Bitcoin Analysis for 14/04/2021

Bitcoin's price broke through to a fresh, all-time high and is currently trading close to $62,900, according to CoinGecko. Congratulations to all investors and traders who managed to buy the dip or execute successfully leveraged orders during these past few days.

After surpassing its prior record price, around $62,000 BTC/USD has entered full discovery mode.

Additionally, volatility remains substantially low, which indicates further room for bitcoin's price to grow.

Not only that, but buying volume has picked up the pace and is already above its 21-day Simple Moving Average (SMA), an astonishing feat.

We now think the next resistance level could be close to $68,000. We came up with this value by using the Fibonacci Retracement indicator. According to Investopedia, Fibonacci retracement levels

"indicate where support and resistance are likely to occur."

Bitcoin's price is also trading much higher than the 21-day Simple Moving Average (light blue), which shows buyers control the short-term price.

The Volume Profile Visible Range (VPVR) on the left of the chart shows BTC/USD has now

entered new territory and is subject to price discovery.

To conclude, we remain bullish on the short-term price action as long as:

- BTC/USD remains above its 21-day SMA.

- BTC/USD doesn't move below $62,000.

- Buying volume remains above its 21-day SMA.

Traders Thoughts

Today's first Tweet comes from Vijay Boyapati, a software engineer, analyst, and author of "The Bullish Case for Bitcoin."

In his post, he celebrated bitcoin's achievement in breaking its prior all-time high and indicated he's pretty excited about the price in the near-term. The analyst wrote that

"Now that #Bitcoin has a new all-time high under its belt, it's finally time to roll."

Essentially, he thinks that BTC/USD could continue to move higher, just as we have discussed in previous Daily Roundups.

In our opinion, the next critical resistance level will appear somewhere between $68,000 and $72,000. However, until bitcoin reaches price levels like that, we think the rally will continue.

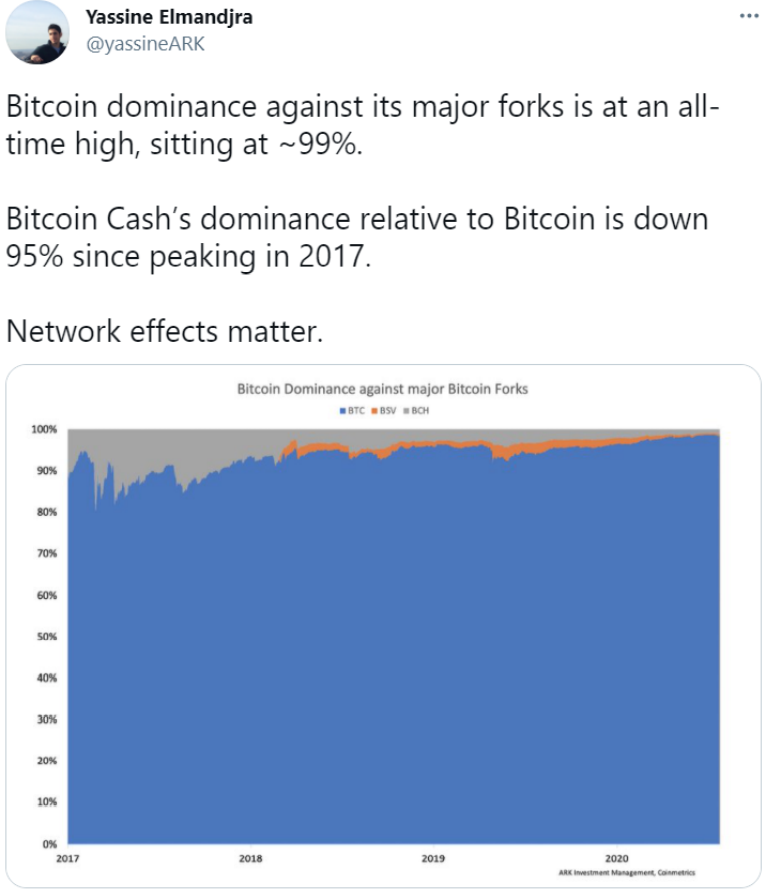

The following post comes from Yassine Elmandjra, an analyst at ARK Invest.

Elmandjra shared the “Bitcoin Dominance against major Bitcoin Forks,” which shows bitcoin’s market capitalization relative to the market value of major bitcoin hard forks, like Bitcoin Cash and Bitcoin SV.

As the analyst wrote,

“Bitcoin dominance against its major forks is at an all-time high, sitting at ~99%.” “Network effects matter.”

The reason why we’ve picked this chart is to show all investors and traders that investing in digital currencies that compete directly with bitcoin may not be such a great idea, nor a sound investment strategy. This is primarily due to bitcoin’s robust and growing network effects.

The following tweet comes from Nischal (WazirX), the founder and CEO of WazirX, a

cryptocurrency exchange located in India.

Nischal shared a brilliant study from Crypto For Innovation that concluded that “Less than 1% of illicit activity uses Bitcoin today,” and it’s “Easier for law enforcement to track illicit activities with #Bitcoin than it is for cross border fiat!”

This is great news, since it shows that the overwhelming majority of illegal activity is not transacted in bitcoin. If criminals do use bitcoin, it is easier for law enforcement to track than fiat currency.

If more papers and studies confirm the above findings, there could be an incentive for more institutions to adopt bitcoin due to its transparent nature leading to increased accountability.

The last post of the day comes from Mike McGlone, a senior commodity strategist with

Bloomberg Intelligence.

In this post, McGlone shared bitcoin's price chart and added the10-day Simple Moving Average (pink) and the Volatility (white) indicators.

He wrote that

"the lowest 30-day volatility since October indicates Bitcoin is ripe to exit its cage and bull-market continuation is favored for the next $10,000 move. Similar to Tesla's equity-wealth allocation to Bitcoin."

Essentially, he highlights what we've recently pointed out: as volatility gets lower, the closer we are to the next rally. Additionally, McGlone identifies Tesla's $1.5 billion bitcoin purchase as a catalyst for the recent FOMO (Fear of Missing Out) and subsequent price appreciation.

Price Prediction

At the time of this writing, bitcoin is trading close to $63,000, according to CoinGecko. Since yesterday, BTC/USD has spiked over 5%.

As we wrote in the introduction, bitcoin's price just broke a new all-time high, and we remain highly bullish on the short-term price action while buyers stay in control, and as long as bitcoin does not start flowing from private addresses into exchange wallets.

Adding to the above, a significant number of analysts are highly bullish on bitcoin's price action as well and think there is a chance bitcoin moves toward $68,000.

How do we think the price will trade today? As shown in the above chart, we believe that bitcoin could approach $66,000 in the next few days, as long as buyers return to the bitcoin space. There's a chance the digital currency breaks this level by the end of the week, but buying volume would need to continue to grow for this to happen.

On the other hand, we don't expect the cryptocurrency to drop much below $60,000. If it fails to hold this level, we think a drop toward $58,000 near the 21-day Modified Moving Average (MMA) could occur. However, we should note that this is now extremely unlikely.

To finalize, the VPVR shows support starts just above $60,000 and that BTC/USD is currently in price discovery mode with just a few orders above $62,000.

Hence, once BTC/USD breaks away from this price range, it should reach $68,000 in no time.

Posted Using LeoFinance Beta