Everything goes to Zero!

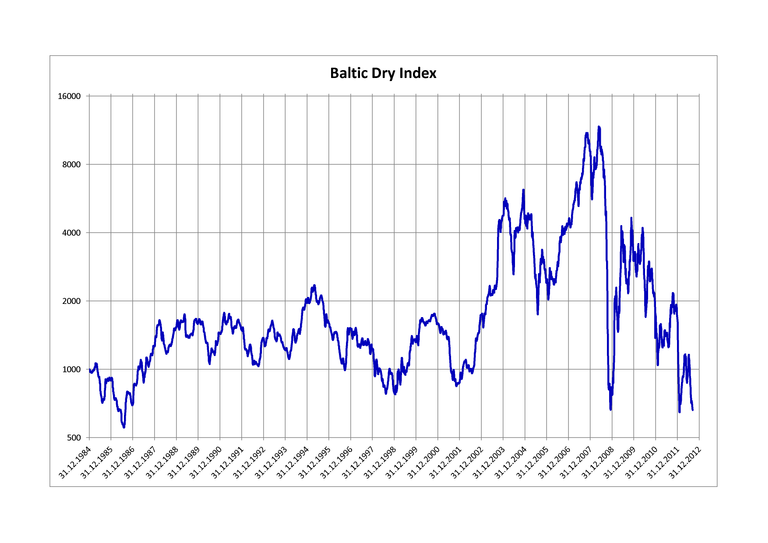

Baltic Dry Index

https://tradingeconomics.com/commodity/baltic

Worldwide shipment index. Peak in Sep, massive negative since then.

In short, everything we have is transported by ships. Low shipment means low demand.

Finance people ignore this fact.

You see the bulls, "we will recover" and " bottom is in".

But wait for forecast is negative and it doesn't price at the high oil price for now.

But wait demand is high

Yeah, supply chains that don't work and war are the main problems.

Inflation and high energy prices will make everything worse.

Shipment becomes more expensive, goods become even more expensive. Inflation increase.

Demand slows down, and inflation slows down. Zero-sum game, rate increase still needed.

But wait.

I think you already get it. Low demand means also fewer jobs in some sectors required.

Special companies that don't make revenue.

With higher rates, Real estate loses value.

It depends now on how long the problems will stay before it impacts the whole real estate market also.

People always talk of high demand. And not enough housing is there.

Idiots, the same happens 2008. With the difference, today banks are more solid and gave less retarded mortgages away.

But it doesn't matter if the real estate is overpriced by inflation and money printing.

A mortgage can become toxic if the prices dump to much and the holders become workless.

So now we have 2008 again, with the difference a bailout doesn't work because of high inflation.

Will it hit everyone?

Most likely new home buyers and people with low net worth. People with money will lose some, but nothing that will damage them long-term ( if they are not retarded invested).

The overall world economy looks bad from east to west.

And because everything is so strong connected things come fast.

Today people want to spend on new solar panels.

Do you think they want to do it if the home losses value? Some maybe, but most would not.

Also, banks don't give a loan for it in bad times ( if home is the only security).

Conclusion

Hard times. And Times will not become easier next time. There is not a single catalyst for its times to become better.

Some look back to 2008

Do you see how fast it can drop? In not a soft landing.

One day to another and because the world economy lacking behind the shipment things after become worse.

https://www.tradingview.com/x/gy6cFIEy/

You see it looks similar.

And this time we have not only a financial crisis. Pandemic, inflation, supply chain issues, war, high energy prices + at some places on the world massive real estate bubbles.

And I don't see how a bailout could help.

And even if not everything is bad, it is still not good like the media tries to sell.

Most Traders on social media, crypto and stocks never face a recession.

In a Bullmarket everyone looks like a genius. Buy and wait.

No financial advice and do your own research

https://twitter.com/PowerGames8/status/1523039827381211136

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Less discretionary spending will mean less demand for goods and fewer jobs. It's as simple as that because higher prices can't last forever. At some point, people will just stop spending as much and watch their own budget.

Posted Using LeoFinance Beta

yup spiral begins

Oh smack, that looks really grim. Didn't realize that.

yeah. Looks like we will see a year of massive pain. Maybe 18 months

Who knows. I don't see any positive catalyst that could change the market fast.

Maybe free unlimited clean energy? :D

Yeah sure, let's ask Dr. Manhatten

maybe elon comes tomorrow

" hey guys btw i have a working cold fusion reactor, just in case you want up only" :D

Well in 2017 Trump suggested to build a border wall with Mexico including solar panels. Eventually it became just an iron fence -_-