Crypto Diversification - Experimenting Polka Dot staking

Diversification is an important term in finance. Especially when it comes to investments it is very important that we diversify our investments so that even if one fails at least the other should help in giving profits. This diversification principle not only applies in regular investments but also in Cryptocurrencies as well.

For the past 3 years, I have been focussing a lot only on Steem Hive blockchain. All my efforts in the crypto world were always going to Hive and the tokens associated with Hive. But for the past 6 months, I have been looking forward to diversifying my investments. I have not been able to purchase any good amount of Bitcoin or Ethereum in the last 3 years. I might do it when the price falls next time.

Right now I wanted to do some experiments on some of the new cryptocurrencies. I tried investing a little in EOS and using REX to get some rewards. It was not very clear to me and I couldn't find better documentation that would help me understand Rex in EOS. Also, I noticed that the returns were not very great compared to other staking options.

Coming to the topic, for the past few months, my friend has been talking a lot about Polka Dot and the capabilities of this blockchain. He is not fully sure about the technical capabilities of this blockchain but from an investment perspective, he's been saying that it is a worthy investment for long-term returns. Today I spent a little time exploring that. I bought little Dot tokens from Binance two days back.

Today I wanted to explore the staking option in Polka Dot and gave it a try. Nothing much but I have bought and staked around 28 Polka Dot. My total purchase was 30 Polka Dot but the remaining 2 Dot tokens went on transactions and other stuff. Binance took 0.03 as transaction fee during purchase. After that, for transfer, I had to spend 0.1 Dot tokens to move it to the wallet. In the wallet, the staking activity is also charging me a little micro Dot.

My initial thoughts on Polka Dot

Though reviews say it has great potential for the future, I'm not very happy about the staking model or the transaction fees. There are several chains where there are no transaction fees for moving coins, staking, or any other operation. Coming up with a chain that again charges for every transaction is not very impressive for me.

For a layman, it is so confusing to get started with Polka Dot. Most of the investors would feel like doing less reading and do all activities easily. I understand that there can be better documentation available that explains how things need to be done but from a crypto adoption perspective, I don't think a normal person without crypto knowledge would find it easier to get started.

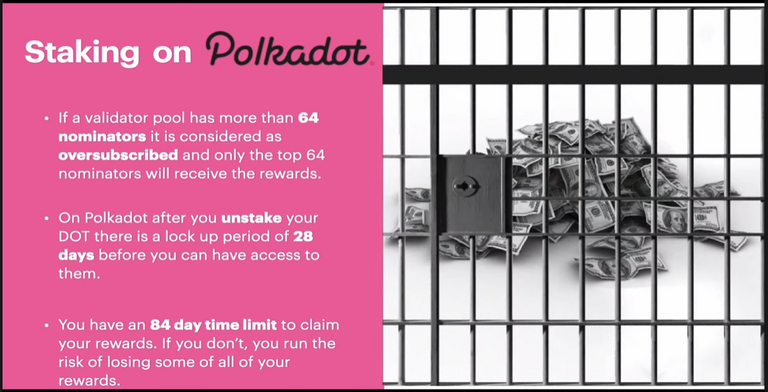

There are a few scary things as well. As mentioned in the above screenshot, there are three things to consider here before investing. The first point talks about the maximum number of nominators in a validator pool. I understand that they are trying to encourage people to invest more to stay on the validator pool but I don't think I'm a big fan of this model because when the pool gets oversubscribed the members of the pool wouldn't get any rewards. There are several blockchains that don't have similar staking reward sharing models and reward distribution is fair.

So in the above screenshot, the first and third point is a bit scary. I understand that I still have a lot more reading and understand to do before investing further. But considering the capability of the blockchain, I'm going to do a small investment here and make a note of it. If at all in the future this coin pumps, I'm going to sell it. If anyone is having any better thoughts on Polka Dot, please do let me know.

Posted Using LeoFinance Beta

I picked up some DOt as well- I’m hearing some good stuff

Posted Using LeoFinance Beta

Diversifications is quite important and at the same time we shouldn't let our cryptocurrencies dormant, at least not in these times. I am not a DeFi participant, but I am checking these days to enter the space. For me the first tryout will be with DeFiBox and I intend to stake EOS against USDT stablecoin at more than 12% provider return and 12% fee return. So I think it is pretty decent.

Do you know if in DeFi the returns are compounded each day or if you can opt in or out on that?

Posted Using LeoFinance Beta

https://twitter.com/bala41288/status/1333146508091297794