Mistakes to avoid during a crypto bear market :

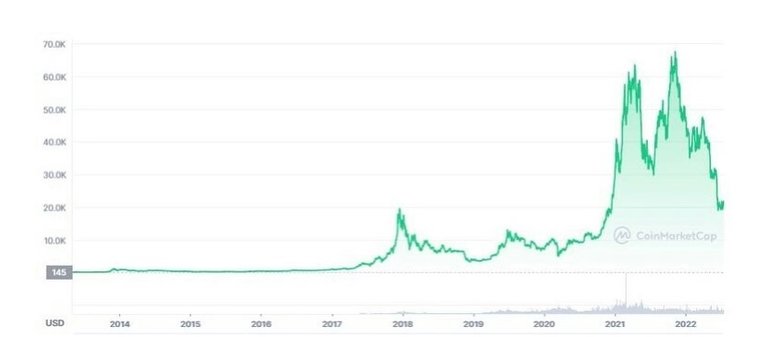

Source:Coinmarketcap

Cryptocurrency bear markets can be brutal for new investors without a wide experience. The swings are typically a lot more violent compared to traditional stock markets, and it’s not unheard of for some coins to lose 90% (or more) from their all time high values.

Not having sufficient knowledge or experiencing a cryptocurrency bear market for the first time can have investors to make mistakes. With this in , learning from people who have been around in previous cycles, as well as identifying these mistakes in advance, could save both money and emotional hurdles.

Below are some of the most common mistakes that traders and investors make during a cryptocurrency bear market and how to avoid them.

*fear of selling

Fear is universally bad. This is because when we panic, we experience an intense sensation of both fear and anxiety, and it usually comes as a response to an existing danger. When this happens, we tend to be more prone to losing control and making reactionary decisions that are lack of common sense and logic.

nvesting in a cryptocurrency is an act that should be based on sound, objective merits rather than emotions. For example, Bitcoin is largely considered to be digital gold – a store of value – something that has historically appreciated over time. Many people invest in it with the intention to preserve the purchasing power of their funds, especially in times of high inflation when fiat currencies tend to get devalued at a quicker rate. If this is the primer – the main reason behind the investment – one is likely to have a long time frame in preference, and the only reason to sell would be if something fundamentally shifts in the narrative and Bitcoin stops fulfilling its role.

*This has a lot to do with mishandling emotions too. Overtrading is frequently the consequence of a few things – regret of misreading an investment thesis, missing out on an opportunity, the strong desire to recover previous losses, and so forth.

The one thing all of the above have in common is that they prompt emotion-based decision-making. Remember the market doesn’t care for your emotions the charts are nothing but a visual representation of information, and it’s up to you how you will interpret this information. In all cases, though, this is a process based on nothing but objectivity – one where emotions have no room to thrive.

There’s also the fact that you pay additional trading fees when jumping in and out of trades, and if you’re not managing this properly, they can add up pretty quickly.

Thank you

Posted Using LeoFinance Beta

Source of potential plagiarism

Plagiarism is the copying & pasting of others' work without giving credit to the original author or artist. Plagiarized posts are considered fraud.

Guide: Why and How People Abuse and Plagiarise

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.