Tron Copying Terra's Tokenomics and Strategy... Another Disaster in Making???

(Edited)

Evening

Terra's implosion along with its stable coin UST has left a void in defi world. Before the collapse Terra accounted for 15% share of defi world. With Terra vanishing investors started looking for other defi chains and Ethereum turned out to be their safe heavens.

But some other smaller blockchains have also pitched themselves as attractive alternative in a bid to attract investors attention, enters the Tron network. Me like all many other hivians have a rather unpleasant history with Tron's founder Justine Sun. But I would try to remain impartial, as much I can.

Terra demise resulted in the death of its $16 Billion market cap stable coin UST, leaving rather a huge void in defi space. Recognizing the opportunity, Justine Sun announced launching a Tron based algorithmic stable coin, USDD. On May 5th Tron launched its algorithmic stable coin USDD.

Launching a new stable isn't a bad thing, right! But copying the older one and rebranding it a newer one is bad. That's the case with Tron's USDD. Surprisingly, USDD follows the same mint and burn mechanism as UST. As if copying the tokenomics of Terra wasn't enough, Tron is also following the same unstable inflating model that Terra did.

Defi apps on Tron are offering high yields on staking USDD like Anchor used to do. So, naturally investors are rushing towards Tron dapp to benefit from those crazy APRS which for sure are not sustainable. As a result TLV across Tron dapps have doubled over the past 30 day.

Tron's lending protocol JustLend is offering 17% APR on USDD and its TLV have increased by 115% over the month. Same is the case with another Tron dapp Sun.io, offering 21% APR on USSD deposits. Sun.io TLV have risen by 220% over the last 30 days.

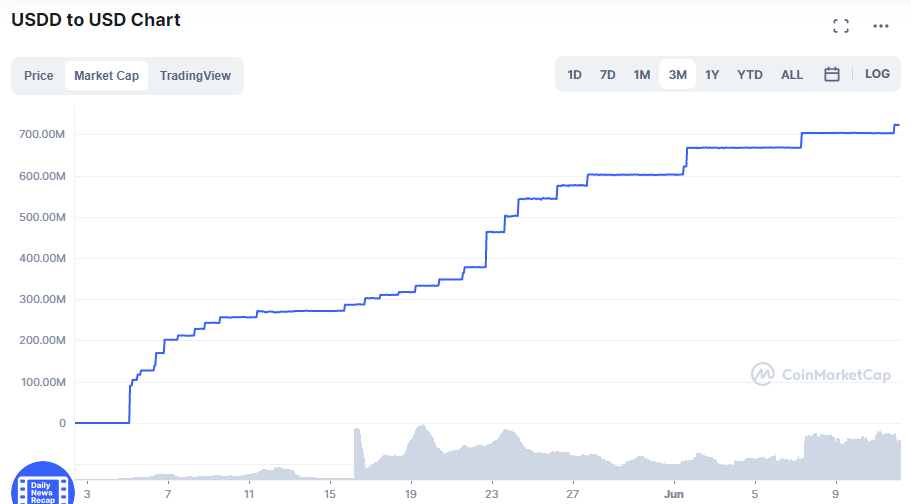

As investors are rushing towards Tron to avail those higher APRs, market cap of Tron's USDD has started to balloon. Currently USDD stands at a market cap of $788 million, just within about a month or its launch. Minting of USDD is on the rise and consequently Tron is getting burned, hence the price of Tron is also swelling.

We all witnessed the same phenomenon with Terra, with Anchor offer 20% APR on UST, market cap of UST inflated to its peak value of $16.8 Billion and Luna pulled triple figures gains last year.

Current USDD market cap of $722 million is still small as compared to other big stable coins out there but this can change pretty quickly. Eyes of bears driven investors are focused of Tron's USDD offering superior stacking APR.

Tron is already facing criticism for copying the Terra tokenomics. So Sun announced introducing the safeguards like backing USDD with over-collateralization using assets like Bitcoin, USDT and Tron (Luna Guard Foundation model). But at the end of the day, it is still rebranding the Terra.

Tron used to a an average blockchain or may be above average, so in Terra's demise Sun saw a rejuvenating opportunity and shamelessly jumped upon it. I guess we will have to see how far this goes and how long before Justin Sun's luck runs out(like happened with Do Kwon).

Its not Sun's actions that surprise me, but the moves of investors does. Why would any one wanna invest in the copy of a failed network. I guess greed and FOMO tends to get the better of many.

I admit the returns are there on Tron for new, with it new Terre like model. But for how long before the Tron also implodes just like Terra did, wiping off Billions from the market. High APRS are certainly a mean to attract investors attention, but they certainly aren't sustainable. Models like Terra and Tron do make profits for the early investors but eventually they collapse like house of cards.

Personally, I would stay away from Tron and anything it offers. Firstly because we Hivians have a history with Justin Sun, and know what kind of person he is. I would have been more inclined to listen if Vitalik advocated rebranding of Terra, but believing in Sun; that is a big NO. Second, I have

experienced the whole Terra demise first hand, sitting hopelessly and watching my investments turning dust was not pleasant. And it would be a foolish to fall for the same kind of Ponzi scheme again. Yes, high APRS are enticing and like all humans I am not greed proof, but learning from past experiences, never repeating the same mistake again is what should be done.

Posted Using LeoFinance Beta

0

0

0.000

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Away from this S**t lol. I am even not using USDT atm. Converting most of my stable coins to USDC or BUSD to be on the safe side ;)

Yeah it is a shit coin like its founder.

Posted Using LeoFinance Beta

Certainly there are major issues. One benefit TRON does have more utility than LUNa, which isnt saying much. However, we are seeing a great deal of similar behavior which is not surprising since Sun is of the same ilk as Do Kwon.

There is little being done to build value. That is the problem.

Posted Using LeoFinance Beta

But I hate Sun regardless, don't know if that can change.

Posted Using LeoFinance Beta