Disclosing my trading Method: How much I dedicate to short-term trading?

Yes gentlemen, my trading strategy covers 3 trading variants.

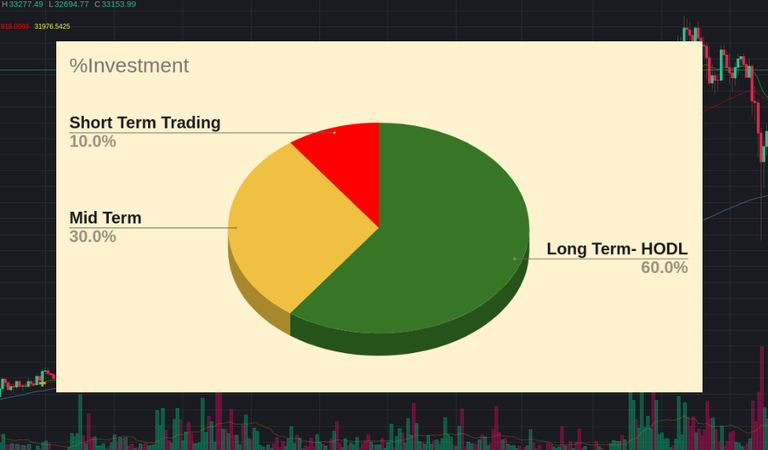

How do I distribute my investment between the 3 variants?

HODL or Long Term Investment: in this section I include those projects on which I base my investment purely on their FUNDAMENTALS and on their ability to act as RESERVE OF VALUE. At this point I have to say that I include HIVE as well since the benefits it brings me simply by staking it, however, I have to say that the vast majority of this stake is focused on the accumulation of BITCOIN, LITECOIN and ETHEREUM. At least 60% of my total investment is focused on accumulating these assets / tokens.

In my opinion, in the end, we are all traders since, at some point we will want to enjoy the benefits, either because BITCOIN becomes the new economic standard or because you have simply decided to make use of that benefit in FIAT money, or...Does anyone think of taking their wealth to the grave?Mid-Term Investment: in this section my investment focuses on projects whose fundamentals and their projections at the Technical Analysis level seem promising, for example, although it still has a lot to prove, CARDANO seems to me one of the best and promising Blockchain in the long run term, but there are others that cover very specific and innovative needs, for example RUNE (THORCHAIN) and that, in my opinion, have the potential to achieve great success not only at the economic level but also at the product level. Generally, the duration of the trade ranges from a few months to a few years. Around 30% of my investment is focused on this section.

Short Term Trading: as I have already said, I like to work daily with futures and although mainly my positions are usually limited to an average life of 2 or 3 days, it is not rare to get "scalping" operations with a duration of less than 5 minutes there are others whose development takes me more than 1 week. Only 10% of my total capital is used in this area and, when I say "it is used" I mean that I do not go ALL-IN with everything but that this 10% also includes my risk safety margin .

But this will be the subject of another article later on.

I only invest on "daytrading" 10% of my total Crypto Funds which is, in my opinion, more than enough and pretty safe in Risk terms.

What about you?

How much of your "funds" you used to invest on crypto day-trading?

More posts are coming!

*Disclaimer: This is just my personal point of view, please, do your own assessment and act consequently. Neither this post nor myself is responsible of any of your profit/losses obtained as a result of this information.

Posted Using LeoFinance Beta

I'd have thought you did way more on the short term considering your returns. This is quite the strategy, and here I was thinking you had a crazy risk appetite

If I would have a crazy risk appetite perhaps I would have invested more than that 10% on the Daily trading but it would be a mistake for sure.

I suck at day trading... I simply can't nail more good trades than bad ones. I've made good money with AVA and a few others a few weeks ago and now I'm stuck on a 3x long on XRP. I was 100% that it will bounce from around 30 cents level and I'm currently under water with around $400... Not using much of my funds for this type of fun of course, but haven't yet managed to become a good trader. Neither a hodler tbh. I was talking to my parents today and was telling them how good my finances would have been if I would have simply held onto ETH since a few years ago.

Posted Using LeoFinance Beta

I'm sorry to read this man. Hope you can get back that money.

No worries. It's a risky bet I took and take the entire credit for it. If it somehow plays good, and here I'm relying a lot on the XRP army and stupidity of new investors FOMO, OK... if not, screw it, another lesson learned.

Posted Using LeoFinance Beta