Tax Benefits with Crypto Drop?

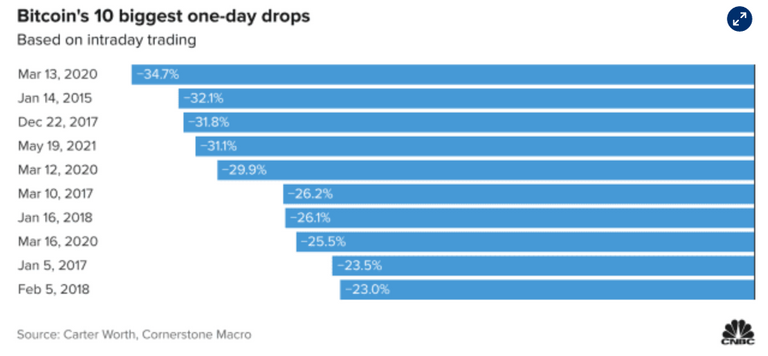

CNBC came out with a new article about that there are tax benefits for selling crypto holdings after this recent selloff. Investors who bought in at the highs or above current crypto prices if sold can have the following benefits in their taxes.

- Tax Loss Harvesting : Which basically allows investors who sell their crypto for a loss is allow to use the amount loss be put against the same year capital gain earnings. For instance if an investor lost $10k in crypto and closed his position while he has earned $10k in another form of investment such as housing property sale or security sale he can use the crypto loss to offset the sale gains making it essentially a wash.

- No Wash Sale : When it comes to trading securities such as stocks and bonds investors who sell their positions at a lost can not purchase the same asset/s up to thirty days or else the original loss from the first sale is consider a wash. That means the lose can not be counted toward the year's income tax capital gains. With cryptocurrency the US government does not consider the asset as a security instead as a property hence wash sale is not applicable. So although cryptocurrency is volatile the investor that sold today for a loss can buy again within the past 30 days the same crypto without incurring a wash sale.

Conclusions

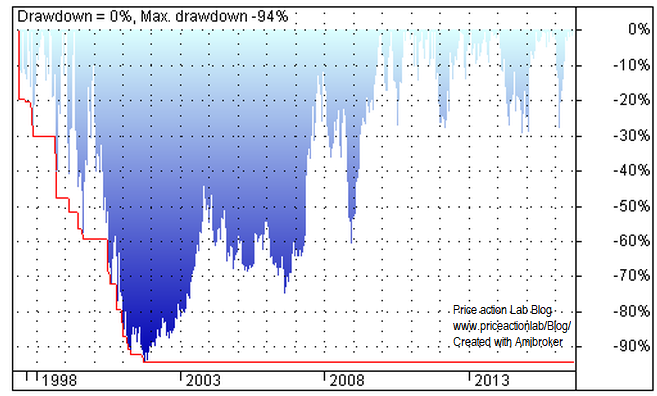

Although investors can have tax benefits from selling crypto at a loss I would like to mention that volatility will also be high. Coping with the price movement is apart of investing and it holds true with cryptocurrency. Actually it holds true for any investment that has potential for significant gains. Take for example equity share of Amazon.

Chart above is courtesy of www.priceactionlab.com. It shows the first six years of AMZN price share since IPO in 1998 to early 2014. Note the largest draw down since IPO price was as steep as 94%. Not even BTC can match that kind of a draw down.

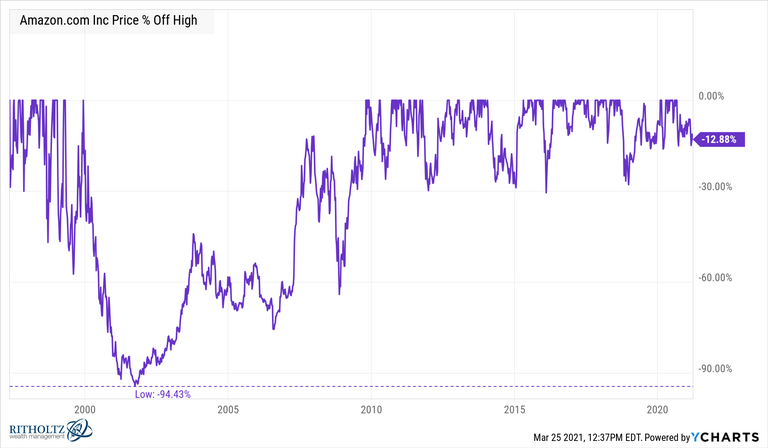

So where is AMZN now?

As of 2020 prices AMZN is a little under 13% from its all time highs. But if someone had bought the shares at IPO of $18 each in 1998 and held on to the shares they would have a staggering 10,800%. Over 1000 times their initial investments would be their current gains if they held on to their AMZN shares since IPO.

We can see the ending here but not many can see that they had to deal with multiple draw downs along the way in order to reach this type of returns. BTC is no exception as it is the first of a decentralized movement that still has much potential to unlock. The growth will come and price will follow. Holding on to your crypto investments for the long run will reap exponential rewards in the future.

Thanks for reading.

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

Congratulations @mawit07! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 100000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!

!LUV

Thanks !LUV and !PIZZA

@logicforce! I sent you a slice of $PIZZA on behalf of @mawit07.

Learn more about $PIZZA Token at hive.pizza

Hi @logicforce, you were just shared some LUV thanks to @mawit07. Holding at least 10 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares

Hi @mawit07, you were just shared some LUV thanks to @logicforce. Holding at least 10 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares

Yay! 🤗

Your content has been boosted with Ecency Points, by @mawit07.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more