US rate hikes and it's implications

Hello,

Today one more news came out from the biggest economic nation USA. Again a hike in the policy rates. Yesterday, when I was analysing some data I found that US already had 40% chances of getting in to recession. And we know as well that if something happens to this economy, it will affect every nation's policy and economy. USA is a $23 Trillion economy and has a world wide economics and trade ties. The biggest implication is that it is going to put more pressure on recovering nations post covid-19. Let us understand what are the things that you can expect in near future!

Image source - Business today

1. Crypto's downtrend

As policy rates are hiking it means that people will have a hard time in getting loans and paying interests. As there is no third alternative available, cryptos are likely to shed off more values from it. People will have to sell off their portfolios to meet their needs. Bitcoin is already down to 22k and we will see it sliding down further.

2. Recession

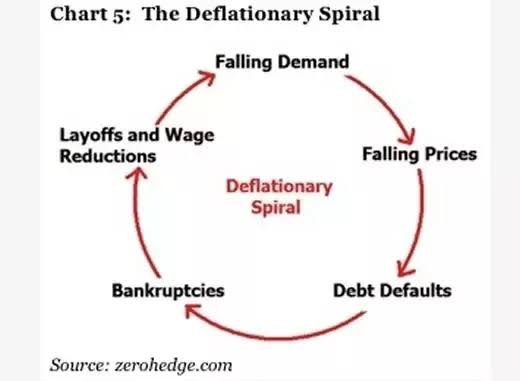

Since hike rates directly affects the amount of money circulating in the economy, lesser supply will affect the manufacturing further. As loans are harder to take, demand will come down and it will trigger deflationary spiral loop. Less demand - less manufacturing - more unemployment!

Image source - Quora

3. Crawling growth rate

Post covid many nations have soften their policy rates to boost the manufacturing and over all GDP growth rate. Now as dollars supply will get limited further, imports will become more costly. And crude oil at this moment has no other alternative so every nation will have to buy oil someway or other. Now a big chunk of the nation money will be spending upon imports which will further affect the development and limit the in-home productions. This will slower down the growth rate, can lead to recession as well.

4. Shrinking startups

Start-ups are the new wheels of the economy and as recession will hit, it will also limit the amount of investments that helps in running startups. Start-ups engaged in production especially the one that brings raw material through imports will face harder situations.

5. Depleting Forex

Image source - Trader trust

Foreign reserves are kept to deal the needs of the country. As imports are getting costlier and the supply of dollar will reduce further, it will depreciate values of other currencies as well. We are already witnessing that how Euros, Yen are already facing the heat. To stabilize the economy and depreciation, forex will have to loose some value out of it.

Now there are many more implications that one nation can face due to this. Expect changes in your economy's policy rate as there will be a rush to shield the economy against growing probability of recession.

Thanks

Thanks to neoxian city and Mr. Dragon for a lot of joys and giveaways.

Posted using Neoxian City

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

This post has been manually curated by @finguru from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Usd is always a big Influencer of the whole market but I wish it goes well anytime soon @theindiankid

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.