The Value of Bitcoin: Preserving wealth in an evolving financial landscape

SOURCE

In the realm of alternative investments, Bitcoin stands as the granddaddy of cryptocurrencies, steadily gaining recognition as a reliable store of value for those seeking to diversify away from traditional asset classes. With its resilience against inflation, Bitcoin has become a compelling option for preserving the value of one's net worth. As someone who has personally embraced this digital currency, and although I am a "STACKER" at heart, I am here to shed light on why I allocate a share of my wealth to Bitcoin and the reasons behind its appeal.

Despite the prevailing volatility and negative rhetoric surrounding this revolutionary investment vehicle, there are compelling reasons why it has emerged as a viable contender in the market. Of course, no seasoned investor would advise you to invest your life savings into crypto, but for those seeking long-term returns or a means to safeguard a portion of their wealth, Bitcoin offers significant potential.

SOURCE

Allow me to elaborate on some key advantages that make investing in Bitcoin a worthwhile pursuit:

Alternative Store of Value: When searching for a store of value that is immune to third-party manipulation(in theory), Bitcoin reigns supreme. Its decentralised nature circumvents the bureaucracy and fees associated with traditional financial institutions. As a result, Bitcoin is insulated from the inflationary pressures that afflict government-controlled fiat currencies.

Potential for Long-Term Growth: Admittedly, Bitcoin's short-term volatility can be unnerving. However, when viewed from a long-term perspective, its trajectory has historically displayed a bullish trend. The concept of "HODLing" comes into play here, emphasizing the importance of holding onto your investment despite market fluctuations, allowing you to truly realise its value over time.

Diversification: Investing in Bitcoin does not entail placing all your hard-earned assets into the volatile realm of cryptocurrencies. Rather, it offers a means to diversify your investment portfolio with a future-oriented asset. As Bitcoin's price increasingly demonstrates limited correlation with traditional assets like stocks and bonds, adding digital coins to your portfolio can mitigate risks associated with conventional investments. In recent years, Bitcoin has even emerged as a semi-safe haven asset class, drawing investors seeking refuge during times of financial instability.

Accessibility: Investing in Bitcoin has become more accessible than ever before. Numerous platforms and exchanges provide secure and user-friendly avenues to buy and hold BTC. Simultaneously, liquidating your Bitcoin holdings for fiat cash has also become streamlined, offering a distinct advantage over markets such as stocks, bonds, or real estate that often suffer from liquidity issues during times of significant financial turbulence.

SOURCE

In the grand scheme of things, allocating a portion of your income to Bitcoin is unlikely to lead to financial ruin. On the contrary, neglecting to include Bitcoin in your investment strategy may jeopardize your prosperity, particularly in these uncertain times. With banks prone to sudden collapses, inflation on the rise, and several fiat currencies losing their value, Bitcoin has emerged as a formidable asset capable of preserving and even enhancing wealth.

As the financial landscape continues to evolve, exploring the potential of Bitcoin as a means of wealth preservation is a prudent step. By embracing this digital revolution, you position yourself to adapt to changing circumstances and protect your financial well-being in an ever-shifting world.

If you dont own any precious metals, then why not tell us? As a community we encourage ALL engagements and encourage everyone to take the plunge and own at lease a sinlge ounce of silver or a fraction of gold. If youre struggleing to find a safe and secure place to buy, reach out to the community as there is always someone willing to offer their time and advice to help you out.

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

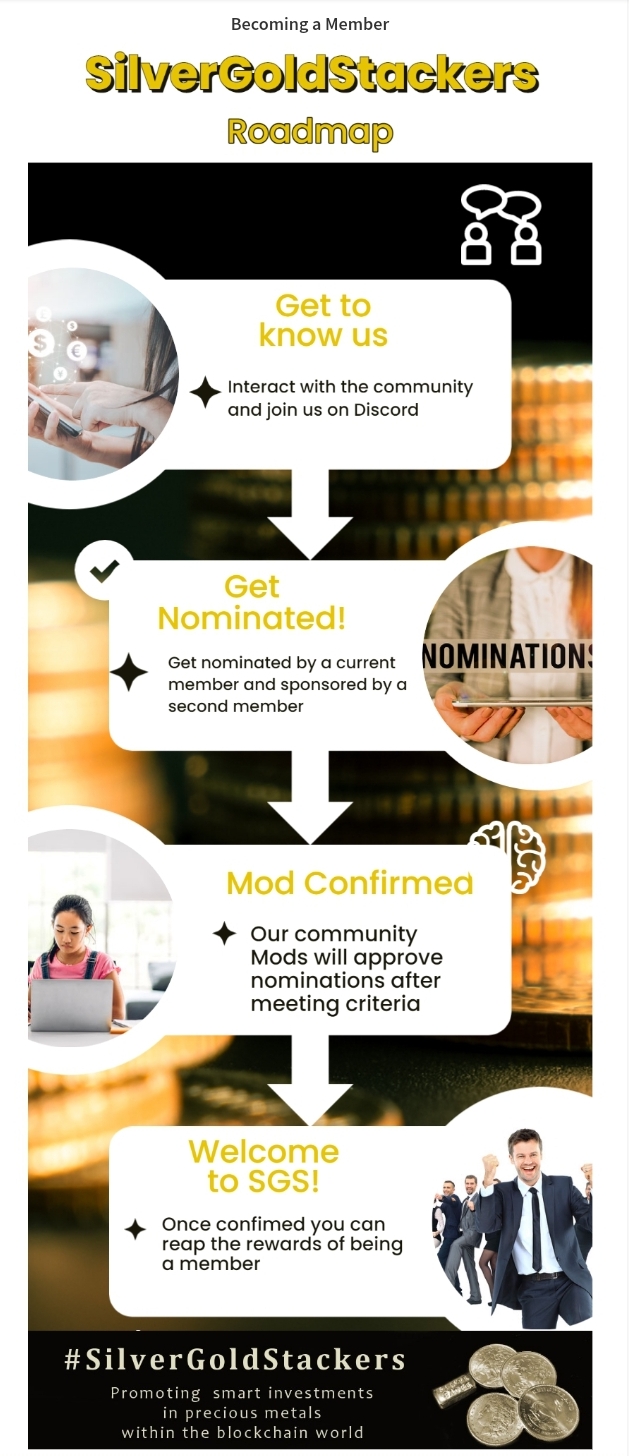

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - #silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.

You received an upvote of 99% from Precious the Silver Mermaid!

Please remember to contribute great content to the #SilverGoldStackers tag to create another Precious Gem.

Everything is skeptical but precious metals. Crypto is tonnes to know how it will perform during a stress test. Gold and silver have historical facts.

I mentioned it in a comment on my previous post - silver wont make you rich, but it will stop you getting poor..... where as a shit meme coin could make you a millionaire. Lol

If anyone wants to put money into this industry, he has to strengthen his mind a lot or he will lose. Those who are small-hearted should put their share in gold and silver.