Bancor 3 Goes Live Offering Ultimate Risk Free Defi Exposure

Evening

Its a blood bath out there, with many Alts falling down on their heads as their leader 'Bitcoin' plunges down below $30K. Worth market bears along with talks of biggest algorithmic stable coin failure, things are already looking pretty gloomy.

The rumor mill and blame game has already started with everyone talking about how and why Terra failed. Whereas my heart weeps for all those who lost on Terra, but the fact remains life is unfair and it goes on regardless. Time to look other way and let the storm pass.

So liquidity pools and staking solution provider Bancor has released their newer version called 'Bancor 3'. 'Bancor 3' has new features designed to provide easiest staking solutions for maximizing the yield for their users and minimizing the risks involved.

Product Architect Mark Richardson stated:

Bancor has spent the past several years creating the equivalent of high-yield savings accounts for DeFi: Deposit your assets, sit back and earn. By helping token projects and their users safely and simply tap into DeFi yields, Bancor 3 enables robust and resilient on-chain liquidity markets that drive healthy token economies.

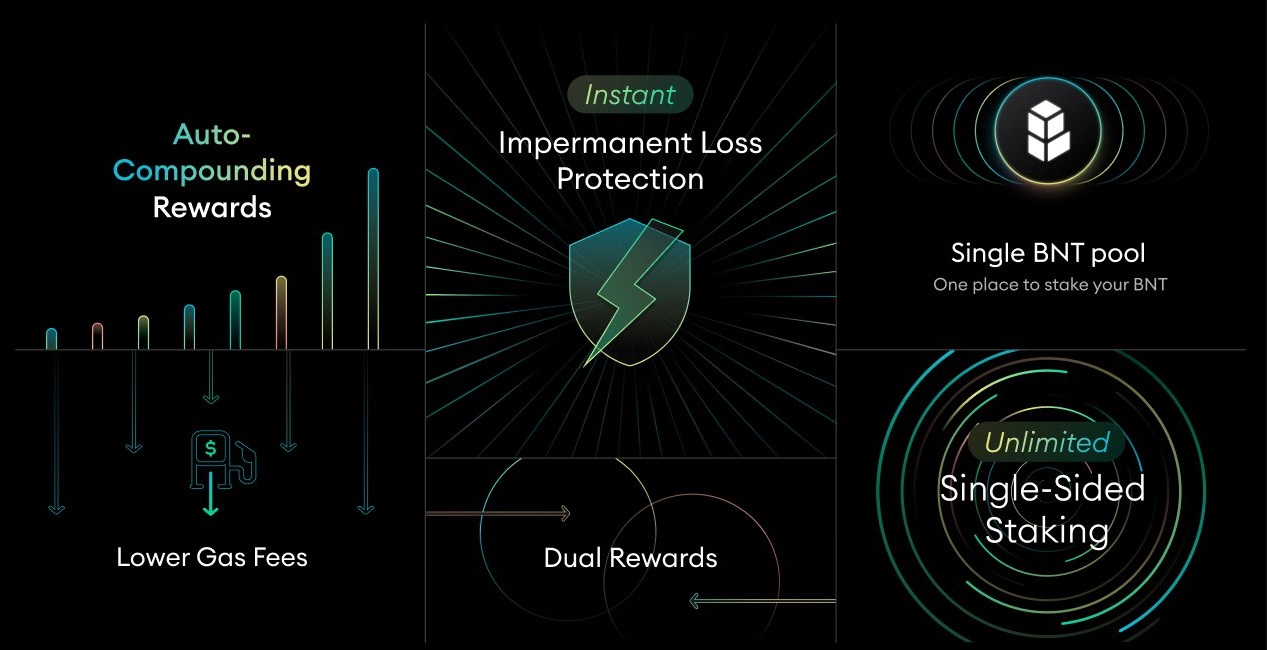

Bancor 3 is the latest iteration of Bancor protocol, providing users with Single-Sided Staking thereby taking away impermanent loss, automated compounding and dual rewards.

Bancor 3 single sided staking is an interesting concept, as it provides users exposure to a single token in Bancor pools. As a return single sided pool token is issued to the LPs as reward, with their price rising or falling with respect to underlaying asset.

In contrast to normal defi pool where LPs are required to provide multiple tokens to enter a pool, with significant risk of impermanent loss. So Bancor 3 users getting exposed to only a single asset in LPs are not exposed to impermanent loss.

Icing on the cake, there is also auto compounding option with rewards getting reinvested in the single sided token of pool so maximizing the returns. Also third parties and projects can also offer addition rewards to LPs on Bancor, called dual rewards.

Several projects and DAOs like 1inch, Polygon (MATIC), Synthetix (SNX), Yearn (YFI), and WOO Network (WOO) etc. have already partnered with Bancor 3 offering dual rewards to their users.

Posted Using LeoFinance Beta