Crypto Analysis | GLX Airdrop - Silverlining for SPS?

Good day Hiveians!

Join me in analyzing the crypto markets!

Yesterday we looked at SPS and discussed its downward trend

But there is a silver lining: GLX. More specifically the GLX airdrop which is being given all SPS stakeholders. GLX is expected to last for 1 year (just like SPS) and will end in October 2023. One key difference to SPS is that the supply will be lower so that the total supply will be 2 billion whereas SPS has an intended supply of 3 billion. In my previous posts I highlighted the problems of such a high inflation for SPS. But there is quite a bit of a difference to SPS as per the whitepaper:

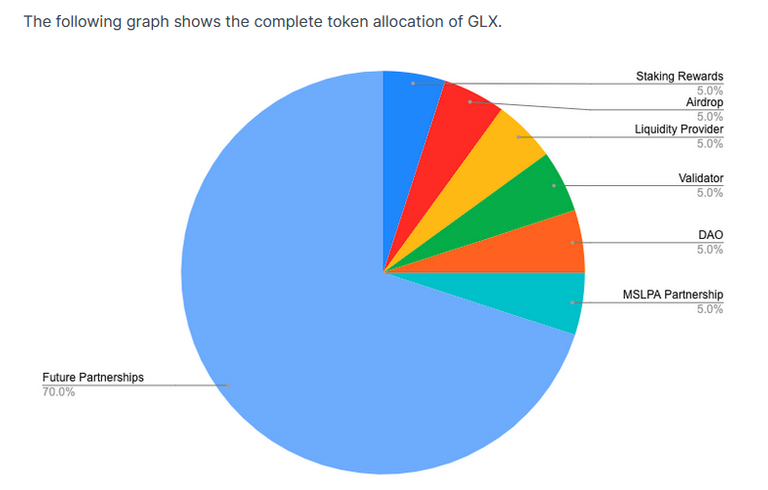

We can see that the staking rewards etc. all "only" have a distribution of 100 million. The main chunk by far is the future partnerships category which will have a distribution of 1,4 billion or 70% or the total supply. However, currently there are no partnerships announced yet which means that all of this GLX is not on the market yet (as for most other).

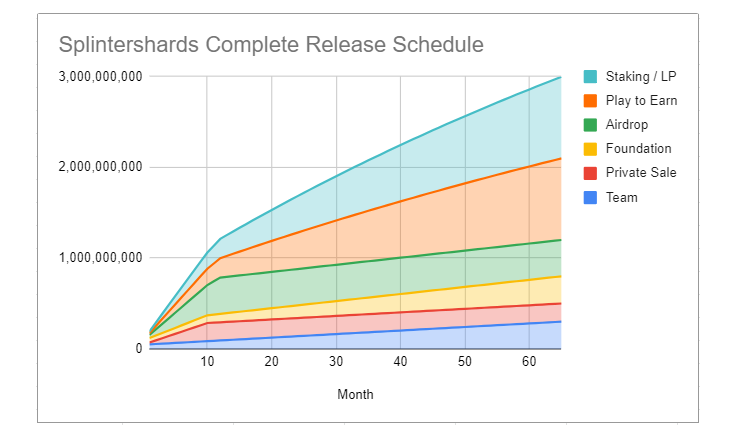

Compare this to SPS:

Here the majority of the distribution is going to the staking rewards as well as the earning by playing categories. The airdrop will account for another 400 million SPS. This is a huge difference. Essentially the main distribution will be through playing the game whereas with GLX the main distribution will be dependent on partnerships. My guess is that every time we get a partnership tokens will get dropped to players with assets (which is then roughly equivalent to the earning by playing).

The bottom line is that much less GLX will be introduced to the market with the supply also being 1 billion less. Depending on the success of the game, this means that the price potential is much higher for GLX than for SPS (there are of course also many burn mechanisms for SPS which will reduce the supply by quite a bit potentially).

It is currently unclear how popular the GLS game will become, but we can clearly see that demand is there for its token. However, I wonder whether we could see a similar development as we had for SPS. For this token we had a strong increase in value for the first 3 months and then a dramatic sell off which lasts to this day. Could we also see a similar pattern for GLX? I think there could be something to it, although I don't think that there will be a similarly strong sell off as (A) the supply is less and therefore it will have a lower inflation rate and (B) it seems that 2023 could be the start of the next bull market (although this remains to be seen).

Staking SPS is very profitable atm

At the moment one can get about 1 GLX for having about 1600 SPS staked. And buying 1600 SPS only costs about $70 at current prices. If we assume that we have an average price of about 20 cents for 1 GLX this means that after one year you would get about $73. In other words, you would get a 100%+ APR. The rate will obviously change, but it is clear that it could make sense to invest into some SPS and stake it as the prices seem to be at rock bottom.

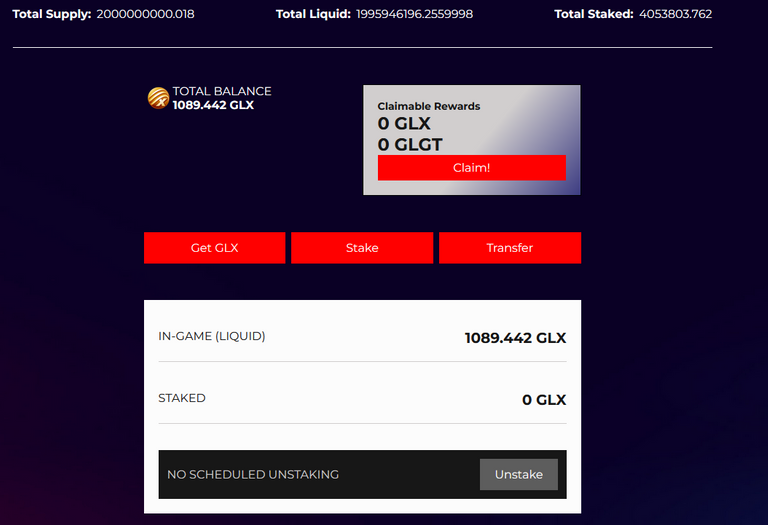

How much APR is there for staking GLX itself? We know that 100 million is being distributed for staking rewards. Every day there is about 274k distributed to stakers. With about 4 million currently staked this means that one gets about 0,068 GLX per day for 1 GLX staked. I believe the APR therefore should be at around ~2300% This will obviously drop very fast, but it probably makes sense to stake some. There is also some GLGT given out which is currently not on the market.

As a general reminder: Please keep in mind that none of this is official investment advice! Crypto trading entails a great deal of risk; never spend money that you can't afford to lose!

Check out the Love The Clouds Community if you share the love for clouds!

Great analysis mate, GLX airdrop is purely profitable. I keep buying more cheap SPS to feed both sides😉

makes sense!

At the moment one can get about 1 GLX for having about 1600 SPS staked. And buying 1600 SPS only costs about $70 at current prices. If we assume that we have an average price of about 20 cents for 1 GLX this means that after one year you would get about $73. In other words, you would get a 100%+ APR. The rate will obviously change, but it is clear that it could make sense to invest into some SPS and stake it as the prices seem to be at rock bottom.

Good to know. Probably like a lot of other people, I have most of my asset locked up in Hive. I hate to take the loss by selling the Hive low to get the SPS, but your data gives me pause to consider. It might be time to load into SPS and stake the GLX for a while. What's the lock up on GLX? Is it 4 weeks like when SPS is staked?

I think it is 4 weeks, yes. I also don't like to sell any Hive at current prices. It's hard to tell what's the best strategy - erhaps a mix of it all

@tipu curate

Upvoted 👌 (Mana: 29/49) Liquid rewards.