What does Bitcoin's halving mean for the BTC Vs Gold debate?

What makes Bitcoin special and different

Bitcoin is an amazing asset in a class of its own. Think of stocks and you need a custodial to hold it for you.

Think of a bank deposit and you need to give your funds to a bank for both safe keeping as well as for making it grow in value.

If you invest in a piece of land or built property you cannot carry it with you.

If you invest in gold or other precious metals the good part is you can carry it with you however since it is a physical asset therefore you need to protect it from the risk of being stolen or you being robbed.

If you have a sizable chunk then you might have to set up a vault to keep it safe.

What makes Bitcoin as an asset quite different and unique is that it can be stored as a private key written on a piece of paper or on a hardware wallet that keeps it secure and offline.

For transactions one could keep small amounts in a hot wallet.

What is so remarkable about bitcoin is that if you know some basic steps to keep it secure then you can carry it on a plane or by any means of transport to any part of the world without the asset being detected.

On the flip side every bitcoin transaction no matter how big or small gets recorded onto a blockchain so your transactions can be traced back to your wallet.

This unique quality makes Bitcoin a really amazing asset to hold. Add to it the fact that there are only 21 million of BTC out there makes it even more rare as an asset class.

Post 4th halving changes to Bitcoin emission

Prior to this halving event the BTC emission was 6.25 BTC reward per block which has dropped to 3.125 BTC per block reward post the 4th bitcoin halving event.

Interestingly the bitcoin halving is a mechanism built into the design of Bitcoin and approximately every 4 years the Bitcoin halving happens.

When the Bitcoin blockchain was launched it was rewarding 50 BTC per block as mining reward and the mining difficulty was low so anyone with a decent computer and processing power on the graphic card could mine a good amount of bitcoins.

Back then the awareness of bitcoin was hardly there and as people got to understand the idea behind bitcoin they became curious and started mining bitcoins.

The initial miners could be put in the category of geeks and techy nerds who had got in out of curiosity and love for the tech as the price was really low.

There were few options to exchange btc for anything of significance.

The current reward of 3.125 BTC per block of mining rewards translates to 450 Bitcoins per day of reward.

Thus there is a significant decrease in the number of BTC added to the available supply.

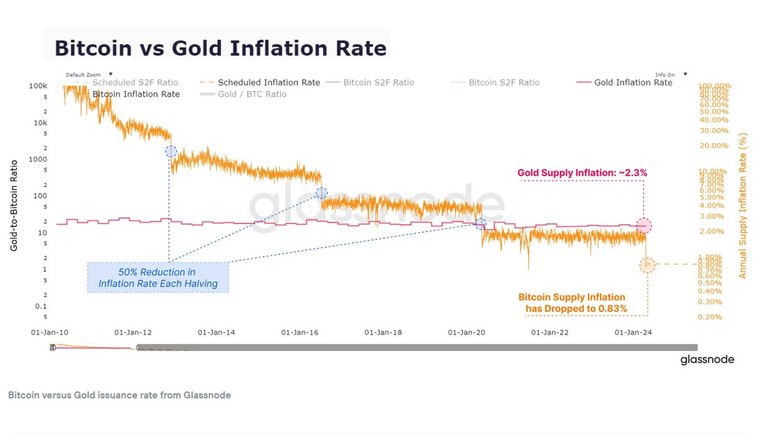

If we look at the inflation of BTC and compare it to that of gold then we see a remarkable shift in the inflation of BTC.

Post the 4th bitcoin halving event we observe that the inflation of Bitcoin has dropped below the inflation offered by gold supply.

We are in an interesting situation. Both gold and bitcoin are mined though in very different ways.

Here we have a scenario where bitcoin mining is adding bitcoins to the system at a slower rate than gold being added to the available supply.

What could this possibly mean?

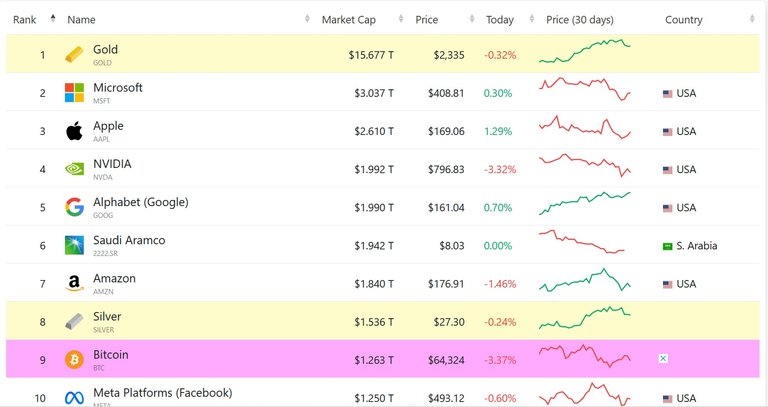

An asset which experience high demand generates high buying pressure. With a limited supply and demand outstripping supply there is a good chance its prices would run up faster and its market cap rankings may also climb up faster as compared to assets like gold which has the ultimate dominance and sits at number one spot on the market cap charts.

cover image created with Bing image creator

Posted Using InLeo Alpha

This post has been manually curated by @alokkumar121 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @alokkumar121 by upvoting this comment and support the community by voting the posts made by @indiaunited.

This post has been manually curated by @alokkumar121 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @alokkumar121 by upvoting this comment and support the community by voting the posts made by @indiaunited.

👏 Keep Up the good work on Hive ♦️ 👏

❤️ @bhattg suggested sagarkothari88 to upvote your post ❤️

https://inleo.io/threads/thetimetravelerz/re-thetimetravelerz-22vssc54d

The rewards earned on this comment will go directly to the people ( thetimetravelerz ) sharing the post on LeoThreads,LikeTu,dBuzz.

Bitcoin has chances of roofing when putting all the algorithms together. Rarity, is one unique components of value . Gold has no mining limit but every 4 years, the case is different for bitcoin. Let's see what the next 365 days holds for btc. Nice article friend

Congratulations @thetimetravelerz! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 11000 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPWe are going to see some nice new highs on BTC and gold as well. The big question is can BTC keep the steam or will it fall back like it has in the past? I'm hoping for the upside personally on both gold and BTC because I love holding both of them!