Beta Testing the KuCoin trading bot

Early in December (or was it late in November?), there was an open call put out by Kucoin looking for people interested in testing out their new in-house trading bots. I figured I may as well give it go, and put my hat in the ring to try it out... seeing as I'm generally pretty happy the the Kucoin experience so far.

At the moment, there is a small pool of around 300 testers... of which there are a surprising number of people who have no idea what they are doing and have obviously jumped in... in the hopes of an airdrop or some reward. Unsurprisingly, they are losing money on really terrible pairings and a complete lack of understanding of how the bots work. Also, there was a couple of "Wen Red Packet?" and "Wen Airdrop?"... which was a little bit annoying. Thankfully, the chat group is now a bit more focussed.

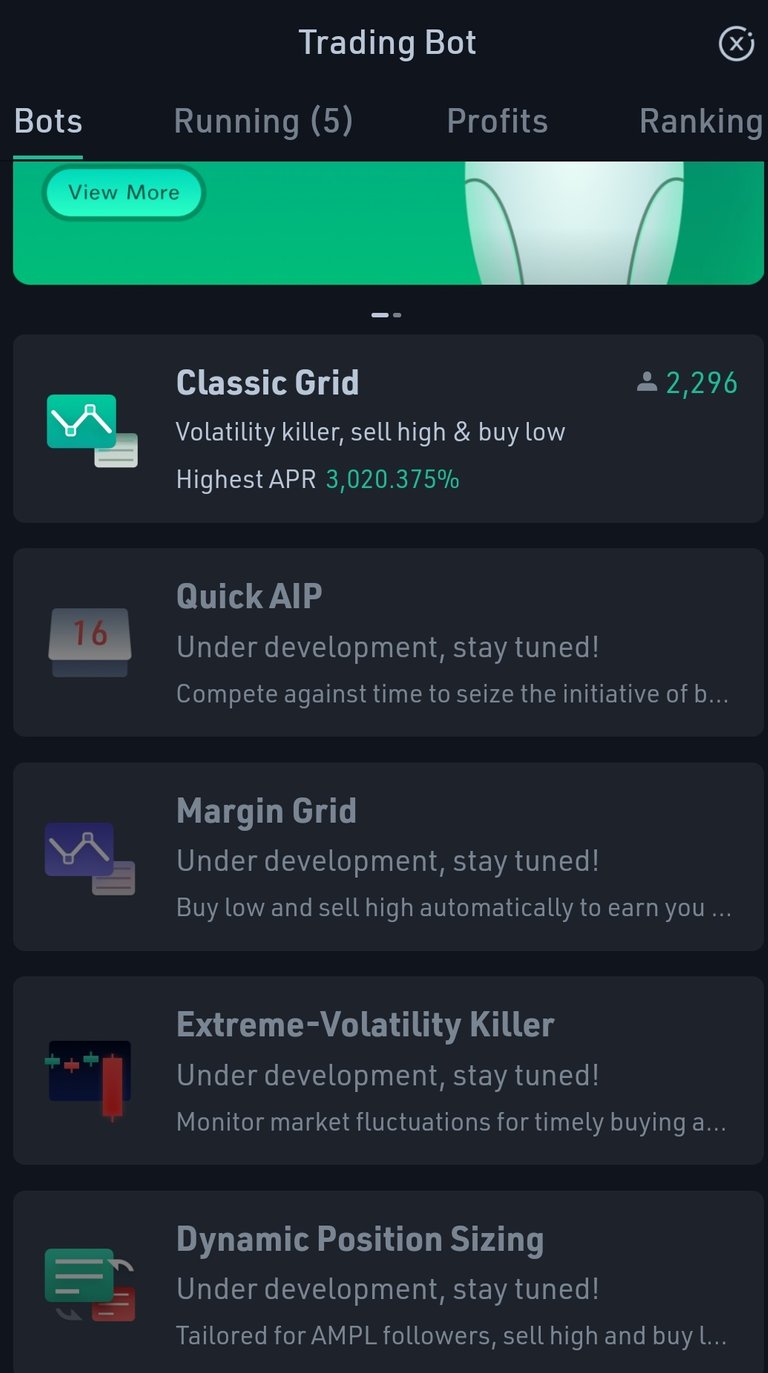

At the moment, the only bot available is a "Grid" strategy with a limited number of pairings (probably about 20 total pairings, mostly in USDT with a few in BTC or ETH). The way that the Grid works is that you have an upper and lower range that you are willing to trade in, and the bot will submit limit orders of buy and sell (on the order of 100-200 orders) using your float to try and capitalise on the micro-volatility between the pairs.

Of course, if the price between the pairs shifts significantly, you are going to be left holding mostly one or the other depending on the direction of the shift. So, it is best to be clear in your mind what you are wanting to be holding (in case you need to stop the bot) or be happy holding either (or both) of the paired assets.

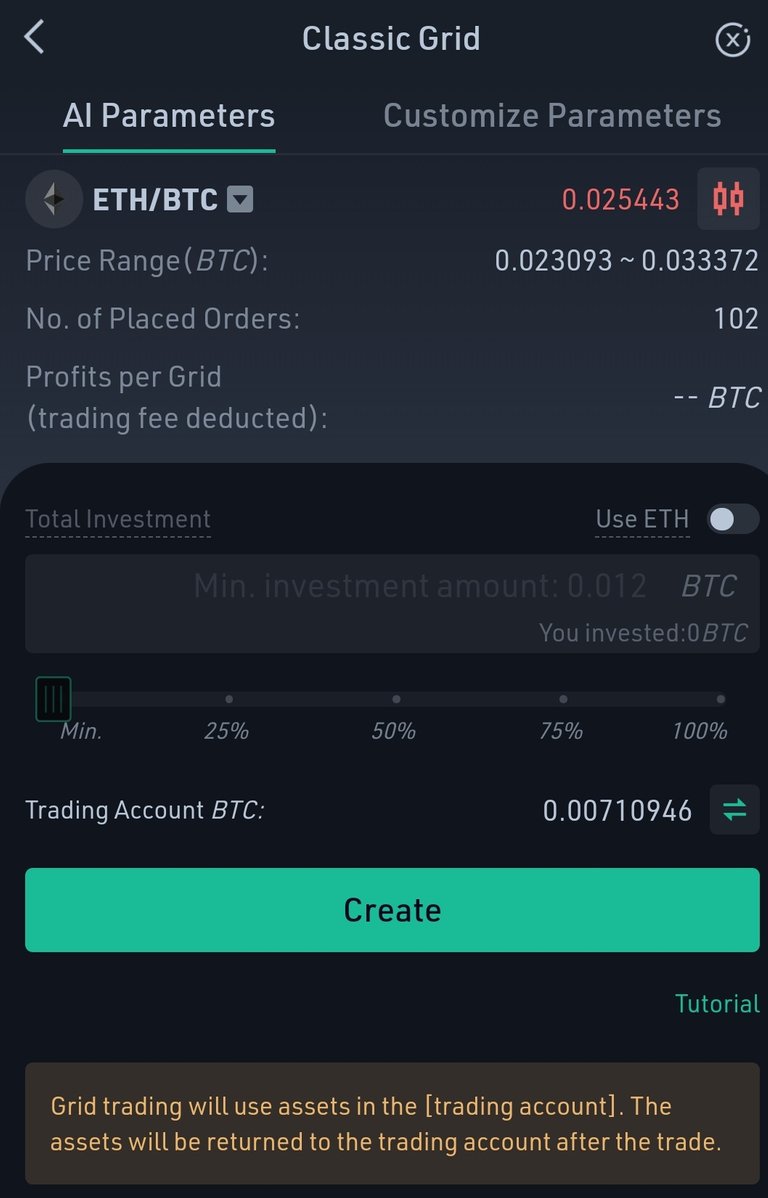

The USDT pairs require only a small float (15 USD per bot) whilst the BTC and ETH pairs need more (0.012 BTC or 0.1 ETH). You can provide the float using either of the pairs, however, it is better to have the float in the currency that you are trying to maximise with bot (just to keep things clearer in the calculation of PNL).

The bot will create a sub-account in your Kucoin account to quarantine the assets used and then return the assets back to the trading section of your account when it is stopped.

The screenshots were all taken when I first started the bots... they have now been running for around 2 weeks... so, I writing with that experience in mind... not the 4 hour one!

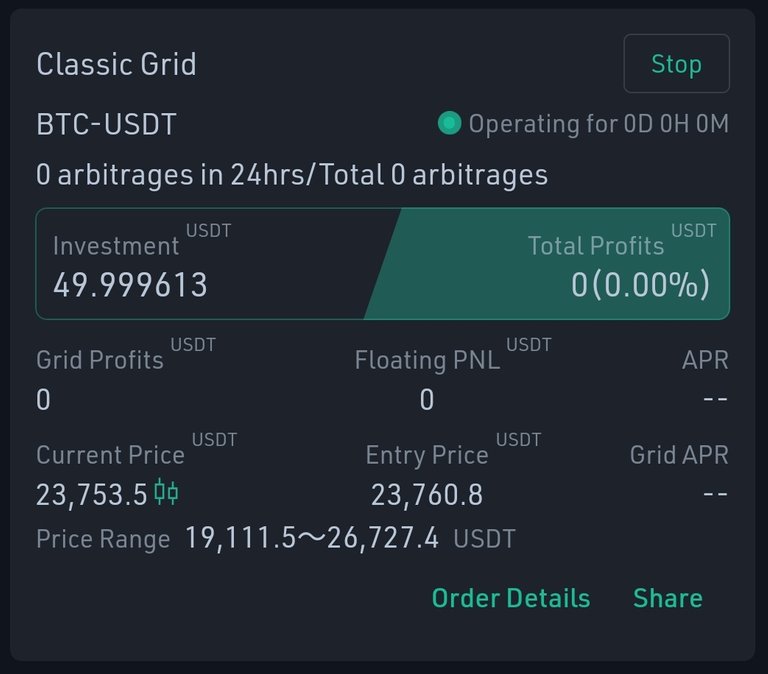

My first bot that I set up was a simple BTC-USDT pairing. Remember that I'm just setting up the floats with a little bit of throwaway money... I'm not confident enough in botting that I want to put serious money on these! After all, a quick and sudden shift in the underlying exchange rate could leave me hanging...

So, a 50 USDT float on this bot... just skimmed from the profits from toying around with AMPL rebasing. At the time, AMPL was in positive rebasing... so, I was just selling it off and keeping it in USDT in preparation for the negative rebases when I would increase the AMPL proportional share.

As you can see, I started the bot when it BTC was at 23k... so, this has proved to be a pretty good bot in the last couple of weeks. Impressive in terms of APR... but it is just toy money! But nice to see it working. I have stopped it and restarted it to take profits a few times over the last couple of weeks. Also, it was starting to hit the top limit of the grid anyway...

This ETH-BTC pairing was the riskiest of my pairings... I don't really mind risking USDT, especially when it comes from AMPL rebases. However, I'm not keen to risk BTC... that said, it isn't too much. This came from the BTC that I have lying around on Kucoin for contests and to do loans... so, skimming off a little bit for the float wasn't too bad. I was careful to choose a pairing where I would be happy having whatever came out the other... ETH or BTC, not fussed.

This bot has been an interesting one to watch over the last few days... with ETH and BTC going up in USDT terms... and the ETH-BTC pair fluctuating quite a bit. This constant shifting is what the Grid is supposed to be harvesting. So far, it has done well... and still trading within range. It's likely that I will probably choose to exit with both ETH and BTC instead of just returning back to BTC... but who knows, I guess it will really depend on what the rate is when I stop it.

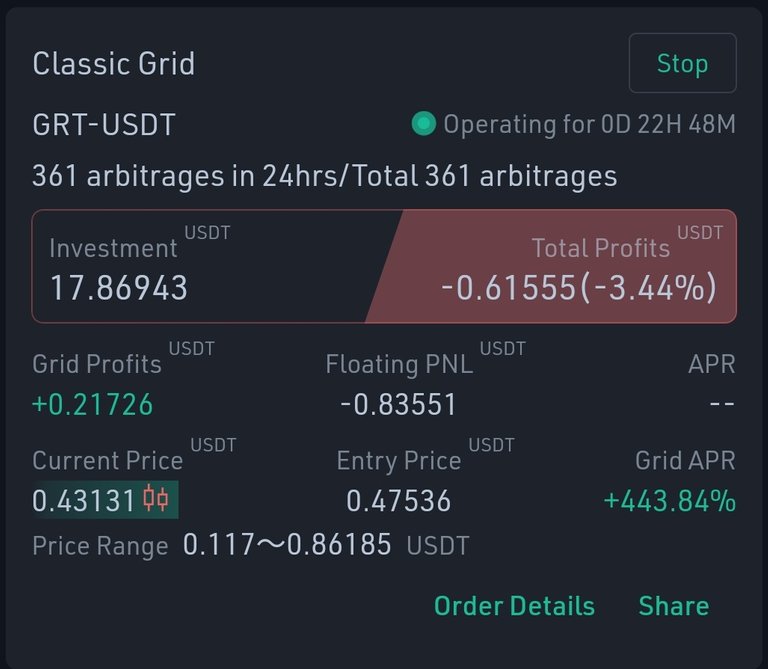

The Graph launched with a good deal of hype around that time... I was curious to see how the hype and subsequent correction would feature in the Grid bot. As expected, it has resulted in a loss as the GRT has dropped against the entry price. Still, the bot is still trading well... but the float is worth less as the bot needed to buy GRT at the higher entry price. If I stop this bot, I might just choose to take it all in GRT rather than selling it out at a loss.

As an aside to this... I have seen other bot owners try their hand at XRP pairs. Not a good idea for a bot like this, where the float gets totalled!

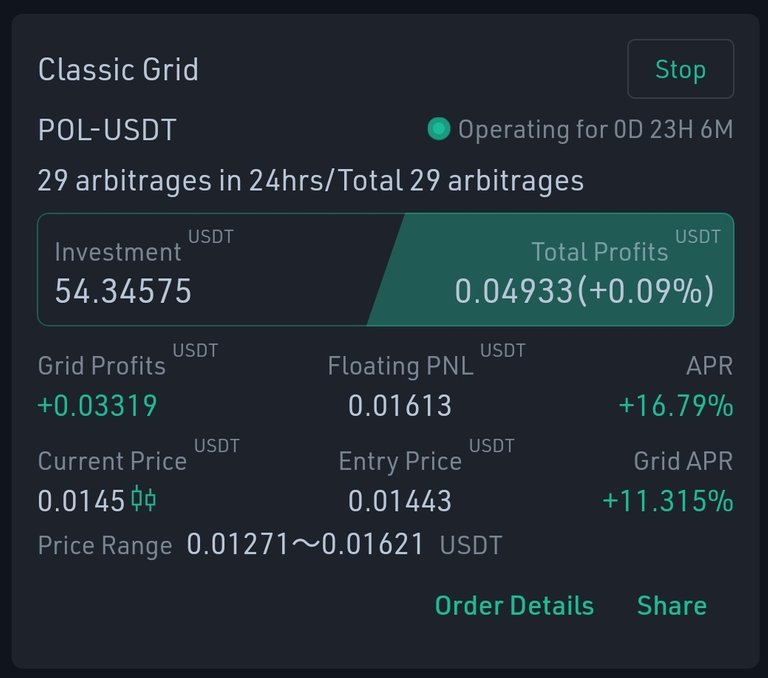

POL is another token that I have quite a bit of sitting around as I have a number of things locked up on the Pool-X part of Kucoin. This is the extra token that is mined as part of the double staking rewards.... anyway, I decided to sell off some to make up the float for this POL-USDT bot.

POL-USDT is relatively stable... so, I don't really expect much to happen here. However, stability is good for this sort of bot, where you are just trying to catch small changes in price and avoid the BIG changes! I expect this one to run for quite some time... slowly, but surely.

KCS... the exchange token that I had just picked up a bunch of through a contest. So, I immediately converted them and used it for the KCS-USDT float. Again, the this pairing isn't crazily volatile... and I'm happy having either KCS or USDT at the end, so not a total risk.

Sadly, the price has dropped significantly against the initial entry price... so, if I exit, it will be to cash out in KCS tokens only. Also good, because that is what I sold to make the USDT float!

So, over a couple of weeks of trying out the bot... I've been pretty happy with how they work. They still entail a risk... but it is nice for them to chug away without needing too much input except to stop them if there is a risk of incoming high volatility. I think that the key lesson is to only trade in pairs where you are happy to have either pair at the end... that way, you can maximise in either direction... and it won't matter which way the price moves.

It isn't a bot for extreme volatility... Kucoin is planning to release different bot strategies in the coming months. I'll be curious to see how all of that works out. I'm especially curious for the one that seems to be tailored for rebasing coins like AMPL!

Coin Tracking

Looking for a quick and easy way to keep track of your cryptocurrencies? Coin Tracking offers a free service that includes manual tracking or automatic tracking via APIs to exchanges, allowing you to easily track and declare your cryptocurrencies for taxation reports. Coin Tracking can easily prepare tax information sheets that are catered to each countries individual taxation requirements (capital gains, asset taxation, FIFO). Best to declare legally and not be caught out when your crypto moons and you are faced with an unexpected taxation bill (unless you are hyper secure and never attach any crypto with traceable personal information, good luck with that!).

Keep Your Crypto Holdings Safe with Ledger

Ledger is one of the leading providers of hardware wallets with the Ledger Nano S being one of the most popular choices for protecting your crypto currencies. Leaving your holdings on a crypto exchange means that you don’t actually own the digital assets, instead you are given an IOU that may or may not be honoured when you call upon it. Software and web based wallets have their weakness in your own personal online security, with your private keys being vulnerable in transit or whilst being stored upon your computer. Paper wallets are incredibly tiresome and still vulnerable to digital attacks (in transit) and are also open to real world attacks (such as theft/photography).

Supporting a wide range of top tokens and coins, the Ledger hardware wallet ensures that your private keys are secure and not exposed to either real world or digital actors. Finding a happy medium of security and usability, Ledger is the leading company in providing safe and secure access to your tokenised future!

Account banner by jimramones