Bitcoin Analysis for 01/04/2021

Bitcoin's price continues to advance. In the past 24 hours, it has stalled, while it consolidates above $58,000. BTC/USD has risen significantly during the past seven days, around 7%, and is now attempting to break a critical resistance level of $59,500 At the time of this writing, bitcoin's price is trading close to $58,800, according to CoinGecko.

While we expect bitcoin's price to move above this critical price range during the course of the day, it may as well remain below $62,000 for a few more days, while it gains enough momentum to move above its prior all-time high.

Additionally, buying volume is slowly increasing, a sign that a recent influx of new buyers is joining the bitcoin space. Not only that but as we discussed yesterday, whales continue to accumulate large sums of bitcoin each time the cryptocurrency dips.

Coming back to the chart above, bitcoin traded ideally within the predicted price range (blue).

Also, as we wrote earlier in the week, while bitcoin's price holds above the 21-day Modified Moving Average (MMA) near $52,000 (red) and the 21-day Simple Moving Average (light blue) around $55,000, we remain extremely bullish in the short-term price action.

In terms of news, most outlets remain bullish on the short-term bitcoin's price, and they attribute the latest rally to Visa and PayPal announcements.

To conclude, we believe bitcoin's price will soon reach a fresh, all-time high, and we remain bullish on BTC/USD as long as:

- BTC/USD remains above its 20-day Modified Moving Average (red), 50-day MMA (green),

and 200-day MMA (blue). - BTC/USD doesn't drop below $57,000.

- BTC/USD daily volume goes above its 21-day MMA soon.

Traders Thoughts

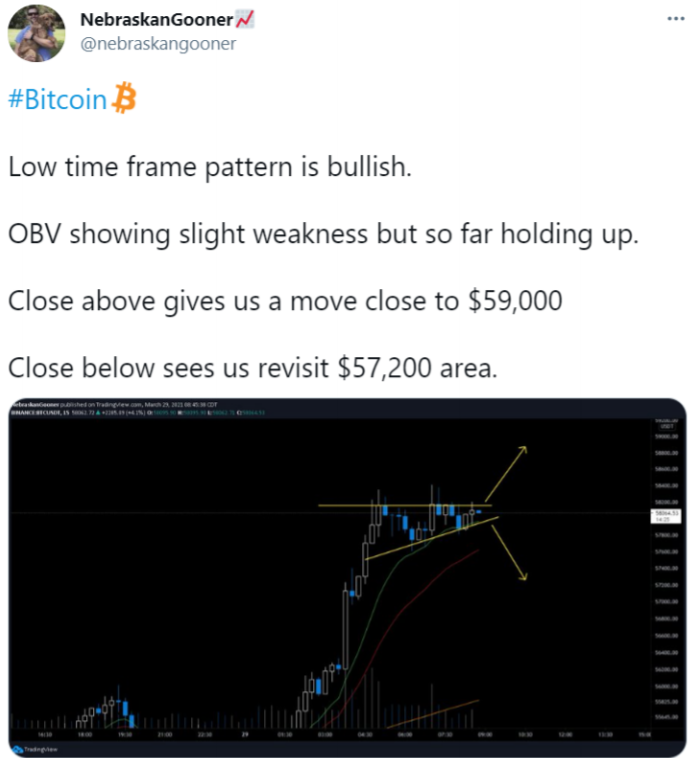

Today’s first tweet comes from NebraskanGooner, whose Twitter profile describes him as the founder at LVL and a co-owner of Elevate Trading.

In his post, NebraskanGooner shared a 15-minute chart of bitcoin’s price and wrote that

“Low time frame pattern is bullish. Close above gives us a move close to $59,000. A close below sees us revisit the $57,200 area.”

Since the tweet was posted, bitcoin’s price closed above $57,800, which means the bullish formation is holding. That points out to a continuation of the ongoing rally, perhaps towards a brand new all-time high.

At the moment of this writing, bitcoin is struggling to hold the $58,000, which means more buyers need to enter the space before bitcoin’s price attempts to break $60,000.

The following post comes from yTedd, described in his Twitter profile as a blockchain news and analysis provider.

In the Twitter post, yTedd shared a daily chart of bitcoin's price. He also added two trend lines showing resistance (black) and two trend lines showing support (red).

Currently, bitcoin's price has found strong support above $57,500, a critical level identified by yTedd.

Adding to that, if bitcoin's price keeps the same trajectory as in past rallies, we expect it to break $62,000 soon and move towards $70,000. To conclude, we couldn't agree more with yTedd's comment that "still can't believe this is real life."

Bitcoin's price is poised to make another massive run, and we're thankful to be part of it.

The following tweet comes from Pentoshi, a cryptocurrency investor and trader.

Pentoshi shared a one-hour chart of bitcoin's price and added three trend lines: the top two lines (pink) showing support and a downwards facing line (green) showing past resistance.

According to Pentoshi, bitcoin's price is "Flipping and confirming resistances as supports on the way up rapidly now", which means BTC/USD should continue to move into higher price ranges.

To conclude, as long as bitcoin does not fall below $57,000, there is little chance the short-term trend will reverse, meaning we think bitcoin will soon break its prior record price.

The last post of the day comes from Willy Woo, a well-known crypto analyst with over 368,000 followers on Twitter.

In its post, Woo shares the "BTC - Futures Long Liquidations (Total) - All Exchanges" that, according to Glassnode represents

"The sum liquidated volume (USD Value) from long positions in futures contracts."

The analyst also added an arrow pointing upwards that indicates that while bitcoin's price has been on the rise, there haven't been many long positions liquidated, unlike previous rallies.

Thus, Woo wrote a sobering comment that

"It's unlike BTC to have a run like this without the sound of liquidations... speculators don't usually money in longs with smooth sailing without being a little bit rekted."

Hence, we think Woo believes there will still be minor retracements while bitcoin's price moves up to higher price ranges. Therefore, we advise care when entering leveraged positions; otherwise, you might be caught off-guard and be liquidated in a sudden downswing.

Price Prediction

At the time of this writing, bitcoin is trading close to $59,000 according to CoinGecko. In the past seven days, BTC/USD has been on an uptrend, growing north of 7%, and we think it may as well continue during April. Hence, a brand-new record price should materialize soon, perhaps by Friday.

As we wrote in the introduction, we remain incredibly bullish on bitcoin's short-term price if the cryptocurrency holds above $57,500, a critical resistance level now turned into support.

Adding to that, most analysts are pretty bullish on bitcoin, along with the entire cryptocurrency market, and they expect bitcoin's price to appreciate sometime during the next few weeks.

Therefore, how do we think the price will trade today? As shown in the above chart, we believe that bitcoin could top close to $62,000 in the next few days, as long as buyers return to the bitcoin space.

On the other hand, we don't expect the cryptocurrency to drop much below $57,500, above the 21-day Simple Moving Average. If it fails to hold this level, then we think a drop toward $55,000 could play out; however, this is highly unlikely.

To finalize, the VPVR shows a high number of buy orders between $46,500 and $50,000.

It also indicates that there are almost no sellers left above $62,000.

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1377377295518736384