Monthly Crypto Portfolio Update (Dec 2019)

The performance over the last year highlights two important investing considerations across many markets. First, asset allocation is the fundamental factor when considering performance in any portfolio. Only two assets, Binance Coin and ChainLink, outperformed bitcoin in 2019. This is demonstrated as bitcoin dominance went from 51% to 68% this year. Second, timing the market continues to be a highly volatile strategy as buying some of these assets at the beginning of the year and selling at the highs would have been the best approach. However, many continued to buy believing that another large rise would come after bitcoin approach $13k earlier in the year. A lot of the returns continue to be concentrated in a small amount of days which signals that holding continues to pay off over time.

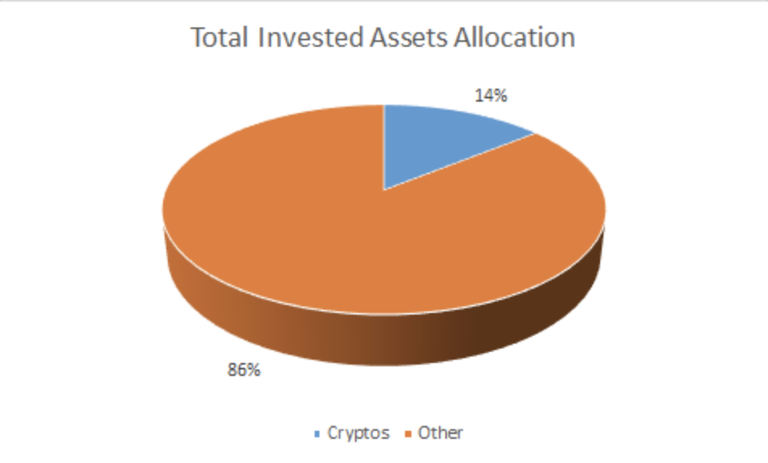

My portfolio underperformed both the market and bitcoin as one of my biggest bets during the bull market, tZero, has been disastrous. The token finally became available to all investors earlier this year but I believe that limited success in adoption of their ambitious platform and lack of liquidity has made it also lose over 90% of its value since the STO capital raise. I still like the concept and potential of the project but challenges remain ahead for it. This has impacted my ability to increase the amount of my assets held in crypto assets to my goals this year as the rest have preserved their capital.

Aside from Steem, which also performed poorly, my additions to the portfolio have also gone down. However, my positions that have been increased have at least held their rankings in the Top 100 cryptocurrencies available. This is encouraging as I still believe that a large capitulation moment is still needed before the market improves. Seeing over 3,000 assets available is ridiculous considering the still immature adoption and progress the technology has had so far. However, those that do survive will surely benefit and outperform longer term.

Bitcoin remains King of all cryptos despite it also limited development and innovation. However, growth in adoption and use ate supporting its continued lead over all others. That is why I have now held my position in bitcoin stable for three years now! Despite the urges to exchange for others, it has been the core to my portfolio. In fact, considering the weakness recently seen, I may consider adding to the position if the opportunity arises at attractive prices like early this year.

Another month of little activity for the portfolio except for the continuation of my DAI periodic purchase. It was fun learning more about the DeFi initiative and how DAI is leading it this month as their upgrade went through. I have yet to follow up on the progress of my savings deposited but it has continued to interest me to grow that position. It has also gotten me to consider to continue adding to my Ether position to participate in the Maker side as well; however, still need to learn more. Given the price of Ether, it could be a good risk/reward opportunity given the expected development of DeFi and the protocol in general.

Overall, no change in my strategy to continue adding to exposure to the asset class while trying to be opportunistic in adding to positions when prices appear attractive. However, nothing is guaranteed so never putting too much that could impact my financial position overall. My disposable capital has remained somewhat limited but there may be potential in the coming quarter to deploy more to the portfolio. In the meantime, I will keep informed of the opportunities and trends in the asset class to adjust the portfolio accordingly.

Discord: @newageinv#3174

Chat with me on Telegram: @NewAgeInv

Follow me on Twitter: @NAICrypto

The following are Affliate or Referral links to communities that I am a part of and use often. Signing up through them would reward me for my effort in attracting users to them:

If you are like me and interested in continued personal growth, invest in yourself and lets help each other out by leveraging the resources Minnowbooster provides by using my referral link

Start your collection of Splinterlands today at my referral link

Expand your blogging and engagement and earn in more cryptocurrencies with Publish0x! Sign up here!

The best new browser to protect your privacy while still being faster and safer. Try the Brave Browser today with my affiliate link here: https://brave.com/wdi876

Try the Partiko Mobile app to engage while on the go with my referral link

Get started on the latest game on the blockchain Drug Wars by signing up here!

If you select one of my above referral links, I will sponsor a @steembasicincome SBI in return. Let me know if you do so in the comments below!

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.

Hi @newageinv!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 4.650 which ranks you at #1770 across all Steem accounts.

Your rank has not changed in the last three days.

In our last Algorithmic Curation Round, consisting of 91 contributions, your post is ranked at #34.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Good Roundup of the crypto market and holdings.

Very informative and incisive.

Thanks as always.

Cheers

Posted using Partiko Android

Thanks! Good to remain accountable for my thoughts! Have to love blockchain!