The Case Study Of Bitcoin Backed Stablecoins - WBTC vs renBTC

As a result of a conversation I had with @atma.love , I've decided to occasionally present blog posts centered on exploring different Stablecoins, hoping on meeting a common agreement on which is preferable for the crypto community.

As the cryptocurrency industry expands, the need for sustainability increases. Picturing a field of investments, a game of sticks and stones are sometimes experimental, however, not having some layer of protection becomes a fun-sponge, making a huge number of investors leave. With increased crypto usage comes some amount of necessities, this keynote shows how big the industry is and just how, whatever is going on now, is only but little beginnings.

Stablecoins being the center of all this shit talks, we'd be comparing two scalable assets, which could become the next big thing (probably exaggerating)

Wrapped Bitcoin (WBTC) vs Ren Bitcoin (renBTC)

In my course of research, I was specifically digging through WBTC, having figured it was a Stablecoin, one to which design is really underrated. But, on some level of gaging, I figured out a flaw, which led to finding renBTC, a similar Stablecoin, with pretty outlooks.

Unlike most greatly hyped Stablecoins, WBTC and renBTC are not backed by the dollar, rather, there are stable assets, supposedly backed by bitcoin at a ratio of 1:1. It's sad to admit that a huge percentage of people in the crypto space are still Fiat minded, however, not being able to judge them as though the world still relies on it for a proper trade session. Considering the nature of cryptocurrencies and what roles they plays in the financial realm, it is important that when dealing with them, we think "crypto volume" rather than "Fiat value"

Maybe, Bitcoin will derive its value from the "Dollar" for sometime, but when seeking for assets that serves as reserves, I couldn't think of a better option than bitcoin backed assets, here is where the beauty of renBTC and WBTC comes in. Being backed by bitcoin means it forever stays tied to BTC, not the dollar.

WBTC brings greater liquidity to the Ethereum ecosystem including decentralized exchanges (DEXs) and financial applications. Today, the majority of trading volume takes place on centralized exchanges with Bitcoin. WBTC changes that, bringing Bitcoin’s liquidity to DEXs and making it possible to use Bitcoin for token trades.Source

While

renBTC is a synthetic asset that represents the value of bitcoin and it is created by the Ren protocol. renBTC allows for bitcoin transfers to be conducted quicker on the Ethereum blockchain and opens up the possibility for bitcoin to be used in the Ethereum ecosystem.

Bitcoin is held in custody by a network of decentralized nodes; it can be converted to renBTC and vice versa easily.

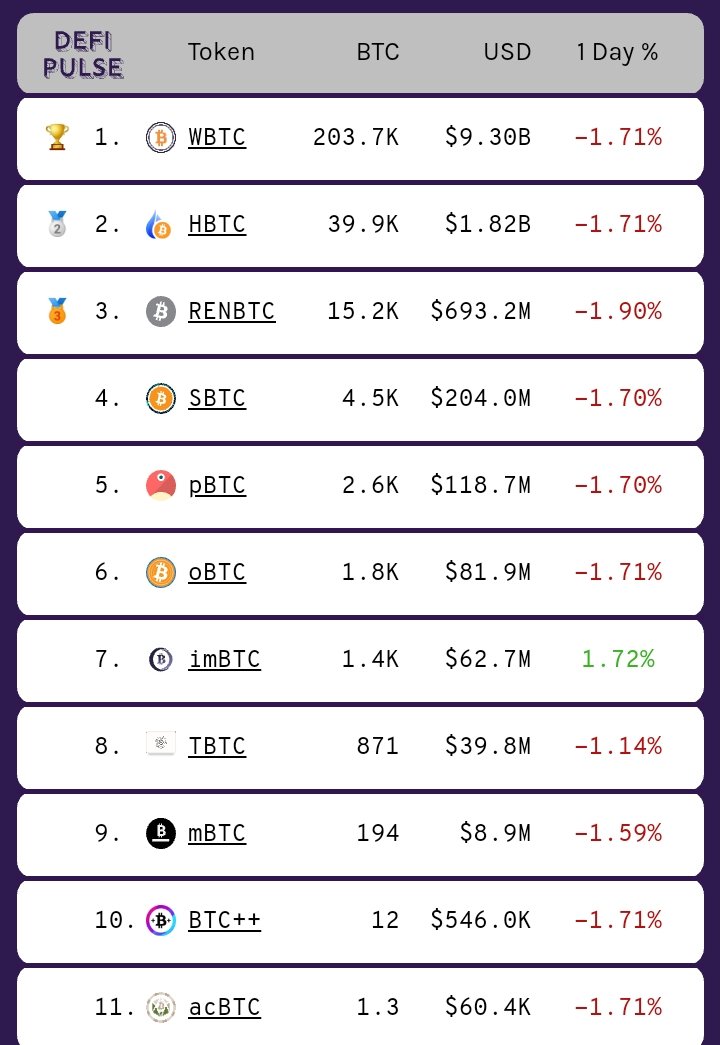

Just like many other bitcoin backed assets like BTCB, HBTC, SBTC and more, WBTC being the most utilized, considering its market cap of $9,186,814,949 on coingecko at the time of writing, with a $443,182,183 24hrs trading volume, and 203.7k bitcoin at work on DEXs, WBTC brings bitcoin to the network of scalability, giving room for many use cases, including being a collateral for securing crypto-backed loans, it also creates a medium for holders to earn interest in decentralized lending pools. However, the difference between WBTC and renBTC is that WBTC is centralized while renBTC is decentralized.

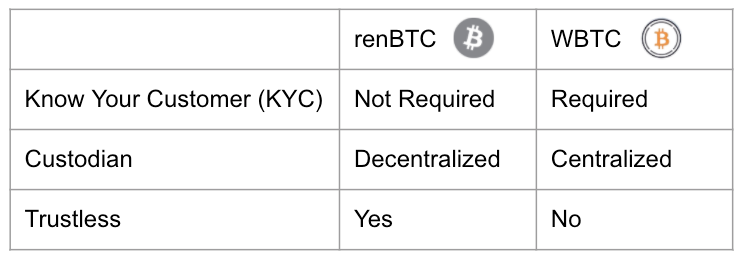

WBTC team supposedly believes bitcoin needed a field to interact with decentralized exchanges, since most if it's liquidity were on centralized exchanges, yet, they went ahead to build it on a centralized platform. The process of acquiring WBTC is through minting on Badger DAO. The process includes customers issuing their BTC to Custodian, a KYC/AML is then performed to verify the user’s identity. It is only when once that is completed, the merchant executes a mint then transfers WBTC to the user. This process is however not needed to acquire renBTC, all a user has to do is swap BTC for renBTC, this process is done through renproject bridge. In the process of turning Bitcoin to WBTC, there's a transfer made, meaning that users BTC no is longer stored in their wallet while waiting on KYC verification, minting and receiving, this process is of high risk, considering the fact that "not your keys, not your crypto" renBTC acquiring process puts an end to such wait period, not requesting KYC in between, making it a much preferable option, due to its decentralized nature. Though, Audits have found the Ren protocol risk minimal, you're still required to do your own research

Notwithstanding the merits therein of a bitcoin backed Stablecoin, I'd say that none of the presented above quite suits the system. Note that regardless of slight difference in prices between BTC, WBTC and renBTC, they are all redeemed at a ratio of 1:1 as pegged. However, the greatest feature a Stablecoin should have is mass adoption capability. These two lack them, considering their max supply. renBTC being 15,177 and WBTC being 203,671, meaning that all DEXs volumes are manipulated as though all tokens were issued in. So the spot remains unfilled and the quest for a better bitcoin backed Stablecoin continues.

However,

What is the benefit of having a Bitcoin peg on Ethereum network?

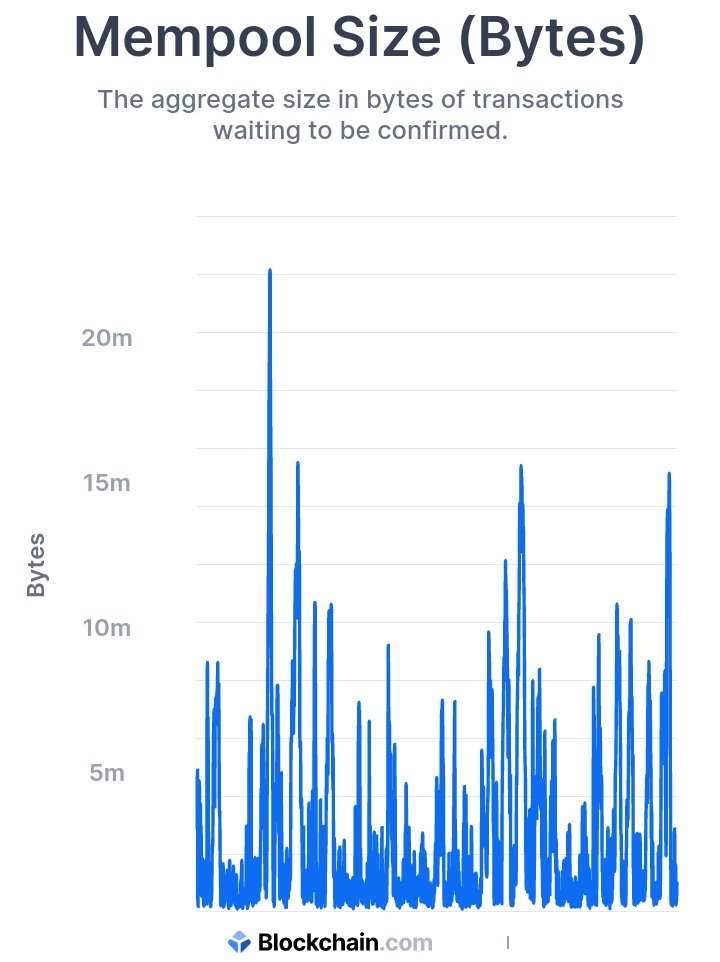

With an increased number of users, the bitcoin network has seen close to 10 million transactions on a monthly chart view since 2018 (raw figures, see charts month for self determination). With more transactions comes network congestion, miners seeing difficulty in processing transactions. According to the mempool chart above, the bitcoin network has seen some pretty difficult times in confirming transactions, though the lightning network, the figures are still high, which is understandable as certain locations have seen mining companies folding up. However, the much scalability of the Ethereum network is what gives it an edge in this field, considering it's upgrade to a proof-of-stake mechanism. However, the demerits remains that assets built on the Ethereum will be vulnerable to what course may be, therein lacking the security of the bitcoin network.

Thanks for reading this far, if there are any questions, do pass them down below and I'll see through them

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

Congratulations @badbitch!

You raised your level and are now a Minnow!

Check out the last post from @hivebuzz: