The Global Recession Is Here

The Global Recession Is Here

The World

Still the united states government doesn't like to talk about being in a recession and instead updates definitions about it you know because of those elections and such. I mean legit a majority of people must just be that clueless if they can't read and do their own research and I hope that's not the case. A recession for the USA set in a few months ago and the stock market seems to keep pumping and doing wild things it shouldn't be doing.

It often reminds me of an addictive gambler. You're so far in the hole that you just keep trying to do anything and everything to keep afloat. While you might pick up some wins here and there in the long term your chances of coming out ahead are slim to none.

There's a few things to note here. Yes we are in a world war however it's not fought like ww2 and ww1 instead this is a informational war and the front is Unfortantlly Ukraine. Let me be clear all of this comes down to resources that a government controls and to put it short without getting into any details the east part of Ukraine holds enough natural gas reserves to kick Russia demand out for good.

Because of this global recession countries are lashing out and people are on edge. Natural resources start to become a hot commodity as inflation sores and we see the constant battle and aggression of some countries trying to overstep and control those resources.

The UK and Europe in that case are in for a rough year or more as they remove gas from Russia and start trying to find other means of production. The biggest issue. There's nearly zero resources for the EU to tap into and instead they import it all.

The UK Mess

The UK prime minister resigned her position held for only 44 days due to massive financial pressure never before seen. The biggest issue right now is the way their retirement system is setup without getting into too much detail it's a program called the Defined Benefits Scheme. It's where the amount you're paid is based on how many year you've been a member of the employer's scheme and the salary you've earned when you leave or retire.

In total 1.6 trillion dollars is currently in this and people are promised a proportion of the money every year out of it for their retirement.

Yep, you could seriously call it a pyramid scheme because these systems are! But when the government runs them they are called other things. You really gotta love it...

The UK government takes that money and invests it. Normally into bonds such as the the UK backed bonds. However that in itself isn't enough money generation so other riskier options are used as well.

Governments gamble with your tax money and investment money. The UK bet that with tax cuts and free markets back open and projects funded by the government started to increase that the economy would turn around. This however was not the case and instead it tanked even harder. This promoted them to now remove any tax cuts and spending plans are now scrapped.

China

Chinas stock market have tanked to levels they haven't seen since the early 2000's. What's crazy is China still has a zero tolerance lock down which is just crippling it's economy every day that takes place. Unemployment seems to be around 20% you have to love it that I can't find a official number since 2019 lol There's also no GDP number but it's speculated that it's one of the worst hit countries since the lock downs started.

The big Achilles heel however is that over 200 Chinese stocks could very well become unlisted on the US markets. This crippling near trillions of dollars in stocks that normally flow into that country. Effectivly it almost looks like China is cutting itself off from the global world and because of that are suffering economically. But it does start to paint a picture for possible military aggression as people falling on hard times often look and support war as the solution to gather more resources and better their country.

The USD

I've gone over this in past articles here on LeoFinance such as 8.2% Inflation What To Expect and Resetting Normal Investing

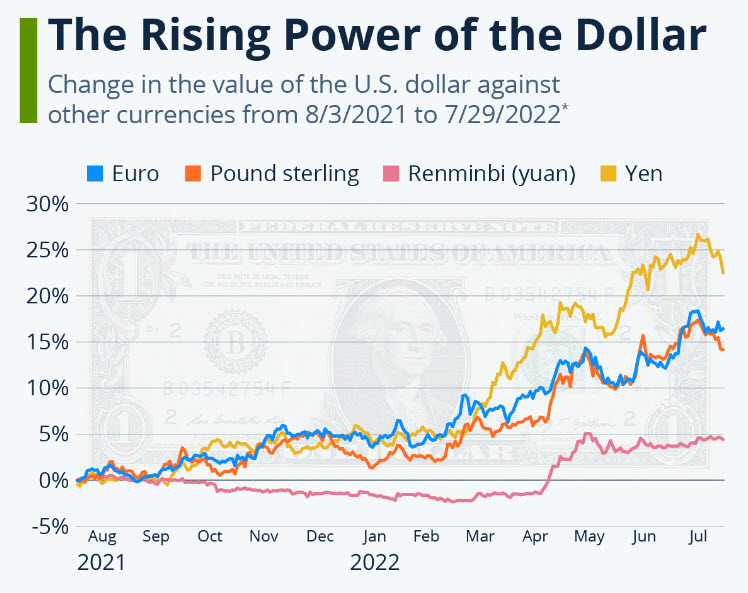

Essentially the USD is getting stronger across the world. Meaning it takes other countries more of their own money in order to pay back debt to the USA, buy goods and services and so on. That's because the USD is the reserve currency for the entire world. What this does is encourages other countries to now buy up more and more US treasuries. So yes, you as a us citizen feel the inflation number but the value of that dollar to the rest of the world is stronger and only becoming stronger as of April 2022. Which I included a graph of that again below from Statista

Sure that sounds great and it is at first. However over time it starts to have a negative impact if it continues. With all other countries facing major issues like the UK issues we talked about above and the China melt down and the EU energy deprived with no resources of their own it's clear why the USD is a prime target to park your money. This however hurts businesses as the cost of selling those products over seas becomes more and more expensive to those people creating less and less demand and revenue for those companies. This should start to hurt the stock market and bring things down.

The fact stands we are headed into a global recession and most likely have and already been in it for over a year. All of this which should have been happening during the lockdowns but got pushed back. It really starts to beg the question or how F'ed up did the lockdowns make things to an already declining global market. With war raging, tensions high and desperate times coming it's foreseeable that things are going to get worse. However many investors already see this and it begs the question if it's already priced in much like you see a year before a bitcoin halving takes place. The real question we should start asking next is how long it will last? Two years like Elon musk says or 10 years like other are predicting?

Posted Using LeoFinance Beta

https://twitter.com/777743941617713152/status/1583598271481933824

The rewards earned on this comment will go directly to the people( @bitcoinflood ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Good analysis, although here in my country we are always in crisis is helpful to know that soon I will be more screwed :)

Yay! 🤗

Your content has been boosted with Ecency Points, by @bitcoinflood.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Despite the menace of a global recession. You can keep succeed even in hard times with a good strategy.