What's Really Causing Bitcoins Hash Rate To Take A Hit?

I found it interesting running into a few articles as of late and most people like to jump on the bandwagon and blame what's in the news. For example Bitcoins hash rate has been taking a hit as of late and with it is the news about China cracking down on miners not allowing them to mine bitcoin.

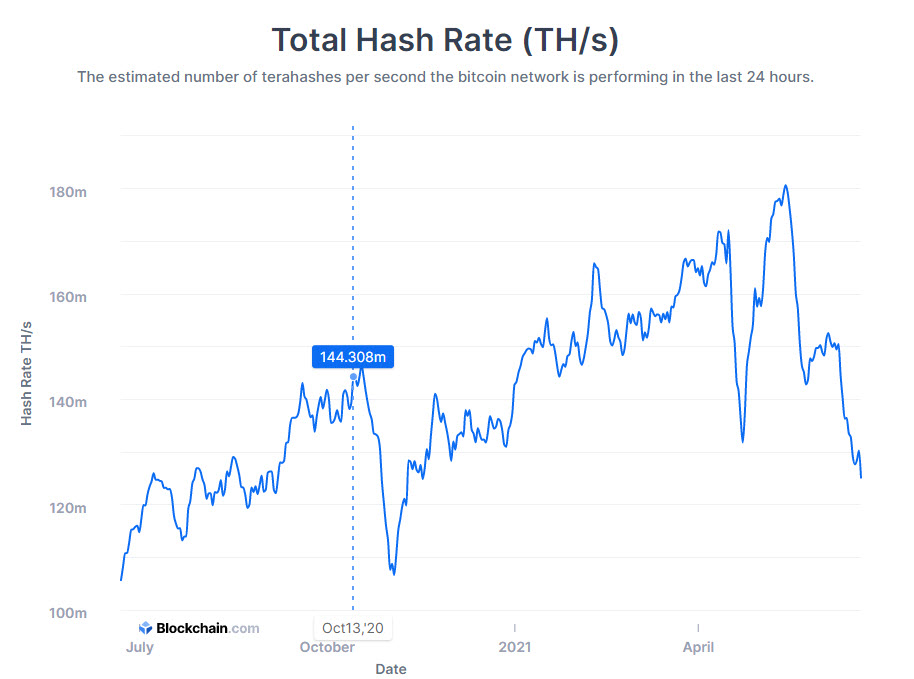

Sure this theory sounds all good and when looking at the charts may seem right

Factors to account for

There will ALWAYS be a steady increase in hash rate over time. This is because better more efficient miners are made and brought online. They produce more hash rate for the price as well as the power usage. It's a continued advancement in bitcoin mining just like any mining where equipment improves over time.

Interest and price play a big factor in how many people are mining for bitcoin including large mining farms as some will shut off a portion of their miners and the cost rate is to high. They need to operate in profit in the short term as many of these farms are not long term investments.

Let's line up the hash rate with the price and see what we get.

The price point of 34,000 puts us right at the point of Jan 31st of this year. When we combine the two hash rates they are nearly the same minus about 5m TH/s seems like a lot but it's not. We also have FUD hitting all new highs with crack downs, talk of regulations, rug pulls, less and less people having interest in it compared to Jan 2021 thus we see a reduction in mining.

If I had to speculate maybe 10m TH/s are a result of Chinas crack down. A less then 10% interest in that area and it could be even less. We also see bitcoin heading towards more of a negative trend in the last few days which also causes drops. We also see throughout the history we seem huge dips at times in mining hash rates for a few days before picking up again.

The one mega dip we see before a huge ramp up was in April 22nd of this year. What happened April 22nd of this year? 55 Billion in bitcoin was erased. No news about Chinas crackdown on miners at that time. It was just a hard reset in which people quickly started to min again having high hopes are the price rallied back to $60,000 per bitcoin.

Well here we are today nearly half of that but do we see the hash rate cut in half?

Nope

We see it a bit above the half way mark which would be steady progression of bitcoin mining.

To me this shows that miners are not going offline because of China's crackdown but instead due to the simple fact that prices are down. When we compared the hash rate with prices over time we can clearly see how well they line up with each other. Those two major dips at the end. Let's not forget bitcoin and crypto have seem some huge hits to their market caps in the last 3-4 weeks which lines it up to the drop in hashing rate.

*This article is for entertainment purposes only

Posted Using LeoFinance Beta

That makes a lot more sense to me. 😊

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points, by @bitcoinflood.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more

This is great to know. I was thinking that China cracking down was going to cause problems in the BTC network. But it kind of makes sense since I have been hearing about how BTC miners wanted to move out of China and they would just relocate their hash rate in a different location.

Posted Using LeoFinance Beta

China did the same crap back in 2017 as well. I hate referencing it but honestly it's the SAME story lol humans we repeat history over and over again while a vast majority don't learn from it simply to repeat the mistakes yet again.

Your post was promoted by @jfang003

I'm not a BTC miner, but I am an ETH miner for 4-5 years and the logic behind mining was always the same... If mining is profitable in your area, you are doing it, if not, you are turning off your machines and BUY tokens from the markets with money that you spared from electricity bills... Of course, this is from the crypto HODLer perspective...

But, if you are mining for short-term profit, it's the same thing... You mine while it's profitable, sell tokens immediately and that's it... If you don't have profit, you don't mine... This drop isn't a big deal at all.. It happened many times when the price of BTC was down... We are witnessing again the SAME thing as always... OVER and OVER the same pattern is repeating... Something that is normal is trying to be "FUDed" as an extraordinary worrying thing... To scare weak hands as always...

Just my 2 satoshis...

I have picked this post on behalf of the @OurPick project and it will be highlighted in the next post!

Posted Using LeoFinance Beta

Very true I mine for fun as a hobby and hodler so far that has paid off well over the years lol But you're right in terms of doing it for money each day to pay for the electric bills etc they have to sell and can't risk the well what if it 10x in 2 months from now. It's crazy watch everything repeat itself.

Ha Ha..as a former miner I agree, the electric bills are fierce, I had three 8 HPU units, I will mine bitcoin next time.

Posted Using LeoFinance Beta

That's an interesting perspective. I never really looked much into hash rates so never considered that point of view. But it does make sense

Posted Using LeoFinance Beta