.625. It's lowest correlation is with gold at 0.226.

This means that when the extremely overpriced Magnificent 7 tech stocks sell off, bitcoin may get dumped too. Unless Wall Street risk managers recategorise Bitcoin as "safe".