Bitcoin Analysis for 29/03/2021

Bitcoin's price had a significant reversal during the weekend and is now trending back towards $60,000. At the time of this writing, bitcoin's price is trading close to $56,100 after gaining over 10% since Friday, according to CoinGecko.

Due to a significant number of buyers entering the bitcoin space, we think a swing toward higher price ranges is a strong possibility. We're now anticipating a move toward $62,000 since BTC/USD could hold the 21-day Modified Moving Average (MMA) near $55,000. Adding to that, bitcoin's price touched the predicted top and is now trading above it.

If bitcoin finds support above $56,000 throughout the rest of the day, we think a new record price is not out of the question during the week. Another indicator that points in the same direction is the 21-day Simple Moving Average (light-blue). As you can see in the chart above, bitcoin's price is holding well above this critical line.

To conclude, all this happened while some media outlets are discussing the possibility of a bitcoin ban. Hence, not even bearish news is bringing down bitcoin's price, an excellent sign and one that points to a continuation of this weekend's sudden BTC/USD appreciation.

Therefore, we remain bullish on BTC/USD as long as:

- BTC/USD remains above its 20-day MMA (red), 50-day MMA (green), and 200-day MMA (blue).

- BTC/USD doesn't drop below $55,000.

- BTC/USD daily volume goes above its 21-day Modified Moving Average soon.

Traders Thoughts

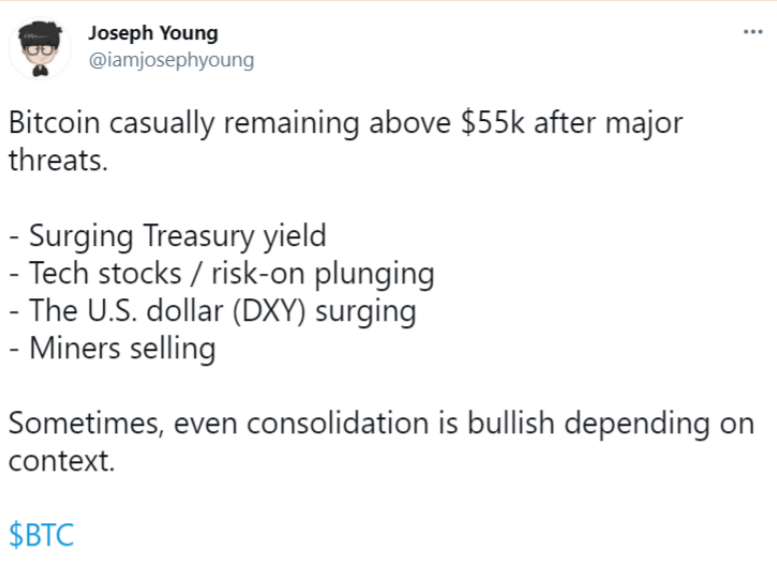

Today’s first tweet comes from Joseph Young, whose Twitter profile describes him as an analyst and investor with more than 131,000 Twitter followers.

In his post, Young wrote that bitcoin

“casually remaining above $55k after major threats.”

The trader identified a few major bearish indicators that could point to a significant price correction such as:

“Surging Treasury yield”, “Tech stocks / risk-on plunging”, “The U.S. dollar (DXY) surging”, and “Miners selling”

Essentially, Young means that even though there was a significant 10% correction in bitcoin’s price during the past week, if we take a macro perspective, the correction wasn’t that bad.

Additionally, bitcoin’s price has already significantly recovered during this past weekend - which points to a continuation of the bull-run.

The following post comes from Seer, a technical analyst and trader.

Seer shared the “BTC Price and All Exchange Stablecoin Ratio” charts and wrote that

“The All Exchange Stablecoin Ratio has reached lows not seen since November. Each time this ratio has gone so low is marked by periods of significant strength for $BTC.”

CryptoQuant’s data not only points to a continuous reduction of both bitcoin sitting at exchanges, as we discussed last week but also to a severe shortage of stablecoins at exchanges.

If fewer stablecoins are available at exchanges, this could point to a rapid price rise if demand for bitcoin or altcoins increases. According to Investopedia:

“the higher the price, the higher the quantity supplied.”

but because bitcoin has a limited supply, its price should increase. Adding to that, we think bitcoin behaves like a Veblen Good; that according to Investopedia,

“ A Veblen good is a good for which demand increases as the price increases, because of its exclusive nature.”

Hence, a reduction in both stablecoins and bitcoin available at exchanges is an excellent sign for BTC/USD.

The following tweet comes from Michael van de Poppe, whose Twitter handle describes him as a full-time trader at the Amsterdam Stock Exchange.

In his post, Poppe shared a chart of bitcoin’s price and added a few indicators. At the top, the trader shared the RSI pointing to a “potential bearish divergence”; however, Poppe thinks it is “not valid” due to the most recent upwards price action. According to Investopedia, “Bearish divergences signify potential downtrends when prices rally to a new high while the oscillator refuses to reach a new peak.”

The trader also added Fibonacci Retracement levels, that according to Investopedia,

“are horizontal lines that indicate where support and resistance are likely to occur. In his chart, the levels appeared around $44,300, $51,300 and at around $68,700. Poppe also wrote that “#Bitcoin is on its way to $68,000 as it is bottomed out most likely.”

Hence, just like previous analysts, Poppe thinks bitcoin’s price has bottomed out -near $51,000 - and is now in an ascending trend towards the high $60,000s.

Let’s see if bitcoin’s price continues to grow during the week.

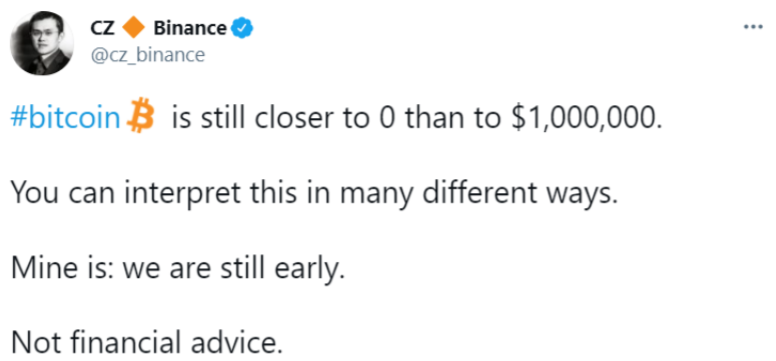

The last post of the day comes from CZ, the founder and CEO at Binance.

In his brilliant post, CZ wrote that

“#bitcoin is still closer to 0 than to $1,000,000.”

He added that

“You can interpret this in many different ways. Mine is: we are still early.”

This is a great selling point for all those afraid to enter the bitcoin space due to its high price, an honest mistake. Bitcoin has indeed increased over 1,000,000% since its inception, but it is also correct to say that there’s much upside to conquer.

This means that if you look at bitcoin’s market capitalization and compare it to gold, or other fiat currencies, you immediately notice there’s plenty of room to grow. Some analysts think 2x, some 5x and others even 10x, from where we currently are.

We think the best strategy is to accumulate bitcoin during dips and to use these corrections as opportunities to open new long positions.

Price Prediction

At the time of this writing, bitcoin's price is trading close to $56,200, according to CoinGecko.

Since the weekend, BTC/USD has been in an uptrend, and we think it may as well continue during the following week. Hence, a brand new record price should be near.

Last week we wrote that unless bitcoin's price found strong support at around $52,000, we thought the drop would continue. Additionally, buying volume had to pick up for bitcoin's price to rise.

Both predictions were correct, and bitcoin's price is now back in an ascending trajectory.

To conclude, most analysts and traders think BTC/USD will likely continue its rally due to indicators showing much less bitcoin and stablecoins available at exchanges.

Therefore, how do we think the price will trade today and during this week? As shown in the above chart, we believe that bitcoin could top close to $60,000 in the next few days, as long as buyers return to the bitcoin space.

On the other hand, we don't expect the cryptocurrency to drop much below $55,000, near the 21-day SMA. If it fails to hold that level, then we think a drop toward $52,000 could play out; however, this is highly unlikely.

To finalize, the VPVR shows a high number of buy orders between $46,500 and $50,000.

It also indicates that there are almost no sellers left above $62,000.

Safe trades. Have a profitable week!

Posted Using LeoFinance Beta

https://twitter.com/Alberto35623593/status/1376300576561106947