Monetary Debasement is here to stay

What started back in 2008 has still yet to be felt in the broader economy

Rewind the clock to 2008 where the early stages of the Great Recession were starting to play out.

Bail out after bail out and stimulus after stimulus eventually emerged from it.

We saw gold and silver prices go through the roof and money printing on a scale never seen before had started.

However, what happened from there was rather interesting.

The inflation that many had expected to cripple the economy and the country never actually happened.

At least not to the scale and degree the new money printing and suggested.

Why was that?

It was mostly due to the fact that the majority of that new money never actually made it's way out into the broader economy where the effects of it would be felt by ordinary citizens.

Much of that bailout money went to banks that sat on it and collected their risk free returns in a time where there was no yield anywhere else.

As we eventually climbed out of that deflationary period and started to actually see some semblance of growth again, we saw inflation start to creep in ever so slightly.

A double cheeseburger at McDonald's for example was around $.99 in 2008 and a decade later it was going for about $2.49.

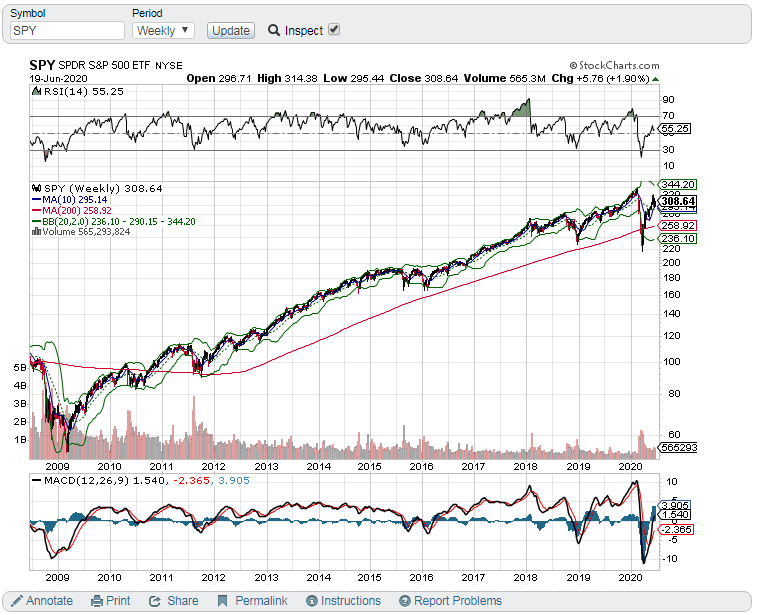

The stock market was the biggest benefactor though as it is now up multiples of where it was at the 2008/2009 lows.

If fact if you pull up a chart of SPY, it looks like that is up close to 6x from the lows to where it is today...

(Source: https://stockcharts.com/h-sc/ui)

When going by that metric it looks like there has been perhaps a little more inflation than most of the talking heads would have you believe...

Which brings me to where we are today...

Recently the US alone just created roughly $6 trillion (a conservative number) out of thin air.

Most estimates point to the US injecting about $2.8 trillion into the economy back in 2008/2009 in order to stimulate it.

So, we have already spent more than double what we did last time, when the stock went up by 6x over the following decade...

By the way, some context of just how big $6 trillion is...

A million seconds ago was 11 days, a billion seconds ago was 31 years, and a trillion seconds ago there was no written human history.

Let that sink in for a moment...

Watch what happens to assets price in dollars when we transition from a deflationary environment to an inflationary environment.

And it will happen, the powers that be are going to make sure of it.

Stay informed my friends.

-Doc

That's good for crypto

Si.

A few years ago, Mrs TWM and I attended a seminar for note investing. Many of the mortgage backed securities were being unpacked and the individual mortgage notes were being sold off. Even banks had been sitting on non performing assets for years to avoid flooding the market with cheap real estate. People were living in their homes for years after they should have been foreclosed. Some houses were empty for years.

This was an opportunity for everyone because buying a non-performing note allows the new owner to either foreclose or renegotiate. Renegotiating is preferable because the investors could get back their investment plus interest as the home owner paid off a modified loan.

An industry of loan servicers came out of this. They take the payments, hold tax escrow, and pay the taxes.

The point of all this is that Wall Street hangs on to these bad assets for years to avoid saturating the market. Even the Government holds on to tapes of mortgages and sells off tranches to hedge funds. The hedge funds unbundle the notes and sell them to wholesalers. Wholesalers sell off individual notes and offer due diligence services to investors looking for mortgage notes.

Of course, there are also mortgage notes that are being paid off like clockwork that can be purchased at a discount towards the end. That’s when the note holder has already realized the majority of amortized interest income. They need a lump sum for another investment.

If allowed to fail, there is tons of opportunity in scooping up the remains of a bad economy. But the government will not allow bad businesses to go on sale.

Posted Using LeoFinance

That is correct. Wasn't this country supposed to be founded on free markets and capitalism. It hasn't been operating like that since the FED was created...