Overcollateralization in DeFi - Is it good or bad?

Overcollateralization is a practice of placing an asset as collateral on a loan where the value of the asset exceeds the value of the loan. Still confused? To put it in simpler terms, overcollateralization means to loan an amount that is less than what one has. For instance, if I have a house that is valued at $1m by the market, overcollateralization means that I will use the house as a collateral and loan less than $1m. In the event when I have to default, the lender will be able to liquidate my house and get his/her money back.

The DeFi movement

Source

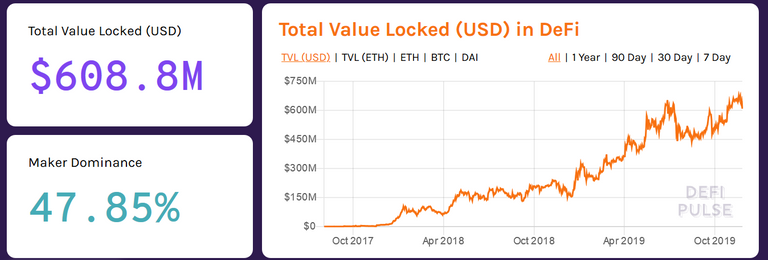

In the past year or so, DeFi or Decentralized Finance is taking the world by storm. According to DefiPulse, there is now over $600m value locked in DeFi right now. If you take a look at the chart below, the growth in DeFi is pretty much exponential.

DeFi is made possible with smart contracts and decentralized, open & permissionless blockchains. The most dominant DeFi platform today is MakerDAO and it governs the issuance of DAI, a stable coin backed by Ethereum. While you might have heard of DeFi, one thing you may not know is that practically all loans taken up in DeFi are overcollaterized.

Overcollaterization in MakerDAO

Note that MakerDAO is in the midst of transiting from single-collateral DAI to multi-collateral DAI during the writing of this post. With the transition, there will be some changes to terminologies. Hence, the explanation below may not be accurate depending when you are reading this post. However, the underlying concept remains the same.

Through DeFi, you can leverage your crypto holdings by using them as collateral to secure your loans. As mentioned, MakerDAO is the most dominant platform today in the realm of DeFi. The platform issues loan by having users take up collaterized debt positions or CDPs. At this point I also want to add that there are several other DeFi loan platforms that are on the rise. However, most if not all of them function similar to how MakerDAO works.

When a CDP is created, DAI is also minted. However, every CDP is overcollaterized with a ratio of 150%. This means that in order to mint $100 worth of DAI, you need to at least have $150 worth of collateral, in this case ETH. Here is an useful guide on how to create a CDP if you are keen. Another key concept about DeFi is that anyone can liquidate a loan if the collateral is insufficient and the liquidators will earn a fee in doing so. That is how this alternate financial system function in a decentralized yet efficient manner.

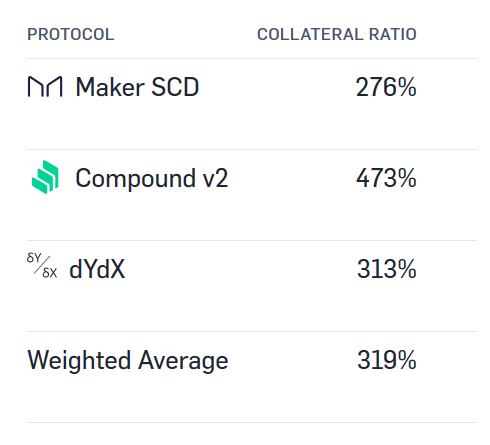

It is however interesting to note that even though the minimum collateralization ratio is 150%, most borrowers do not maintain their collateral at such low levels. Usually, people tend to put in more collateral so that in the event of sudden market down move (e.g. What has happened in the past few days. By the way, it is a brutal market again today...), they will not be liquidated. To put things into perspective, the current collaterization ratios on the 3 largest DeFi loan platforms are as follows.

Source

Overcollateralization - Good or bad?

Our current financial system is built on easy credit and that is why it may seem that having excess collateral for loans is a dumb thing to do. It is simply not an efficient use of money. For example, I could have used the same amount of money to fund a contract-for-difference (CFD) account and get over 10x leverage. Banks, as a result of the fractional reserve system, can lend out more than what they have in deposits. Many of us can take up unsecured personal loans/credit lines/credit card debts, without even a $1 of collateral. So why bother with overcollateralization?

On the surface, it may seem that leveraging more and creating more credit is a more efficient use of money. However, that is only true if the money generated falls into the right hands. These credit need to go to people/organizations that are using them to improve productivity. With the improved productivity, it brings increased income, which can therefore be used to service the interests on loans. However, we know that our current financial system is far from efficient. Now, with so much credit floating around in our financial system, I think overcollaterization might be a better approach.

While it is easy to understand why overcollateralization is necessary in DeFi due to the volatility of the collateral itself (again looking at what is happening in the crypto market in the past few days), there is another reason why overcollateralization might be a better system.

Here is something interesting about overcollaterization. Using MakerDAO as an example again, we need $150 worth of collateral in order to generate a $100 loan. Supposed the borrower wants to bet big that ETH is going to rise up even more and he recursively use what he loaned to buy more ETH. Using the fresh ETH as collateral, he then take up more loans. $100/$150 = 2/3, which is the ratio of the summation series.

When we sum this series to infinity, here is what we get,

In other words, the borrower will never be able to leverage beyond 3x his/her collateral. In fact, for any overcollateralized system, there will always be a cap to the amount of credit created. On the other hand, if the system operates under an under-collateralization mechanics, the possible leverage is infinite.

This is a powerful concept and it also underlines why and how our current financial system is flawed. At this stage of the credit cycle, I will personally opt for overcollateralization than under-collateralization. I hope that DeFi will bring about a better system for the world and as more and more people opt into this system, I think we will have a much stable system. However, I doubt the shift is in time for us to avert the next epic financial crisis.

10% of post rewards goes to @ph-fund and 5% goes to @leo.voter to support these amazing projects.

The "Raise to 50" Initiative

Under 50 SP and finding it hard to do much on this platform? I might just be able to raise your SP to 50. Check this post to find out more!

This article is created on the Steem blockchain. Check this series of posts to learn more about writing on an immutable and censorship-resistant content platform:

- What is Steem? - My Interpretation

- Steem Thoughts - Traditional Apps vs Steem Apps

- Steem Thoughts - A Fat or Thin Protocol?

- Steem Thoughts - There is Inequitable Value Between Users and Apps

- Make my votes count! Use Dustsweeper!

- What caused STEEM to get dumped? Why I think the worst might be over

- Steem 2020 is about having a "SMART U"

Hello, this topic of your post is not one that I handle a lot, but you have written it in a very fluid, understandable and interesting way.

Thanks for sharing.

You are welcome! And thanks for reading! 🙏

@culgin, Really Knowledgeable subject and i will sit with it, with peaceful state because it's so much important topic and Adding to knowledge books 📚 and it's indepth.

Keep up the productive work and good to see that your work is holding so much Economics and Financial Points to learn.

Have a wonderful time ahead and stay blessed.

Posted using Partiko Android

Thank you! Glad you enjoyed it

Dear @culgin

I only had a chance to read your publication right now. However I upvoted it already earlier on.

I must admit that it's my very first time I'm hearing about Overcollateralization .

Can "regular human beings" do that? Or is this "service" designed for large players only? I also wonder how popular is Overcollateralization in current days.

That sounds like a suicide :)

Cheers

piotr

"Regular human beings" can definitely do it now through DeFi.

Why is it suicide? It is safer for the lender and improves the creditworthiness of the borrower.