National Currencies | The Last Cast

As you may realize, national currencies are in a fight with both Covid-19 side effects on the economies and the fundamental problems that fiat currencies go through. It is not surprising for any politician or citizen to see that the national currency is not as safe as before. However, it is not just related to the outlook of their nation, it is about their pockets; their salaries.

Once a national currency starts losing power, people who are being paid by the currency start seeking better options to save their purchasing power because, after some time, the digits on the fiat currency lose their sense. As a person, I do not want to see any currency failing to stabilize itself due to any reason. Each fluctuation may result in severe damage in the lives of millions of people. As human beings, we are always deceived by the alluring sides of money and, in the end, it could find a way to upset us. Starting as a store of value, money becomes the center of our lives. So, any negative change in money (in our piled up/ stored value) means that your efforts were in vain.

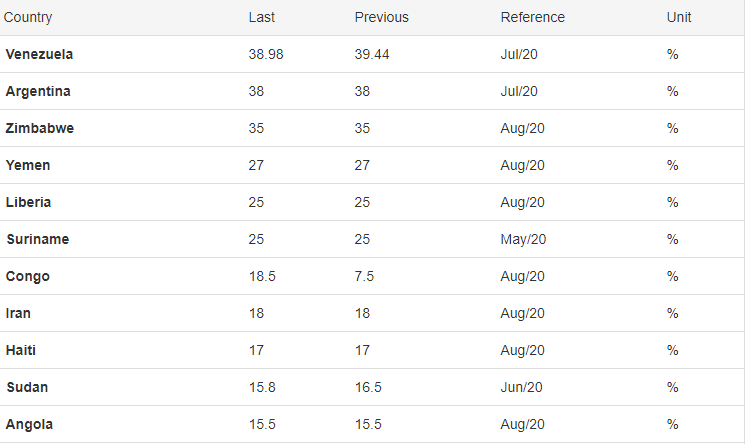

As it is easy to comprehend in this era, national currencies try hard to stay in the game. What do I mean by that? Let's examine the interest rates of national currencies as of September 2020.

Screenshots of interest rate charts are taken from Tradingeconomics

When you look at the interest rates, you may find them too much and it is easy to locate a problem in the economic model. Even though the reasons can be various, the message that is conveyed by the interest rates is that even though the inflation rate is rising or the value of the national currency is decreasing, the national currency is tried to be attractive for the new investors. If no one puts their money for the currency, then nothing goes fine. The rate can be adjusted to succeed in the goal even if it is away from being realistic considering the situation in the world economy.

The national currencies might be under sell pressure; effected by political risks; by an imbalance in the income-outcome model. No need to deal with one by one in detail, things are not perfect and possible solutions are being implemented.

Yet, what is certain when we look at the interest rate is that there may problem(s) but the required actions are taken by respective parties.

There is a list of countries with the lowest interest rate. I'm pretty sure the vast majority of people seeing the condition will not be able to suggest any reason or relate the situation in a negative interest rate.

Do these negative interest rates serve for attracting people to bring value to the national currency as in the ones with the highest interest rate?

Not actually...

According to Investopedia,

Negative interest rates occur when borrowers are credited interest rather than paying interest to lenders. While this is a very unusual scenario, it is most likely to occur during a deep economic recession when monetary policy and market forces have already pushed interest rates to their nominal zero bound.

A simpler explanation is that if you have these national currencies, do not leave your money in a bank account. With this policy, you are expected to spend money and help the economy revive. Well, as long as the national currencies are trusted by people (as a kind of stakeholders), then the recession can be handled. Otherwise, such monetary policy will not be successful in the long term.

Someone without adequate knowledge cannot assume the problem in these countries. Even though inflation is difficult to take over for developing countries, recession or stagflation gives more damage. I suggest you check the amount of money printed by these countries since 2000.

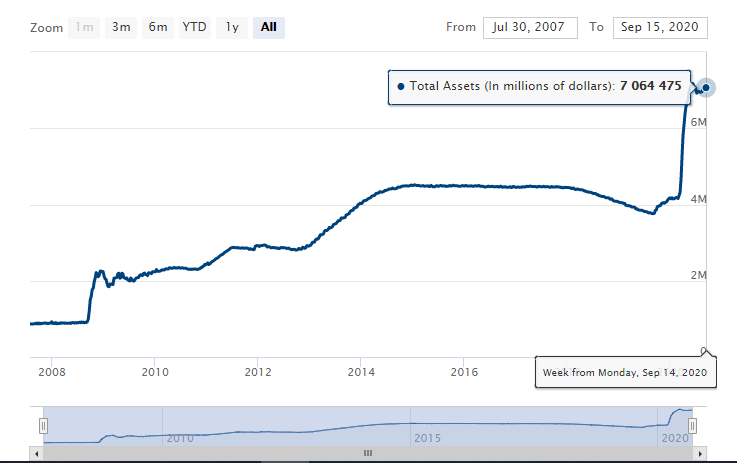

Now that we are talking about money printing, we must check the amount of dollar printed as it's the reserve currency all around the world.

Source Federal Reserve

Well, over the last two years, FED printed two times more money than before. Surprisingly though, in 2008, the quantitative easing was not even comparable with 2020. Since the problem is not local but global, national currencies similarly take action.

Millions of people invest in precious metals, digital currencies, or real estate to protect their purchasing power. The actions taken by the central banks are temporary solutions. The fundamental problem is that people no longer trust in paper money and they do not feel comfortable with it.

In my opinion, none of the cryptocurrencies are ready for being the major medium of exchange in exchange for paper money nor do other types of assets. The next COVID Wave will bring new issues for the global economy. When I consider, I cannot realize any solution which is one-fits-all kind. Maybe, successful local practices may bring about global tests once the paradigm shift starts popping up.

Even though all these interest rates, quantitative easing plans, and ways to deal with stagflation or inflation are to be able to control surviving concerns, they are not permanent solutions... It is hard to blame some parties for this unpleasant situation; its about the acknowledged system which blows up "The everything baloon"

As a person, are you comfortable by holding national currencies?

What's going to be the next step taken by the central banks as for you?

Please enlighten us with your precious thoughts 😌

Regards,

https://twitter.com/idiosyncratic1_/status/1309403714009079811

Your current Rank (61) in the battle Arena of Holybread has granted you an Upvote of 28%

@tipu curate

Upvoted 👌 (Mana: 18/27) Liquid rewards.

Yes, you must save in the precious metals and pay off your land and hope they don't tax you to death on your land. Living a simpler life is the way I'm going to do it.

Posted Using LeoFinance

Absolutely. Even if I do not buy and store them, I buy papers backed by gold as an investment

Congratulations @idiosyncratic1! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: