Are All Stablecoins Made Equal?

Top 5 Stablecoin Research

It seems like in the span of just a couple years stablecoins are seemingly everywhere. I've never stopped to dig into each one and understand fundamentally how they differ.

The top 5 stablecoins in use are all 1B+ market cap coins.

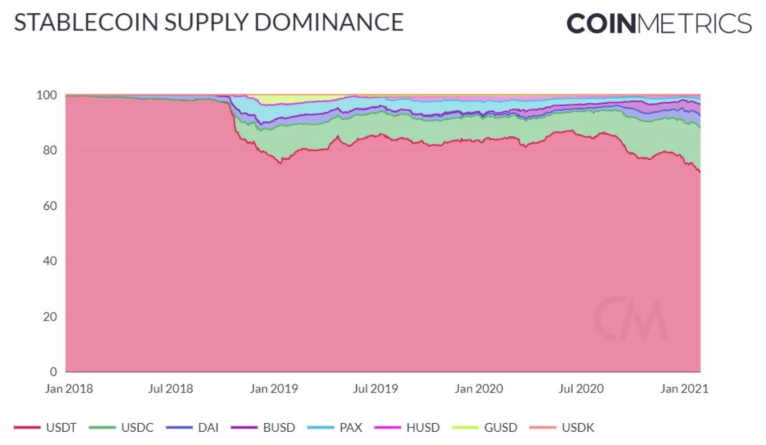

Looks like the explosion really kicked off in mid 2018 with a number of stablecoins taking a bite into Tether dominance.

USDC emerged quickly as a competitor along with PAX and GUSD, however over time the latter two coins have slipped in terms of maintaining market dominance.

What Is A Stablecoin?

Simply put, a stablecoin is an asset class that is backed by reserve assets in order to maintain price stability.

As a cryptocurrency it maintains the core advantages of security and speed of transaction, with much less exposure to volatility.

- Stablecoins are cryptocurrencies that attempt to peg their market value to some external reference.

- Stablecoins may be pegged to a currency like the U.S. dollar or to a commodity's price such as gold.

- Stablecoins achieve their price stability via collateralization (backing) or through algorithmic mechanisms of buying and selling the reference asset or its derivatives.

5 Stablecoins To Rule Them All

It's a bit crowded in this kingdom! But in this case choice is to our benefit, with many exchanges offering multiple stablecoins to choose from.

I use stablecoins for much of my trading, so I'll use whichever stablecoin has the best pair in terms of volume. For this reason I primarily trade within USDT (Tether) as there's tons f high volume pairs on Binance.

But what if I'm simply storing a portion of my portfolio in stablecoins, for the medium to long term to have cash on hand essentially. Is there reason to use one coin over the other, that's really what I want to know.

USDT

Tether was launched as RealCoin in July 2014 and was rebranded as Tether in November by Tether Ltd., the company that is responsible for maintaining the reserve amounts of fiat currency. It started trading in February 2015. -www.investopedia.com

- Every Tether token is always 100% backed by our reserves, which include traditional currency and cash equivalents and, from time to time, may include other assets and receivables from loans made by Tether to third parties, which may include affiliated entities (collectively, “reserves”).

- Recently settled a lawsuit with the NYAG. Tether admitted no wrong doing, but information unrelated to lawsuit revealed again that Tether is not backed 1 to 1 with US dollars.

![]()

USDC is issued by regulated financial institutions, backed by fully reserved assets, redeemable on a 1:1 basis for US dollars, and governed by Centre, a membership-based consortium that sets technical, policy and financial standards for stablecoins. -www.circle.com

- It was created in a joint venture by fintech company Circle, and crypto exchange Coinbase.

- Every month, the US dollar reserves for USDC are attested to by top 5 accounting services firm, Grant Thornton LLP. We publish those reports so that you can be confident that USDC is always 100% redeemable for dollars.

- Regulated, USDC’s parent company is a registered Money Service Business in the United States. That means it’s regulated by the government’s Financial Crimes Enforcement Network (FinCEN), which combats money laundering.

- Originally an ERC-20 token, it has since expanded to the Algorand and Solana blockchains.

BUSD is a U.S.-regulated stablecoin, fully backed by U.S. dollars: 1 BUSD = $1.00 USD. BUSD offers faster ways to fund your trades and is acceptable as a medium of exchange, store of value, and method of payment across the global crypto ecosystem. -www.binance.us

- BUSD is a stablecoin developed by Paxos in partnership with Binance. Paxos are also issuer of other stablecoins Paxos Standard (PAX), HUSD and PAX Gold (PAXG).

- BUSD are approved and regulated by the New York State Department of Financial Services and is 100% backed by U.S. dollars held in FDIC-insured U.S. banks.

- uditing firm (Withum) audits BUSD monthly to check if the money held in banks matches the BUSD supply

The world’s first unbiased currency. Dai is a stable, decentralized currency that does not discriminate. Any individual or business can realize the advantages of digital money. -www.makerdao.com

- A price-stable currency that you control. Generate Dai on your terms, instantly.

- Lock your Dai with the other 6.94M earning the Dai Savings Rate set by the Maker community.

- A community of MKR token holders govern the Maker Protocol, the smart contracts that power Dai.

- Over 400 apps and services have integrated Dai, including wallets, DeFi platforms, games and more.

Use Paxos to Build your Stablecoin. As the creators of the industry’s first and most liquid regulated stablecoin, Paxos Standard (PAX), Paxos has unique expertise in the market. Our white-labeled Stablecoin as a Service offering lets partners leverage that expertise to create their own stablecoins quickly and securely. -www.paxos.com

- Paxos serves as the qualified custodian for your stablecoin, ensuring fiat assets are held 1:1 in dedicated omnibus cash accounts at FDIC-insured U.S. banks or in Treasury Bills. These balances are audited every month to validate 1:1 backing.

- Paxos works with New York banking regulators to get formal approval for the issuance and usage of your custom branded stablecoin. Our Trust status and additional licenses enable us to serve customers in all U.S. states and globally.

- We’ve done the heavy lifting so you don’t have to. Our stablecoin platform is API-enabled to make your technical integration simple. With an extensive library of endpoints, it’s easy to select the best options for your customer experience.

Conclusions

From what I can gather the most important elements of modern stablecoin is regulatory approval, regular transparent audits, and 1:1 backing with US dollars.

The more I look into stablecoins, the more I realize they're not all equal. Tether seems sketch, so for that reason I'll limit it's use to short term trading on exchanges.

For me the choice is pretty clear, USDC and DAI take the cake!

USDC is issued by company registered as a Money Service Business in the United States, it's regulated and is subject to regular audits.

DAI is a decentralized and I had no idea it's governed by the Maker Protocol. It's open source, and uses smart contracts on the Ethereum blockchain. Powerful!

I'll put BUSD as a close third but with ties to CZ and Binance, I'll remain somewhat skeptical about it's place in the stablecoin world. However they did go through PAX so it should be regulated for US finance, and reserves audited.

I Would Be Open To Being Paid In Stablecoins

As the use cases for US Dollar-backed stablecoins continues to rise, I have to say I would be open to being paid directly from a company in USDC or DAI. As long as their backing assets are subject to regular audits with a considerable amount of transparency I'm on board..

Ciao for now,

Posted Using LeoFinance Beta

Nice review of the stable coins. I do prefer USDC most, but unfortunately have to use tether still when USDC isn't available.

Posted Using LeoFinance Beta

Weee, I learned something new today! I'm with ya, I'm going to use USDC for any longer term storage of funds going forward.

Posted Using LeoFinance Beta

I'm the same - stake USDC on Defi platforms hold USDT on the exchanges for trading I think is what it comes down to.

And try to avoid USDT pool pairs to limit your exposure to it.

Posted Using LeoFinance Beta

I only use usdt for trading and holding on exchanges. I also staked BUSD to farm some shitcoins.

.

There's work being done on HBD and it has largely stayed within the dollar range, although it's supply isn't in the billion mc category like the others. I think it could have a big future, seeing as it is decentralized

Posted Using LeoFinance Beta

Ah very cool, that would be a pleasant surprise! I would say fix it or abandon it and swap it out for a USDC integration.. would be great to get that peg working after all these years.

Posted Using LeoFinance Beta

@agr8buzz, good review. I started with DAI sometime ago but have since moved on to USDC. For the DEFI market to work properly, a stable "stable coin" is crucial. DAI has had a few ups and downs, so USDC seems to be the best for me. Fortunately it is gaining popularity.

Posted Using LeoFinance Beta

Cheers, appreciate the support! That makes complete sense to me, the stablecoin has to function correctly, no if an or buts about it. Otherwise confidence in the DeFi platform would erode. I don't see any reason why USDC should not challenge for top spot other than the sheer number of trading pairs on Binance. At least you and I both know USDC and DAI is where it's at..

Posted Using LeoFinance Beta

Interesting article!

Posted Using LeoFinance Beta

Cheers, I just wanted to know a bit more about the main stablecoins.

Posted Using LeoFinance Beta

This article is fairly well done. However, i think the idea that a stable coin should be backed by a fiat currency is a ridiculous idea. Stability doesn't need only come from the usd. This is why the coin we created the BBD coin is i believe far superior to these stablecoins. We'll let you sample one.. BBD's are backed by human beings.

It's not backed by gold or fiat currencies because human beings are more valuable than gold rocks or government excess spending and taxation on individuals to force value into their currencies. BBD's maintain stability on an entire different principle that works so far. I'd advise you take a look at them.

Posted Using LeoFinance Beta

what's a BBD?

Posted Using LeoFinance Beta

It's basically a stable coin that's not backed by a currency of force or manipulation. They are issued based on every new account created as there is a value to each account. So there are some similarities to hive and hbd's. So if you believe every social media account has some value everytime one is created a bbd is issued.

As the network value grows the value goes back into the bbds in a controlled gradual inflation. The inflation rate is so subtle merchants. vendors global remittance and the fundamental use of the currency generally doesn't notice the instability. As it''s gradual it creates the ultimate stable coin. A coin relatively stable that goes up but not down. The ability to redeem bbd's into the native btcmyk token or the token of the platform that has the function and utility of paying for promotions and burning against transactions creating a store of value coin that gets more rare. BBD's always receive the usd pegged value of the coin at redemption which allows it to remain relatively stable at all times. I believe it's the perfect stable coin.

Posted Using LeoFinance Beta

Humans are real disappointment in my experience. But I wish you and the BBD stablecoin all the best!

Posted Using LeoFinance Beta

I found myself holding onto a lot of GUSD for accumulating interest on BlockFi. I believe GUSD has the same model as USDC, so I'm fairly comfortable with holding it.

Tether definitely makes me nervous... both in the way that it doesn't appear to be backed at all, and how nonchalant so many people seem to be about that. I try to avoid it whenever I can, but who knows how much it'll matter if I avoid it if the community as a whole loses faith in USDT. It seems to me (as someone very new to crypto) that it would be fairly disastrous for cryptocurrency as a whole if that were to happen.

Posted Using LeoFinance Beta

I think you're right in that a major disaster with Tether would rock the industry hard.

HUSD, is that the stablecoin from Gemini?

Posted Using LeoFinance Beta

Yeah, GUSD is.

Posted Using LeoFinance Beta

I want to add a few points:

USDC is now also on stellar blockchain, that is supposed to be used for government issued stable coins. So it is another + 1 point for USDC.

The second is money printing. USDT printer worked really fast in 2021. There were at least 2 days when more than 1 billion USDT were printed. The curious thing is that after the hearings in NY, the amount of USDT printed per day greatly reduced. At the time, Binance started their money printer.

Posted Using LeoFinance Beta

USDC for the win, Interesting for sure. I've definitely noticed some tweets this year about Tether printing large quantities..

Posted Using LeoFinance Beta

I agree 100% - USDC and DAI and then the Binance coin - TBH the fact that it's regulated makes me a bit happier about holding some.

I don't really get PAX!

I'm looking at HBD now and wondering whether I might start storing a bit more of that as a stable. It's a useful time to have some liquid HIVE/ LEO too.

Posted Using LeoFinance Beta

Haha I felt the same way about PAX after I wrote this post, but I think I got it figured out. So it's a collateralized stabecoin, ERC20, regulated, audited and legit. But Paxos also has a white-label service, so you and I could make our own stablecoin using the PAX protocol.

Posted Using LeoFinance Beta

I don't think I need that in my bag!

Posted Using LeoFinance Beta

yeah, I'll pass on PAX

Posted Using LeoFinance Beta

Image Source: giphy.com

Great to have all of this information in one place! Thank you for sharing your research with all of us. I really enjoy posts like this one that help folks navigate the complicated world of cryptocurrency finance!

Posted Using LeoFinance Beta

Cheers, yup just trying to learn and we go, keep building that foundation of knowledge.

Posted Using LeoFinance Beta

Very interesting. The USDT case shocked me a lot. I read that Bitfinex used non backed USDT to inflate BTC price, buying millions of USDT in BTC. They even admitted not to have 1:1 backup for USDT. CRazy!!

Posted Using LeoFinance Beta

Agreed! while they got off not admitting wrong doing, there was definitely some others issues uncovered. Really looks like a coverup happened plus they haven't been entirely truthful about their collateralization.

Posted Using LeoFinance Beta

We all kind of knew this was the case..... didn't we.

DAI and any decentralized solution is the best IMHO. If our stable coins need a bunch of bankers and governments, that's not really in line with what crypto are about.

PS: I love this type of analysis posts :)

Posted Using LeoFinance Beta

Glad you dig the post and excellent point!

I'm with you 100%, decentralization all the way with DeFi.

It removes trust from centralized banking cartels that have frankly been exploiting people for as long as they've existed.

Auditable, decentralized smart contracts is where it's at. I guess that's the beauty about crypto-collateralized stablecoins, they can be completely decentralized end to end.

Posted Using LeoFinance Beta

Don't' forget these legacy systems are super slow and expensive too. You could transfer a million bucks in 3 seconds with no fees on Hive or Steem. On EOS it's only 0.5 seconds. I was blown away when my bank took multiple days to transfer funds from one account in the same bank to my own account.

shocking huh! Whenever I see legacy systems perform like this I cant help but think "You're days are numbered!"

Posted Using LeoFinance Beta

Great article. Very insightful. I have to admit that I read it from the "I like DAI anyway" side, but very interesting.

What I would like to see, and I don't know how such a thing could be done, is a coin that is stable but resilient against inflation. I don't know to what number you could tie a coin to be like that, an averaged market cap?

Posted Using LeoFinance Beta

I'm not sure that Fiat collateralized coins would work, but the other option is the algorithmic stablecoin. I think in a way HIVE stablecoin acts like this in terms of being produced as a mechanism to control inflation but I could be way off...

Posted Using LeoFinance Beta

Yes, Fiat collaterized coins are doomed. For the others there are two ways to escape inflation, tie the coin to something that holds value but moves slow (this is why I mentioned an averaged market cap as an option) or to give the proportional coins to the holders. I don't remember but there was one coin that did that with the coins that were staked. And of course there could be other ways too.

Posted Using LeoFinance Beta