Silver Performed Well Despite Market's Recent Slump.

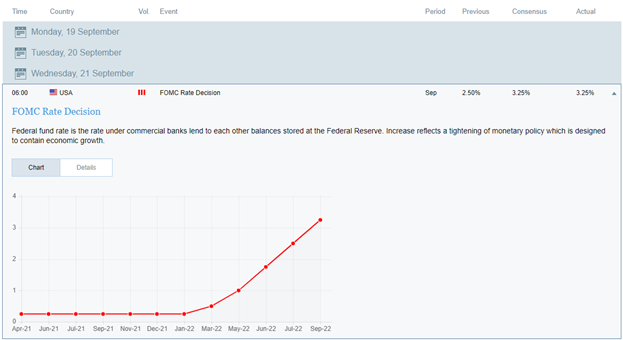

The Fed did it yet again! Another three-quarter percentage rate hike, or 75 basis points, or 0.75% for normal people. This destroyed everything; the S&P 500 fell by 1.7%, the NASDAQ 100 fell by 1.8%, bitcoin sank below $18,000, Ethereum fell below $1,300 despite the merge, and silver fell to... Wait, the price of silver is still holding up pretty well; in fact, it did really well this week!

[Source: https://www.fxpro.com/]

Many have speculated that the Fed will announce a 100 bps rate hike, but the actual outcome was consistent with the consensus and predictions. The aggressive and hawkish rise in interest rates being implemented in the U.S. has already had an impact on economies around the world. Not only is the market heading down, but everything in the world is going horribly wrong as well. To put it succinctly, the U.S. is doing okay (because of the rising rate and the status of the USD as the world reserve currency); meanwhile, Japan, China, and Europe are not doing okay. I mean, we are already familiar with the general gist of what took place in those nations where things were not okay: Japan’s YCC to bailout big banks caused inflation, Europe’s unhealthy obsession with renewable energy, and sanctions against Russia caused the rise in energy prices and inflation, China’s capital control that prevented its people from investing in foreign assets caused the housing bubble. Apparently, China is currently dealing with a different problem as well: its mercantilism which is an economic strategy to maximize exports and minimize imports, is about to fail because the plan requires relatively inexpensive Renminbi (RMB) or Chinese Yuan in order to be effective. I don’t know if you’ve noticed, but the Japanese Yen is weakening against the dollar as we speak, which drives down the price of everything manufactured in Japan. This poses a threat to Chinese exports. But, I guess this is beneficial for everyone else as we can now afford a cheaper Prius.

Silver Saves The Day

The silver is still modestly up after all the brutal beating from the Fed. I’m not saying it won’t dip lower, but it’s performing quite well. I came across a post not too long ago that mentioned how the industrial demand for silver is on the rise. I could write an entire post about it, but TLDR: High energy prices led to an increase in demand for solar panels, which in turn increased the demand for silver because solar panels need silver, which eventually drove up the price of silver. That might explain the recent silver price action.

I know that we are all about crypto for the future, but as you said, silver is needed for solar panels and much other stuff and its price will eventually go up! I would say that it makes it a good asset for diversifying portfolios...

I have picked this post on behalf of the @OurPick project which will be highlighted in the next post!

Posted Using LeoFinance Beta

Congratulations @blockbunnyorg! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 4000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Silver has built a stronger resistance against market over time compared to gold

the gold to silver ratio can correct with pressure from industrial and bullion market

in the long run, definitely

They gotta have that silver for the promised renewable energy in Europe.

silver just dumped 4% 🤮 but I believe that the long-term demand is what really matters.