The Great Recession of 2008

Hello guys!

I joined hive a while back and finally made my first post some days ago. I must say, it's been a fun ride, most especially the way I was treated in the comment section of my post. I felt much welcomed and those beautiful people gave me a lot of pep talk and advice. I just want to thank everyone for that 🤗.

Well, since I'm here on hive to stay, I decided to take another step in making my second post and what other community than leofinance. It's surely the first community any newbie will notice and since I have a little knowledge on economics, I decided to offload some of that in this post. The post is basically about one of the worst recessions the world has experienced and I'll try my best to make this as detailed and simple as possible. Hope you guys like it.

Designed by Me on Canva with two pictures from pastdaily.com and poverty.ucdavis.edu

A recession is just like a natural disaster which is felt in all parts of a country. The country is temporarily crippled economically and if not handled properly, it leads to bankruptcy in different sectors of the country. Businesses begin to close up since consumers are unable to afford as much as they used to before, prices of products and services are then inflated to manage costs. This leaves the average earning citizens which are more than half the population of the country in starvation and poverty. From all that explanation we can see how disastrous a recession can be.

The United States experienced such occurrence between 2007 - 2009 and you can imagine the condition citizens were put in. Also, being that the US dollar is the most important currency in the world, mostly used for international trades and sometimes used as a store of value in the reserves of countries, the globe was also affected by this recession.

What caused the Recession?

A series of wrong decisions and bad policies led to this decline, let’s get on with them.

Image source www.visualcapitalist.com

The American dream supports the fact that every citizen should be given an opportunity to have a home and from the image above, we can see that it’s impossible with a minimum wage of about $1100. This is why government backs the idea of mortgage loans given out to citizens.

Image source www.shine.cn

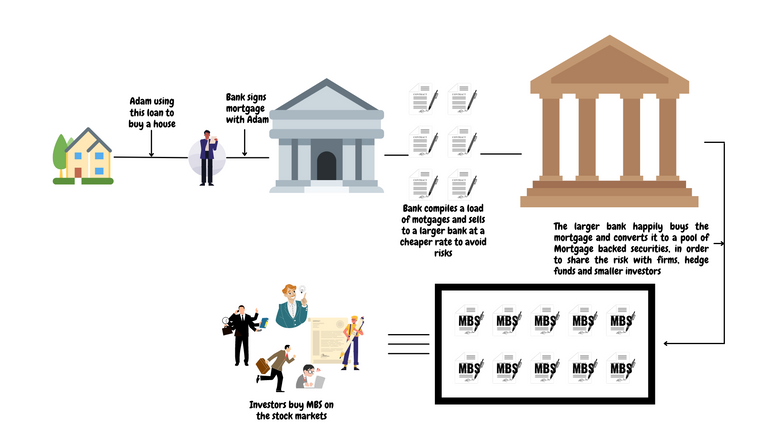

Individuals who took these loans are meant to pay a fee monthly for a number of years. This means that the banks will have to do a background check and ensure that with the borrower's earnings, he or she will be capable of paying off these loans in the long run. There were still misjudgments and some borrowers would default in their payments, this then makes the bank lose on the loan investment.

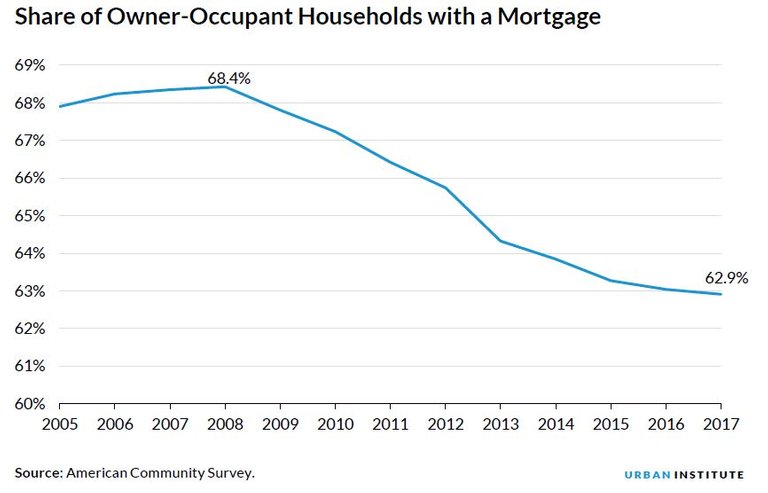

Image source urban.org

From the line chart above, more than 68% of home owners at the time had mortgages which means a large percentage of the US population was living in debt. Also, mortgage backed securities were introduced. These are shares which are backed by mortgage loans. The bank would sell off mortgages to larger financial institutions which would convert these mortgages to securities for investors to buy. Of course, a lot of firms and hedge funds would be interested in buying securities which are associated with real estate assets.

As home prices kept increasing, a reduction in interest rates was introduced to incentivize individuals to keep getting mortgages. Since it was cheaper to take loans, a lot of individuals saw it better to borrow in order to acquire a home for their family. Why wait a little longer for home prices to keep inflating when you could take up a cheap loan and buy yourself a house early🤷♂️. This caused an increase in the number of individuals who had mortgages. Some home owners who had bought earlier even refinanced their mortgage by taking loans at cheaper interest rates to pay up their mortgage with the hope that in the long run, the home assets would be worth more but this just put them in more debt.

No one was checking the status of individuals banks were giving these loans to anymore and they ended up giving mortgages to lots of people who were not capable of paying off in the long run. The banks didn't bare the risk because they sold these mortgages to larger institutions who converted them to securities.

Over time, since there was high demand for home assets, prices became extremely expensive and impossible for individuals to buy. The rate of mortgage defaults also increased making more houses to be put up for sale. This caused an increase in supply of home assets and a huge reduction in demand of these assets. Home prices began to plummet and lots of home owners who had mortgages began to default in the payments because the value of their houses were not worth the amount they were paying back.

This caused a major decline in the value mortgage backed securities which were at the heart of the stock markets. Fear set into the stock markets and due to risky leverage ratios, a lot of traders, hedge funds, firms, business lost more than 60% of their capital. This ran businesses into the ground, millions of citizens lost their jobs, production rates in the US dropped evidently and the economy of the country got crippled.

Traders watch as the stock markets crash: Image source federalreservehistory.org

Image source theatlantic.com

According to yahoo.finance, losses experienced in the recession was estimated to be around $12.8 trillion.

In my Closing Remarks

Aside the high rate of borrowing by home owners, firms who traded in the stock markets used high leverages to place their positions. They were reckless in their trades, borrowing a lot of money to trade without having enough capital to cover up unforeseen drops in the value of the assets they were trading. Doing the maths, for a hedge fund who used the 40x leverage (which means $40 borrowed for each $1 traded), a plunge as high as 4% could cause liquidation of all assets and land the hedge fund in bankruptcy. This also contributed to the Great Recession.

The government did their best to set regulations to curb the recession. Emergency funds were pumped into the financial sector to help ease the markets and rescue dying businesses. Things were difficult but by June 2009, the recession was over.

After these hurtful occurrence, people realized how untrustworthy the system can be and the first cryptocurrency was introduced. A decentralized, immutable and permissionless currency which can not be controlled by government manipulations and policies. All these led to the reason we have HIVE today🙂👏.

Thank you so much for reading and See you in the next one!

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

Congratulations @zekea! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 300 upvotes.

Your next target is to reach 50 comments.

Your next payout target is 50 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Support the HiveBuzz project. Vote for our proposal!