The Total Value of Bitcoin 700 Billion !

Nearly three years ago, Mr. Warren Buffett - seen as an important customary financial specialist - portrayed Bitcoin as a "rodent poison".

From that point onwards, Bitcoin was up over 300%, and the absolute market estimate for Bitcoin outpaced the market estimate for "Berkshire Hathaway," which Buffett runs.

In 2018, Bitcoin withdrew from its past high of $ 19,000.

At the start of May 2018, Bitcoin's value had shrunk by more than 60%, bringing its cost to no less than $ 11,000.

A massive gathering of shamans and pessimists emerged about Bitcoin and its potential, and among them was a name that existed because it spared no moment to attack Bitcoin and told that the cryptocurrency market in general will have a sad ending.

Around that time, Class An shows were exchanged at Berkshire Hathaway, an organization Buffett runs, for roughly $ 300,000.

Class B shares were simply under $ 300.

As mentioned above, the cost of Bitcoin in May 2019 stabilized at around $ 9,000, and Bitcoin's drop agreed with Buffett's explanation that Bitcoin is a rodent poison.

What is Next ?

While these increases are worthwhile.

However, upon seeing what has been portrayed as "rodent poison", we find that the view has improved dramatically, with Bitcoin increasing more than fourfold and expanding 300% in value.

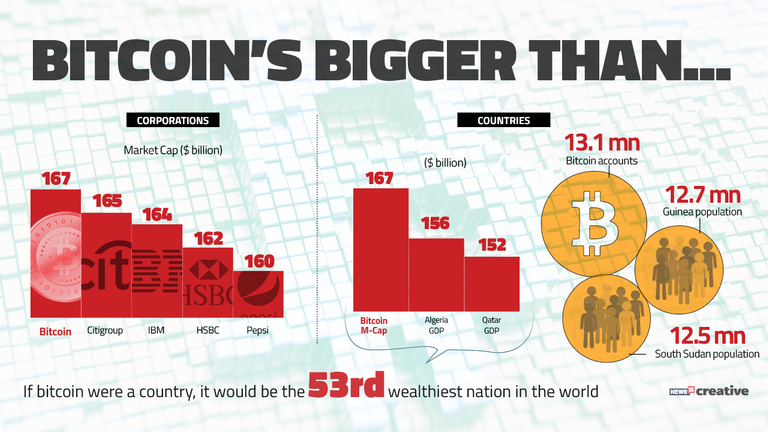

Despite being trapped, Bitcoin is being hit similarly with regard to the capitalization of the business sector in general.

Bitcoin has far outperformed Berkshire Hathaway's estimated value.

Buffett now ranks 12th with a current valuation of $ 500 billion, while Bitcoin has a market cap of $ 750 billion.

Buffett's assertions about Bitcoin indicate that the time is 100% wrong, and moreover demonstrates that Buffett is talented in traditional institutions rather than in the crypto market.

Image Credit

Thank You