What Drives Electric Vehicle Stocks? The Ford and Tesla Story!

Ford and Tesla Deals on Charging technology and infrastructure

Collaboration and technology leveraging has become the fastest route to improved outputs and finance for brands who know how best to broker such business deal. Such collaborations can boost revenue as well as reduce cost that could have been incurred independently by either party. A recent deal between Ford Motor and Tesla on electric vehicle (EV) charging technology and infrastructure has edged the duo in the EV market as well as opened up both brands for crossed investments from more investors.

The report of a surprise Twitter Spaces meeting between Ford CEO, Jim Farley and Tesla CEO, Elon Musk on Thursday revealed that Ford owners will be able access to more than 12,000 Tesla Superchargers across the U.S. and Canada, starting early next year. The partnership between these EV rivals on charging initiatives is believed to impact greatly the current and future revenue of electric vehicles. Moreover, Ford’s next-generation of EVs, expected by mid-decade, will include Tesla’s charging plug, allowing owners of Ford vehicles to charge at Tesla Superchargers without an adapter.

“We think this is a huge move for our industry and for all electric customers,” Farley said on the call. source

Tesla presently operates more than 40,000 EV chargers globally, including 17,000 in the U.S., which only its owners can use. On the other hand, Ford's BlueOval Charge Network has become North America’s largest public charging network, with more than 84,000 chargers. Ford's dealers plan to add 1,800 more DC fast-chargers and locations by next year. The deal between these two giant EV creators is not without benefits to both brands. Ford customers would get access to Tesla’s superior charging network, and Tesla gets crucial buy-in for its charging technology from one of the top automakers in the world.

Ford and Tesla Stocks have been Impacted!

Already, the collaboration has impacted the shares of both companies on Friday after the announcement. Some specific impacts of the deal on Ford and Tesla's stocks were captured by Forbes as follows:

Ford’s stock spiked 7.4% by early afternoon of Friday.

A 7.4% spike would be the largest daily gain for Ford's stock since October 2022. The news was first shared by Ford CEO Jim Farley during the Twitter Spaces conversation on Thursday with Tesla and Twitter CEO Elon Musk. The announcements breaths fresh assurances for the future of Ford's EV and this is what every investor needs.

Tesla shares rose 6% on Friday.

The collaboration is a massive expansion in Tesla economy and also presents a new source of revenue though the companies did not say Thursday how much Ford owners will pay to use Tesla’s chargers. It is certain that there would financial involvements and Tesla charges would have added use cases.

Before this collaboration announcement, Tesla’s services division, which includes revenue from its charger fees, brought in $1.8 billion during the first three months of 2023. This revenue accounts for 8% of total sales and rising 44% year-over-year. With Ford EVs to use Tesla chargers, it is believed that the revenue from Tesla’s services division would drastically increase.

It is on record that Ford sold about 11,000 electric cars domestically during the first three months of year 2023, That represents a tiny fraction of Tesla’s more than 160,000 EVs sold within the time frame. It is obvious that charging fees for over 11k Ford EVs would be added to Tesla's revenue.

Tesla added $45 billion in market value Friday, nearly matching Ford’s total market cap.

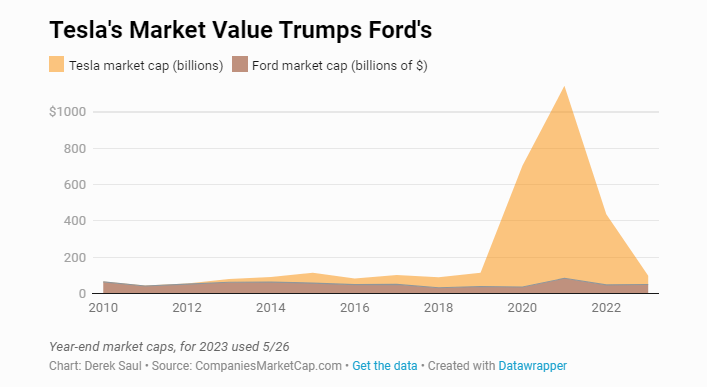

The boost in the Tesla's shares raised the market value of Tesla stocks by $45 billion in response to that announcement. This helps to keep Tesla's market capitalization ahead of Ford's. When Tesla first went public in 2010, its market capitalization was about $2 billion, while Ford was roughly $35 billion. The tables hav changed over time , now having Tesla as the ninth-biggest company in the world with a $615 billion market cap, That is far from Ford's $49 billion valuation.

Flexible Technology and Infrastructure is it!

We can link all of that jump in Tesla valuation to technology improvement and infrastructure. Ford's push to leverage on Tesla's charging infrastructure could bring a leap in Ford's market valuation while also opening the stocks for more investors' visibility and acceptance. In 2022, Tesla turned a $12.6 billion profit while Ford lost nearly $2 billion. Some of these stats could inform the need for this collaboration to close the gap between these two EV brands.

Indeed, success in the EV market is more than good marketing. Technology sustainability is key in the delivery and it is obvious that Tesla has it in its infrastructure, The possibility of Tesla EV chargers to charge Ford EVs is already a testimony Tesla's flexibility in design.

This single collaboration on charging technology and infrastructure could put new pressure on other automakers’ EV strategies. Indeed, there could be more future collaborations.

Let's see the future unfold!

If you found the article interesting or helpful, please hit the upvote button, share for visibility to other hive friends to see. More importantly, drop a comment beneath. Thank you!

What is LeoFinance?

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: https://leofinance.io/@uyobong

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using LeoFinance Alpha