Betting on a bounce!

Toying around with futures is always a risky proposition, especially if you aren't actively hedging and matching trades. I never really have the time to faff around with that stuff, so I've been happily playing with the grid trading bot on the Binance perpetual future markets.

It is still completely risky, so I only pay around with small amounts with some serious discipline. For quite a few weeks I had happily picked up a nice bonus through a neutral strategy of 10x leveraged grid on the Doge/USDT stablecoin settled perpetual contracts. Until doge spiked and wiped out my bot by triggering my stop losses. Thankfully the bot had made enough so that the loss on exit wasn't a problem... The problem was that against my better judgement, I shorted manually...

Anyway, the step sell off over the last couple of days has created an opportunity to make small bets on long futures (with smaller leverage just in case the volatility isn't over).

I managed to get a few small bots running longs on perpetual futures of dollar settled BTC, ETH and Link. I missed the slide to the bottom, so I only caught some of the upside at 5x, but in general my grids were positioned a bit too low to trigger properly.

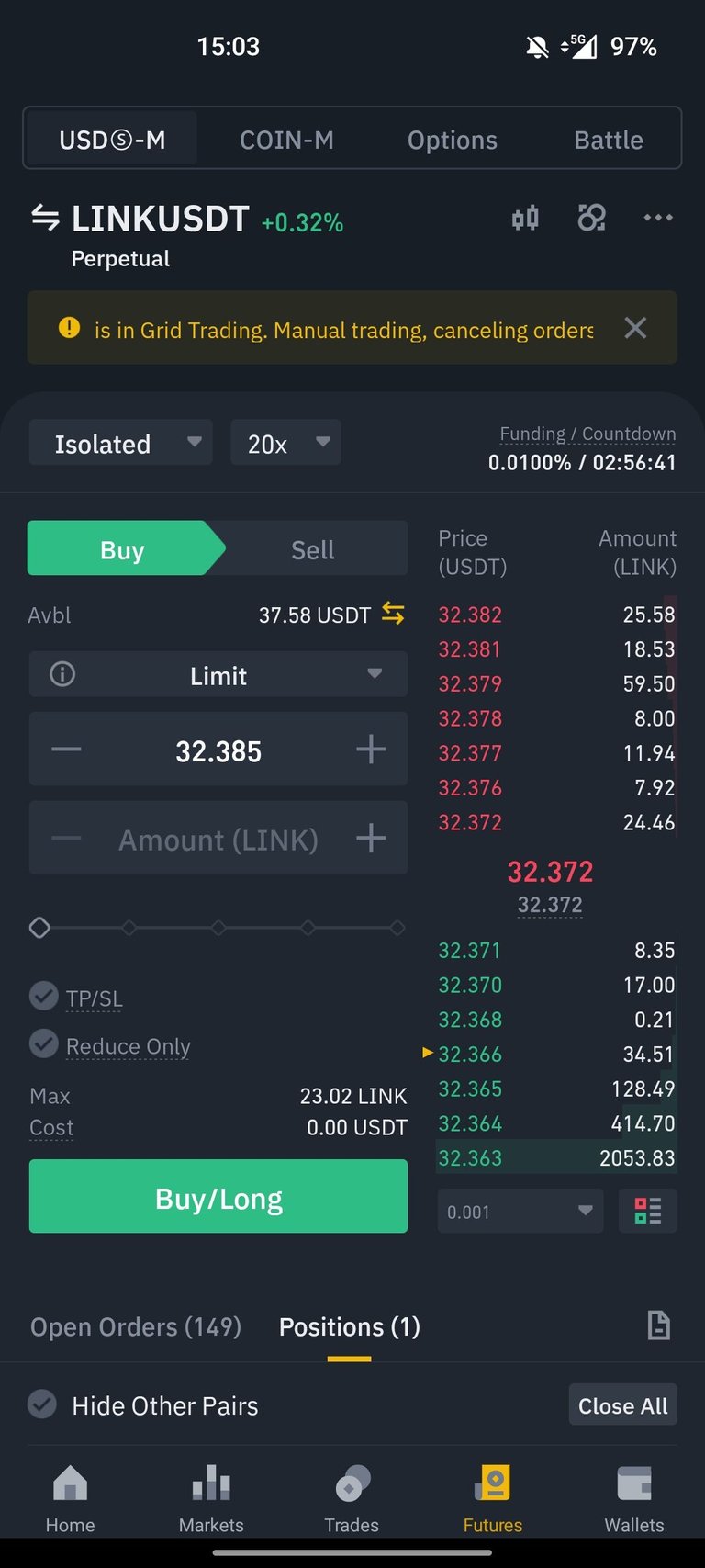

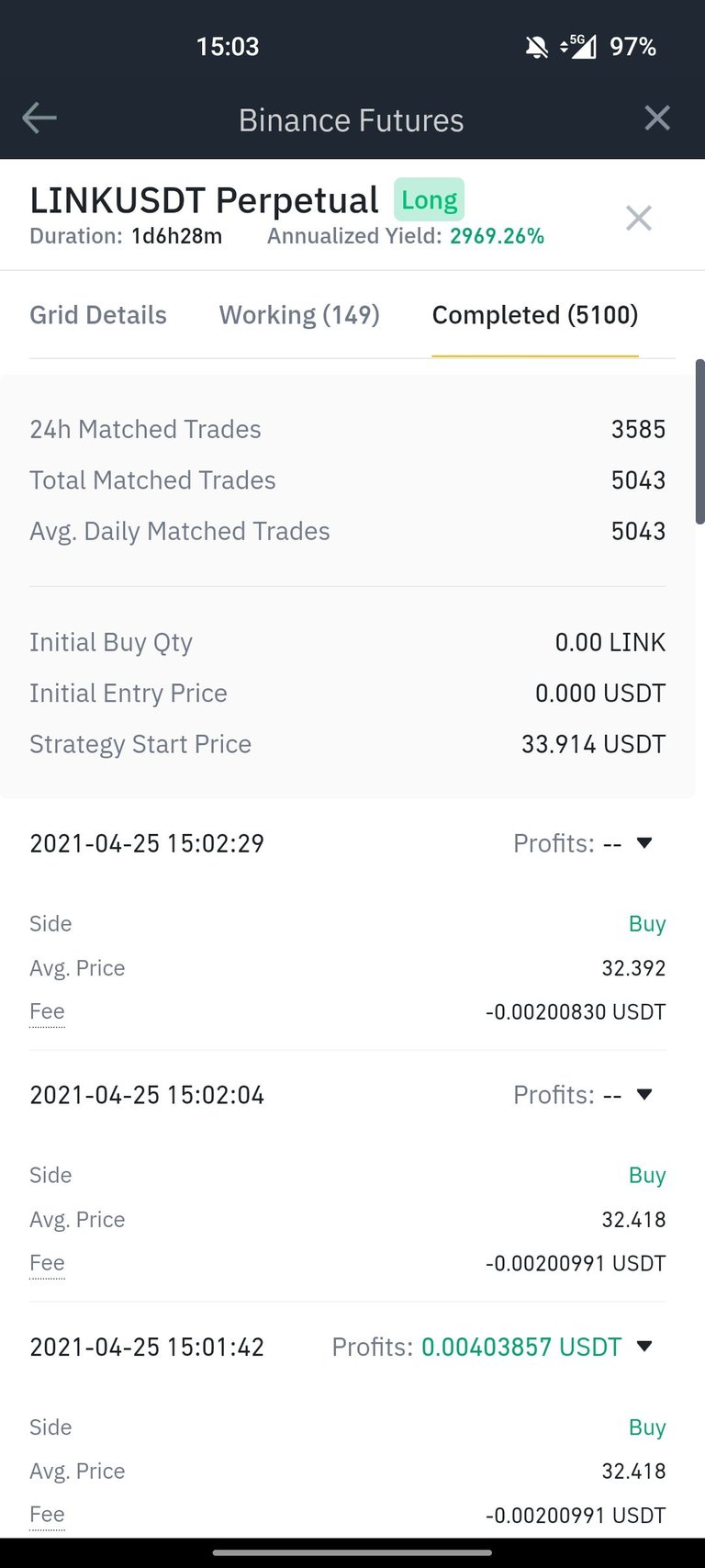

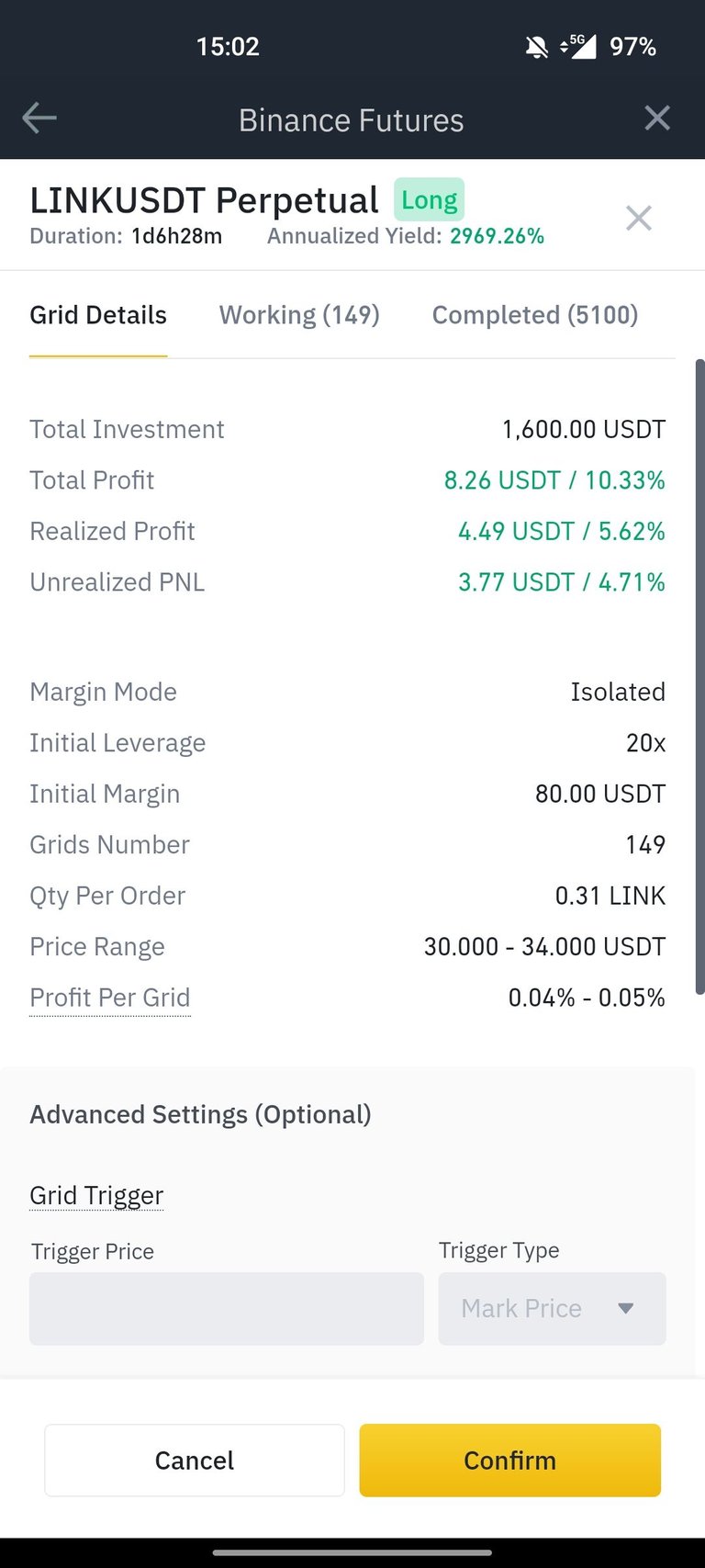

I decided to move to focus on the link perpetual futures as there was some decent support around 30 usd, and it had been bouncing around the 30-35 region. So I set up a long strategy with a grid of 149 orders between 30-34 usd at a risky leverage of 20x. I have a stop loss at just below 30usd... But if that gets triggered I'm already lost as a long strategy means that I've been buying long orders all the way down from 34usd!

The difference between a neutral bot and a long/short bot is that the neutral starts making money immediately on the matched trades. Meanwhile the long bot runs a large deficit at the start as it picks up unmatched long orders on the way down. This leaves you wasting into your margin... So need need to keep spare margin to account for this or the bot terminates at a loss.

However, if you are expecting a setting up then it can be profitable. At the moment the bot has traded and matched enough (nearly 6000 matched pairs!) to get over the initial deficit.

It could be possible to start the bot with a grid that straddles the market price. However, that means that need to start with a large position to match against the upside. I guess I can try that out next time!

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

Kucoin: My second choice in exchanges, many tokens listed here that you can't get on Binance!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

Account banner by jimramones

Posted Using LeoFinance Beta

Congratulations @bengy! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Support the HiveBuzz project. Vote for our proposal!

Gonna study this in more detail. I have plenty time and moey to play a bit more than stocks and crypto. The transaction costs is what is most important as these kill me with options.

It is fun, but can be a bit casino like. I just like toying around with a little bit too learn and see how it all works. Normally I would not put 20x leverage, generally 5-10 at most.

This is generally too face paced for my tastes, I prefer the slower long term outlook!